Greek bank recap

The ECB published the comprehensive assessment of the four major Greek banks (Alpha Bank, Eurobank, National Bank of Greece and Piraeus Bank) yesterd

As was the case in 2014, the exercise comprises two parts: an asset quality review (AQR) and a forward-looking stress test.

The asset quality review is a point-in-time assessment of the accuracy of valuation of banks’ assets as of 30 June 2015, and provides a starting point for the stress test. The exercise yields an AQR-adjusted common equity tier 1 (CET1) ratio, to be compared to a threshold of 9.5% CET1 (which was also used as reference for the stress test).

The stress test provides a forward-looking view of the resilience of banks’ solvency to different levels of stress, taking the new AQR information into account. The stress test baseline scenario entailed a required minimum CET1 ratio of 9.5%, whereas the adverse scenario entailed a minimum CET1 ratio of 8%.

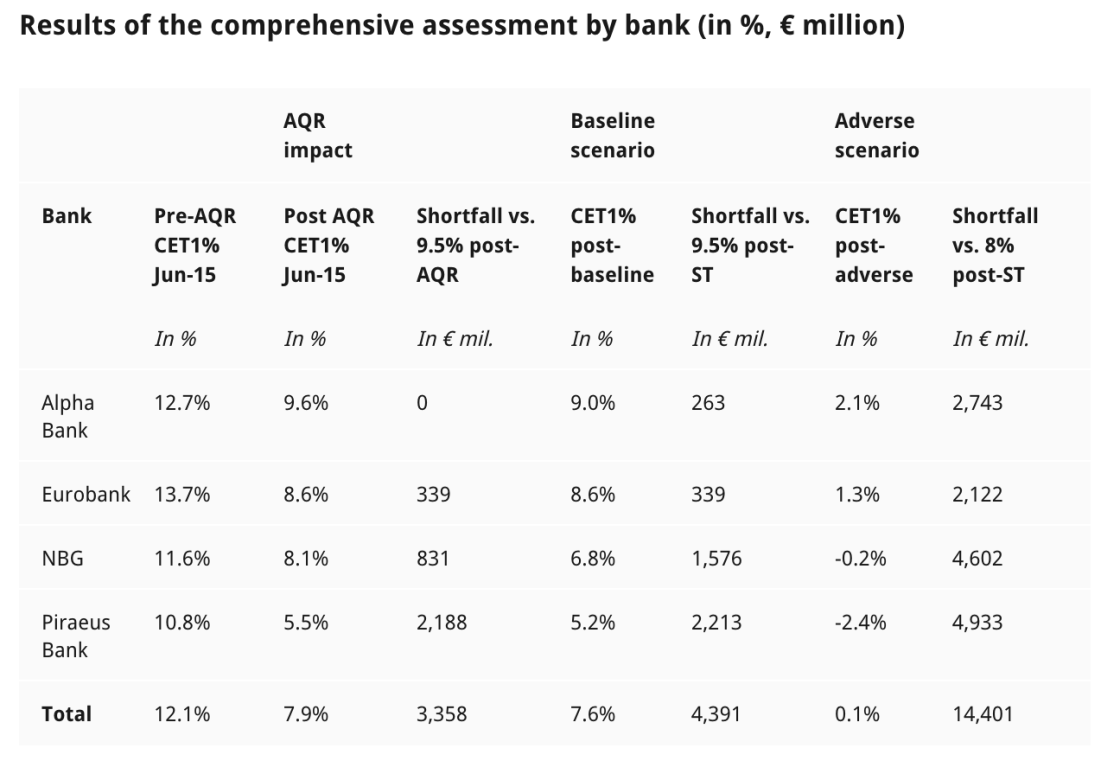

These requirements are quite different from those of the 2014 stress test, i.e. 8% baseline and 5.5% adverse. The ECB should explain this more clearly and explicitly. As a result, the exercise resulted in aggregate AQR-adjustments of €9.2 billion and overall, the assessment identified capital needs post AQR of €4.4 billion in the baseline scenario and €14.4 billion in the adverse scenario (table 1).

Source: ECB report

Piraeus bank has been the worst performer in the stress test, requiring 4.93 billion of new capital, followed by the National Bank of Greece (4.6 billion), Alpha Bank (2.7 billion) and Eurobank (2.1 billion). The impact of the AQR has been the largest on Piraeus, whereas Alpha Bank did not record any AQR-related shortfall.

The banks’ plan to plug the capital hole will need to be announced in the coming week, and both Piraeus and Alpha banks have started attempts to raise private capital already. Piraeus recently launched an exchange offer on 1.1 bn of subordinated and senior bonds, while Alpha bank announced a similar plan for a 1.1 bn bond swap last week. The additional capital needs that cannot be raised from private investors will reportedly be covered by the Hellenic Financial Stability Fund with a mix of new shares and cocos. The recapitalisation bill passed by the Greek government this week covers exactly these issues (see here for a summary of the main points).

Beyond the timing of the recapitalisation, which has been matter of discussion over the last weeks, a couple of things remain unclear. First, the biggest source of risk for the Greek banks may still be not accounted for. The exercise does not deal with Greek banks’ reliance on sizable Deferred Tax Assets (DTAs). For some banks, these make up about 50% of CET1 (as previously discussed). DTAs are by no means used by Greek banks only, and the issue is ultimately rooted in the definition of capital in our regulatory framework, so it would make absolutely no sense for the ECB to change the rule only for Greek banks in this exercise. Rather than solving the problem, this would delay finding a solution.