Reserves depletion and quantitative tightening

What’s at stake: Rather than being led by the Federal Reserve, global monetary tightening might be coming from the reserve depletion of emerging marke

The drawdown of FX reserves

Simon Kennedy writes that the great global monetary tightening of 2015 is under way, but it’s not being led by the Federal Reserve. One recent source of central bank liquidity in financial markets is drying up and the loss of it partly explains August’s trading volatility. Behind the drawdown are the foreign exchange reserves run by the central banks. Jun Nie and Nicholas Sly write that eased restrictions on capital flows, combined with lower growth expectations and a declining return to capital in China, have generated large capital outflows. In 2014-15, China experienced five consecutive quarters of capital outflows for the first time since 2000, and the annual volume of outflows is at a record level.

Matthew Klein writes that China has switched rather abruptly from being a massive buyer of foreign currencies to a major seller. Some are worried that this switch from suck to blow, as it were, could cause Treasury yields to spike. Robert Sinche writes that such activity would drain global liquidity, but only to the extent that there is not an offsetting expansion of liquidity through open-market operations. However, in the case of China, there have been numerous reports of liquidity-adding activities over recent weeks, suggesting that they have been sterilizing at least part of the drain of liquidity from international operations. Joseph Gagnon writes that hot money gets its name because it moves around quickly. But hot money is not unlimited, and it would be a mistake to conclude that it will continue to flow out at the current pace for long enough to exhaust China’s reserves.

The basics of reserve depletion and quantitative tightening

David Keohane writes that for those who haven’t been following this, ‘quantitive tightening’ is the idea that current outflows from EMs reduce FX reserves as exchange rates are defended and that — since those EMs will be selling DM bonds as their reserves deplete — might cause a significant reversal of total central bank support for global asset prices, especially if the EM crisis gets worse.

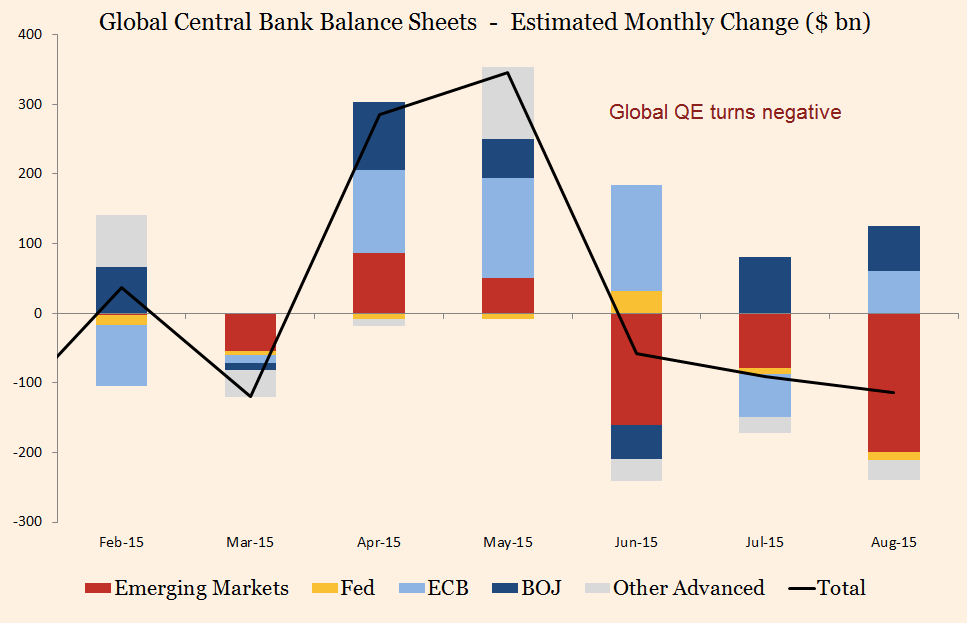

Gavyn Davies writes that capital outflows from the emerging market economies have surged, and have resulted in large declines in foreign exchange reserves as EM central banks have intervened to support their exchange rates. Since these reserves are typically held in government bonds in the developed market economies, this process has resulted in bond sales by EM central banks. In August, this new factor has more than offset the entire QE undertaken by the ECB and the BoJ, leaving global QE substantially in negative territory.

Source: Gavyn Davies

Niko Panigirtzoglou writes that the capital that leaves EM does not disappear from the financial system. Frances Coppola writes that the only monetary tightening going on is in China. When PBoC sells USTs for dollars, what does it do with the dollars? It’s hardly going to put them in vaults, or dollar deposit accounts – after all, USTs are a far more convenient form of storage. No, it sells them straight back into the markets again in exchange for yuan. It is not exchanging USTs for dollars that supports the yuan versus the dollar, it is sales of dollars in exchange for yuan. So the net effect is that dollar liquidity does not change, UST supply increases and yuan liquidity decreases.

Matthew Klein writes that if foreign purchases of Treasury bonds had any effect on US interest rates, it would have shown up in the form of a steeper yield curve caused by relatively lower rates at the short end and the belly compared to the back end of the curve — the exact opposite of what everyone was complaining about at the time of the so-called conundrum. To put this in today’s context, if US interest rates will be affected by foreign reserve managers liquidating their holdings, we should expect rates to rise at the short end and stay flat at the long end. Yet the worrywarts focus on the prospect of a steepening curve driven by rising rates further out.

The portfolio channel in reverse

Gavyn Davies writes that one of the few analytical lapses made by the Keynesian camp after 2010 has been a reluctance to believe that QE – or bond buying by foreign central banks – could impact asset prices and economic activity, except through a signaling effect about the future path of Fed short rates. Yet studies by the Fed and the ECB suggest that these bond purchasing programmes have had important effects on yields through “portfolio balance” effects, as private investors are induced to extend bond duration and hold riskier assets. Surely, the same could now happen in reverse when EM central banks trim their bond holdings.

Gavyn Davies writes that the average maturity of US bond holdings by foreign central banks, at 3.95 years, is not negligible. Furthermore, since the Fed is thinking about raising rates, it may not want to offset the impact of foreign bond sales on US medium dated bond yields.