Negative ECB deposit rate: But what next?

The main question for Thursday is what other measures will be deployed by the ECB’s Governing Council, and perhaps even more importantly, if Mr Draghi

See also policy contribution 'Addressing weak inflation: The European Central Bank's shopping list', comment 'Easier monetary policy should be no worry to Germany' and analysis 'Negative deposit rates: The Danish experience'.

There are widespread expectations that the ECB will cut its interest rates today. Both the current 0.25 percent ECB main refinancing rate and the current zero percent deposit rate, which banks receive when depositing liquidity at the ECB, are expected to be marginally reduced. The latter would imply a negative deposit rate, meaning that banks would have to pay interest for placing a deposit at the central bank.

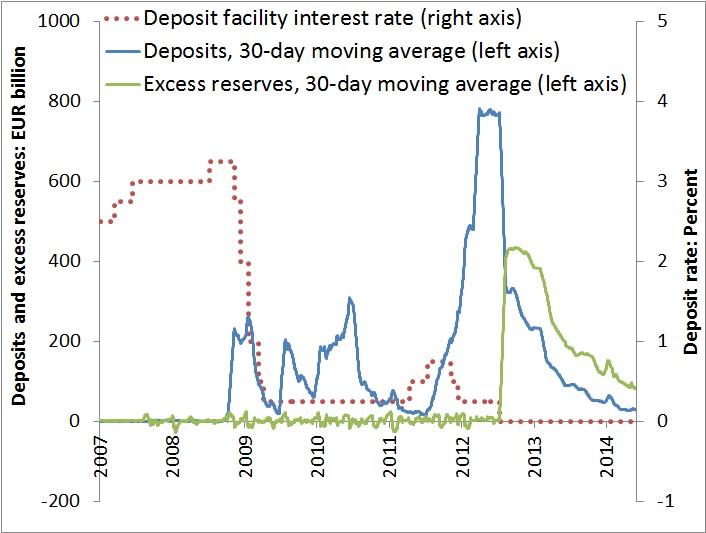

Figure 1 shows that the banks’ deposits at the ECB are declining steadily. Moreover, when the deposit rate was reduced to zero in mid-2012, banks shifted half of their deposits to excess reserves. Since currently banks can hold excess reserves on their current account at the ECB at zero interest, a negative deposit rate should therefore be accompanied by the same negative interest rate on excess reserves or a cap on excess reserves holdings, to avoid the shifting of all deposits to excess reserves.

With the normalization of money markets and the repayment of the 3-year longer term refinancing operations (LTRO), the sum of banks’ deposits and excess reserves may return to their pre-crisis close-to-zero values. A negative deposit rate may even accelerate the repayment of the LTRO. Therefore, the direct impact of a negative deposit rate, in terms of changing the incentives to hold deposits and excess reserves, would be minimal.

Figure 1: The ECB’s interest rate on the deposit facility (percent), banks’ deposits at the ECB’s deposit facility (in EUR bn) and banks’ excess reserves at the ECB (in EUR bn), 1 January 2007 to 3 June 2014

Source: updated from Claeys, Darvas, Merler and Wolff (2014) using ECB data. Note: banks’ excess reserve is the reserves banks hold at their current account with the ECB minus the minimum reserve requirement. Due to huge volatility of daily data, we use a 30-day moving average.

The Danish central bank adopted a negative deposit rate between July 2012 and April 2014. The main objective of the Danish negative deposit rate was to reverse the appreciation of the Danish krona exchange rate, which to a large extent originated from capital flight from the euro area to Denmark, due to the euro crisis (see our earlier post on Denmark here). The ECB has a different goal: boosting inflation and inflationary expectations.

After the introduction of negative deposit rate in Denmark, the Danish Krona depreciated against the euro by about half a percent from 7.43 to 7.46. However, the Danish evidence suggests that the rate cut did not lead to changes in retail interest rates, nor an increase in bank lending.

These findings and the small and declining amount of deposits at the ECB (Figure 1) suggest that a negative ECB deposit rate may not change retail interest rates and bank lending in the euro area. At best, it could weaken a bit the exchange rate of the euro, if the rate cut is not yet fully priced in. But a small change in the exchange may not have a big impact on inflation either.

The main question for Thursday is what other measures will be deployed by the ECB’s Governing Council, and perhaps even more importantly, if Mr Draghi's communication will pave the way for further actions, such as asset purchases.