Taylor-rule interest rates for euro area countries: diversity remains

Despite the very low headline (0.5%) and core (0.8%) inflation figures for March 2014, the Taylor-rule recommendation for the euro area has in fact sl

Last September we wrote a blog post with Silvia Merler on Taylor-rule interest rate recommendations for euro area countries (see this post for explanation and interpretation of the results). Here is the update.

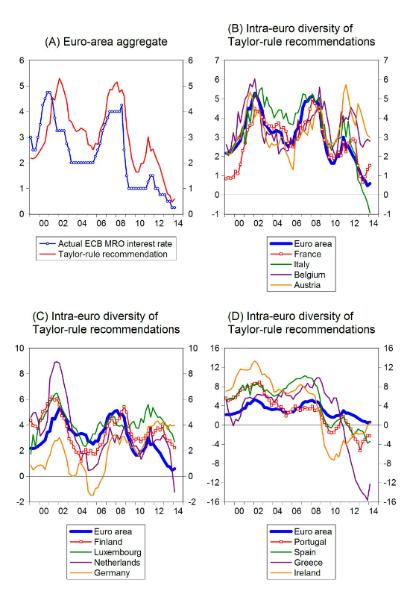

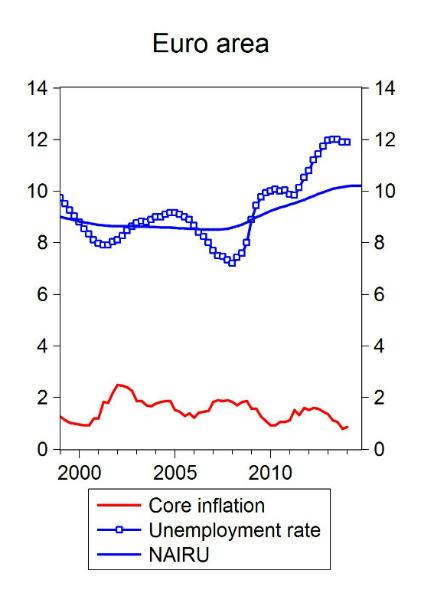

Not much has changed for the euro area as a whole (Figure 1, Panel A). The recommendation for the euro area is slightly lower in 2014Q1 than it was in 2013Q3. However, despite the very low headline (0.5%) and core (0.8%) inflation figures for March 2014, the Taylor-rule recommendation for the euro area has in fact slightly increased from the last quarter of 2013 to the first quarter of 2014. The reason is that average core inflation during the quarter was slight higher in 2014Q1 (0.87%) than in 2013Q4 (0.80%) and the gap between actual unemployment and the NAIRU (non-accelerating rate of unemployment) slightly narrowed, because unemployment remained the same (11.9% on a seasonally adjusted basis between October 2013 – February 2014), while the NAIRU increased a bit.

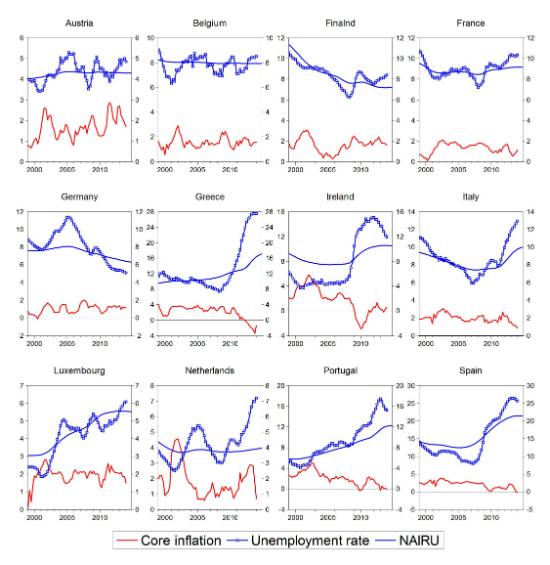

But diversity among the first 12 members of the euro area remained (Panels B, C and D of Figure 1). In Italy and the Netherlands there was a major decline in the Taylor-rule recommendation, due to a drop in core inflation and an increase in unemployment (Figure 2). In 2014Q1, the Taylor-rule suggests negative interest rates for five of the first twelve members of the euro area. Such a huge diversity makes the job of the European Central Bank extremely complicated, as we discussed in our blog post with Silvia last year.

Figure 1: Taylor-rule recommendations for the central bank interest rate (percent per year), 1999Q1-2014Q1

Notes: Taylor-rule target = 1 + 1.5 x Inflation – 1 x Unemployment gap. Similarly to Mechio (2011), we use core inflation (all items HICP excluding volatile food and energy prices; change relative to the same quarter of the previous year) and the deviation of the actual unemployment rate from the estimated non-accelerating inflation rate of unemployment (NAIRU), as estimated by the OECD. MRO = Main refinancing operations. The 2014Q1 recommendations are based on January-March 2013 core inflation rate for the euro area. For the 12 countries the March core inflation is not available: we assumed that it declined from February to March by as much as in the euro area aggregate (ie by 0.2 percentage points) and then calculated the average for January-March. The unemployment rate is available for January and February for most countries and we used their average for 2014Q1.

Figure 2: Core inflation, the unemployment rate and the estimated NAIRU (non-accelerating inflation rate of unemployment), percent

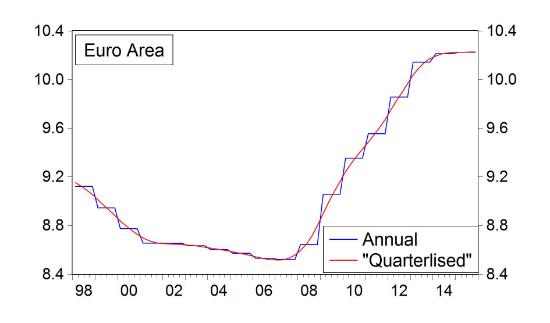

Note: the OECD’s NAIRU (non-accelerating inflation rate of unemployment) estimate is available at the annual frequency. We converted it to quarterly frequency by using the Hodrick-Prescott filter, which assumes smooth changes for the filtered series. For this filter, we used a rather low smoothing parameter, ie 10, in order to filter out only the impact of frequency conversion, but to keep tendencies. See, for example, the results of this smoothing for the euro area in Figure 3.

Figure 3: OECD’s annual estimate for the NAIRU and our approximation for the quarterly frequency, 1998-2015

Note: see the notes to Figure 2. The annual data is indicated by the blue line, which has the same value in each quarter of the year. The red line is our “quarterlised” estimate.