Chart of the week: The real test of the euro

The single most pressing threat to the integrity, and perhaps also to the existence, of the euro is the depth of the recession in southern European member states, and their bleak economic outlook, as I argued in a policy contribution we published last week.

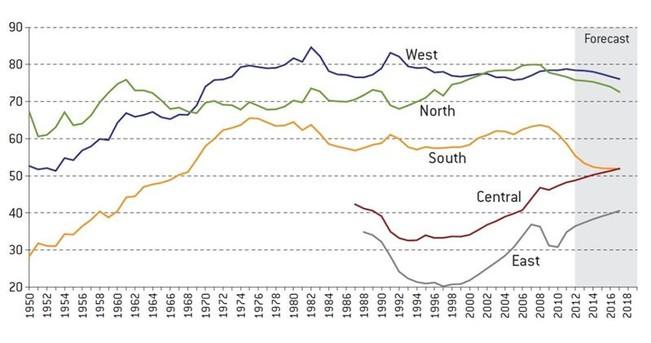

Figure 1 shows that following three decades of relatively stable GDP per capita compared to the USA, southern Europe is expected to fall behind quite dramatically.

Figure 1: GDP per capita in major geographical regions of the EU (USA = 100), 1950-2017

Source: Figure 1 in Darvas, Zsolt (2012) ‘The euro crisis: ten roots, but fewer solutions’, Bruegel Policy Contribution 2012/17, October. Note: GDP is based on purchasing power parity dollars; median values are indicated for the groups, which are as follows: West: Austria, Belgium, France, Germany, and the Netherlands; South: Greece, Italy, Portugal, and Spain; North: Denmark, Finland, Sweden, Ireland, and the UK; Central: the Czech Republic, Hungary, Poland, Slovakia, and Slovenia; East: Estonia, Latvia, Lithuania, Bulgaria, and Romania.

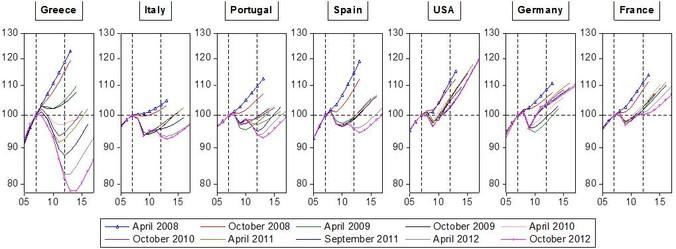

Figure 2 shows country specific data: GDP levels at constant prices, using various vintages of the IMF’s World Economic Outlook (WEO). The Greek outlook has worsened in every update of the WEO since April 2008 and according to the latest WEO, the cumulative real GDP fall is expected to be 22 percent. The situation is not that bad, but also worrying in Italy, Portugal and Spain.

Figure 2: GDP outlook five years ahead, as projected by the IMF at different dates (2007=100)

Source: IMF World Economic Outlook published on the dates indicated in the legend. Note: the two vertical lines indicate 2007 and 2012. GDP is measured at constant prices.

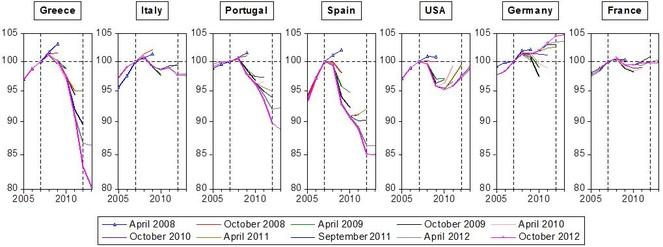

The employment situation is similarly miserable (Figure 3): in 2008 there were more than 4.5 million employees in Greece, which is expected to fall by 21 percent to 3.6 million by 2013 – the lowest figure during time period for which WEO reports data, 1980-2013. Employment developments are also very poor in Spain and Portugal, yet in Italy jobs were well preserved.

Figure 3: Employment outlook two years ahead, as projected by the IMF at different dates (2007=100)

Source: IMF World Economic Outlook published on the dates indicated in the legend. Note: the two vertical lines indicate 2007 and 2012.

If the recession continues to deepen in Greece, social tensions could escalate, which may lead to domestic political paralysis. Under such circumstances, cooperation between euro-area partners and Greece, including financial assistance that has already been granted, could come to an end, leading to an accelerated and possibly uncontrolled exit from the euro area, causing devastating consequences for economically stronger countries as well.

The top priority should be preserving the integrity of the euro area and offering southern euro countries improved prospects. Structural reform and appropriate fiscal consolidation in southern Europe, wage increases and slower fiscal consolidation in economically stronger euro-area countries, a weaker euro exchange rate, debt restructuring and a European investment programme should be part of the arsenal.

Economic growth in southern Europe would gradually help to improve the unemployment situation, public finances, asset prices, balance sheet of banks, and would reverse capital outflows. And without the problems of southern euro-members, western and northern members would be able to overcome their banking woes and the other roots of the euro crisis would have much lower relevance.

It is high time to address the most pressing issue of the euro crisis.