Blogs review: Dating the European Double Dip

What’s at stake: Eurostat announced this week that euro area GDP declined for a second consecutive quarter – pushing back the euro area into recession

What’s at stake: Eurostat announced this week that euro area GDP declined for a second consecutive quarter – pushing back the euro area into recession according to the commonly used rule of thumb for defining a recession. But the European equivalent to the NBER’s business cycle committee – generally seen as the authority for dating US recessions – announced that the recession actually started earlier than that, arguing that the euro area has been in a recession since economic activity peaked in the third quarter of 2011. The CEPR committee's procedure for identifying turning points, established in 2002, slightly differs from that of the NBER to help deal with heterogeneity across euro area countries.

Eurostat and the CEPR peak

In its Flash estimate for Q3 2012 Eurostat reports that GDP is down by 0.1% in the euro area compared to the previous quarter and down by 0.6% compared with the third quarter of 2011.

Source: Center for Economic Policy Research (CEPR)

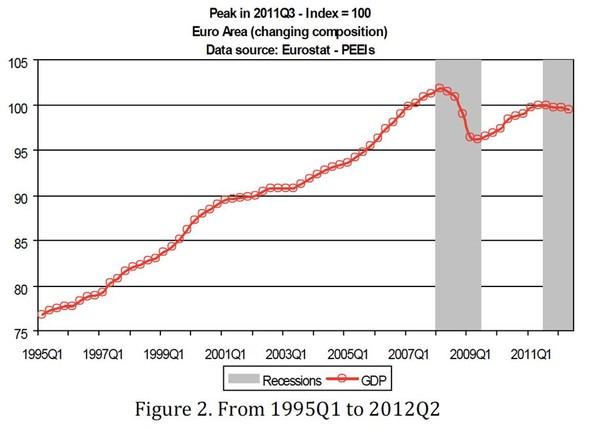

The CEPR Committee concluded that economic activity in the euro area peaked in the third quarter of 2011 and that the euro area had been in recession since then. The third quarter of 2011 marked the end of an expansion that began in the second quarter of 2009 and lasted 10 quarters. Although output increased 4.03 per cent from trough to peak, this was not enough to bring euro-area GDP back to its pre-financial crisis level: at the end of the expansion in 2011Q3, GDP was about 2% below its previous 2008Q1 peak.

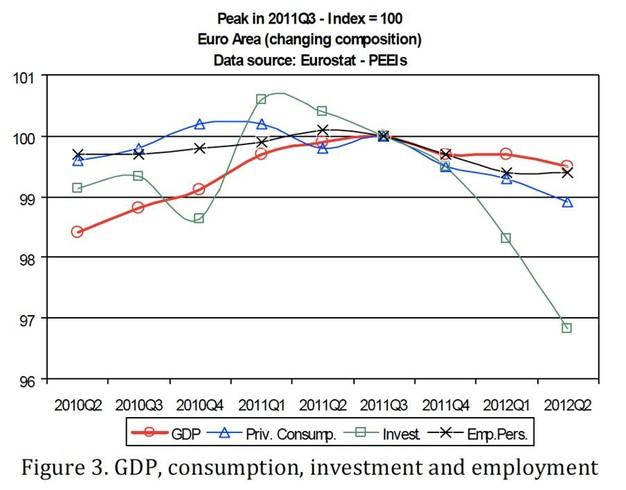

The Committee’s procedure for identifying turning points differs from the two-quarter rule in a number of ways. First, we do not identify economic activity solely with real GDP, but use a range of indicators, notably employment. Second, we consider the depth of the decline in economic activity. Several other key macroeconomic aggregates have also been decreasing markedly since the third quarter of 2011, such as euro-area consumption, investment and employment.

Source: Center for Economic Policy Research (CEPR)

The uncertainty of turning points

Karl Whelan – a member of the Committee – writes that given the small size of the declines in GDP reported by Eurostat, you might question whether the CEPR committee’s recession call is a marginal one or whether it may be reversed after the data get revised.

But the CEPR Committee argues that it is confident that 2011Q3 marks the beginning of a recession in the euro area. The Committee uses the statistical properties of past data revisions to compute the probability that future revisions might lead the Committee to change its current findings. The Committee has estimated that there is a 75% probability that, based on the data that will be available three years from now, it will still determine that 2011Q3 was a peak of euro-area GDP. In addition, the probability that, after revision, GDP in 2012Q2 will eventually be found to exceed GDP in 2011Q3 is only about 5%.

The CEPR methodology vs. the NBER methodology

While the CEPR Euro Area Business Cycle Dating Committee has been conceived to operate in a manner similar to the NBER Business Cycle Dating Committee, its deliberations and timing of announcements are independent.

The Committee also had to adapt the NBER definition of a recession to reflect specific features of the euro area.

· Unlike NBER, the CEPR committee dates episodes in terms of quarters rather than months. Quarterly series are currently the most reliable European data for our purposes and those around which a reasonable consensus can be achieved.

· In the past, the CEPR monitored individual country statistics to make sure that expansion or recessions were widespread over the countries of the area. However, since October 2012 the Committee has dropped its requirement that peaks or troughs mark turning points in economic activity in most countries of the euro area, dating turning points using only euro-area aggregate data.

In a document providing an account of the reasoning underlying the decision of the Committee, the CEPR Committee argues that the increased heterogeneity among euro-area member countries necessitated paying attention only to the euro area as a whole, so that the committee's pronouncements of cyclical turning reflect only the aggregate data used by policymakers at the euro-area level.

Binnur Balkan investigates whether heterogeneity is the driving force behind the dating of previous recessions. The author redraws the charts for GDP, investment and employment for post-98 and GDP and investment for pre-98 periods using GDP weighted, simple sum and finally population weighted series together with GDPs of the major Euro area economies. When he works with the current vintage data, the author finds slightly different results for the timing of peaks and troughs than the committee’s previously announced dates in two cases. However, these differences seem to be data revision dependent rather than methodological since different treatments of heterogeneity and country-wise evaluation suggest consistent results among themselves.

Institutional background on the CEPR dating committee

In 2002 CEPR established a Business Cycle Dating Committee for the euro area. The Committee’s mission is to establish the chronology of the euro area business cycle, by identifying the recessions and expansions of the 11 original euro area member countries from 1970 to 1998, and of the euro area as a whole since 1999.

The Committee comprises the following members: Philippe Weil, Domenico Giannone, Refet Gurkaynak, Monika Mertz, Richard Portes, Lucrezia Reichlin, Albrecht Ritschl, Barbara Rossi, Karl Whelan, Michael Artis, Fabio Canova, Jordi Gali, Francesco Giavazzi, Harald Uhlig, Volcker Wieland and Paul Hubert.

More resources on euro area business cycle research

The Euro Area Business Cycle Network (EABCN) provides a forum for the better understanding of the Euro area business cycle, linking academic researchers and researchers in central banks and other policy institutions involved in the empirical analysis of the Euro area business cycle. The three main areas of research undertaken by the Network are: establishing key facts on the Euro area business cycle, monitoring business cycle in practice, and methodological issues.

Members of the EABCN can download an up-to-date Euro Area macroeconomic time series from the Area Wide Model (AWM) dataset. The dataset covers a wide range of quarterly Euro Area macroeconomic time series and has become a standard reference for empirical studies on the Euro Area economy.

The EABCN Real Time Database (RTDB) is a project that aims at creating and maintaining a real time database for the euro area and for the European countries. The Euro area Real Time database, constructed at the ECB with contributions in particular from DG Research and DG Statistics of the ECB, consists of vintages, or snapshots, of time series of more than 200 macroeconomic variables, based on series reported in the ECB’s Monthly Bulletins.