The bond market consequences of Mr Draghi

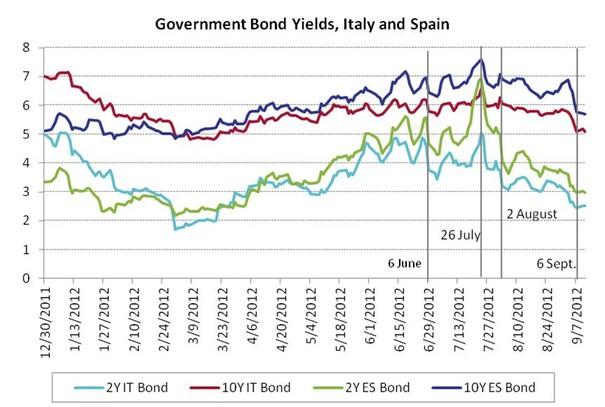

In the last two months, several events have had an impact on the sovereign bond market: the 29 June Euro Summit, Mario Draghi’s 26 July speech at the Global Investment Conference in London, and the European Central Bank Governing Council Decisions of 2 August and 6 September. Sovereign bond yields have come down significantly recently and Figure 1 shows that this has been particularly the case after these events. There has also been some reversal of the positive effects, as we have pointed out previously.

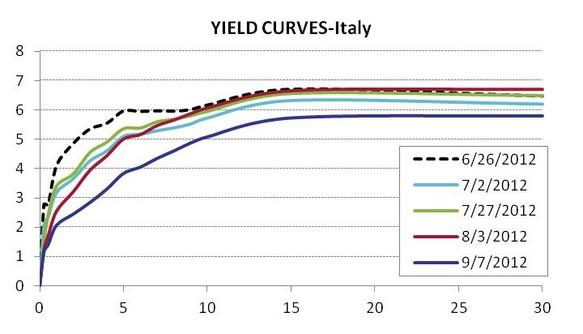

The ECB interventions had an effect on the long term yields and also on the shape of the yield curves. Figure 2 plots the Italian and Spanish yield curves the day after (T+1) the above-mentioned events. The 26 June is chosen as a starting point. Compared with the initial level, the events of late June, July and August marked a downward shift of the short term component of the Italian and Spanish yield curves. The announcement of new the ECB Outright Monetary Transactions (OMT) programme had the clearest impact.

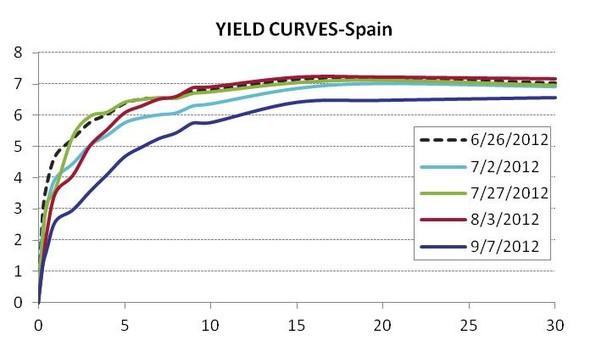

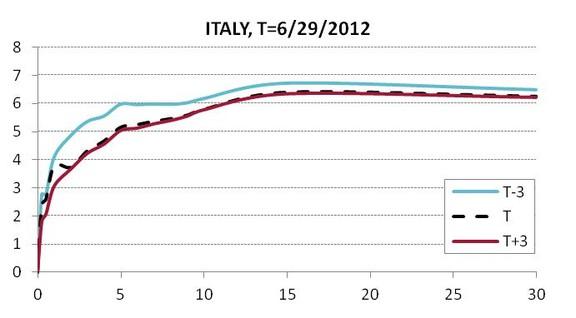

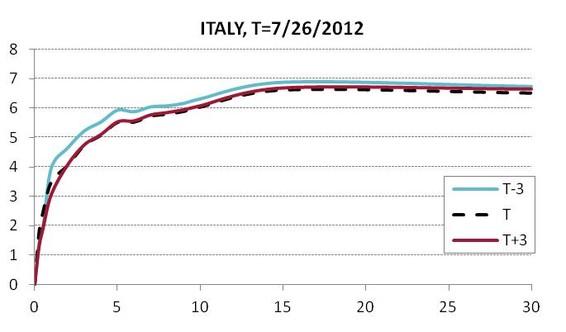

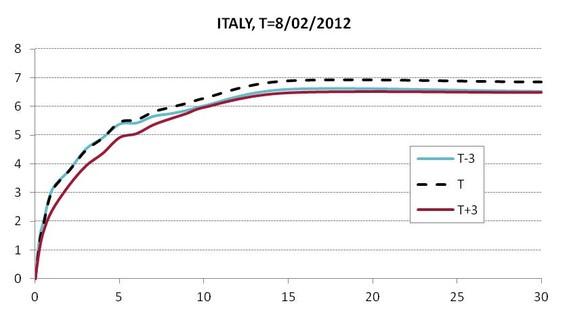

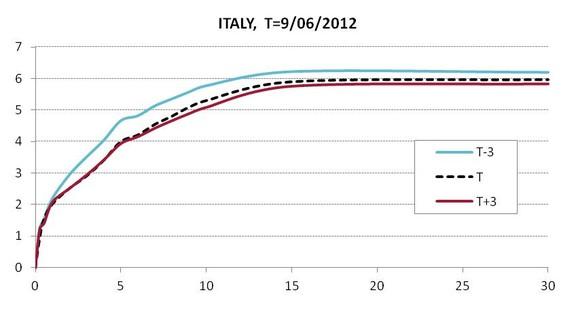

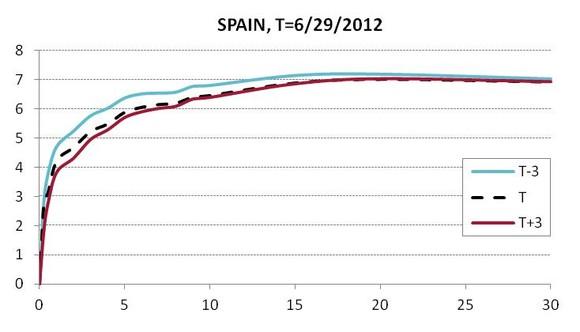

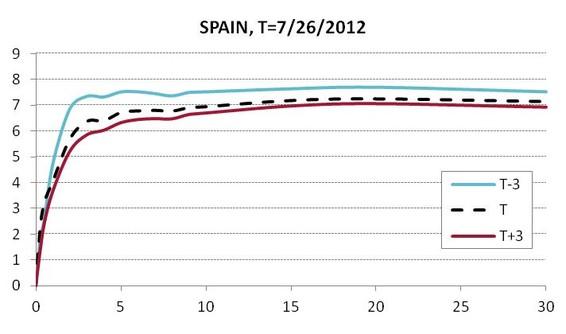

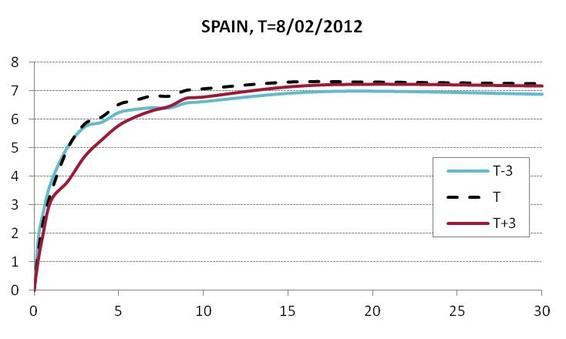

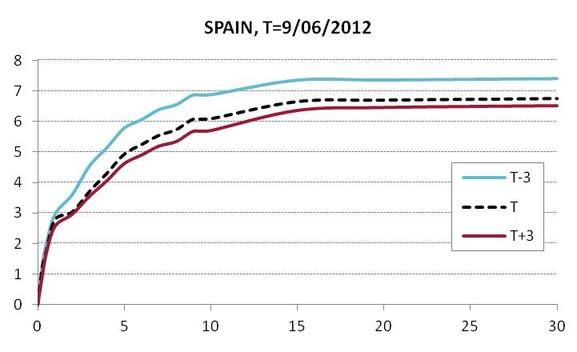

Figures 3 and 4 give more detail. In particular, the patterns of yield curves on the date of the event (T) are compared with the patterns of the previous (T-3) and following (T+3) three days. The 29 June Euro Summit had a material effect on the short term component of the Italian and Spanish yield curves.

Draghi’s speech in London, which raised expectations of a possible ECB purchase of government bonds, caused a downward shift of the yield curves for Italy and Spain. It must be noted that the pre-event shape of the Spanish yield curve was characterised by extremely high yields in the short-term component of the curve, with interest rates higher than 6.8 percent for 2-year maturity bonds.

On 2 August, Draghi announced that the ECB might undertake “outright open market operations… focused on the shorter part of the yield curve”. In response, Italian and Spanish curves started to exhibit a material downward shift only for short maturities, with the long term part remaining at the pre-announcement level.

Draghi’s announcement of the OMT programme has a substantial impact on the pattern of yield curves, with a downward shift for both short-term and long-term maturities, particularly for Spain. The new programme is targeted to government bonds with residual maturities of between one and three years. As a consequence, the yields of the government bills with maturities of three months, six months and one year have remained unchanged since the announcement.

Figure 1: 2-year and 10-year Government Bonds Yields, Italy and Spain

Figure 2: Comparison of Italian and Spanish yield curves in selected dates

|

|

|

|

Source: Datastream

Figure 3: Italian Yield Curves

|

|

|

|

Figure 4: Spanish Yield Curves

|

|

|

|