Policy complacency is the greatest threat to euro area growth

On 25 February 2014, the European Commission released its Winter 2014 Forecast document. After a double-dip recession and two consecutive ye

On 25 February 2014, the European Commission released its Winter 2014 Forecast document. As broadly ancipated, the Commission services revised (slighly) upward their forecast for euro area real GDP growth, on the back of positive cyclical indicators, a milder aggregate fiscal stance, and the expectation that structural reforms will start to bear fruit. Since November, when the last forecast was released, euro area GDP growth was revised up by 0.1% both in 2014 and 2015, to 1.2% and 1.8%, respectively. After a double-dip recession and two consecutive years of negative growth, the Commission seems to be prospecting the famous “light at the end of the tunnel”.

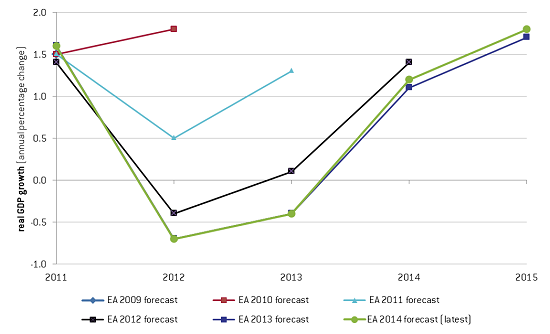

I would however caution against excessive optimism or, as Ashoka Mody called it recently, Europhoria. As displayed in the figure below, the Commission forecasts for the euro area have been systematically revised down over the past few years. In 2010, euro area 2012 growth was expected to come in at 1.8%, up from 1.5% in 2011. This figure was then revised down to 0.5%, then -0.4%, and the realisation came in at -0.7%. Similarly, in 2011 the Commission was penciling in just a minor dip in 2012 and expecting growth to rebound forcefully in 2013. This did not materialise, and actually 2013 was another year in which growth was in the red.

By anaylsing Commission Forecast documents over the period 1969-2011, Gonzales-Cabanillas and Terzi (2012) debunk the claim that the Commission displays a significant over-optimistic forecast bias for the EU or the euro area. However, it is accepted that its forecast accuracy deteriorates significantly during economic downturns – perhaps due to the haste to forecast a turn in the cycle.

It would be very unfortunate if European policy-makers were to interpret these mild good news as sufficient to pat each other on the shoulder, sit back and relax. Euro area unemployment has stabilised around 12.0%. Together with youth unemployement at around 24%, these are the highest levels observed in over a decade. The euro area outlook is still characterised by several risks going ahead. Large public and private debt overhangs, together with a banking sector which still needs restructuring, leave the euro area in a precarious condition. Moreover, the threat of potential deflation is looming and Wolff recently argued that the ECB should be more aggressive in tackling this risk. The greatest threat from and to the current more positive outlook, is that it might engender policy complacency. As the Commission itself concludes, “There is still some sailing to do before we reach harbour”.