Blogs review: The economics of sanctions between Russia and the West

In the context of Russian involvement in Ukraine and the annexation of the Crimea, the EU, US and other countries have announced sanctions a

What’s at stake: In the context of Russian involvement in Ukraine and the annexation of the Crimea, the EU, US and other countries have announced sanctions against Russia. These include restrictions of access for Russian banks to EU and US financial markets, bans on military and “dual use” goods as well as travel restrictions for individuals close to the Russian government. Russia has retaliated by imposing bans on the import of food from Western countries.

Long-term financial prospects of the Russian oil sector depend on its ability to continue pressing into new sources of oil

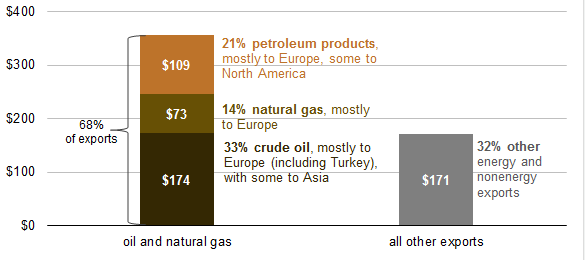

Matthew Yglesias writes that the last package of EU sanctions agreed on July 29 deals Russia three big blows: Firstly, cutting a large share of the Russian banking sector from EU-based sources of financing forces the Russian government to either spend money on the banking system that then cannot be used for creating mischief in Ukraine or watch the economy collapse as bank finance dries up. Secondly, the ban on arms trade is more effective by stopping imports of Russian-made equipment to the EU (EUR 3.2 bn p.a.) than by restricting EU arms exports to Russia (EUR 300 m p.a.). Thirdly, the ban on EU exports of equipment used in deep-sea drilling, arctic exploration, and shale oil extraction won’t put much pressure on the Russian economy in the short run, but will divide the Russian elite: The long-term financial prospects of the Russian oil sector depend on its ability to continue pressing into new sources of oil.

Fig. 1 Russia gross export sales, 2013, USD bn

Francesco Pappadia looks at the impact of the events around the Ukrainian crisis (including sanctions announcements but also the Crimean “referendum” or the shooting down of flight MH17) on stock markets in Russia, the USA and EU. While the impact was generally negative in all markets concerned, the Russian economy suffered more than twice as much as the American one. EU markets took a middle position with no significant intra-EU differences. In order to predict the impact on political reactions, the ability to bear economic pain is however just as crucial as the damage sustained. Russia with its little democratic vigour may have an advantage in the short run and in the long run one should expect democracies to prevail – but the short to medium run may be rough.

If a Russian bank that is more than 50 percent owned by the government issues stock or bonds, no European can participate

Peter Spiegel summarizes the EU’s financial markets sanctions: if a Russian bank that is more than 50 percent owned by the government issues stock or bonds, no European can participate. According to the European Commission’s estimate, between 2004 and 2012, $16.4bn was raised by Russian state-owned financial institutions through IPOs in EU markets. And in 2013 alone, about 47 per cent of all bonds issued by those banks — €7.5bn out of €15.8bn – were issued in the EU. However, no restrictions are Russian sovereign bonds will be implemented at this time, as a retaliation in kind by Russia could put EU sovereign bonds that currently enjoy low borrowing costs under pressure.

Robert Kahn writes that although the markets may underprice the escalation risks, Russia had (in April) already suffered a 9% stock market decline and capital flight of USD 60-70 bn in the first quarter of 2014 alone. Further sanctions (which have since been implemented) could meaningfully reduce Russian wealth through bans on trade and investment, but the most powerful effect on Russia comes from financial sanctions. The complexity of Russian entities' financial dealings with the West creates the potential for forced, rapid deleveraging—an intense "Lehman moment" of the sort witnessed in global markets after the failure of Lehman Brothers in September 2008. Risks of Russian retaliation exist particularly in the domain of energy exports, but the longer-term effects of a reorientation of European energy imports elsewhere would be far more damaging to the Russian economy than to the West.

The Economist writes that, as of September 2014, the sanctions have so far been in vain. Sanctions have hurt the Russian economy, but they have had no discernible effect on Mr Putin’s military strategy. Further measures could include blocking the property and accounts of entire sectors of the Russian economy, stretching asset freezes and financing restrictions across the entire banking industry or blocking Russia access to the SWIFT network, which is the arterial system for international bank-to-bank payments (and would make life very difficult for all Russia’s internationally active companies). Although historic precedents give rise to some scepticism over the effect of sanctions, which often do not achieve their immediate goals, there are two good reasons to impose them: First, they force aggressors to factor the growing costs of escalation into their decision-making. Second, they can be used as a bargaining chip to be conceded later, when the other side is coaxed into talks.

Contagious effects of sanctions?

It seems improbable that no contagion should exist, as financial streams between East and West will be affected

Wolfgang Münchau wonders at adjustments of the IMF’s economic forecasts after the announcement of sanctions. The 2014 growth forecast for Russia has been reduced by 1.1 percentage points to 0.2%, the forecast for Germany has been raised from 1.7% to 1.9%, but it seems improbable that no contagion should exist, as financial streams between East and West will be affected.

Robert Kahn writes that due to the view that Russia is of little systemic importance to the global economy (e.g. due to limited integration in global supply chains), the view of most investors is that sanctions against Russia would have limited regional contagion effects. In reality, contagion through trade channels is indeed likely to be limited. However, the financial market sanctions could cause strong effects on other markets: Particularly given the high external debt of Russia (equity exposure is limited), a rapid deleveraging of Russian financial institutions could cause sizeable losses for Russian and external investors. It is too sanguine to assume in a global market that the effects of sanctions will be limited to a region.

Retaliatory sanctions by Russia

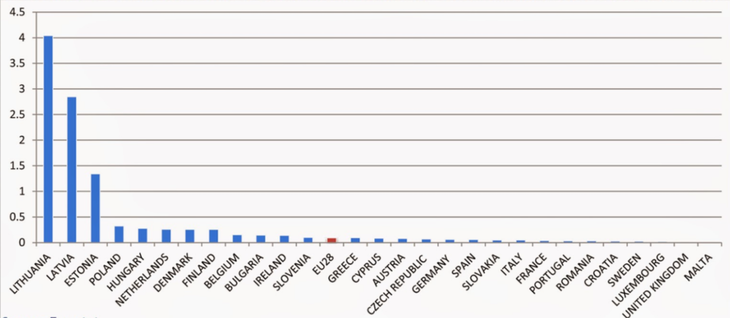

Open Europe analyses the exposure of European countries to Russia in agricultural trade. In aggregate terms, agricultural exports are about 7% of total EU exports. Of this, 10% goes to Russia and not all goods are affected by the sanctions. In terms of specific countries, the Baltic countries (Latvia, Lithuania and Estonia) will be hardest hit in terms of the trade as a share of GDP. In absolute terms, Poland, the Netherlands, Germany and Denmark will also face losses. On the Russian side, agricultural imports are 13.3% of total imports, equivalent to 1.2% of annual GDP.

Fig. 2 Shares of agricultural trade with Russia as percent of annual GDP, 2013

Food price rises will have a significant impact on the average Russian household, affecting the poor the most

Sarah Boumphrey writes that although the Russian ban on imports may strongly affect some EU countries, Russia may score an own goal here. Russia is a food importer with a trade deficit in food, live animals and beverages of US$23,878 million in 2013; and the ban on EU products could push up inflation, already high at 6.8% in 2013. Also, food and non-alcoholic beverages accounted for 30.5% of all consumer spending in the country in 2013. Food price rises will therefore have a significant impact on the average Russian household, affecting the poor the most.

Gabi Thesing and Whitney McFerron write that lower food prices, not restrictions in the gas supply, may give rise to the biggest negative fallout of the Ukraine crisis on the EU’s economy. Exports of EU food products now banned by Russia were worth €5.1 billion ($6.5 billion) last year, or 4.2 percent of the bloc’s agricultural shipments, according to the European Commission. Food prices now are falling: According to Copa-Cogeca, one of Europe’s largest farmers’ unions, prices for Dutch cucumbers and tomatoes dropped 80 percent and the price of apples in the Czech Republic dropped by 70 percent after the ban went into effect. Falling food prices seem now to be the biggest downward influence on already critically low Euro area inflation.

The Economist’s Buttonwood is surprised by Russia’s retaliatory ban on food imports from Western countries. As Russia will presumably still have to buy these goods on the world market, world market demand will remain unchanged, with just some pairings of producers and consumers changed. The problem is that food is a fungible good and one demand market can simply be substituted by another as long as aggregate demand remains the same. The same holds for export embargoes to selected countries: Sanctions may just create intermediary traders (also see this older piece by Johny Tamny on trade embargoes and fungible goods). Only if a good is not fungible – like gas, which could not easily be replaced – do trade sanctions seem potentially more effective. But Russia’s dependency on gas revenues makes this another possible own goal.

Coordination issues and smart sanctions

Daniel Drezner (HT Tyler Cowen) empirically investigates whether cooperation between multiple sanctioning states improves the success of sanctions – and finds that it does not. His evidence suggests that the lack of success of cooperation in sanctioning is due to enforcement problems, not bargaining difficulties between would-be sanctioning countries. After an agreement between cooperating sanctioners is reached, these equilibria seem not to be robust as incentives of cooperating parties may change, destabilising equilibria dependent on cooperation. If sanctions are supported by an international organisation, however, the success probability of cooperative sanctions is higher.

Erik Voeten advances the argument that “smart sanctions”, targeting the elites of the target country instead of its broad population, may fail because restricting access to finance and financial services in other countries, including blocking access to assets, could tie elites even more strongly to their regimes. This argument is similar to one often voiced against the International Criminal Court, namely that it restricts exit options for elites. Of course, the normative appeal of smart sanctions as well as their possible deterrence effect should also be weighed in the argument, but when ways to undermine regimes are sought (the author wrote on the issue of Syria), positive incentives such as rewards for defectors should also be considered as another option.