Has a stronger renminbi contributed to financial tightening?

The People’s Bank of China (PBC), the Chinese central bank, finally cut its benchmark interest rates on 21 November, after easing its policy in a shad

The People’s Bank of China (PBC), the Chinese central bank, finally cut its benchmark interest rates on 21 November, after easing its policy in a shadow-boxing fashion for more than six months. This is a vindication of our strong and non-consensus view that China ought to ease its monetary policy. There is more Chinese easing to come, in my view.

Of the many arguments I have put forward for a timely and measured monetary easing, one important consideration is that China’s financial conditions have tightened considerably since the global financial crisis. Hence, as an insurance policy, the PBC ought to ease.

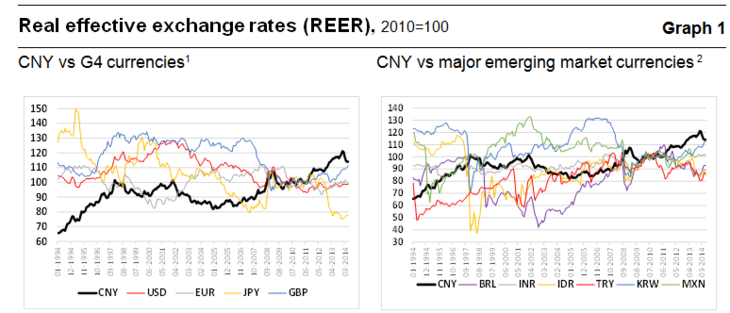

One obvious possible source of financial tightening could be the substantial real effective appreciation of the renminbi (RMB), one of the five financial asset prices underlying our constructed financial condition index. The past twenty years have witnessed a 50 percent-plus real effective appreciation of the RMB, a record matched by few major emerging market currencies (Graph 1).

Note: CNY stands for Chinese renminbi, USD for US dollar, EUR for euro, JPY for Japanese yen and GBP for sterling. 2 BRL for Brazil real, INR for Indian rupee, IDR for Indonesian rupiah, KRW for Korean won, MXN for Mexican peso, and TRY for Turkish lira.

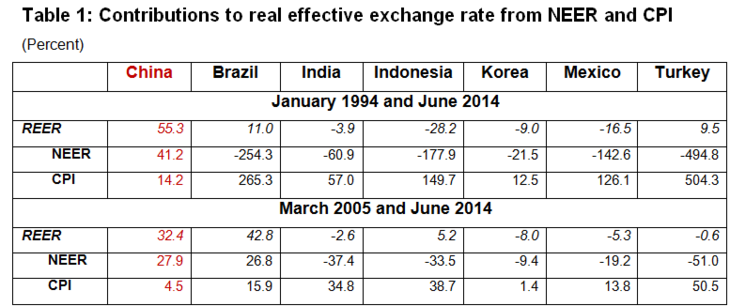

To what extent would such sizeable real effective appreciation add to China’s broad-based financial tightening? This is a tricky question. By definition, a change in the real effective exchange rate (REER) comes from two sources and their interaction: nominal effective exchange rate (NEER) and inflation differentials vis-à-vis trading partners.

One popular story goes like this: the PBC has heavily intervened in the foreign exchange market to slow the appreciation of the NEER, as evidenced by the bulging Chinese official foreign exchange reserves, which rose 70-fold between 1994 and 2014 to a staggering pot of US$4 trillion. Buying a large amount of dollars and euros of course means lots of printing of money by the PBC. This could compromise the autonomy of its monetary policy. Thus the burden of the REER adjustment might fall heavily and expensively on Chinese inflation, which could go through the roof.

Moreover, the resulting higher local consumer price inflation would pressure the PBC to hike domestic interest rates, further tightening China’s financial conditions. And higher interest rates might in turn hurt the real economy and hit the local equity market, which has lost more than a quarter of its value since the global financial crisis prior to the latest boom. Thus, all five underlying financial asset prices would collectively tighten China’s aggregated financial conditions, according to our constructed financial condition index.

So Chinese financial tightness is in part self-inflicted, owing to its rigid exchange rate. Effectively, this story predicts that the REER of the RMB has appreciated mostly via China's much higher domestic inflation relative to its trading partners, rather than mainly through a marked strengthening of its NEER.

Fortunately or unfortunately, this story is mostly imaginary, once we decompose the RMB’s big REER appreciation over the past two decades into relative contributions from the NEER and trade-weighted CPI differential. To put the matter into perspective, I benchmark the RMB against six weighty emerging market currencies. From the following table, three important observations can be made.

Note: natural logs of REER and NEER. A positive (negative) number indicates appreciation (depreciation). Contribution from CPI is computed as the natural log of REER less that of NEER. The BIS REER and NEER take into account third-market competition.

the RMB has strengthened by more than 50 percent in real effective terms, the most among the major emerging market currencies over the past two decades

First, the RMB has strengthened by more than 50 percent in real effective terms, the most among the major emerging market currencies over the past two decades. This observation also broadly holds for the last decade. Rather than exerting competitive devaluation pressure on its major emerging market peers, it appears that China has instead endured it. The main exceptions perhaps are the resource-based emerging market currencies, mostly because of big hikes in commodity prices over the past two decades, until the latest corrections.

Second, the Chinese RMB has demonstrated remarkable long-term trade-weighted ‘currency flexibility’, as three quarters of this 50 percent-plus REER appreciation have come from nominal appreciation over the past twenty years. Indeed, the RMB NEER has strengthened the most among the six emerging market currencies listed in Table 1.

Third, relative inflation has played a reinforcing but secondary and minor role in the REER appreciation of the RMB. The Chinese trade-weighted inflation differential has averaged slightly higher than those of its trading partners but apparently way lower than most of its major emerging market peers.

These three observations combine to highlight one marked contrast between China and these six big emerging markets. In the RMB’s case, both its NEER and trade-weighted CPI differential have complemented each other to share the sizeable adjustment burden of real effective appreciation, whereas for most major emerging market currencies, typically much higher local inflation has interacted and probably forced sharp nominal currency depreciation, floating or otherwise, resulting in either noticeable real depreciation or tiny real appreciation.

it is the much stronger nominal exchange rate and not inflation that has principally delivered the substantial real effective appreciation of the RMB

In short, it is the much stronger nominal exchange rate and not inflation that has principally delivered the substantial real effective appreciation of the RMB over the past two decades. A much stronger RMB on its own tightens China’s financial conditions but is not the principal cause of its broad-based financial tightness. Instead, China’s decent inflation record since 2000 should reduce its inflation risk premium, warranting lower rather than higher domestic interest rates and thus easier financial conditions.

After all, why should a much stronger RMB still need to pay or offer a higher and rising interest rate? In my view, this makes little or no sense, except perhaps for the chuckling currency carry traders or fat coupon clippers!

Read more:

Are financial conditions in China too lax or too stringent?

A compelling case for Chinese monetary easing