Could Europe’s next growth locomotive be Made in Italy?

Important reforms put in place over the past months, combined with a conjunction of particularly supportive external factors, mean that Italy could in

“I bet you that in the next 10 years, Italy will return to be the [economic] leader of Europe, the locomotive of Europe.” When reading these words on TIME magazine in late April 2014, many must have thought that Italy’s then new Prime Minister Matteo Renzi was at best youthfully delusional, at worst a dazzling propagandist.

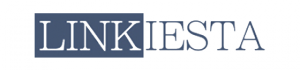

Scepticism was all but unwarranted for a country that, over the past decades, had proved serially impossible to reform and, as a consequence, is the only EU member state, together with Greece, where real GDP is now below its 2000 level.

However, one and a half years down the road, the Prime Minister’s optimistic view for Italy starts no longer looking like a completely far-fetched scenario, but rather as a possibility. Important reforms put in place over the past months, combined with a conjunction of particularly supportive external factors, mean that Italy could indeed become the fastest growing large economy in the euro area in a not-too-distant future.

Figure 1. Real GDP (2000=100)

Source: Eurostat

Notwithstanding a wafer-thin majority in Parliament, Renzi has managed to secure approval for reforms that have the potential to restructure deeply the Italian economy.

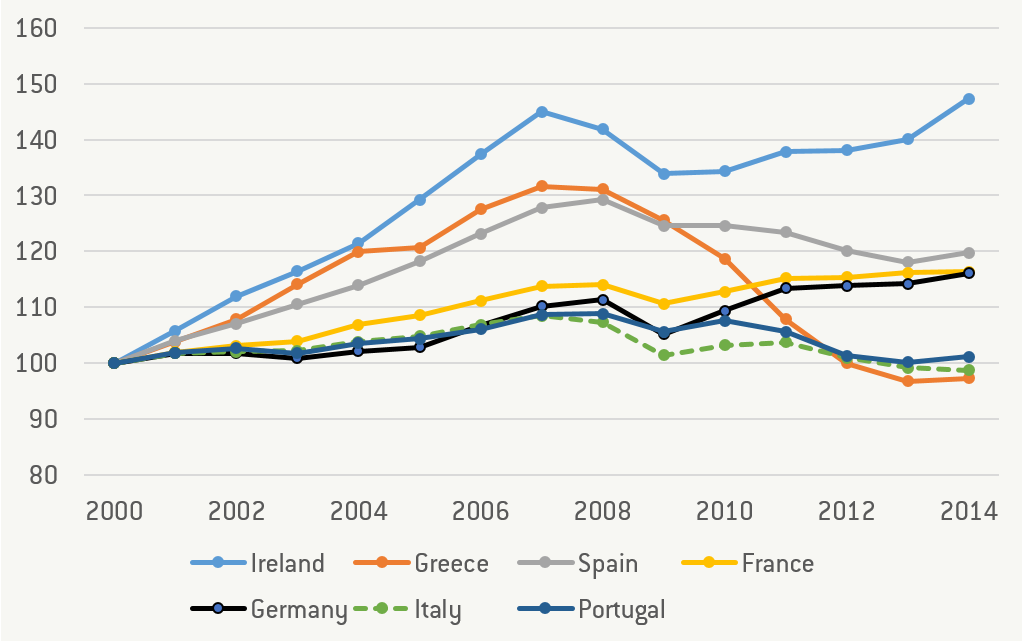

A substantial liberalisation of the labour market – embodied in the so-called ‘Jobs Act’ – could boost Italy’s appallingly low employment rate by as much as 10 percentage points over the long term according to a survey of business leaders attending the Forum Ambrosetti, and reverse the decline in labour productivity observed during the 2000s.

Figure 2. Employment rate (15 to 64 years)

Source: Eurostat

With a final vote in the Senate in early August, foundations have been laid for a deep reorganisation of the public administration. Designed to simplify the byzantine bureaucratic apparatus that has long choked the Italian economy, the PA reform is also set to promote transparency and clearer lines of accountability. Past success stories show how these are precisely the set of principles behind an effective anti-corruption strategy, in a country where the problem has become disconcertingly rampant.

The latest major addition to Renzi’s reform checklist is an agreement on overhauling the Italian institutional set-up that, in the Prime Minister’s plans, will transform the Senate in a regional chamber with little say on national legislative matters. Combined with the electoral reform – the so called Italicum – approved in May, the constitutional reform has the potential to ensure political stability to a country where the average lifetime of a government in the post-War era has been 12 months.

Tables have turned in favour of Renzi’s prophecy also due to a set of particularly favourable external conditions. The ECB’s QE programme has proved more successful in Italy than elsewhere in rekindling bank-lending channels, while a combination of low oil prices and a weak euro have bolstered the country’s domestic and foreign demand. Finally, the compression of sovereign bond yields resulting from the ECB’s actions have granted Italy more fiscal leeway: a lever that the Renzi government seems set to use to the fullest extent.

All the above suggests that indeed Italy could potentially become the fastest growing large economy in the euro area over the next few years. However, this scenario has merely moved from wishful thinking to an eventuality, still hardly representing the baseline.

While the reforms put in place so far represent important milestones that could help transform the recovery from cyclical to structural, their success will rest on effective implementation. The overarching framework of the PA reform was indeed approved by Parliament, but will require as many as 20 executive decrees in order to be completed. As usual, the devil will be in the details. Similarly, agreement was reached on the text of the constitutional reform, but this will still require a final vetting in Parliament and, most likely, official sanctioning by a referendum in late 2016.

More in general, Italy’s reform agenda is far from completed, with important measures still needed to shorten the length of judicial procedures, simplify the current labyrinthine tax system, bring wage bargaining closer to plant level, and restructure the banking sector, only to mention a few priorities.

Moreover, Italy’s longstanding vulnerabilities such as its mammoth public debt – second only to Greece’s in GDP terms – and high dependency on energy imports imply that a macroeconomic shock, be it in the form of renewed financial market jitters or higher oil prices, could easily derail the recovery.

The challenges facing Italy are formidable, but an equally formidable and far-reaching reform plan can succeed in finally bringing the country back to sustained growth after decades of stagnation. As the recovery gains traction and reforms start bearing fruit over the coming months, no resting on laurels will be allowed if Renzi intends to win his bet.