The dual objective of China's competition quest: mitigating structural deceleration and great power rivalry

The Chinese economy has been decelerating for over a decade and will likely continue to do so, given the structural forces pushing it in this direction, such as an increasingly low return on assets but also aging. China’s single ‘silver bullet’ to mitigate such structural deceleration is innovation. To counter the downward pressures to development, and to increase domestic productivity, the central government is doubling down on its quest for industrial upgrade and technological innovation. Progress is visible. China has risen to the top in terms of number of scientific publications and patents. While quantity does not necessarily equal quality, there is plenty of evidence of China’s ambition in many different sectors.

There are three main reasons for this success. First, the increase in expenditure for research and development (R&D) and improvements in human capital are central to the government’s priorities. Second, the Chinese government has been lending financial and organisational support to research institutions such as universities, state-run laboratories, and urban technology development zones. This also implies that the government is pushing for the maximum level of international cooperation, especially with the United States and Europe. Third, innovation-centered industrial policy has become an important tool to finance and foster innovation. The ‘Made in China 2025’ initiative has been complemented by a range of industry-specific plans like the ‘Little Giants’ initiative which is a strategy to cultivate innovation in small- and medium-sized firms and to help them become leaders in niche markets. The government has also ramped up subsidies and tax incentive schemes, among many other forms of financial support for innovation, including equity investment into firms through sector-specific government guidance funds. However, this has yet to increase productivity. This could be due to a lack of business dynamism and government favoritism, or cronyism. Institutional development in China is still not complete and local governments often do not internalise the central government’s concern for technological upgrading. The other problem comes from the US in its quest to protect its comparative advantage. All these potential bottlenecks might be reducing the impact of innovation on growth.

Beyond China’s institutional issues, great power competition is simultaneously helping China innovate – by emulating the West – and creating chokepoints for China. The strategic competition between the US and China started in early 2018 when the Trump administration implemented untargeted import tariffs and reoriented most of its trade efforts towards widening the technology gap between China and the US with a special focus on deep tech, such as semiconductors. The Biden administration has pushed even further in that direction. However, one should not forget that China was reducing its dependence on certain technologies (especially internet and digital platforms) even before Trump came to power. The US is trying to contain Chinese technology while China is choosing where to engage and where to disengage.

Given how entrenched the strategic competition between the US and China has become, the question is no longer when it will end but, rather, what consequences it may have. A slow but steady process of bifurcation of technologies and technological standards may happen.

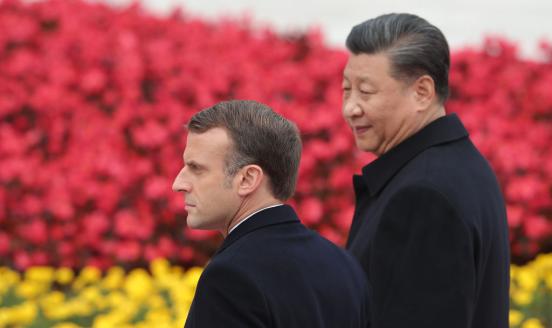

Unlike the hawkish tone of US leaders towards China’s technological containment, European policymakers tend to be more nuanced as their interpretation of de-risking mostly focuses on reducing strategic dependence (ie excessive concentration of the EU's imports on one single source, namely China) rather than on national security grounds. Also the EU is still far from expanding its export controls on key technologies except if imposed by the US, as is the case of ASML’s lithography machines within the semiconductor supply chain. More coordination of the EU’s export control apparatus is in the making as well as potential outbound investment screening (which is already in place in the US), but both come with a lag and with much less enforcement capacity than for the US.

Whether China succeeds in reducing – or even eliminating – the technological gap or not, it seems clear that both the US and China are fighting for alliances to create cohesive enough blocs in which to run their technological ecosystem. In that regard, emerging and frontier economies – collectively known as the Global South – are increasingly interested in China’s technology as they believe it will remain more accessible than that of the US, which is another factor pushing for the two ecosystems to continue to expand beyond the US and China themselves. The EU seems reluctant to fully contain China technologically as it is leveraging China’s indispensability in the very specific case of lithography machines for electronic chips, which is creating a relevant chokepoint for China. Therefore, economic security in the US, China and increasingly in Europe will make it harder for China to mitigate its structural deceleration through innovation.

This is an output of China Horizons, Bruegel's contribution in the project Dealing with a resurgent China (DWARC). This project has received funding from the European Union’s HORIZON Research and Innovation Actions under grant agreement No. 101061700.

ZhōngHuá Mundus is a newsletter by Bruegel, bringing you monthly analysis of China in the world, as seen from Europe.