Which mergers should the European Commission review under the Digital Markets Act?

This paper assesses which firms are likely to be gatekeepers under the Digital Markets Act.

Executive summary

Large digital platforms acquired 1149 firms in various economic sectors between 1987 and July 2022. The European Commission reviewed only 21 of these mergers as most did not meet the European Union merger control turnover threshold. This suggests under-enforcement, with some problematic mergers escaping merger review and thus posing competition risks.

The EU Digital Markets Act, which entered into force in November 2022, imposes obligations on firms that are considered ‘gatekeepers’ in relation to some core platform services, such as online search engines. In particular, these firms must now inform the Commission of all their intended acquisitions. This, in combination with Commission guidance on referrals by EU national competition authorities of mergers for review, should ensure more merger reviews in the digital sector.

Current European Commission guidance on referring cases for merger review is flexible but impractical as it relies on theories of harm rather than clear and objective criteria. Without clarification, there could be over-enforcement in which unproblematic mergers are reviewed, human resources are allocated inefficiently and legal uncertainty persists.

The Commission should issue new guidance on which digital mergers are likely to be problematic, thus triggering referral for merger review. This is likely to be the case when the target’s user base overlaps with that of the acquirer, when the target is a leader in a future critical market and when the target is active in a core platform service.

1 Introduction

The European Union’s Digital Markets Act (DMA) is a landmark law that imposes a list of ex-ante obligations and prohibitions on large online platforms[1]. Within its scope are ‘gatekeepers’, or hard-to-avoid operators in some core platform services, such as online search. In particular, the DMA imposes an obligation on gatekeepers to inform the European Commission of all intended acquisitions, as part of a process to identify problematic ones that would require a merger review (Art. 14 DMA).

The DMA is intended to work in tandem with Article 22 of the EU merger regulation (EUMR), under which EU countries can refer mergers to the Commission for review[2]. Previously, the Commission accepted referrals only if mergers met the merger control threshold – usually a minimum level of aggregated turnover of the parties – of at least one EU country. However, in guidance issued in 2021 on Article 22 EUMR (European Commission, 2021), the Commission abandoned this requirement. This was a response to criticism that the Commission reviewed only a few mergers involving potential DMA gatekeepers. Of 1149 mergers involving gatekeepers from 1987 to July 2022, the Commission reviewed only 21. Most of these mergers fell below EU and national merger control thresholds because of the low or non-existent turnover of the merger target.

With the new approach, the Commission can therefore now review any merger, even those below national merger control thresholds. The combination of Article 14 DMA and Article 22 EUMR thus better equips the Commission and EU countries to identify problematic mergers that can be referred to the Commission for merger review.

The Commission can now review any merger involving a gatekeeper, even those below national merger control thresholds.

However, the Commission guidance (European Commission, 2021) does not rely on clear and objective criteria but on theories of harm to identify problematic mergers. Moreover, the guidance is only illustrative, meaning that the Commission can accept referrals of mergers that are outside the scope of the guidance . The advantage of this is that the Commission can review any mergers involving gatekeepers. However, it also creates risks of over-enforcement of unproblematic mergers, inefficient allocation of resources for both competition authorities and gatekeepers, and legal uncertainty.

To alleviate those drawbacks, the Commission should issue new guidance specific to the DMA, setting out which mergers involving gatekeepers are likely to be problematic, based on clear objective criteria.

In this context, this Policy Contribution assesses which firms are likely to be gatekeepers under the DMA. It then explains how Article 22 EUMR and the DMA should work in tandem. Finally, based on analysis of past acquisitions by gatekeepers, it proposes objective and clear criteria to identify which mergers are likely to be problematic, thus requiring a merger referral to the Commission by an EU member state.

2 Potential gatekeepers

The DMA defines a gatekeeper as a firm that has a significant impact in Europe, provides a core platform service (CPS) that is an important gateway for business users to reach end users, and has an entrenched and durable position, or is likely to have in the near future (Art. 3 DMA). It further outlines three cumulative quantitative criteria that if met create a presumption that a firm is a gatekeeper.

These criteria are:

- The firm’s annual EU turnover is at least €7.5 billion in each of the last three financial years, or its average market capitalisation/fair market value is at least €75 billion in the last financial year;

- It provides the same CPS in at least three EU countries. A CPS defined in Article 2 DMA includes: (1) online intermediation services, (2) online search engines, (3) online social networking services, (4) video-sharing platform services, (5) number-independent interpersonal communications services, (6) operating systems, (7) web browsers, (8) virtual assistants, (9) cloud computing services, and (10) online advertising services by a firm that provides any of the above CPS; and

- The CPS has at least 45 million monthly active end users, and at least 10,000 yearly active business users in the EU, in the last three financial years.

The firm can rebut the presumption. However, the Commission can still, by carrying out a market investigation under Article 17 DMA, designate a firm as a gatekeeper even if it does not meet the above quantitative criteria. This Commission power enables the designation of a gatekeeper based on qualitative and quantitative criteria (Art. 3 DMA).

The DMA thus does not define gatekeepers based on their alleged monopolistic power. This is because assessment of monopolistic power requires the defining of a relevant market and then identification of market power in this market, as in antitrust laws. In the digital economy, the market-by-market assessment is complex because of the characteristics of digital markets, including the multi-sided nature of firms that act as intermediaries between at least two distinct groups of consumers – end users and business users (Crémer et al, 2019). The complexity is one reason for the slowness of antitrust laws in digital markets. Lawmakers wanting to foster enforcement in digital markets thus abandoned the market-definition requirement in favour of a definition based on criteria related to the power of intermediation.

Based on the first two criteria, 13 firms are likely to be designated gatekeepers under the DMA (Table 1; data on the third criteria is not available publicly) (Mariniello and Martins, 2021).

Table 1: List of potential gatekeepers based on criteria 1 and 2

|

Firm |

Criterion 1: turnover (€ billions) |

Criterion 1: market capitalisation (€ billions) |

Criterion 2: provision of a CPS |

|

Airbnb |

2.5 (2021); 1.5 (2020); 2.7 (2019) |

87.8 (2021) |

Airbnb (1) |

|

Alphabet (Google) |

118.1 (2021); 85.3 (2020); 77.3 (2019) |

1417.4 (2021) |

Google Play Store (1); Google search (2); YouTube (4); Android (6); Google Chrome (7); Google Home (8); Google Cloud (9); Google display and search ad (10); YouTube video ad (10) |

|

Amazon |

108.1 (2021); 91.6 (2020); 66.8 (2019) |

1429.5 (2021) |

Amazon e-commerce (1); Twitch (4); Fire OS (6); Alexa (8), Amazon web services (9); Amazon display and search ad (10); Twitch video ad (10) |

|

Apple |

74.7* (2021); 61.4* (2020); 53.4* (2019) |

1839.7 (2021) |

Apple app store (1); Apple e-commerce (1); Apple Books (1); MacOS (6); iOS (6); Safari (7); Siri (8); Apple iCloud (9); Apple search ad (10) |

|

Booking Holdings |

8.1 (2021); 5.3 (2020); 12 (2019) |

79.6 (2021) |

Booking (1); Booking search ad (10) |

|

Meta (Facebook) |

24.6* (2021); 17.9* (2020); 15* (2019) |

768 (2021) |

Facebook marketplace (1); Facebook (3); Instagram (3); Facebook iGTV (4); Facebook Messenger (5); WhatsApp (5); Facebook display ad (10); Instagram display ad (10) |

|

Microsoft |

70.6 (2021); 63.2 (2020); 54 (2019) |

1440.9 (2021) |

Bing (2); LinkedIn (3); Skype (5); Microsoft Teams (5); Windows (6); Microsoft Edge (7); Microsoft Azure (9); Bing search ad (10); LinkedIn display ad (10) |

|

Oracle |

18.3 (2021); 18.7 (2020); 18.2 (2019) |

156.9 (2021) |

Oracle Cloud (9) |

|

PayPal |

9.9 (2021); 9.2 (2020); 7.4 (2019) |

252 (2021) |

PayPal (1) |

|

Salesforce |

5.1*(2021); 3.9* (2020); 3.1* (2019) |

200.6 (2021) |

Salesforce cloud (9) |

|

SAP |

12.6** (2021); 12.1** (2020); 12.1** (2019) |

143.2 (2021) |

SAP IaaS (9); SAP PaaS (9) |

|

Uber |

7.1 (2021); 4.4 (2020); 4.5 (2019) |

77.2 (2021) |

Uber (1); Uber Eats (1) |

|

Zoom |

0.7** (2021); 0.4** (2020); 0.06** (2019) |

75.4 (2021) |

Zoom (5) |

Source: Bruegel based on data from Bloomberg for criterion 1. The data on turnover is at the international level (meaning outside the United States), except specified otherwise by * for data at European level and ** for data at EMEA level. The numbers in brackets in the CPS column refers to the type of CPS in line with criteria 2. For example, (1) refers to online intermediation services.

3 Article 22 EUMR and the DMA

3.1 How it works in practice

The DMA requires gatekeepers to inform the European Commission of any merger in the digital sector, including those involving data collection (Art. 14 DMA). The Commission must then inform EU countries about the information received to enable the latter to make a merger referral under Article 22 EUMR. The Commission might then expect to review more mergers in the digital sector thanks to the combination of the DMA obligation and Article 22 EUMR referrals (see the introduction).

Under the DMA gatekeepers must provide at a minimum information on the firms concerned, their EU and global revenues, their fields of activity, and the value of the transaction. Gatekeepers must also provide a summary of the merger that stresses its rationale, and a list of EU countries concerned by the merger. For core platform services, information must be provided on the relevant annual EU revenues, numbers of yearly active business users and numbers of monthly active end users. However, the Commission can ask gatekeepers for more information.

Article 22 EUMR allows EU countries to refer to the Commission mergers with a local nexus in Europe that affect intra-EU trade and could undermine competition withinz the territory of the country or countries making the request. The 2021 Commission guidance on Article 22[3] prioritises review of mergers where the target turnover does not reflect the actual or future competitive potential, irrespective of the economic sector, but is purely illustrative. The Commission can decide to accept or decline any referrals that are outside the scope of the guidance. Nevertheless, the guidance provides guiding principles for the identification of appropriate mergers for referral. These guiding principles highlight mergers involving acquisitions of nascent, innovative or current/potential competing firms that have competitively significant assets (eg data) and/or provide key inputs for other industries. Moreover, the Commission will consider the value of the transaction compared to the current target’s turnover.

However, the guiding principles are impractical for identifying only problematic mergers as they rely on theories of harm related to killer acquisitions and nascent competitors, rather than objective and clear criteria.

A killer acquisition is when the acquirer buys a target and shuts down the target’s innovation projects or its own projects (reverse killer acquisitions) to pre-empt future competition. This leads to less innovation and loss of potential competition (Cunningham et al, 2021; Caffarra et al, 2020).

However, the theories of killer acquisition and reverse killer acquisition both rely on internal data from the merging entities, which the competition authority might not have access to. Moreover, both theories conflict with the aim of a merger. A merger aims to integrate the target into its activities, sometimes resulting in the discontinuation of the target because it is absorbed by the acquirer. But the integration or discontinuation of the target does not mean that the acquirer kills the target’s innovation projects or its own projects. The evidence of integration or discontinuation is thus not evidence of killer acquisition. For instance, Meta acquired the group messaging service Beluga in April 2011 without a plan to shut down the target[4]. A few months later, in October 2011, Beluga announced it was shutting down its service because "it duplicates some of Facebook Messenger's functionality"[5]. It is impossible to know whether Meta shut down Beluga to prevent competition with Facebook Messenger or to incorporate it into Facebook Messenger. This example shows that only internal documents can provide evidence of integration or discontinuation done to prevent competitive threats. However, an internal analysis is unlikely to help the competition authority during the merger review because documents might not show the acquirer’s intention to discontinue the target’s activity in order to prevent a competitive threat, or to incorporate it into its existing products/services. Therefore, regulators are unlikely to find the necessary evidence on whether the buyer buys the target to integrate it, kill it or kill its own projects.

The concept of nascent competitors means that incumbent firms buy potentially competing innovative targets at an early stage to avoid future competitive threats. As with integration and discontinuation, acquisition of nascent competitors leads to a loss of potential competition, resulting in consumer welfare loss because of less competition and innovation (Hemphill and Wu, 2020).

3.2 Cost-benefit analysis

For Article 22 EUMR to be effective, the Commission should be able to accept only referrals of mergers that will likely pose competition issues. The Commission should focus only on problematic mergers without impeding unproblematic deals. In that instance, the Commission and the merging parties save time and resources while problematic mergers are under scrutiny.

Inefficiencies could arise if the Commission and EU countries overuse Article 22 EUMR. Under political pressure and considering the high number of past acquisitions by gatekeepers that were not reviewed, some EU countries might have the incentive to refer to the Commission a significant number of mergers involving gatekeepers, in order to avoid under-enforcement in the digital sector. However, overuse also creates enforcement costs and legal uncertainty. In terms of the former, competition authorities and the parties will both have to dedicate significant time and resources to reviewing mergers that are unproblematic in most cases (see section 4).

In terms of legal uncertainty, gatekeepers cannot know in advance whether EU countries will refer their acquisitions to the Commission and whether the Commission will accept the referral. Consequently, gatekeepers must wait until deadlines defined in Article 22 EUMR (at the latest 40 days) have passed to know whether the Commission will review or not. Once the Commission informs merging parties that a member state has made a referral, the parties must suspend the deal from that time until the Commission decides to clear or block the merger (Art. 7 EUMR). The suspension of the merger can lead to substantial costs because any review results in delays and creates a risk that the Commission will block the deal.

In sum, the costs might outweigh the benefits of Article 22 EUMR as the Commission has the ability and the incentive to review many acquisitions to avoid under-enforcement. At least in the first years of the DMA, this is a likely scenario because of political pressure and the need for the Commission to learn from past cases in terms of which mergers to review under Article 22 EUMR.

4 Past acquisitions by gatekeepers

The Commission should accept merger referrals that only pose competition issues based on clear and objective criteria. Examining gatekeepers’ past acquisition strategies, specifically in relation to core platform services, will help define these criteria.

4.1 Gatekeepers’ acquisition strategies

To review past acquisitions, we use the methodology of Argentesi et al (2019), who grouped the target’s activities into clusters, facilitating insights into the type of merger based on Crunchbase descriptions and Crunchbase tags (Argentesi et al, 2019)[6]. There are three caveats to this. First, Crunchbase provides a description of the target that might not be up-to-date or might not accurately reflect the target activity at the time of the merger. Second, Crunchbase offers several tags that might not always be accurate for the target’s economic activity, requiring judgements to be made in order select tags that are most relevant to the target’s description. Third, the economic activities of targets are very diverse. It is thus necessary to cluster them, but this implies some imprecision in the targets’ economic activities.

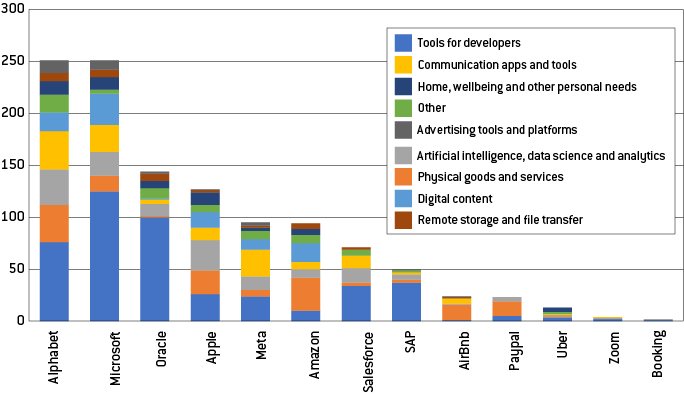

Table 2 clusters the 1149 mergers involving gatekeepers from 1987 to July 2022. It shows that the acquisition strategies of potential gatekeepers span many economic sectors, from security, payments and eBooks, to geospatial. Moreover, most acquisitions concern targets that offer tools for developers, such as software, artificial intelligence, data science and data analytics.

Table 2: List of clusters based on Argentesi et al (2019)

|

Cluster |

Economic sector |

Number of mergers |

|

Tools for developers |

Apps; developer tools; marketing; operating systems; product design; security; software |

444 |

|

Physical goods and services |

Augmented/virtual reality; e-commerce; finance; hardware; hospitality; internet of things; manufacturing; payments; robotics; semiconductors |

149 |

|

Artificial intelligence, data science and analytics |

Apps; AI software; computer vision; data analytics; data storage; voice recognition; computer vision |

147 |

|

Communication apps and tools |

Apps; customer relationship management; messaging; photo-sharing; search engine; social media; videoconferencing |

133 |

|

Digital content |

Apps; audiobooks; computer vision; digital entertainment; eBooks; gaming; music; movie; music streaming; photography; publishing; video editing; video streaming; video sharing |

92 |

|

Other |

Aerospace; apps; autonomous cars; consulting; geospatial; internet; news; recruiting; research; telecommunication; web; wireless |

64 |

|

Home, wellbeing and other personal needs |

Apps; delivery; education; healthcare; navigation/mapping; transportation |

57 |

|

Remote storage and file transfer |

File transfer; cloud services |

34 |

|

Advertising tools and platforms |

Advertising |

29 |

|

Total |

|

1149 |

Source: Bruegel based on Argentesi et al (2019), table I.1, and Crunchbase.

Figure 1 shows the clusters by potential gatekeepers. Most gatekeepers have acquired targets in all the clusters. This suggests that the acquirer buys the target to complement, rather than compete with, its core products/services. Gatekeepers have thus tended to diversify their economic activities, instead of focusing on one, in line with previous findings in the economic literature (Parker et al, 2021).

Figure 1: Acquisitions per cluster by likely gatekeepers, 1987 to July 2022

Source: Bruegel based on Crunchbase.

From a competition standpoint, this means that the acquisitions of potential gatekeepers have been mainly conglomerate mergers, to expand the acquirer’s ecosystem from one core service/product to others, rather than horizontal to grow their core services/products. In other words, they are so-called conglomerate mergers involving companies in unrelated areas (Box 1).

Box 1: Conglomerate mergers

Competition authorities generally do not consider conglomerate mergers problematic, and thus rarely investigate them. This is because the acquirer’s activity does not overlap with the target’s activity. Therefore, in most cases, the merger will not lead to competition issues (European Commission, 2008). In fact, the merger can generate positive effects in terms of efficiency gains resulting from economies of scale and scope, and the dissemination of the target’s assets to a broader set of users (Parker et al, 2021).

However, conglomerate mergers can have negative effects when the acquirer has the ability and incentive to prevent rivals from accessing the target’s assets, such as data, thus preventing them from providing services on top of data. They could also combine data, raising entry barriers against rivals.

In view of the number of conglomerate mergers in digital markets, academics and international organisations are looking at how to improve merger review to avoid the risk of under-enforcement of conglomerate mergers (Bourreau & Streel, 2019; OECD, 2020; International Competition Network, 2020). In addition, there is a concern that digital conglomerate mergers might lead to the creation of ecosystems, or groups of services. Ecosystems encourage users to use only the firm’s services because of their seamless integration. This can entrench the firm’s market power and make it harder for competitors to compete (Crémer et al, 2019; Witt, 2020; Kanter, 2022).

A closer look at the data at target level suggests that the targets of potential gatekeepers have complemented the acquirer in three different ways.

4.1.1 Internal integration

Via internal integration, the target complements the acquirer’s product/service in order to improve it. Potential gatekeepers have acquired several targets offering software, apps, artificial intelligence and data-driven products/services. For instance, Apple bought Siri in 2010: the target was a mobile virtual assistant app only available for Apple iPhone users that had 250,000 downloads at the time of the merger[7]. Apple integrated Siri into its products and offered it to all users for free as a native app. By doing so, Apple provided innovative functionality to its users and entered the virtual-assistant market. Most of these acquisitions are likely benign or beneficial for competition and consumers because they provide more offerings and higher product quality to a larger set of consumers.

4.1.2 Related complementors

Related complementors are targets that complement the acquirer’s core product/service and enable expansion into a related market. For example, Amazon bought five firms between 2005 and 2009 in the eBooks and audiobooks sectors to enter the market in 2007 with Kindle, complementing its book offering. While such as expansion might pose no competition issue, because of the absence of overlap with the acquirer’s core product/service, it could pose significant competition issues.

This could happen when an acquirer buys a target used by its consumers. In that case, products/services do not necessarily fully overlap, but the consumers’ consumption does. Prat and Valletti (2022) showed in a model of attention oligopoly that a merger between concentrated online platforms with overlapping users has a detrimental effect on consumer welfare because it is easier for the incumbent to prevent new entrants. Prat and Valletti (2022) stressed that it is necessary to analyse the overlap between the merging firms in terms of their consumers, whereas competition authorities focused on the usage rate based on market shares. The target could then become a competitor of the acquirer by integrating its functionality. For instance, Meta bought Instagram in 2012 in order to enter the mobile photo-sharing app market, while Meta was developing a similar standalone application. The acquisition was seen as “squashing a threat to its dominance in photo sharing”, while Instagram was “increasingly positioning itself as a social network in its own right — not just a photo-sharing app”[8]. Overall, most of these acquisitions are unlikely to pose competition issues unless they concern target with overlapping consumption usage, especially in a critical future market.

4.1.3 Unrelated complementors

Unrelated complementors are targets that complement the acquirer’s core product/service by enabling expansion into an unrelated market. Gatekeepers have bought several targets, sometimes in sequence, in order to enter an entirely new market. At first glance, this expansion is unlikely to pose competition issues because of the absence of overlap with the acquirer’s core product/service. The acquisition might even spur competition in traditional concentrated markets. For example, some potential gatekeepers have acquired firms in the autonomous car sector, which are likely to compete with the traditional car sector.

However, acquisition of unrelated complementors might pose competition issues if the expansion allows potential gatekeepers to dominate a critical market. Competition authorities are already discussing the importance of forward-looking analysis in the digital sector[9] (European Commission, 2022). Analysis should focus on markets subject to disruptive innovation. Identifying a critical market could rely on objective quantitative criteria, including the level of investment in a market, the number of entries and exits, the number of acquisitions and subjective qualitative criteria, including internal documents or external reports from business analysts and management scholars. Typically, an acquirer might buy in sequence several targets that are leaders in the critical market at the time of the merger, allowing the acquirer to obtain some of the core assets, including staff, technology, intellectual property rights, the user community and data.

For instance, the social networking provider Meta entered the sale of physical goods and related services, in the form of virtual/augmented reality handsets and apps, via six acquisitions between 2014 and 2021 of targets that provide augmented/virtual reality (AR/VR) products and services. Competition authorities worldwide reviewed none of these acquisitions until Facebook rebranded its group into Meta in October 2021. The rebrand signalled a shift from provision of social networking and related services to the metaverse: a hybrid experience between the online world and the physical world built, among other things, on top of augmented and virtuality hardware and related services[10]. The metaverse could enable Meta to enter a variety of economic sectors, from gaming to fitness, health, education and commerce. While Meta only announced the rebrand in 2021, it has worked on the metaverse since at least 2014 with the acquisition of the leader in virtual-reality technology, Oculus. Meta CEO Mark Zuckerberg saw the Oculus acquisition as a starting point for the next generation of platforms, stressing that “mobile is the platform of today, and now we’re also getting ready for the platforms of tomorrow”[11]. Since 2020, Meta has accelerated its virtual/augmented reality acquisitions by acquiring four firms. The acquisition of the virtual-reality fitness app Within is at time of writing under investigation by the US Federal Trade Commission, which seeks before a federal court to block the merger[12]. Overall, most of these acquisitions of unrelated complementors are unlikely to pose competition issues, unless they are part of a pattern of sequential acquisitions to ensure that the acquirer owns the necessary assets in a critical market, making it harder for competitors to compete.

4.2 Gatekeepers’ acquisition strategies related to CPS

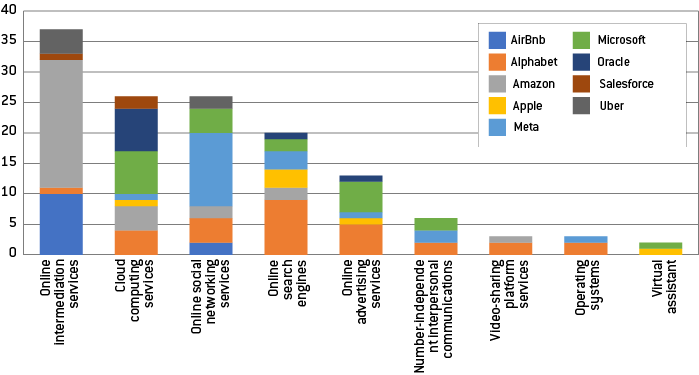

The DMA only applies to gatekeepers active in a core platform service (CPS), or markets with competition concerns. The acquisitions of a target active in a CPS are thus likely to pose significant competition issues because of the overlap with the acquirer’s CPS and the resulting risks of less competition in these markets. Figure 2 shows that potential gatekeepers have acquired only 136 firms that were likely to be active in a CPS market.

Figure 2: Potential gatekeepers’ acquisitions of core platform services (CPS) between 1987 and July 2022

Source: Bruegel based on Crunchbase.

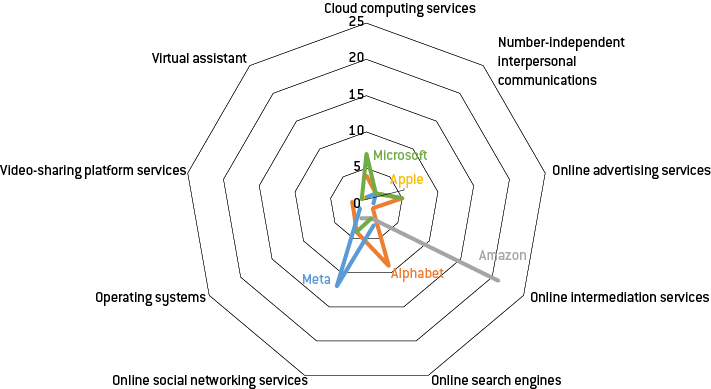

Interestingly, most potential gatekeepers acquired firms in various CPS. They have focused mainly on online intermediation services (37), followed by cloud computing services (26), online social networking services (26), online search engines (22) and online advertising services (13). This suggests that gatekeepers follow a strategy of diversification into new CPS.

However, Figure 3 indicates that gatekeepers focus the distribution of their CPS acquisitions in their main activities: Meta in online social networking services (12 out of 20), Alphabet in online search engines (9 out of 29), Amazon in online intermediation services (21 out of 30), and Microsoft in cloud computing (7 out of 21). This suggests a strategy of consolidation first to secure and develop the core activity, and then expansion into new markets.

Figure 3: Distribution of potential gatekeepers’ acquisitions per CPS, between 1987 and July 2022

Source: Bruegel based on Crunchbase.

Moreover, a closer look at targets shows that some of these acquisitions enabled the gatekeepers to dominate a CPS. This is, for example, the case with Alphabet’s 2006 acquisition of YouTube in the video-sharing platform services market.

5 Recommendations

Gatekeepers mainly acquire firms that complement rather than compete with their core products/services. Most of these acquisitions are unlikely to pose competition issues. However, three categories of cases are likely to do so. In these cases, EU countries should use Article 22 EUMR to refer the acquisition to the Commission for merger review, when the acquisition falls below the EU merger control turnover threshold. The Commission and EU countries can identify problematic mergers based on the information gatekeepers must provide to the Commission (see section 3).

The first category of cases likely to create competition concerns is when the target’s users overlap with those of the acquirer. The target could become a competitor of the acquirer by adding functionalities similar to the acquirer. Moreover, such acquisitions could make it easier to exclude new entrants by concentrating user attention on the acquirer. National competition authorities and the Commission can find evidence of such overlap by looking at cross-activity and cross-usage by active business users and end users. Thus, the overlap assessment requires analysis of cross-consumption usage rather than usage rates based on market shares, as outlined by Prat and Valletti (2022). Competition authorities could derive such evidence from the information that gatekeepers must provide under the DMA on the field of the target’s activity and the number of yearly active business users and monthly active end users.

The second case for concern is when the target is a leader in a future critical market. The target could offer the acquirer key assets in a critical market and is part of a strategy of sequential acquisitions. The Commission should require gatekeepers to provide in the summary of the concentration a list of past acquisitions that were active in the same activity as the target, and should put this information into perspective based on current and future market trends. Thus, competition authorities should assess whether the target owns significant assets related to the development of current and future markets, and whether they complement or increase the acquirer’s existing assets following external growth arising from prior acquisitions and internal growth arising from investment in research and development.

The third concern is when the target is active in a core platform service. If the target is a current or potential competitor of the acquirer, national competition authorities and the Commission should consider the merger carefully, as the DMA focuses on CPS. Authorities should thus require gatekeepers to flag whether the target is active in a CPS, and if it could be a CPS subject to the obligations of the DMA.

References

Argentesi, E., P. Buccirossi, E. Calvano, T. Duso, A. Marrazzo and S. Nava (2019) Ex-post Assessment of Merger Control Decisions in Digital Markets, Final Report, Document prepared by Lear for the Competition and Markets Authority

Bourreau, M. and A. de Streel (2019) Digital conglomerates and EU competition policy, Centre on Regulation in Europe

Caffarra, C., G. Crawford and T. Valletti (2020) ‘“How tech rolls”: Potential competition and “reverse” killer acquisitions’, VoxEU, 11 May, available at https://new.cepr.org/voxeu/blogs-and-reviews/how-tech-rolls-potential-competition-and-reverse-killer-acquisitions

Crémer, J., Y.-A. De Montjoye and H. Schweitzer (2019) Competition policy for the digital era, European Commission, Directorate-General for Competition

Cunningham, C., F. Ederer and S. Ma (2021) ‘Killer Acquisitions’, Journal of Political Economy 129(3)

European Commission (2008) ‘Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings’, 2008/C 265/07

European Commission (2021) ‘Guidance on the application of the referral mechanism set out in Article 22 of the Merger Regulation to certain categories of cases’, 2021/C 113/01

Hemphill, C.S. and T. Wu (2020) ‘Nascent Competitors’, University of Pennsylvania Law Review 1879(2020)

Kanter, J. (2022) ‘Assistant Attorney General Jonathan Kanter of the Antitrust Division Delivers Keynote at Fordham Competition Law Institute’s 49th Annual Conference on International Antitrust Law and Policy,’ US Department of Justice, 16 September, available at https://www.justice.gov/opa/speech/assistant-attorney-general-jonathan-kanter-antitrust-division-delivers-keynote-fordham

Mariniello, M. and C. Martins (2021) ‘Which platforms will be caught by the Digital Markets Act? The “gatekeeper” dilemma,’ Bruegel Blog, 14 December, available at https://www.bruegel.org/blog-post/which-platforms-will-be-caught-digital-markets-act-gatekeeper-dilemma

OECD (2020) ‘Roundtable on Conglomerate Effects of Mergers - Background Note by the Secretariat’, Organisation for Economic Co-operation and Development

Parker, G., G. Petropoulos and M. Van Alstyne (2021) ‘Platform mergers and antitrust, Working Paper 01/2021, Bruegel

Prat, A. And T.M. Valletti (2022) ‘Attention Oligopoly,’ American Economic Journal: Microeconomics 14(3): 530-57

Witt, A. (2020) ‘Big Tech acquisitions: The return of conglomerate merger control?’ forthcoming, Concurrences No 3-2020

Footnotes

[1] The DMA (Regulation (EU) 2022/1925) entered into force on 1 November 2022.

[2] See Council Regulation (EC) No 139/2004, https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32004R0139.

[3] Confirmed by the EU General Court in T-227/21 Illumina v Commission, 13 July 2022 (subject to appeal); https://curia.europa.eu/juris/liste.jsf?lgrec=fr&td=;ALL&language=en&num=T-227/21&jur=T. This case relates to the only use so far by the European Commission of the 2021 guidance.

[4] M.G. Siegler, ‘Facebook Acquires Group Messaging Service Beluga In A Talent AND Technology Deal’, TechCrunch, 1 March 2011, https://techcrunch.com/2011/03/01/facebook-beluga/.

[5] Dante D’Orazio, ‘Beluga group messaging shutting down on December 15th, Facebook Messenger to fill void’, The Verge, 29 October 2011, https://www.theverge.com/2011/10/29/2523159/beluga-group-messaging-shutting-down-closing-december-15th-facebook-messenger.

[6] Crunchbase (https://www.crunchbase.com/) is a platform that collects publicly available firm information. It provides a list of acquisitions but might not report all acquisitions. The analysis might thus be incomplete, but Crunchbase provides enough data to derive significant insights. Crunchbase descriptions describe the target, while Crunchbase tags label the target’s activity.

[7] Erick Schonfeld, ‘Silicon Valley Buzz: Apple Paid More Than $200 Million For Siri To Get Into Mobile Search’, TechCrunch, 29 April 2010, https://techcrunch.com/2010/04/28/apple-siri-200-million/.

[8] TechCrunch, ‘Facebook Buys Instagram For $1 Billion, Turns Budding Rival Into Its Standalone Photo App’, 9 April 2012, https://techcrunch.com/2012/04/09/facebook-to-acquire-instagram-for-1-billion/.

[9] See European Commission press release of 13 October 2022, ‘Competition: Second EU-US Joint Technology Competition Policy Dialogue consolidates international cooperation on competition policy and enforcement in technology sector’, https://ec.europa.eu/commission/presscorner/detail/en/IP_22_6167.

[10] See Meta, ‘Introducing Meta: A Social Technology Company’, 28 October 2021, https://about.fb.com/news/2021/10/facebook-company-is-now-meta/.

[11] Meta, ‘Facebook to Acquire Oculus’, 25 March 2014, https://about.fb.com/news/2014/03/facebook-to-acquire-oculus/.

[12] See press release of 27 July 2022, ‘FTC Seeks to Block Virtual Reality Giant Meta’s Acquisition of Popular App Creator Within’, https://www.ftc.gov/news-events/news/press-releases/2022/07/ftc-seeks-block-virtual-reality-giant-metas-acquisition-popular-app-creator-within.