Is globalisation reducing the ability of central banks to control inflation?

This Policy Contribution reviews the impact of globalisation on inflation dynamics, and it analyses whether and how this affects the ability of centra

Highlight

- After soaring in the 1970s, inflation in Organisation of Economic Cooperation and Development countries stabilised, coming down from 9 percent on average in the early 1980s to about 2 percent in the years before the crisis, and to a lower level in recent years.

- This trend coincided with the acceleration of globalisation, triggering a debate about whether global integration (of goods, labour and financial markets) could be one of the main drivers of the disinflation process and whether central banks’ ability to control inflation could be weaker as a result.

- We explore the different ways in which globalisation could have an impact on inflation and monetary policy transmission channels. We conclude that inflation dynamics can be affected by globalisation and that central banks should take external factors into account in their decision-making processes and in their economic models. Even if the transmission mechanisms are affected by globalisation and in particular by financial integration, ultimately, central banks retain their ability to control medium-term inflation, as long as they adopt flexible exchange rates.

Executive Summary

- After soaring in the 1970s and early 1980s, inflation has declined significantly in all advanced countries and is now at very low levels. This movement coincided with the acceleration of globalisation, triggering a recent debate on whether globalisation could be one of the main drivers of the disinflation process, and whether the ability of central banks to control inflation could be undermined as a result.

The acceleration in globalisation has mainly taken three forms that could affect inflation dynamics and monetary policy: trade integration, labour market integration and financial integration. - Openness in terms of trade and finance has led to a greater sensitivity of domestic price levels to external price shocks. Trade with low-cost countries has increased massively in the last two decades, which has logically resulted in a reduction in the price of imported goods. Global competition between firms might have also reduced the pricing power of domestic companies, while the integration of billions of workers into the global labour market has likely reduced the bargaining power of domestic workers. The empirical literature shows that the contribution of globalisation to the global disinflation movement since the 1990s has been positive, but rather limited for the moment.

- A more important question is whether these integration trends affect the transmission mechanisms of monetary policy and reduce the ability of central banks to fulfil their mandate.

- The transmission channels of monetary policy could potentially be affected at various levels. First, central banks could lose their ability to control inflation if inflation becomes a function of global slack instead of being a function of domestic slack. Second, central banks could lose control of short-term rates if rates become a function of global liquidity instead of the liquidity provided by the domestic central bank. And third, central banks could lose their hold over domestic inflation and economic activity if long-term interest rates depend only on the balance between savings and investment at the global level, and not at the domestic level.

- It is true that the negative relationship between domestic slack and domestic inflation has changed and that that the slope of the Phillips curve has flattened since the mid-1980s. However, recent empirical studies have failed to demonstrate that globalisation had been one of the main drivers behind this trend. A more plausible explanation seems to lie in the monetary policy changes that have taken place since the mid-1980s, with the adoption of credible inflation-targeting regimes in many advanced countries.

- Concerning the control of central banks over the domestic yield curve, it is clear that as long as central banks retain some kind of domestic monopoly over the issuance of base money, they will be able to control the shorter end of the domestic yield curve. For long-term rates, this is less clear, however. The conundrum episode of 2004-06 in the US suggests that long-term rates can become less sensitive to short-term rates and that external factors can affect them significantly. Since the beginning of the crisis, central banks also showed that they were willing to use less conventional monetary tools in order to influence the whole yield curve, in particular when they are constrained at the short end of the curve by the zero lower bound.

- In any case, even if financial integration could result in a reduction of the role of the long-term interest rate channel, for countries that accept flexible rates globalisation should at the same time increase the role of the exchange rate as a transmission mechanism, because of the increased sensitivity to differences in interest rates of the demand for domestic and foreign assets.

- Given the potentially greater effects of external shocks on more open economies and the potential alteration of monetary policy transmission channels in more integrated financial markets, globalisation forces central banks to take external developments into account in their monetary policy decisions. In particular, central banks will need to have a medium-term policy goal orientation instead of trying to manage yearly inflation rates that are driven by global shocks. Overall, we think that central banks will retain their ability to stabilise inflation at the targeted level in the medium term, even though globalisation does not facilitate the central banks’ task, which is already quite difficult because of the zero lower bound.

1. Introduction

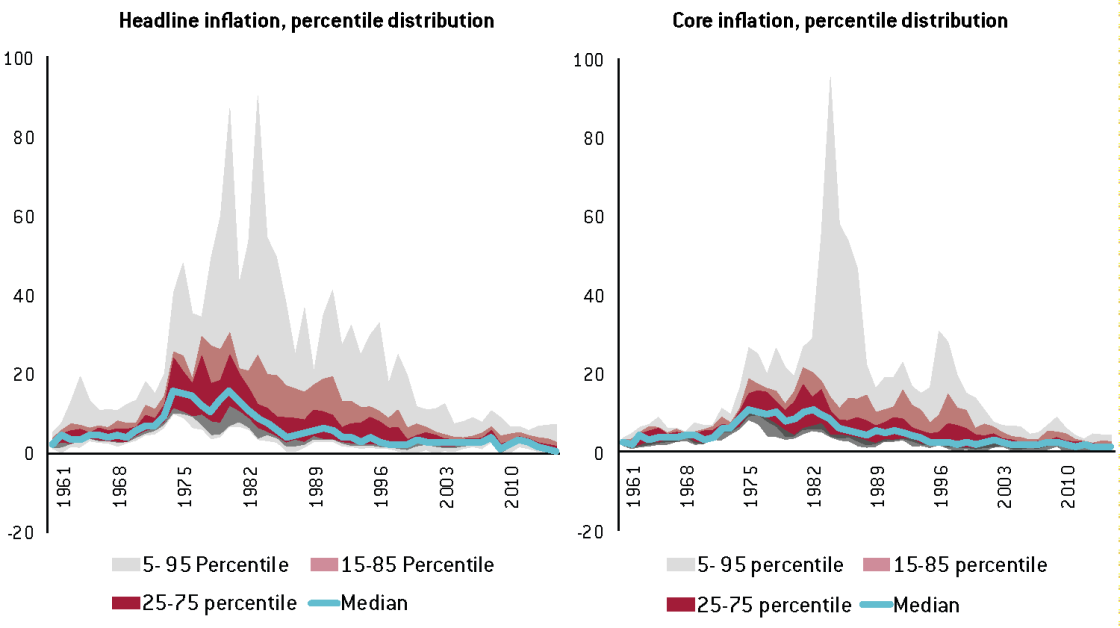

Inflation has come down significantly in the last 30 years worldwide. Figure 1 shows the median inflation rate and the distribution of inflation rates of 50 major economies. Inflation rates are lower across the globe and differences in inflation rates are now very minor compared to the past. In the 1970s, the average 25-75 percentile range for headline inflation was 7.8 to 23.7 percent, compared to 1.2 to 4 percent since 2010 (while the core inflation range was 6.5 to 17.7 percent in the 1970s compared to 0.9 to 3.2 percent since 2010). This lowering and narrowing of inflation has triggered a debate about whether globalisation is the cause of this disinflation and whether central banks’ ability to control inflation has weakened.

There are different definitions of globalisation, but for the purposes of this paper, three different forms of globalisation appear to be particularly relevant because they could have an impact on inflation dynamics and the conduct of monetary policy, as suggested for instance by Yellen (2006).

Figure 1: Headline and core inflation worldwide

Source: Bruegel based on OECD Economic Outlook. Note: Median year-on-year inflation across an unbalanced panel of 50 countries for headline inflation and 38 countries for core inflation.

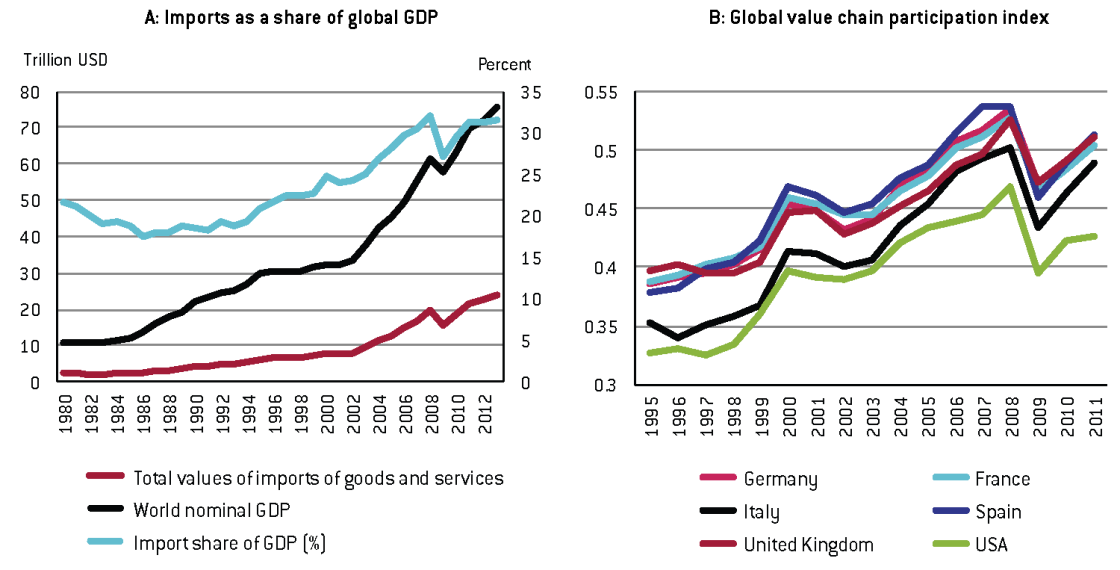

The first is globalisation in the markets for goods and services. As more and more goods and services are produced in many different parts of the world, the prices for these goods seem to be set in international markets. This might reduce the ability of central banks to control inflation1. Panel A of Figure 2 on the next page shows that global trade as a percentage of global GDP has increased substantially in the last three decades. Panel B of Figure 2 documents the increasing integration of production processes in global value chains (GVCs).

Figure 2: Global trade integration

Source: Bruegel based on OECD, IMF IFS, World Input and Output database (WIOD) and ECB calculations following Koopman et al (2010). Note:The global value chain participation index is a synthetic measure of how much an economy is involved in internationally fragmented production.

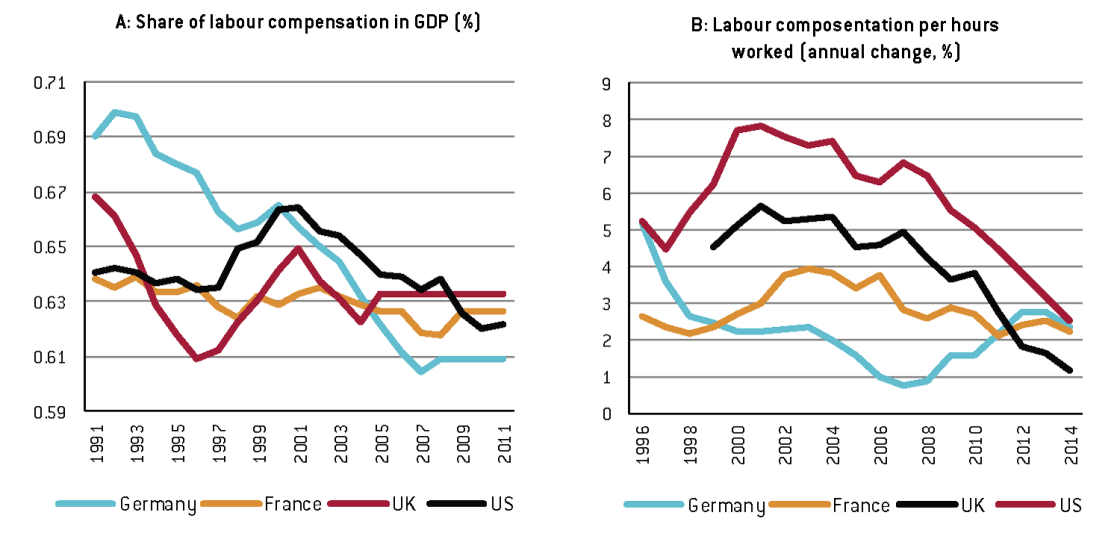

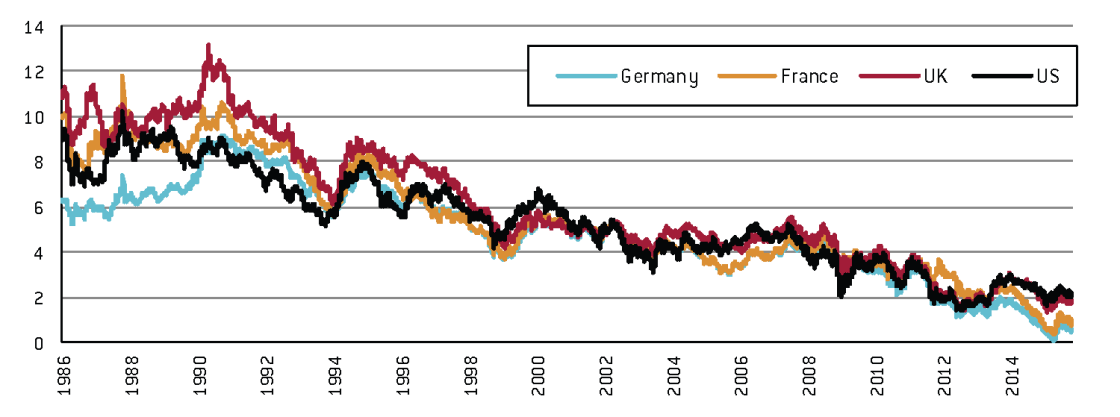

Finally, increased financial integration is often seen as a factor undermining the ability of central banks to control interest rates, especially over longer time horizons, and might thereby influence output and inflation. Deeper financial integration has triggered a convergence of global interest rates (as Figure 4 shows).The second relevant form of globalisation is the global integration of labour markets. Migrating workers, and most importantly the increase in the global labour force available to produce exportable goods and services from 1.5 to 3 billion workers in two decades (Freeman, 2006), is probably reducing the bargaining power of unions and workers in advanced countries in setting wages and therefore influencing domestic inflation rates. Combined with increased trade integration and other factors, this might have contributed to the structural shift of power from workers to firms (as Figure 3 illustrates) with profound effects on inflation.

Source: FRED (Saint Louis Fed); OECD. Note: A: Share of labour compensation in GDP at current national prices; B: Series have been smoothed by 5-year moving average.

Figure 4: Convergence of global interest rates

Source: Datastream.

This Policy Contribution first reviews the impact of these three integration trends on inflation dynamics. We then discuss whether and how this affects the ability of central banks to influence inflation. Our approach is similar to Mishkin (2008), who argued that globalisation could influence policymakers in stabilising prices and output in two different ways: by directly influencing inflation and output, and by influencing the way monetary policy can influence inflation and output.

2. Globalisation and inflation

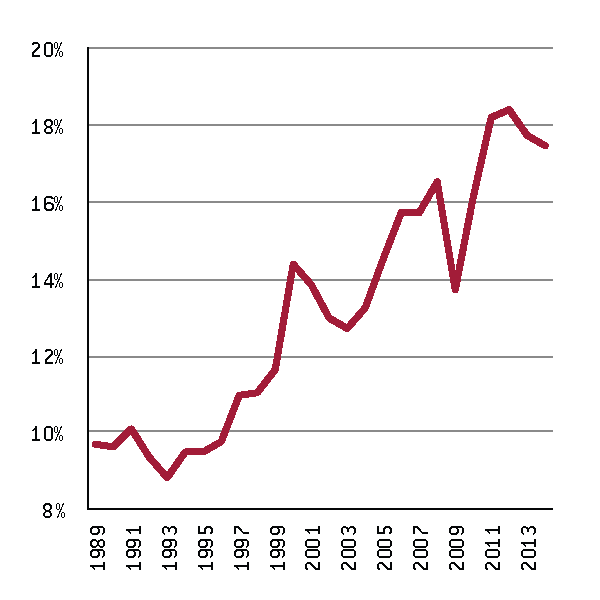

Imports from outside the Economic and Monetary Union (EMU) have significantly increased as a share of GDP since the beginning of the 1990s (Figure 5)2. The prices of imports should therefore matter for domestic inflation rates but are also determined by the exchange rate. Moreover, in addition to increased imports, one can observe increased exports, which also affect the domestic economy’s price setting mechanism.

Figure 5: EMU imports of goods from extra-EMU countries (% of GDP)

Source: Eurostat.

A number of different channels can be identified through which import prices impact domestic inflation. First, there is a direct effect from lower prices for imported goods, either because they enter the consumer basket directly or because they reduce the cost of domestic production via imported intermediate goods. Moreover, there is an indirect effect or second-round effect in that the increased purchasing power of wages induced by lower import prices might dampen demand for wage increases. Finally, there is also a wealth effect in that lower import prices free purchasing power for domestic goods which in turn can boost demand and inflation in that sector3. The overall inflation effect is therefore theoretically not fully determined.

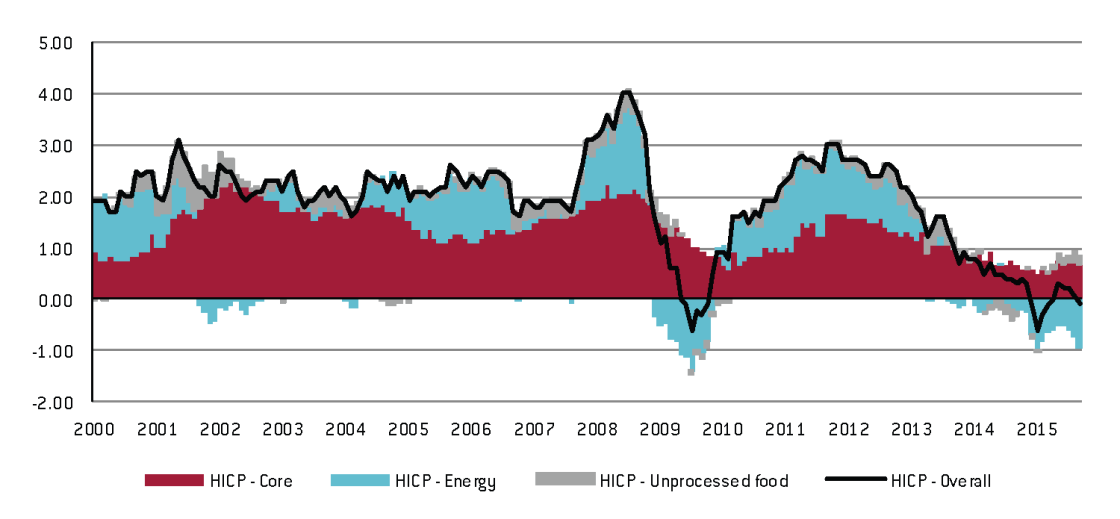

Empirically, of course, fluctuations in global prices can have major temporary effects on domestic prices. Figure 6 shows that energy and (to a lesser extent) food price inflation are major determinants of euro-area headline inflation. These fluctuations pose a significant challenge to central banks. Some central banks have reacted by emphasising that their inflation goal is centred on core inflation measures . Others, such as the ECB, carefully document that core inflation measures4 suffer from a number of drawbacks5. Instead, the ECB emphasises the medium-term nature of its inflation goal. The aim is not to reach an inflation rate of close to 2 percent every year but rather to have such an inflation rate in the medium term. In its focus on the medium term, the ECB should therefore tolerate the effects of temporary external price shocks (coming from commodity prices in particular), as long as these shocks do not have second-round effects and do not disanchor inflation expectations from the 2 percent target. On the contrary, if inflation in the price of important imported goods is on a long-term downward trajectory, this dampens inflation even in the medium term and monetary policy would then have to aim to increase the inflation rate of domestically produced goods in order to reach its 2 percent target.

Figure 6: Headline and core inflation in the euro area

Source: Eurostat.

Another channel through which increased integration of goods markets affects inflation dynamics is its effects on competition. Increased global competition reduces mark-ups for domestic firms in advanced countries. In addition, increased competition might have spurred innovation (in the 1990s in the US for instance) and increased productivity, which could have exerted downward pressure on production costs and therefore on prices6.

Labour market integration could also have a significant impact on domestic inflation rates. Workers in some euro-area countries might accept wage restraint in the face of possibly larger numbers of migrants or posted workers that could come to perform their work. Such wage restraint could in turn lead to lower inflation numbers. Empirically, it is hard to know whether this effect is relevant. Certainly, many euro-area countries currently receive large numbers of migrants, but the recent empirical literature suggests that such immigration has only moderate effects on wages7. More importantly, the integration since the beginning of the 1990s of China, India and countries from the former Soviet bloc into the global labour market has increased competition between workers across countries and reduced the bargaining power of workers in advanced countries8 (especially of the less skilled) because of the enhanced opportunity for firms to substitute imports for domestic production and the fear of offshoring.

Finally, capital market integration could also affect inflation rates. Cheaper capital would reduce the cost of production and thereby affect inflation. Again, the empirical relevance of this effect might be quite limited.

A different question is whether deeper financial integration, deeper trade integration and deeper labour market integration affects the transmission mechanisms of monetary policy, a topic we turn to in the next section.

3. Globalisation and monetary policy transmission mechanisms

What are the main transmission channels of monetary policy and how could they be affected by globalisation? Central banks mainly influence domestic economic activity and inflation through changes (and expected changes) to financial conditions. In normal times, the main way for central banks to do that is though their ability to control the short-term interest rate at which banks lend to each other overnight (ie the Fed fund rate in the US, the EONIA in the euro area) through the provision of short-term liquidity (via open market operations in the US, via direct lending to banks in the euro area)9. In turn, overnight interbank rates influence financial conditions through other types of short-term rates and the rest of the yield curve, as well as equity prices and exchange rates, which are all relevant for aggregate demand, economic activity and ultimately for inflation.

As noted, for instance, by Woodford (2009), three aspects of the transmission mechanism of monetary policy could potentially be affected by globalisation:

- Central banks could lose their ability to control inflation even if they retain some power over domestic output if inflation becomes a function of global slack instead of being a function of domestic slack;

Central banks could lose control of short-term interest rates if the liquidity premium becomes a function of global liquidity instead of domestic liquidity provided by the domestic central bank;

Central banks could lose theirgrip on inflation and the domestic economy if long-term interest rates depend only on the balance between saving and investment at the global level and not at the domestic level.

Concerning the first point, we assume for the moment (we discuss that assumption later) that despite globalisation, central banks can perfectly control financial conditions and therefore influence the level of economic activity domestically (at least in the short term). Traditionally, in a closed economy, the existence of slack reduces the ability of producers to increase prices and of workers to ask for higher wages. In broad terms, the transmission mechanism of monetary policy relies on this inverse relationship (known to economists as the Phillips curve) between the degree of slack and the price level to achieve the desired level of inflation.

Could the loss of workers’ bargaining power in wage negotiations and the reduction of the market power of firms discussed in the previous section lead to a flattening of the Phillips curve (ie weaken the positive link between domestic activity and domestic inflation)? In that case, even with a low domestic unemployment rate, wage developments and domestic inflation could be subdued as long as some global slack exists10. It is true that Phillips curves have started to flatten in many advanced countries since the mid-1980s, or in other words, that the rate of unemployment triggering wage increases and inflation is lower today than in the past. However, while recent research tends to show that consumer price indexes are slightly affected by import prices11, the literature on Phillips curves in the US and Europe12 also suggests that foreign output gaps are not important determinants of domestic inflation13.

As pointed out by Mishkin (2008), better monetary policy in advanced countries is a more plausible explanation for the observed flattening of the Phillips curves and is more consistent with the timing of their flattening. After the surge of inflation of the 1970s, monetary authorities implemented credible policies that have anchored inflation expectations at a low but positive level. These policies, combined with the move away from indexation of wages, have made external price shocks much less persistent than in the 1970s thanks to the absence of the second-round effects. Figure 6 suggests a low pass-through of recent external shocks from the headline inflation rate (eg from oil prices) to the core measure.

Second, on the control of central banks over their main short-term rate instrument, it is clear that in a closed economy the monopoly given to central banks to issue base money allows them to perfectly control the shorter end of the yield curve (the previous discussion took for granted that the central bank was able to change financial conditions to influence domestic economic activity). However, given the massive provision of liquidity by all major central banks since the beginning of the crisis, there have recently been a lot of discussions about the role of ‘global liquidity’ and an increased perception that it may now matter more than domestic liquidity induced by domestic monetary policy in determining domestic financial conditions, especially for small open economies.

The increase in the correlation of the short-term rates of advanced countries in the last decade has led some observers to fear that global financial integration has eroded the monopoly power of central banks by giving agents the possibility to use different currencies. In theory, the perfect control of the central bank over short-term rates derives from the assumption that only the currency and reserves issued by the central bank are useful for facilitating transactions. So what happen if this assumption is relaxed?

It is important to note that in advanced countries, we are very far from a situation in which multiple currencies could be substitutes for executing payments. However, even if that was the case and multiple currencies would be accepted as means of payment, as explained by Woodford (2007), the central bank could still have some control over inflation as long as some goods are priced in the domestic currency. In extremis, however, the possibility to use multiple currencies as means of payment would mean that inflation is measured in different currencies – close to a system of dollarisation/euroisation in which the inflation rate is set outside of the dollarised/eurorised country. However, dollarisation/eurorisation are not an outcome of globalisation. Dollarisation usually happens only in countries in which the central bank’s objective is not to stabilise the price index in its own currency. Virtual currencies such as Bitcoins are also still quantitatively small. So overall, central banks retain control of short-term interest rates, over which they have the monopoly power. By controlling short-term rates, they can influence financial conditions and demand.

Finally, long-term rates are conventionally decomposed as the expected future path of short-term nominal rates plus some duration and risk premium. So, if we believe that short-term rates are still under the control of central banks, it should logically follow that long-term rates should also be under central-bank control. However, developments in the last few decades have shown that long-term rates are more influenced than before by external factors, as capital markets become more integrated worldwide. It is not only interest rates in advanced countries that are more correlated than before14, but it also seems that on various occasions, long-term rates have become less responsive to short-term rates. In the recent past, the ‘conundrum’ period (2004-06), during which long-term rates were well below short-term rates, is a good example of a disconnect between the movement of short and long-term rates. It seems that the global savings glut phenomenon identified by Bernanke (2005), with high demand coming from emerging markets for safe assets in the form of sovereign bonds from advanced countries and from the US in particular, could have been responsible for a major reduction in risk premiums at the time. However, after the start of the crisis, major central banks have expanded their traditional toolbox with new instruments (such as asset purchases, forward guidance and long-term refinancing operations) in order to influence more directly the longer end of the curve, in particular since they have reached the zero lower bound.

In the extreme case in which long-term interest rates would be determined by the balance between investments and savings at the global level because of full capital market integration (again a situation still quite far from today’s), it is conceivable that domestic monetary policy could lose some of its influence over long-term interest rates (especially if central banks do not want to use unconventional monetary tools in normal times). However, it would not mean that domestic central banks would lose their ability to control inflation. As highlighted by Yellen (2006) and Mishkin (2008), even if financial globalisation could reduce the role of the long-term interest rate channel, it increases at the same time the role of the exchange rate as a transmission mechanism. The disappearance of capital controls and the reduction in the portfolio home bias in many advanced countries already mean that financial markets are much more integrated than a few decades ago and that the demand for domestic and foreign assets is more sensitive to differences in interest rates, thus enhancing the influence of monetary policy on the exchange rate. Furthermore, in the medium term, deflation or even lower inflation abroad than at home should also lead mechanically to an appreciation of foreign currency relative to domestic currency, which should also limit the direct effect of globalisation through lower import prices. In theory, a flexible exchange rate regime should therefore shield a country’s monetary policy from the main effects of financial and trade integration.

These arguments are similar to the classic textbook open-economy policy trilemma formalised by Obstfeld and Taylor (1997). In the absence of capital controls, only flexible exchange rates allow central banks to conduct an autonomous monetary policy and therefore to have some control over domestic inflation and output. Rey (2015) recently challenged this view, arguing that in practice the global financial cycle has transformed the trilemma into a dilemma and that independent monetary policies are possible if and only if the capital account is managed. Empirically, anecdotal evidence from emerging markets when the Federal Reserve started tapering in 2013 and recent studies (Chung et al, 2015) suggest that domestic financial conditions and credit developments in peripheral economies are influenced by conditions in the world’s main financial centres.

However, as argued by Georgiadis and Mehl (2015), even if the global financial cycle reduces the effectiveness of domestic monetary policy, another feature of global financial integration has the opposite effect and increases its effectiveness. Economies maintaining large foreign asset positions experience large valuation effects on their external balance sheets in response to exchange rate movements triggered by monetary policy measures. Given that these valuation effects can only take place if the exchange rate is truly flexible, adopting a flexible exchange rate regime remains critical for monetary policy autonomy under capital mobility and in the presence of global financial cycles.

Overall, the relative importance of these two opposing effects on the effectiveness of monetary policy depends mainly on the size and the depth of domestic financial markets and on domestic financial regulation and macroprudential policies. Therefore, small open emerging economies, with underdeveloped financial markets, weaker macro and micro financial supervision and regulation, and sticky exchange rates, might see the effectiveness of their monetary policy reduced by global financial integration if they do not adopt the right policies. However, large economies such as the euro area or the US, with deep and liquid financial markets, more developed financial policies, and flexible exchange rates should not be too vulnerable to external financial cycles, and the ability of their central banks’ to control inflation should not be much affected.

4. Conclusions

There are some good reasons to believe that globalisation can change inflation dynamics. More integration in goods markets means that imported goods with fluctuating prices have more influence over the price level, as is most evident with oil and food, as well as with tradeables produced domestically. Deeper integration of labour markets can affect the local workers’ wage-bargaining power, while deeper financial integration has an influence on long-term interest rates. All three effects could not only influence inflation rates but also affect in one way or another the transmission mechanism of monetary policy.

All three effects render the work of central banks in achieving their inflation target more difficult. However, powerful counter-forces are also at play. Deeper financial integration not only affects long-term interest rates but also increases the role of the exchange rate, and can thereby increase the effectiveness of monetary policy. Labour market integration is unlikely to be a strong and important element in today’s world of managed borders. Trade integration only affects a limited part of the basket of goods and services that are consumed. from tradeable goods can be offset by higher inflation rates for purely domestic goods.

In an increasingly integrated world, central banks need to take into account global economic developments and their spillovers onto the domestic economy. But through their control over short-term nominal interest rates and through their ability to affect long-term interest rates directly through asset purchases, central banks have powerful instruments to steer financial conditions that affect demand and inflation. Finally, as has been forcefully argued by Trichet (2008), a medium-term orientation of monetary policy reduces the need for the central bank to react to short-term variations in inflation rates that arise from external price shocks.

A more serious problem for monetary policy than globalisation is the constraint resulting from the zero lower bound. Once the short-term nominal interest rate has fallen to zero, financial conditions can be negatively affected by a temporary drop in inflation over which the central bank has no control – and such drops in inflation can result from global demand and supply shocks. And while we argue in favour of unconventional monetary policy such as asset purchases, the ability of the ECB to meet its inflation goal would be facilitated by greater support from other euro-area policies.