Will Europe pay for Japan?

As the Bank of Japan is rolling out its new programme of quantitative easing, a significant debate about the impact on Europe is emerging. Is Japan en

As the Bank of Japan is rolling out its new programme of quantitative easing, a significant debate about the impact on Europe is emerging. Is Japan engaging in a “beggar-thy-neighbour” policy? Is Europe paying the price as other central banks are responding? Jean-Claude Juncker has already announced that the euro is overvalued while Jens Weidmann sees global central bank independence endangered. At the same time, Yasutoshi Nishimura, Japan's deputy finance minister, already stated that Europe is in no position to criticise. Let’s first look at the facts.

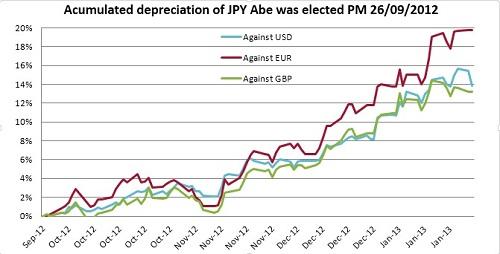

Since the election of Prime Minister Shinzo Abe on 26 September 2012, the Yen depreciated significantly againt the US Dollar as well against the Pound Sterling and the Euro. However, the difference between the euro and the two other considered currencies is striking: The depreciation against the euro amounts to 20% while it depreciated by only around 14% against the US Dollar and the Pound Sterling.

So is Europe becoming the main variable of adjustment to reduce Japan’s current account deficit? A number of arguments are relevant in this context. First, Japan trades more with the US than with the Euro area. A smaller exchange rate adjustment may therefore still mean a larger current account adjustment. Second, as my colleague Zsolt Darvas is pointing out on this blog, the recent Japanese exchange rate movements only correct the value of the Yen to its long-run trend. Third, the recent strength of the euro appears to reflect a renewed confidence in the financial markets in the ability of the euro area to resolve its crisis. It is not related to any new monetary policy decisions taken in the euro area since the election of Shinzo Abe. Fourth, current forecasts by the European Commission predict an increase in the trade surplus for the euro area while Japan and the US are predicted to have increasing trade deficits.

For Japan, the monetary easing is appropriate. Its monetary policy needs to finally act decisively to counteract the persistent deflation in Japan. Until the monetary actions will lead to a shift in inflation, Japan’s real exchange rate will depreciate allowing for the external adjustment of Japan’s current account deficit. A persistent current account deficit could pose a risk to Japanese debt sustainability and should therefore be avoided.

From the point of view of Japan, it thus seems that a stronger euro is appropriate given the predicted trade surpluses in the Euro area. At the same time, it is clear that a stronger euro will render adjustment in the Euro area more difficult. Overall, these developments suggest that the euro area should not hope to achieve its adjustment by running external current account surpluses. Japan but also the US will want to keep their currencies weak. Europe should avoid a currency war by trying to ease monetary policy by too much. Too easy monetary policy will trigger further monetary policy action not just in Japan but also the US and the UK. Overly abundant global liquidity will then risk compressing yields on risky assets too much thereby laying the foundations for the next bubble. Instead, it is high time that the euro area addresses its domestic demand weakness with the right wage and fiscal policies differentiated appropriately across the area. Europe needs to fix its macro-policies and not rely on the ECB to do everything.