Private sector debt matters, and better data means better policy

Private debt is emerging as a central concern in EU policy. However, the Commission’s regular country reports still give more attention to sovereign t

The IMF/World Bank annual meetings in October once again underlined risks from private debt, whose reduction in the past eight years has been much slower than in previous periods of deleveraging. In the Eurozone, private debt stood at 138 per cent of GDP in 2014, unchanged from the outset of the crisis six years before.

As was underlined by the financial crisis, private debt can quickly morph into public debt – through the financial sector, or once the government participates in a balance sheet restructuring. The debt overhang has far-reaching consequences: lower household spending and weaker corporate investment and hiring. This leads to a vicious circle, where low growth and price deflation aggravate debt distress further.

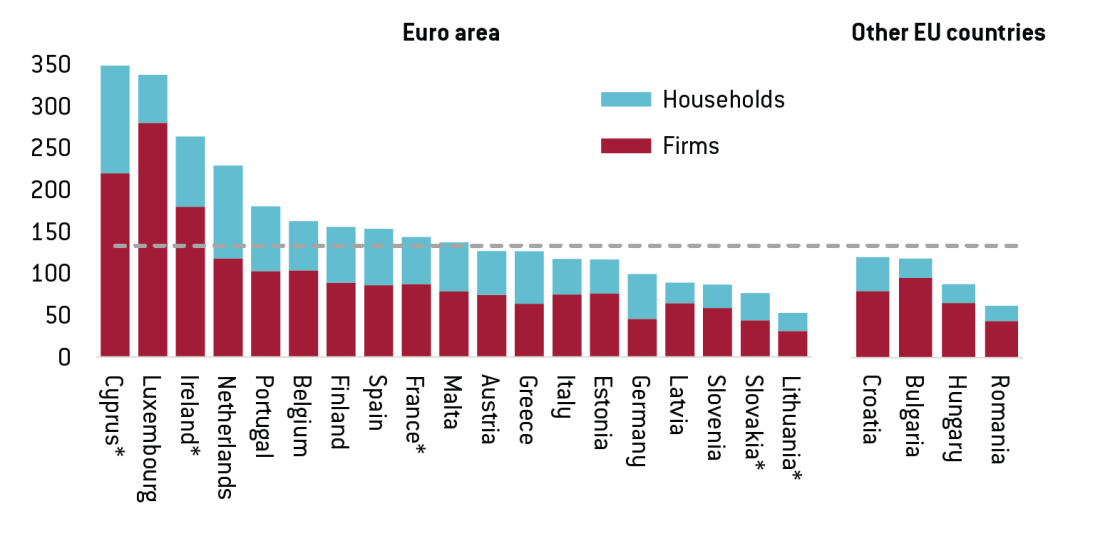

These worrying dynamics of deleveraging have now motivated national reforms to legal and restructuring regimes, and also the upcoming EU Directive on insolvency laws. Private debt is one of the 14 indicators examined annually in the EU’s Macroeconomic Imbalances Procedure. This process flags risks where a country’s consolidated non-financial corporate and household debt relative to GDP rises into what has been the top quartile of the historical EU wide distribution. Based on 2014 data, the latest Commission reports found the threshold of 133 per cent of GDP was breached by 13 member states (see chart with the most recent data).

Debt to GDP is of course a fairly broad indicator, as aggregate income may be a poor predictor of the repayment capacity of individual households or firms. There are more specific indicators of debt distress that could be based either on national accounts data, or on national firm-level and household data, but these have not yet been consistently evaluated.In the future, the Commission could analyse private debt using three questions.

1. What types of debt vulnerability affect households and businesses?

Individuals and enterprises are affected by various kinds of debt risk, some of which are not obvious at first glance. Indeed, countries may well look sound in terms of the general debt to GDP indicator, while building up other risks which could be assessed:

- Liquidity risk: the ratio of total debt servicing costs or interest repayments to income indicates whether borrowers may be unable to service debt obligations from their current income.

- Solvency risk: the ratio of debt to equity (in the case of households this means the ratio of outstanding loans to the value of residential property and other assets) measures the extent of any debt overhang.

- Debt dynamics: a more forward-looking analysis would also look at the differential between the real cost of debt and income growth in order to assess whether private debt is on an unsustainable trajectory.

For instance, in the Commission’s 2015 review of Italy the aggregate corporate debt ratio does not seem excessive (63 per cent of GDP), but serious NPL problems in banks’ corporate exposures underlines the liquidity problems in the sector.

The Commission’s analysis of deleveraging dynamics across the EU-28 acknowledges that more detailed and more regular data would be desirable. But difficulties in compiling this with a consistent quality and frequency so far seem to have prevented this.

Private debt to GDP, 2015

Source: Bruegel, based on Eurostat.

2. How much deleveraging is needed?

The Commission’s debt analyses are based on a model which estimates sustainable aggregate debt ratios in household and corporate sectors (as set out in this methodology for euro area countries). In 2014 this produced some striking figures, for instance a deleveraging need of over 30 per cent in Greece, Cyprus and Spain and about 20 per cent for Dutch households.

However, unlike sovereign debt, private debt is owed by borrowers with widely different balance sheet strength and earnings prospects. Therefore the distribution of excess debt matters greatly. A moderate aggregate debt ratio may reflect evenly sound corporate finances, or conceal groups of companies with excess leverage. Deleveraging dynamics could still emerge.

For instance, within the corporate sectors of the eleven formerly socialist EU members, there remain many highly leveraged state-owned companies amidst a sizable foreign-owned sector that has ample equity coverage. Conversely, over the past two years many governments have sought a restructuring of foreign currency denominated mortgages, even though the households which had taken out these loans often had sufficient assets and good earnings prospects.

3. What are the priorities for debt restructuring?

In a third step the Commission’s analysis could provide analysis to inform national restructuring efforts. Unlike in the euro area crisis, where countries were placed under financial programmes, national government will remain in the lead. However, comparable assessments could reflect on fiscal projections, for instance where the restructuring of liabilities to tax authorities and social security accounts is required.

In Croatia, for instance, the Commission report found a striking concentration of debt in public companies in just two industrial sectors. This then led to very specific recommendations by the Council on debt restructuring.

A recent IMF paper for the countries of central and south eastern Europe demonstrated how this could be done using a single firm-level dataset across a number of countries. This analysis would address two questions:

- Which types of borrowers suffer from debt distress which is so severe that ultimately insolvency appears inevitable?

- Which types of borrowers can potentially be viable following a debt restructuring? In the corporate sector, for instance, restructuring by banks may initially need to be very focused. Early success in turning the most promising cases around could yield benefits more widely.

Such a ‘sorting’ of distressed borrowers could also inform discussions between supervisors and the key banks. Banks are now tasked with the development of strategies to deal with the existing stock of NPLs, but also with spotting the early signs of debt distress, developing appropriate restructuring solutions, or writing off exposures that are clearly unviable.

It is therefore worth developing deeper analysis and comparable private debt indicators, which could help design policy packages that are jointly supported by supervisors, banks, and government.