The impact of Volkswagen on the automobile stock market

On Friday 18th September 2015, the U.S. Environmental Protection Agency (EPA) reported that according to their analysis, Volkswagen engine software ha

Potential fines resulting from this alleged manipulation could be as high as US$18 bn according to the FT, to which other significant costs could be added. It is too early to know about the exact costs of this scandal. In this blog, we want to instead analyse the impact of this event on the stock market prices of Volkswagen and its main competitors.

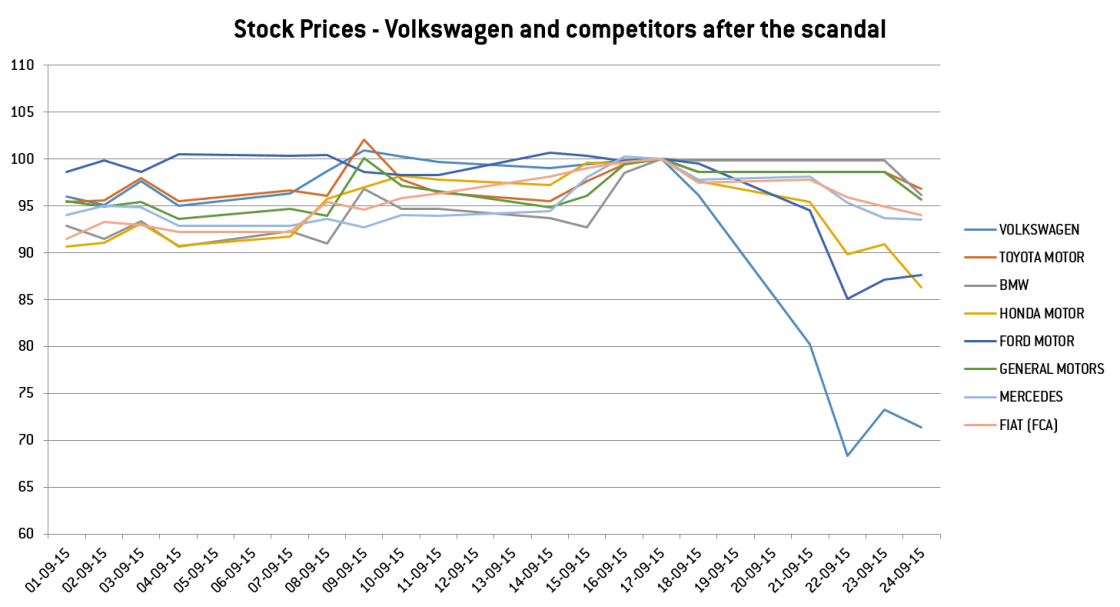

Since September 17, the date of the revelations, the VW stocks lost 28.64% in value. The main competitors of VW also lost: Toyota -3.24%, BMW -3.88%, Honda -13.73%, Ford -12.42%, General Motors -4.32%, Mercedes -6.51% and Fiat -5.97%.

Note: Stock prices indexed at 17th September 2015

Source: Datastream

We find two facts noteworthy: competitors such as Toyota have not yet benefited from the scandal. German car manufacturers have not been more affected than other European, American or Asian competitors.

It is too early to understand the reasons for these important developments and in fact the markets may re-assess their judgement. One possible reason for the negative impact on the entire industry is that markets may fear stronger and more stringent enforcement of environment regulation affecting all global car producers. It is also possible that the Diesel technology's reputation as a “clean fuel” will be fundamentally discredited, undermining profitability in other companies as well. Finally, the absence of a Germany effect may suggest that markets consider the effects of this scandal to be isolated for the one company.