Fiscal arithmetic and risk of sovereign insolvency

The record-high debt levels in advanced economies increase the risk of sovereign insolvency. Governments should start fiscal consolidation soon in an

The author would like to thank Giovanni Sgaravatti, Guntram Wolff and Stavros Zenios for their comments on the earlier version of this blog post.

Rapidly growing public debt

Fiscal policy responses to the global financial crisis (GFC) of 2007-2009, the European financial crisis of 2010-2015 and the COVID-19 crisis of 2020-2021 led to the rapid increase of public debt-to-GDP ratios in most advanced economies. In most countries, the gap between both crises (the second half of the 2010s) was not used to repair fiscal balances and create sufficient room for a fiscal response to a new downturn.

Table 1 shows that by 2019 only Germany, Iceland, Ireland, Malta and the Netherlands managed to radically improve their gross debt-to-GDP ratios (compared to the peaks during the global and European financial crises), some of them (Germany and Malta) below their pre-financial crisis levels. Czechia, Denmark and Portugal recorded a less impressive but still meaningful improvement. Beyond Europe, the same happened in Israel. Norway, Sweden, Switzerland, and Taiwan avoided increases in public debt aftermath of the financial crisis. The euro area and the European Union decreased their relative indebtedness only marginally.

The outbreak of the COVID-19 pandemic was marked by rapid deterioration of the debt-to-GDP ratios in almost all advanced economies except Norway, Sweden, Switzerland and Taiwan. The IMF World Economic Outlook forecast for 2021 (the last column of Table 1) does not promise much improvement despite the ongoing rapid recovery. On the contrary, several countries may record a further increase in their indebtedness.

In 2020, general government gross debt exceeded 100% of GDP in 12 advanced economies, including all G7 economies except Germany and will remain above this threshold in 2021. These are record-high figures for peacetime and are a cause for concern for public debt sustainability in advanced economies and the stability of the global economic and financial system.

Public debt sustainability

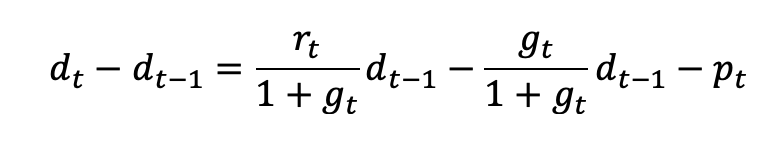

The public debt dynamic is described by the following equation:

(Eq.1)

where dt = general government gross debt-to-GDP ratio at the end of period t

dt-1 = general government gross debt-to-GDP ratio at the end of period t-1

rt = real interest rate in period t computed as rt = [(1+ it)/(1+ πt)]–1

it = nominal interest rate in period t

πt = change in the GDP deflator between t – 1 and t

gt = the rate of growth of real GDP between t-1 to t

pt = the ratio of primary fiscal balance (deficit or surplus) to GDP in period t

It follows from Eq.1 that changes in general government gross debt-to-GDP ratio can be driven by:

- changes in the general government primary balance, ie the difference between revenue and non-interest general government expenditure;

- changes in the difference between the real interest rate of general government borrowing (r) and the growth rate of real GDP (g).

When a government borrows in foreign currency, the above equation becomes more complicated because it must include the effects of exchange rate movements. However, as governments of advanced economies borrow predominantly in domestic currency, we will skip this factor in our analysis.

Uncertainty as to r and g

The record high debt-to-GDP ratio will decrease in the future if r is lower than g for an extended period and/or fiscal policies produce a primary surplus p.

Figure 1 shows that real interest rates on the United States federal government borrowing have been on a downward trend since the global financial crisis (actually since the mid-1980s), despite short-term fluctuations. Similar tendencies have been observed in other advanced economies.

An in-depth analysis of the decline of real interest rates is beyond the scope of this blog post. We hypothesise that it most likely reflects trends in global savings and investment. Figure 2 shows a continuously declining trend of investment rate (faster than the similar trend in the gross national savings rate) in advanced economies and a rapid growth in savings and investment rates in emerging-market and developing economies. Advanced economies absorbed part of emerging-market and developing economy excess saving. Both phenomena put downward pressure on real interest rates in advanced economies.

Similar explanations relate to the so-called global savings glut (or savings surplus) produced in some emerging-market economies (China, oil-producing countries) which put downward pressure on international interest rates.

Whatever the reason for declining real interest rates, it dampens concerns that high and increasing public debt-to-GDP ratios could lead to sovereign insolvency. On the contrary, an increasing number of policymakers and economists have started arguing that record-low interest rates allows countries to run higher public debt levels than previously assumed without negative consequences for the stability of public finances. This optimism is based on an (often implicit) assumption that ultra-low real interest rates will remain for a long time. But, this is a mechanical extrapolation of the past trends without reflecting whether factors contributing to low r will continue in the future.

One can imagine that both high saving rates in China and other emerging-market and developing economy can decline and investment rates in advanced economies will increase as a result of the green transition, with both factors potentially contributing to an increase in r.

The optimistic assessment of debt sustainability also misses another parameter of Eq.1, the growth rate of real GDP, which is on a declining trend in advanced economies (Figure 3) primarily due to demographic changes (slower growth and then decline in working-age population). The available demographic forecasts make clear that this trend will continue for at least the next three decades. Thus, one should expect a further decline unless some revolutionary increase in total factor productivity happens. However, optimistic scenario will probably require higher investment, which will push up r, other things being equal.

The need for prudent policy planning

Betting on a low r and g>r in the long term is unjustifiably optimistic. The factors and circumstances listed up to now that can change trends in r and g, demonstrate this. Those aside, additional government expenditures related to an ageing population (public pension, healthcare, and long-term care systems) and the green transition will require fiscal policy space by raising additional revenue or reducing existing spending commitments.

In the short-to-medium term, several risk factors must be taken into consideration. First, the ongoing COVID-19 pandemic will require at least additional public health spending and assistance to COVID-19 victims in addition to compensation to those suffering from the lockdown measures (even if these measures are applied more selectively than at the beginning of the pandemic).

Another risk factor relates to the uncertain future of quantitative easing and ultra-low policy rates of central banks. They have contributed to the decline of nominal and real yields on government bonds in the 2010s and during the COVID-19 crisis. Given increasing inflationary pressure in 2021 (which has further contributed to a decrease in r), central banks may start tightening their monetary policies sooner than one expects. This will lead to higher yields on government bonds (as was the case in 2013 when the US Federal Reserve Board announced tapering of quantitative easing – see Figure 1) and change the optimistic scenario of debt arithmetic. Monetary tightening may also increase real interest rates and temporarily decrease g, like in the first half of the 1980s in the US and other advanced economies.

Higher interest rates would, in first instance, affect countries with the largest gross financing needs (defined as the sum of general government net borrowing and maturing general government debt in a given year). According to the IMF (2021) the largest gross financing needs in 2021 are expected in Japan (61.3% of GDP), the United States (45.0%), Italy (27.0%), Spain (22.4%), Canada (21.8%) and France (20.7%).

Generally, yields on newly issued bonds tend to increase when the debt level is high and rising. That is, marginal yields are an increasing function of a debt level and its increase. In practical terms, it means that the highly indebted countries, with rapidly increasing debt and short debt maturity are more fiscally vulnerable to unexpected adverse economic and political shocks and have a smaller room of manoeuvre to use fiscal policy as a countercyclical tool. Debt tolerance by financial markets is a subject of multiple equilibria and may change very quickly, as demonstrated by the sequence of events in the euro area periphery in 2010-2012.

On the other hand, some factors and circumstances can increase debt tolerance. We will mention just three of them:

First, countries with global currencies (US dollar, euro, Japanese yen, British pound, Swiss franc, Chinese renminbi) can count on higher demand for their government bonds from foreign central banks, sovereign wealth funds and private entities.

Second, a large amount of liquid public financial assets (central bank international reserves, sovereign wealth funds, official loans granted, funded public pension programs, etc) makes a net general government debt substantially lower than a gross debt (Table 2).

Third, stable, credible and binding fiscal rules on national and subnational levels such as debt, deficit or spending increase ceilings and prudent procedures of budgetary planning and accepting new spending commitments may also increase resilience against adverse shocks according to the IMF.

Fiscal consolidation should start soon

The high level of public debt, high primary deficits (Table 3) and uncertain future trends of r and g are the arguments for starting fiscal consolidation as quickly as possible. The fiscal stimulus packages aimed at boosting aggregate demand should the first to be cut. There are numerous indications that the global economy is overheated. Product shortages and supply bottlenecks, growing assets bubbles, increasing energy prices and consumer price inflation should serve as warning signals that the continuation of these packages can bring more harm than good. Other fiscal adjustment measures must be country-specific and, in most cases, include both increases in revenue and a reduction of expenditure. Ideally, they should help in addressing long-term development challenges. For example, higher retirement age and green taxation could reduce fiscal deficits, mitigate the adverse effects of population ageing and limit carbon emissions.

Even if fiscal consolidation remains politically unpopular, economic arguments suggest that it should be considered seriously: fiscal multipliers are low due to the capacity constraints (so benefits of the continued fiscal expansion are doubtful) and the risk of debt dynamic getting out of control increases every month. It also worth remembering that p is the only parameter of Eq. 1 which can be controlled by fiscal policy. Both r and g remain largely outside government control, at least in the short term.

The risk of global destabilisation

In the last decades, sovereign insolvency episodes occurred mainly in emerging-market and developing economies. These cases (Latin American debt crisis in the 1980s or the series of emerging-market crises in the 1990s and early 2000s) did not go unnoticed and caused severe turbulence in a global economy. The series of public debt crises in the euro area periphery in the first half of the 2010s was a warning signal that consequences of sovereign insolvency in advanced economies can be much more serious than in emerging-market and developing economies. As of now, the largest advanced economies, which play a crucial role in the world economic, monetary and financial system, are experiencing record-high public debt levels that may quickly get out of control.

One can imagine the consequences of sovereign default, or even symptoms of increasing fiscal tensions in any leading economy, in the form of rapidly growing yields on its government bonds. This could cause a chain reaction on financial markets against other highly indebted countries (the contagion effect). As a result, exchange rates between major currencies would become more volatile and the stability of the entire financial system, especially its banking component, would be put under question (due to its large public debt portfolio). If central banks come to the rescue of governments, it may further increase inflation, which is already rising. Such a catastrophic scenario would not help in restoring economic growth after the COVID-19 pandemic.

There is limited ground for a public debt sustainability optimism and more caution is needed in assessing future fiscal policy scenarios. A more realistic and balanced picture of potential risks should lead to budgetary consolidation soon. The sooner this starts, the less radical the fiscal adjustment scenario that can be applied. It will be also easier and less costly to reduce high primary deficits now, in the environment of still low nominal and real interest rates and post-COVID growth recovery, than postpone to an uncertain future.

Recommended citation:

Dabrowski, M. (2021) ‘Fiscal arithmetic and risk of sovereign insolvency’, Bruegel Blog, 18 November