Europe is losing competitiveness in global value chains while China surges

The European Union owes much of its economic weight to its regional value chain and integration into the global value chain. But the EU’s global value

COVID-19 has led to the transmission globally of value chain disruptions originating in China and the scarcity of critical medical goods, not helped by an increase in export restrictions imposed by producing countries. These developments have prompted a debate on the resilience of economies in dealing with such challenges. For the European Union, this discussion poses major questions: how has the world’s most industrially-integrated area and largest exporter become so dependent on China for a large number of products, and which sectors are most affected and why?

To answer these questions, we look in this blog post at the EU’s role in global value chains and, more generally, its external competitiveness. The EU is the region with the greatest degree of participation in global value chains, but that participation – in the EU’s regional value chain as well as globally – is shrinking fast, a phenomenon that may have significant relevance for the integration of the EU single market. The EU’s decreasing role in value chains is linked to technological innovation and human capital. On both fronts, we find preliminary evidence that China is catching up very fast.

GVC integration with China at the expense of the single market

The most extended technical definition of GVC participation is the sum of foreign value added incorporated in an economy’s exports (FVA) and the domestic value added that is subsequently re-exported by a third country (DVX) as a percentage of gross exports. This indicator represents the position of an economy in global trade networks. The first component (FVA) captures an economy’s reliance on imports for its exporting activities, while the second component (DVX) accounts for an economy’s capacity to generate income through trade integration.

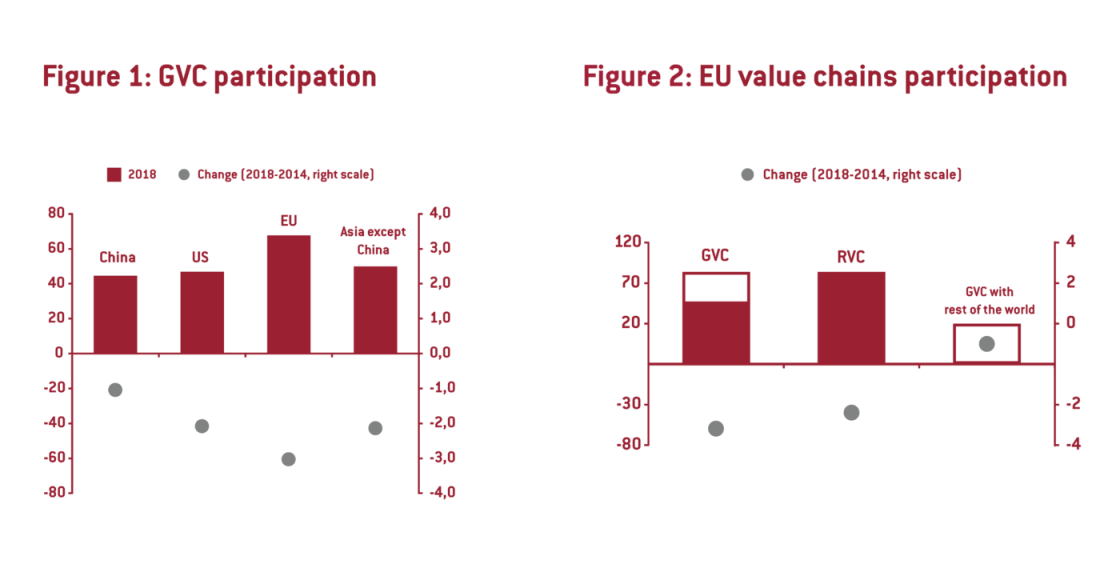

Following this definition, Figure 1 shows the level of participation in GVCs, and the change from 2014 to 2018, for the United States, the EU, China and Asian economies excluding China. The EU is the region with the greatest degree of participation in GVCs, but is also the region where participation is declining fastest. Most notably, a good part of the reduction in the EU’s participation in GVCs is within the single market. In other words, EU intra-regional trade integration (RVC in Figure 2), at least when measured in terms of value added, is shrinking, while the level of trade integration between EU countries and the rest of the world remains stable (GVC with RoW in Figure 2), although at a much lower level.

Sources - Fig. 1: Bruegel based on UNCTAD-Eora database, Natixis. Note: GVC participation is defined as FVA and DVX as a % of gross exports. DVX = domestic value added in exports subsequently re-exported by third countries; FVA = foreign value added incorporated in an economy’s exports. Results for 2016-2018 were forecast by UNCTAD-Eora. We use the UNTACD-Eora GVC database given its larger geographical coverage (189 countries) as well as relatively recent input-output data (2018).

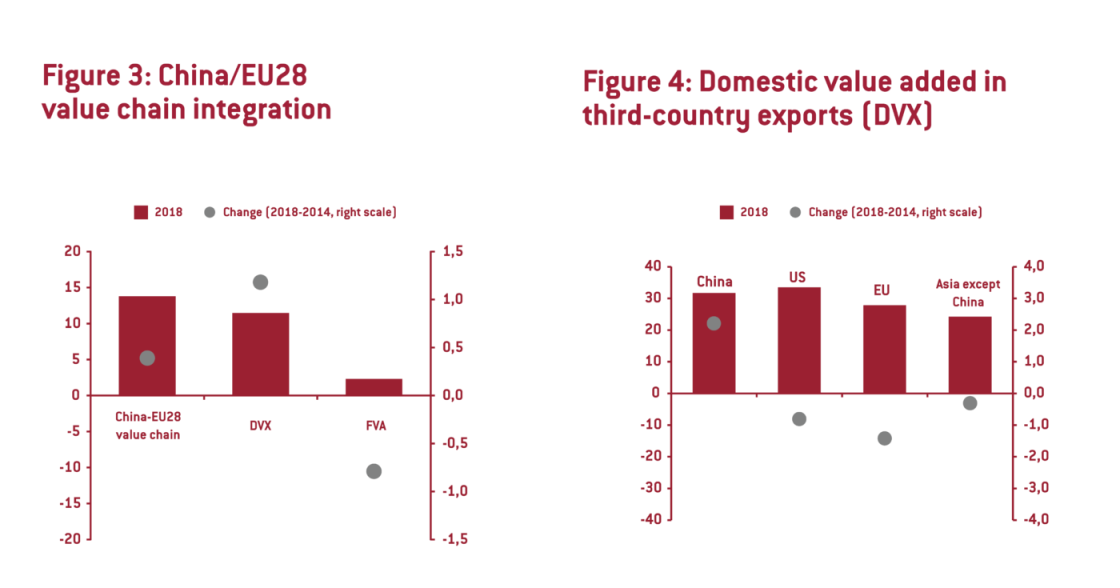

Fig. 2/3/4: Bruegel based on UNCTAD-Eora database, Natixis. Notes: RVC = regional value chain (EU single market). See notes to Fig. 1.

Stable integration with the rest of the world is mainly explained by the increasing trade linkages between EU countries and China, which is shown by the increasing exchange of intermediate goods. However, the benefits of such integration accrue mostly to China. In other words, EU exporters integrate into their products an increasing volume of intermediates from China (captured by the increase of DVX in Figure 3), while the EU’s exports of intermediate goods that go into China’s exports has fallen (represented by the decline of FVA in Figure 3).

We can conclude then that Chinese inputs into the EU value chain are increasingly predominant, but EU exporters are losing out because China’s reliance on them is declining. This however does not mean there might not be welfare gains if China’s products are more price-competitive for the same quality.

What is particularly worrying for the EU is that China’s vertical integration seems to be impacting the EU’s ability to export intermediate products to a greater extent than it impacts the US or the rest of Asia (as shown by changes in DVX shares in Figure 4). Given that the EU is a massive exporter of intermediate products, this should be a major concern for the EU, and particularly for countries that continue to run an export-led model, such as Germany. China’s vertical integration will increasingly challenge such export-led models.

Loss of competitiveness as a key explanatory factor

The most obvious explanation for the EU’s declining global trade integration is its relatively smaller size in the world economy. However, this seems to be not the only reason. While most of the diminishing global role of the EU in manufacturing value chains is a consequence of much weaker EU domestic demand growth compared to the rest of the world, almost 25% is explained by other factors (see here and here, using a broader definition of GVCs than the one described in the previous section). This is captured by the decline in EU market shares at different production stages in manufacturing value chains, and may be associated with a loss of competitiveness. In employment terms, the decline of EU participation in manufacturing value chains accounted for the loss of around 1 million EU jobs between 2000 and 2014. The United States and Japan have experienced similar changes, contrasting with the significant participation gains of China in all manufacturing value chains.

A more detailed analysis shows how EU competitiveness has changed relative to China across different sectors. Figure 5 compares the contribution of changes in market shares to changes in the EU’s and China’s global shares of value added for different manufacturing value chains. The size of each bubble represents the value added generated during all stages of production of the final product.

Figure 5 shows a strong correspondence between those manufacturing activities in which China has gained more competitiveness (ie positive value chain participation effects) and those in which the EU has lost the most. The EU food and pharmaceutical sectors remain competitive relative to China, but the EU has lost out in respect of most other sectors, regardless of their technological intensity.

Loss of EU competitiveness has been especially dramatic for textiles and electronics. While this trend should be expected for the textile industry in face of the competitive advantage low-wage economies have, the situation with electronics should concern the EU. Increasing competition from non-EU economies, primarily China, has resulted in a significant rise in the share of imported electronics, while the share of EU electronics exports in non-EU demand has decreased. These developments mean EU manufacturers have benefitted less than they might have done from the dramatic increase in the use of electronics globally, as both input for other industries and for mass consumption.

Moreover, value added from EU business services that contribute to the electronics value chain has also declined. The redistribution of value added triggered by the relocation of electronics supply to non-EU economies and, especially, China is very clear in the data (Table 1). This finding is not unique to the EU; similar situations can be found in the United States and Japan.

The ingredients of Chinese success

In responding to the trends we have outlined, some analysts point to potentially unfair Chinese cost-price competition, and the importance of improving the competitive environment and access to the Chinese market. This, however, might only be a partial answer as long as there is also an issue with Europe’s relative competitiveness. In fact, Chinese wages and labour costs more generally have been increasing for years, meaning the price-level gap with developed economies has shrunk significantly in the last two decades, with no sign that China has lost major market share. In addition, the price argument becomes less relevant for high-end sectors. While it can probably explain the EU’s loss of competitive advantage in the textile industry, it is harder to explain the same loss for the electronics sector.

Human capital and innovation are undoubtedly major factors in China’s increasing ability to compete with European exports. In education, China has clearly been converging with other countries, and certainly with EU member states. In particular, the average number of years of schooling in China has risen, and in STEM (science, technology, engineering and mathematics), the absolute number of graduates in China now equals those in the US, Japan and the EU together. The Penn World Tables index of human capital shows China quickly approaching the level of EU countries (Figure 6). China remains further behind the US, Japan and Korea by this measure.

Meanwhile, Chinese business expenditure on research and development has reached levels above 2% of GDP (Figure 7), in line with that in the EU. China’s income per capita is still not even half that of the EU, which makes the doubling of R&D expenditure all the more impressive. The global share of Chinese patent applications has also steadily increased since 2000, with those granted by the European Patent Office amounting in 2019 to a 6% share in artificial intelligence and 11% in information and communication technologies.

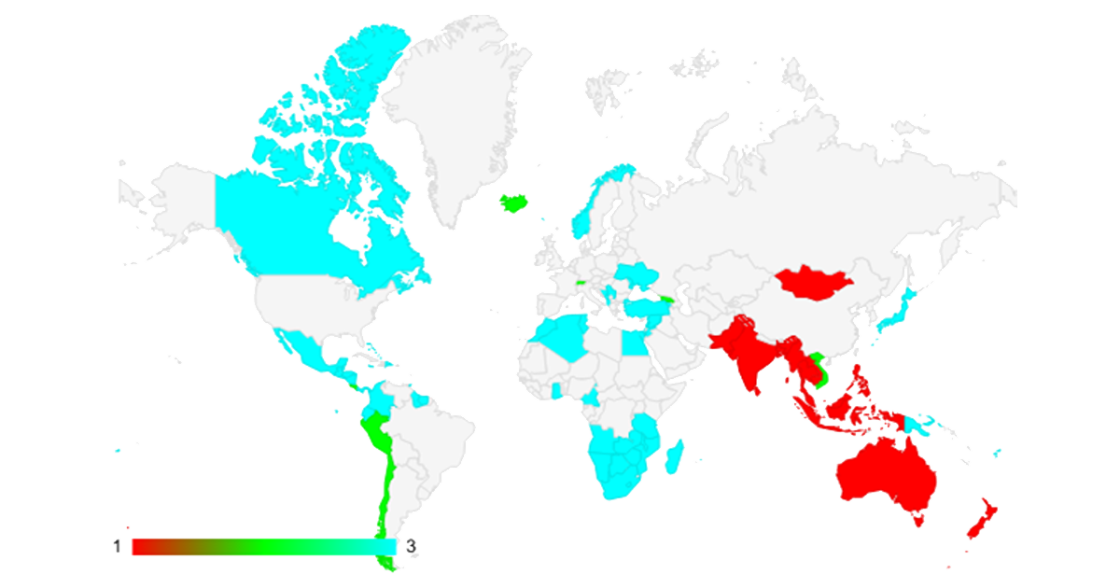

A key additional ingredient in this story is the expansion of global market access for Chinese products. When China joined the World Trade Organization at the end of 2001, the EU already had 13 regional trade agreements in force. Since then, China has signed 15 of these agreements and the EU has added 29 more. However, the EU’s deals tend to be with smaller economies. China clearly outperforms with 30% of world economic size and population covered by new trade deals, as opposed to 15% for Europe. In addition, countries covered by Chinese agreements are mostly located in the fast-growing and densely populated Asia-Pacific region, where middle classes are booming (Figure 8). The massive regional agreement between China and other Asian countries, the Regional Comprehensive Economic Partnership, further tilts the scales in China’s favour.

Fig.8

Source: Bruegel based on WTO. Note: red = signed only with China; blue = signed only with the EU; green = signed with both.

Conclusions

The European Union owes a good part of its economic weight to the creation of a large and efficient regional value chain, while it continues to integrate into the global value chain. But the EU’s role in the global value chain is declining. A good part of this can be explained by the EU’s shrinking share of the global economy, but that is clearly not all. In fact, the declining trend is particularly strong within the single market, while EU trade integration with China is increasing, though this is mainly to China’s benefit, putting at risk the EU’s external competitiveness.

In response, individual governments and the European Union have room in a number of areas to support competitiveness gains without distorting fair competition. For instance, they should reorient education, lifelong learning and active unemployment policies to build the knowledge capacities and skills for technological adoption and innovation, and to increase resilience to shocks. Other non-distortive policies should include improving the assessment of returns from, and coordination of, projects in the fields of research, innovation and digital infrastructure, while providing a solid legal and financial framework to develop these activities.

Recommended citation:

García Herrero, A. and D. Martínez Turégano (2020) ‘Europe is losing competitiveness in global value chains while China surges’, Bruegel Blog, 26 November