Designing a new EU-Turkey strategic gas partnership

The 2014 Ukraine crisis reinforced the EU’s quest for security of gas supply. The European Commission released an Energy Union Communication in Febru

Read the Policy Contribution Designing a new EU-Turkey strategic gas partnership

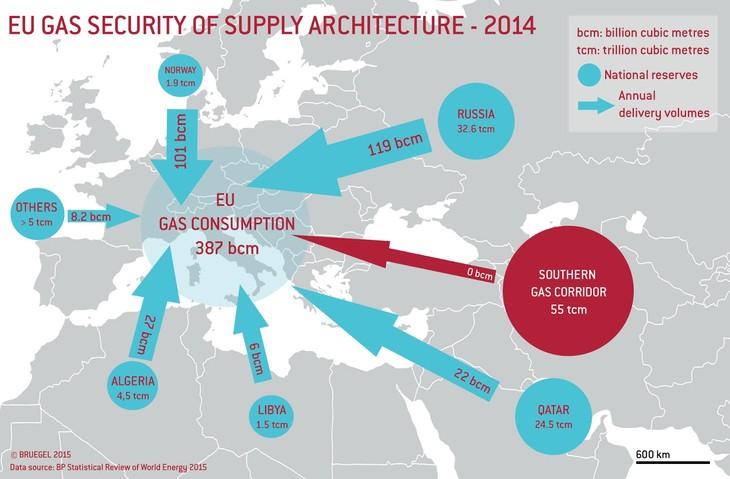

The Southern Gas Corridor in the EU gas security of supply architecture

Source: Bruegel.

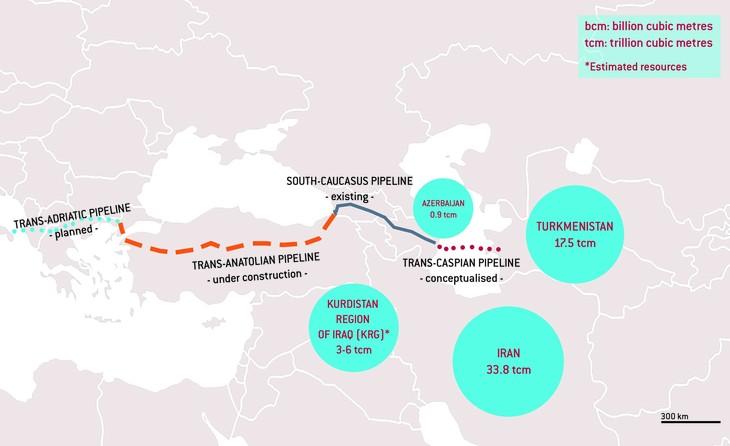

In the last decade, the failure of the Nabucco pipeline project, combined with EU vagueness about the opening of the accession process’ energy chapter, has brought EU-Turkey energy relations to a dead-end. This situation is in the strategic interest of neither the EU nor Turkey. A coherent and actively coordinated strategy on the SGC could allow the two players to strengthen gas cooperation with Azerbaijan (to date the only prospective supplier of the SGC) and to open new, realistic, cooperation avenues with other potential suppliers in the region: Turkmenistan, Iran and the Kurdistan Region of Iraq (KRI).

The Southern Gas Corridor: reserves and pipeline projects

Source: Bruegel.

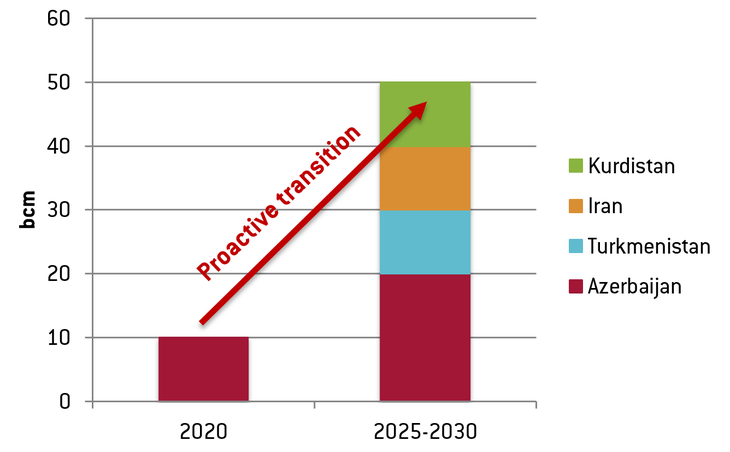

The EU and Turkey share considerable geopolitical synergies in the region, that if accurately exploited might helpunlock future gas exports from the region to their respective markets. If each potential supplier contributes 10 bcm/y by 2025-2030 the corridor might ultimately be expanded to 50 bcm/y: a significant order of magnitude for EU gas markets, most notably for southern and eastern European markets.

The Southern Gas Corridor: a potential scenario

Source: Bruegel.

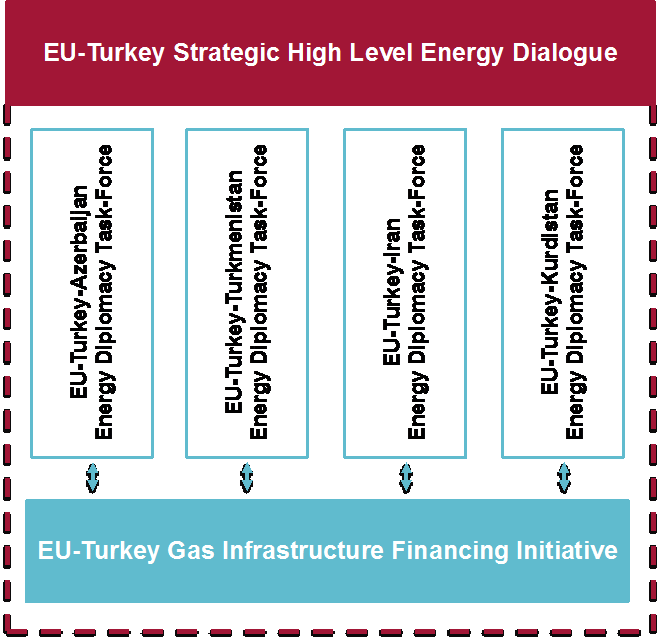

But how can the EU secure such a “proactive transition”? First of all, the EU should establish dedicated energy diplomacy task forces with Turkey and with each potential supplier. This would allow the EU and Turkey to make full use of complementary diplomatic leverages in the region, and thus to ensure that barriers halting regional gas trade are overcome. The four task forces (EU-Turkey-Azerbaijan; EU-Turkey-Turkmenistan; EU-Turkey-Iran; EU-Turkey-KRI) would represent the key pillars of a new EU-Turkey strategic gas partnership.

In parallel to energy diplomacy, the EU and Turkey should establish a dedicated financing mechanism for gas infrastructure investments, with a primary focus on upgrading the Turkish gas grid (through which new volumes of gas from regional suppliers might also flow to the Turkish-EU border). The European Investment Bank (EIB) could play a key role in attracting private and institutional investors, through its wide set of financing tools. The four “EU-Turkey Energy Diplomacy Task-Forces” and the “EU-Turkey Gas Infrastructure Financing Initiative” would act under the common framework of the “EU-Turkey Strategic High Level Energy Dialogue” recently launched by the Vice-President Šefčovič and Minister Yildiz.

A new EU-Turkey strategic energy partnership

Source: Bruegel.

Any new EU-Turkey cooperation efforts on the SGC should focus on small, but feasible, bilateral projects, instead of multilateral mega-projects that, as in the case of Nabucco, have proved to be problematic in this complex regional context. The target should not be to provide new major supply alternatives for Turkish and European natural gas markets in the short term; this would be unfeasible, as realistically an expansion of the SGC will not take place before 2025-2030. Its target should rather be to secure the basis for the expansion of the Corridor in the medium term.

Tested cooperation, with relatively limited gas volumes and up to four different supply sources will do most for Europe’s long term security of supply. It is not possible to foresee the political situation in any of the source countries, but cooperation would enable Europe to increase import capacity relatively quickly, from the most appropriate sources at that point in time. Investing today in the option of expanding imports from four different sources works, without having to commit to importing gas-volumes that are currently not (and might never be) needed.