Chart of the week: fiscal deficits in the euro area under the new forecast

The 2012 Autumn Economic Forecast of the European Commission confirms the Spring Forecast expectation that several euro area countries, including Fran

The 2012 Autumn Economic Forecast of the European Commission confirms the Spring Forecast expectation that several euro area countries, including France, will breach their commitment to return below a 3 percent deficit in 2013, unless they change their budget plans or the EU gives them more time to meet their commitment. However, most of these countries, including France, appear to be taking EU rules seriously as their structural balance figures have improved since the Spring Forecast.

In the Policy Brief “Fiscal rules – timing is everything” we used fiscal deficit figures from the 2012 Spring Economic Forecast of the European Commission to assess how far each euro area member was likely to be from its own deficit target. At the time, the following countries were found to be at risk of being sanctioned for an excessive deficit in 2013: Cyprus, Slovenia, Slovakia, France, Spain and the Netherlands[1]. During the summer, Spain’s deadline for correction was extended from 2013 to 2014 in light of the country’s poor growth conditions.

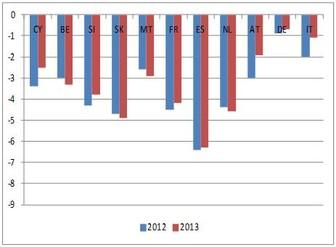

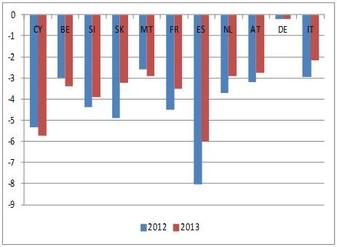

Here we compare nominal deficits of all euro countries under Excessive Deficit Procedure with the exception of assisted countries (Greece, Portugal and Ireland) as they appeared in the Commission’s Spring Forecast (Figure 1 a) with those in the Autumn Forecast published this week (Figure 1 b). The countries that are still likely to face sanctions for excessive deficits in 2013 are: Cyprus, Slovenia, Slovakia and France. Hence, besides Spain, the Netherlands have been removed from the list due to its budgetary adjustment.

Figure 1: Expected evolution of deficit levels, 2012 and 2013

(a) Spring 2012 (b) Autumn 2012

|

|

|---|

Source: author’s own elaboration based on 2012 Spring Economic Forecast and on 2012 Autumn Economic Forecast

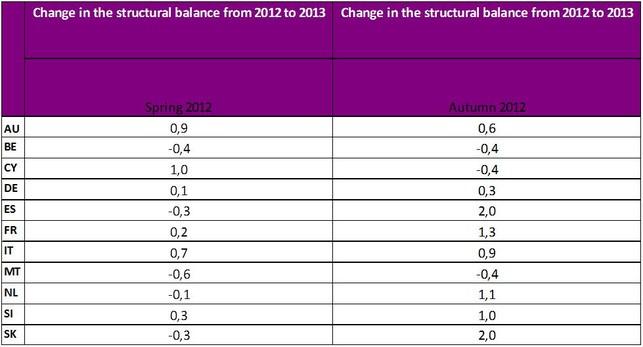

Excessive deficits may stem either from the lack of discretionary government measures or from lack of growth. Discretionary government measures are best captured by structural balance figures[2]. A majority of euro area governments is found in the Autumn Forecast to be going through a more ambitious structural adjustment path than projected by the Spring Forecast (for details see Table 1). This is especially true for the Netherlands and Slovakia, although the latter is still expected to breach the 3 percent limit in 2013, but not by much. Structural adjustment is also substantial in France. The only exception among countries potentially facing sanctions in 2013 is Cyprus, which is however likely to enter into the list of programme countries, and therefore to exit the list of countries having to return below the 3 percent mark by 2013, fairly soon. On this basis it appears that France and Slovakia should probably be given, like Spain, an extra year to meet their budgetary requirement and therefore escape sanctions for excessive nominal deficits in 2013.

Table 1: Changes in the structural balance 2012 - 2013 across the two forecasts

Source: author’s own elaboration based on 2012 Spring Economic Forecast and on 2012 Autumn Economic Forecast

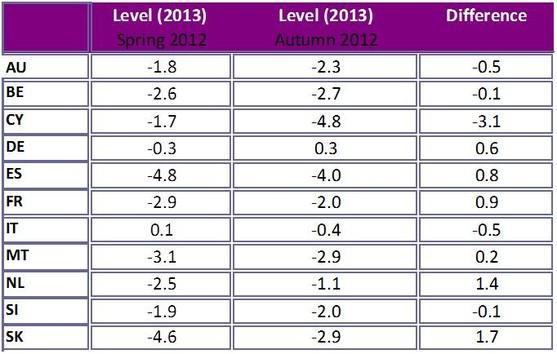

Table 2: The 2013 structural balance across the two forecasts (% of GDP)

Source: author’s own elaboration based on 2012 Spring Economic Forecast and on 2012 Autumn Economic Forecast

[1] For Cyprus the deadline for deficit correction is 2012 (and so is for Belgium). For all others it is 2013.

[2] The structural balance is defined as the cyclically adjusted balance net of one-off and temporary measures.