Chart of the week: Is external adjustment working in the euro area?

In the sixth year of the crisis of the euro area, it is time to review whether adjustment to external imbalances in the euro area is working. Current

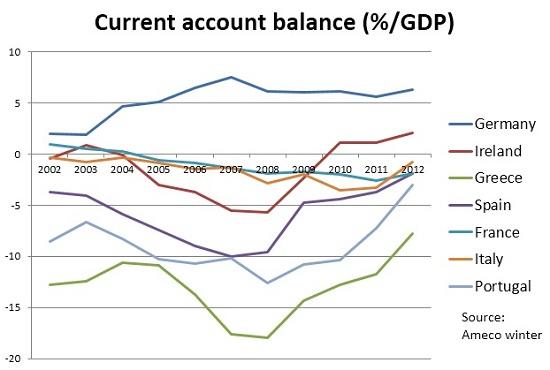

In the sixth year of the crisis of the euro area, it is time to review whether adjustment to external imbalances in the euro area is working. Current accounts have dramatically adjusted in a number of countries of the euro area as the graph below shows. The one country showing virtually no adjustment is Germany and I will revert below to it. Is the dramatic adjustment in current account deficits a sign of success of the export sector or merely a reflection of a dramatic collapse in domestic demand due to the private sector deleveraging and the start of fiscal consolidation?

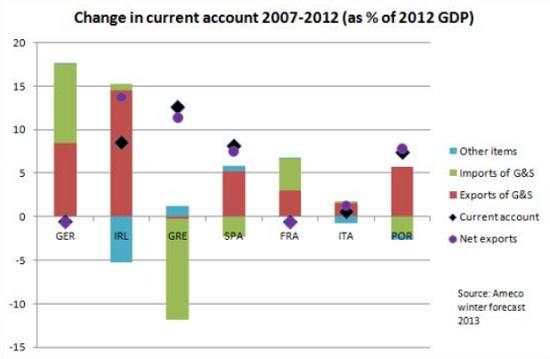

To answer the questions, the following chart is assessing the relative contributions of increases respectively decreases in imports and exports measured in percent of 2012 GDP. Ireland, Spain and Portugal show a spectacular export-driven adjustment. In all three countries, the increase in exports during 2007-2012 was far larger than the decrease respectively small increase of imports in Ireland. During the 5 years considered, current account adjustment was thus rather coming from exports than from a decline in imports due to a collapse of domestic demand. Greece is standing out with basically the entire adjustment coming from a huge decrease in imports. In Germany, both imports and exports grew by similar size so that no major change in the trade balance was recorded.

Two major policy lessons follow.

· First of all, if the euro area does not or cannot move to permanent current account surplus, then Germany should make a net contribution to demand by increasing imports more than exports. Given the demand deficiency in the euro area, there is a clear case for strengthening demand in Germany. This will further help re-balancing by increasing demand for exports from Ireland, Spain and Portugal in particular.

· Second, for the export sector to grow further in Spain, Portugal, Ireland but also Italy, it is important that the conditions for growth are fulfilled. Two things are needed for growth: Cheap access to credit to finance investment into new capacities as well as competitiveness of labour. The deep current fragmentation of the financial market and the divergence of financing conditions with significant risk premia paid by corporations located in the countries concerned is the single most important threat to further euro area adjustment. The banking union together with more aggressive monetary policy is needed.