Blogs review: Does economic growth have a future in the United States?

What’s at stake: In an effort to rebut the criticisms that his controversial 2012 paper “Is U.S. economic growth over?” drew and the recent affir

What’s at stake: In an effort to rebut the criticisms that his controversial 2012 paper “Is U.S. economic growth over?” drew and the recent affirmations by techno-optimists that productivity is reaching an inflection point, Economist Robert Gordon of Northwestern University published a new NBER working paper, which argues that growth will significantly slow down over the next four decades even if one does not assume a significant slowdown in the pace of future innovation.

The great stagnation hypothesis and the “four headwinds”

Zachary Golfarb writes that Northwestern University professor Robert Gordon – who gave us a downer in 2012 on the question "Is U.S. Economic Growth Over?" – is out with a new, depressing paper. This time Gordon takes aim at the so-called techno-optimists, such as the authors of the new book "The Second Machine Age," who claim that technological growth is accelerating. Robert Gordon predicts that growth in the 25 to 40 years after 2007 will be much slower, particularly for the great majority of the population.

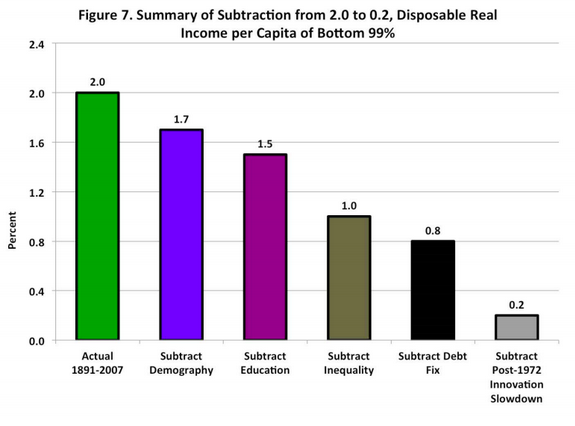

Robert Gordon writes that there is no need to forecast any slowdown in the pace of future innovation for this gloomy forecast to come true. The primary cause of this growth slowdown is a set of four headwinds. Demographic shifts will reduce hours worked per capita, due not just to the retirement of the baby boom generation but also as a result of an exit from the labor force of both youth and prime-age adults. Educational attainment, a central driver of growth over the past century, will stagnate at a plateau as the U.S. sinks lower in the world league tables of high school and college completion rates. Inequality will continue to increase, resulting in real income growth for the bottom 99 percent of the income distribution that is fully half a point per year below the average growth of all incomes. And a projected long-term increase in the ratio of debt to GDP at all levels of government will inevitably lead to more rapid growth in tax revenues and/or slower growth in transfer payments.

Source: Robert Gordon

Jan Hatzius does not expect any of these “four headwinds” to be particularly stiff. First, Hatzius expects further steady gains in the educational attainment of the US population – which together with the aging of the population, which implies increased average years of experience and skill – should ensure continued steady increases in labor quality. Second, he considers the demographic drag to be less than half the size estimated by Gordon, because the decline in labor force participation is a one-off and the current employment to population ratio is well below normal. Third, the increase in inequality seems to be slowing. Finally, a hit from fiscal retrenchment is unlikely. If taxes only rise to keep up with rising transfer payments, the net effect on disposable income will be zero.

The IT revolution and inflection points in productivity

Gavyn Davies notes that Hatzius and Gordon agree that the IT revolution will not make much of a contribution to accelerating productivity growth from now on. It is this assumption, which is certainly the most controversial. Many economists are much more optimistic, arguing that the effects of the IT revolution will become cumulatively larger as they are applied in conjunction with robotic and biological advances. For example, Andrew McAfee and Erik Brynjolfsson’s influential book on the march of the robots identifies many reasons for believing that the “second machine age” is only just starting. Martin Wolf, among others, is taking this possibility very seriously indeed.

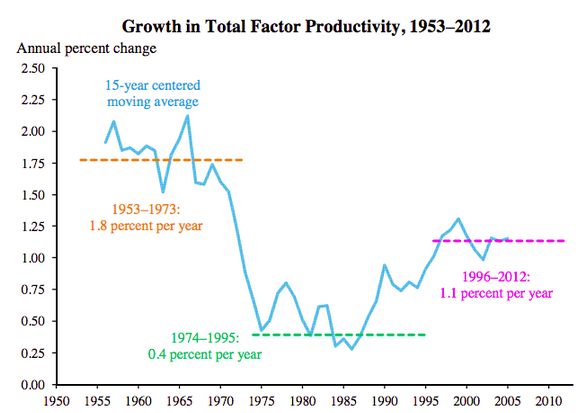

Paul Krugman writes that Gordon’s key point, actually deeper than his specific numbers, is that the digital revolution really just doesn’t match up to the major innovations of the Second Industrial Revolution of the late 19th century, which he contends drove growth well into the 20th century. Basically, indoor plumbing beats iPads. Robert Gordon writes that the techno-optimists ignore the temporary character of the late 1990s dot.com productivity revival. The third industrial revolution was uniquely concentrated in those eight years 1996-2004 and contributed remarkably little to productivity growth before or since.

Twenty-Cent Paradigms notes that the White House’s CEA has a more optimistic view than that of Robert Gordon on productivity. In its latest economic report to the President, the CEA finds that productivity growth has risen about halfway back to its "postwar golden age" level since the mid-1990's (Wonkblog notes that this is Jason Furman’s favorite graph from the 410 –page report). But the CEA's method of averaging (over periods of 15 years) means that their graph stops in 2005. The years since then have not been good ones for TFP. Since their data point for 2005 is an average over the years 1998-2012, the CEA is not ignoring the bad news, but they are lumping it in together with some good years (the late 1990's and early 2000's). If one were to break the post war period into 4 ears instead of 3, one would find:

- 1949-1973 -- 1.9%

- 1974-1995 -- 0.4%

- 1996-2005 -- 1.6%

- 2006-2012 -- 0.5%

This would be consistent with the brief 'boom' interpretation of Gordon, perhaps attributable to information technology and the internet, in 1996-2005, but one that is already exhausted.

Source: Economic Report to the President, 2014

Twenty-Cent Paradigms writes that it may be sensible to think the reduction in TFP growth over the past several years is largely the artifact of cyclical factors. That seems to be, implicitly, the CEA's view (and Ben Bernanke also has argued for a more optimistic interpretation of long-run prospects). Whether they're right or Gordon is will make a huge difference for standards of living a generation or two hence, but, just now, it is too soon to tell.

William Janeway (HT Martin Anota) points to a basic flaw in Gordon’s argument. Gordon distinguishes three Industrial Revolutions that have driven economic growth and improved living standards since the eighteenth century: IR #1 (“steam, railroads”), whose defining inventions date from 1750 to 1830; IR #2 (“electricity, internal combustion engine, running water, indoor toilets, communications, entertainment, chemicals, petroleum”), whose defining inventions date from 1870 to 1900; and IR #3 (“computers, the web, mobile phones”), dating from 1960. The core of his article contrasts the transformational impact of IR #1 and, especially, IR #2 on per capita GDP and the quality of life with the relatively trivial consequences of IR #3. The vulnerability of Gordon’s argument is his shortened time horizon for IR #3. Gordon cuts off IR #3 circa 2005 – that is, 45 years from its onset, but less than half the time allowed for IR #1 and IR #2 to run their respective courses.