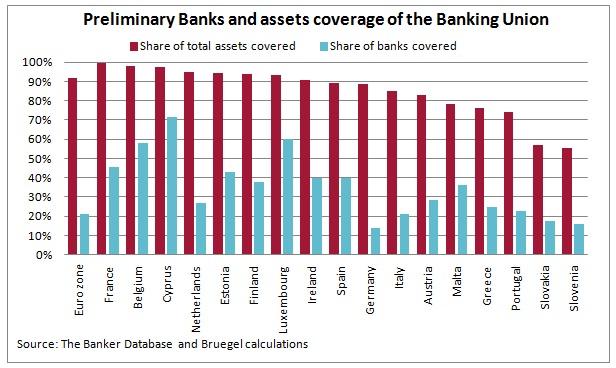

A banking union of 180 or 91%?

The European finance ministers have agreed on a deal for the banking union. According to the deal, the ECB would be directly responsible for banks wit

The European finance ministers have agreed on a deal for the banking union. According to the deal, the ECB would be directly responsible for banks with assets exceeding 30bn euro or 20% of GDP, or at least the 3 largest banks of each country member for those nations where fewer than three fulfil the previous criteria. In this chart of the week, we applied the two criteria to the Banker dataset, which includes 754 banks in the euro zone, so 14% of the 5404 banks. In terms of assets, a comparison between the Banker database and ECB aggregate statistics shows a good overall coverage of the banking system.

The graph shows that the threshold allows covering 92% of the total assets of banks in the euro zone and at least 187 banks. For most countries of the euro area, more than 80% of the assets of the banks located in the country will be covered. Notable exceptions are Portugal, Malta, Greece, Slovenia and Slovakia, where only the 3 biggest banks or at most 5 in Greek and Portugal would be under the direct oversight of the ECB according to our database, while in France almost 100% of assets are covered. In terms of the percentage of banks, a relatively low fraction of banks is covered as indicated in the graph.

Going forward, it will be crucial that the actual final implementation of the SSM will provide the ECB with the power to step in for any bank in the euro zone if it deems it necessary. The published compromise seems to point in that direction but is not entirely clear. After all, problems coming from 10% of assets can still be very significant. But overall, it is a big achievement that the ECB will have direct oversight over such a big proportion of assets.