Is Abenomics' success due to weaker YEN/USD exchange rate (as suggested by Big Mac Index)?

The Economist’s Big Mac Index suggests that the yen is undervalued by 30%. The gap between “implied exchange rate” (local price divided by dolla

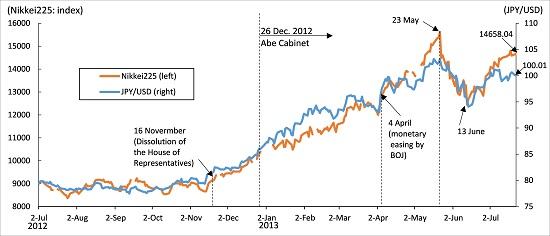

A plunge of Nikkei Index from the year-highest 15,942.60 on 23 May to 12,415.85 on 13 June triggered discussion that Abenomics is a failure. The Index has increased by 20% since then but this has not led to a positive re-assessment. No new concrete policy measures have been announced since then.

In fact, Nikkei Index has been correlated with the exchange rate of the yen against dollar, even before Mr Abe was in office (figure 1). Since the dissolution of the House of Representatives late last year yen has depreciated against dollar until middle May and the Nikkei Index has surged.

Figure 1: Recent development of stock price index and exchange rate

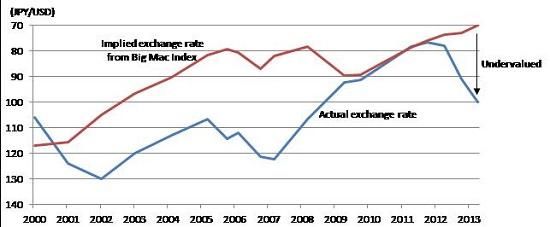

Meanwhile, the Economist’s Big Mac Index suggests that the yen is undervalued by 30% (figure 2). The gap between “implied exchange rate” (local price divided by dollar price in the US) and actual rate is widened from a year before (5.4%). So is the success of Abenomics just due to the weak exchange rate? If the Index is a good proxy of the equilibrium exchange rate, the undervaluation of the yen could be the main driver of the success of Abenomics so far. More studies should be done to assess the true equilibrium exchange rate.

Figure 2: Undervaluation of the yen from the Big Mac rate

(Data source) The Economist.