China’s M&A activity rebounds with a clear focus on Europe

Despite the pandemic, China’s interest in overseas M&A started to rebound in late 2020, with European industrial companies still of particular interes

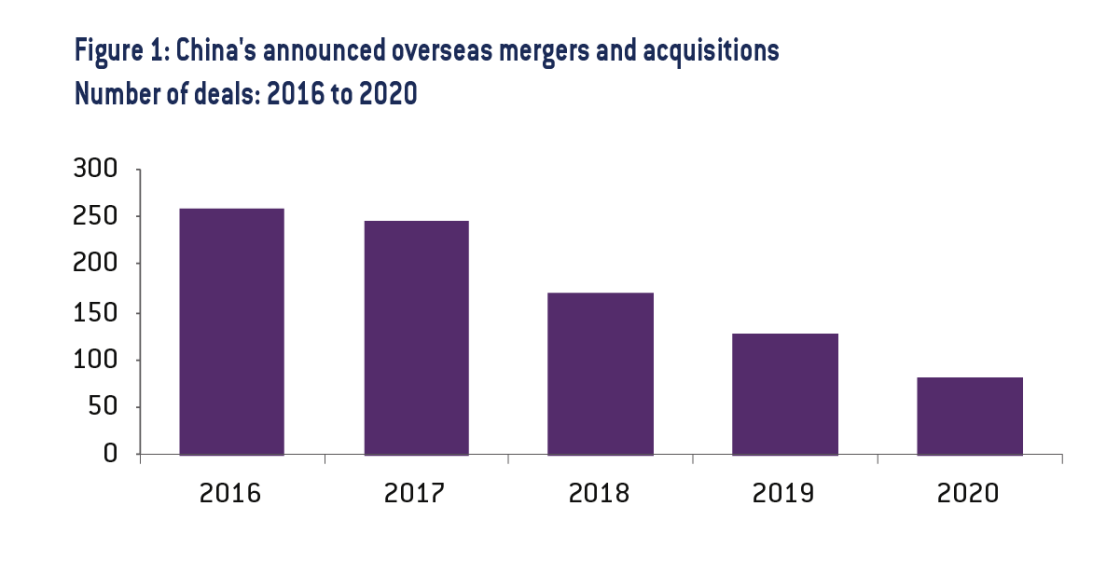

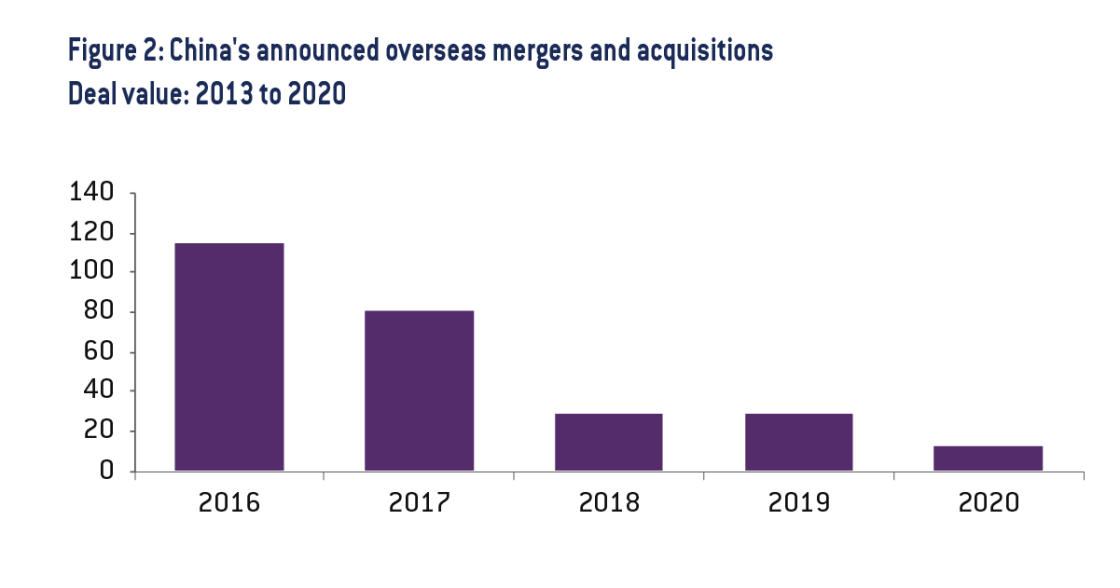

The sharp recession of early 2020 and tightened measures on social interactions weighed on China’s announced outbound mergers and acquisitions last year, despite China’s containment of COVID-19 and a significant recovery in growth later that year. Outbound M&As in 2020 were down by nearly one-third in number and more than half in value compared to 2019 (Figures 1 and 2). The rapid deceleration was even worse than the global trend for announced M&A, which only declined by 10% during 2020 according to the UNCTAD Investment Trends Monitor.

Source: Bruegel based on data from Natixis

That said, the decline in Chinese overseas M&A was already clear in 2018 and 2019. COVID-19 might therefore not be the only underlying reason for the retreat. A deeper reading of the evolution of Chinese announced M&A activity confirms a much faster decline in the first three quarters of 2020, with a significant turnaround in the last quarter with obvious green shoots. These were clearly associated with the lifting of restrictions and economic rebound in the second half of the year, and contrasted sharply with the still-weak situation in the rest of the world as COVID-19 spread from March 2020 onward. In other words, China regained some lost energy in the outbound M&A market as the economy reopened. Structural reasons including the uncertain international environment facing Chinese overseas investment, which was present before the COVID-19 pandemic, and China’s own restrictions on ‘unreasonable’ capital outflows, may be other factors that explain China’s declining outbound M&A.

In fact, there is already a more favourable funding environment for Chinese corporates that want to go abroad, as dollar interest rates have edged much lower since the US Federal Reserve introduced a massive monetary stimulus to boost the economy. The laxer financial environment is likely to last as the world’s central bank may continue with the low-interest environment for a long time.

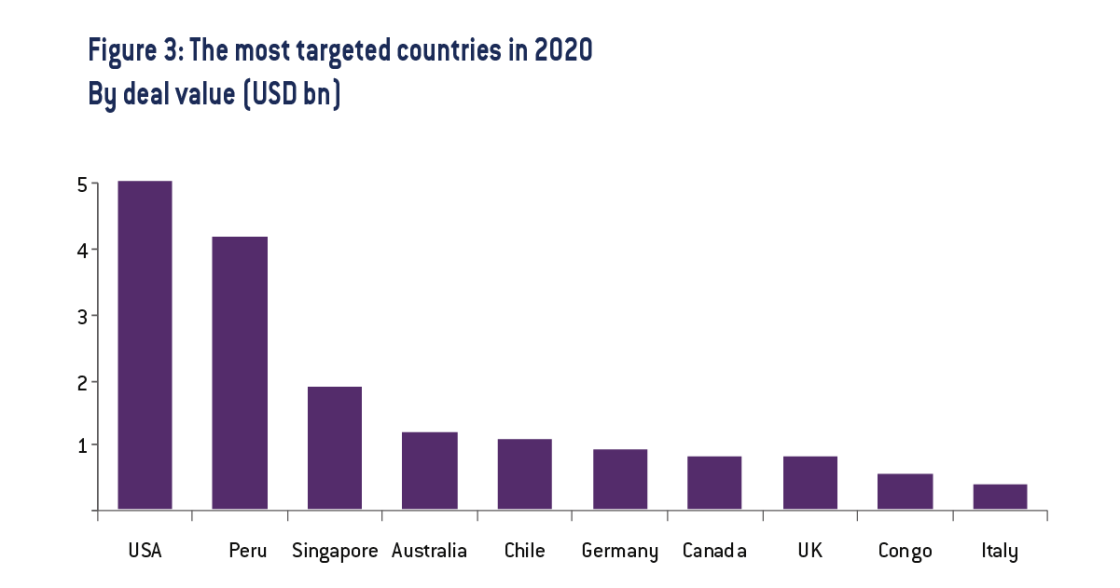

In addition to the overall change in number and value of deals, another feature of Chinese M&A activity in 2020 was the rebound in the value of completed deals (finalised deals) in the US (Figure 3), which in number terms were at about the same level as in 2019. The rebound in value was thanks to two giant deals. It is important to note, though, that both of these were Chinese purchases from European owners. The biggest by far was Tencent’s acquisition of a 10% stake in Universal Music, majority-owned by French media conglomerate Vivendi. The second was Shanghai RAAS’s acquisition of 45% of Grifols Diagnostic Solutions from Spanish pharmaceutical company Grifols, in exchange for a 26.2% stake in the Chinese company. Peru was the second-largest target for China because of Yangtze Power’s completed acquisition of Luz del Sur, one of Peru’s largest power companies.

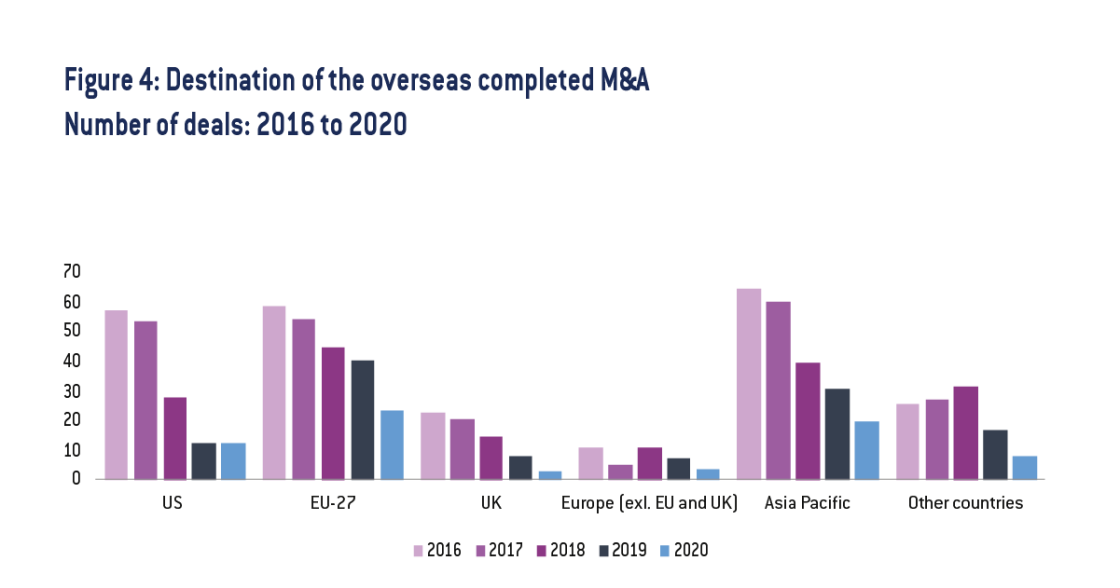

Beyond acquisitions from European companies in the US market, the most preferred region for Chinese acquisitions is the European Union. In fact, the EU was the region with the largest number of completed Chinese deals in 2020, including Huazhu Group’s acquisition of Deutsche Hospitality and Guangdong Wencan Die Casting Corporation’s deal with the French car-parts maker Le Bélier. However, both the value and the number of Chinese deals in the EU in 2020 were lower than in previous years (Figure 4).

Source: Bruegel based on data from Natixis

In terms of the sectoral distribution of Chinese acquisitions, the industrial sector remains the main target for Chinese overseas M&A, with a special focus on European Union countries. The second most important sector in 2020 was healthcare. However, because of several big deals targeting energy and entertainment, the sectoral distribution in value terms was more evenly distributed in 2020 than in previous years.

Acquisitions by Chinese state-owned enterprises (SOEs) increased in 2020 with a special focus on the Asia-Pacific, while those in the US and Europe were smaller. In particular, the share of deals from Chinese SOEs in Europe decreased. Most of these SOE acquisitions are still in resource-related sectors, whereas private companies dominated in the industrial and consumer sectors.

China’s intention to explore global market opportunities, and its thirst for technology and other types of industry upgrade, are also main pillars of China’s engagement in the global M&A market. The eagerness to acquire technology explains Chinese interest in the EU, where regulatory limits on acquisitions are much less obvious than in the US, Japan, South Korea or other parts of the developed world. In addition, the current extremely lax global financial conditions and the relative strength of the renminbi are positive factors which should push investors to engage in new deals. If we add to the equation the number of companies globally that might be facing difficult financial conditions and looking for a potential buyer, Chinese companies will certainly have a big pool of assets to choose from. The announcement in early April that China Eastern Airlines, one of China’s big four state-owned carries, would participate in a €4 billion French rescue plan for Air France-KLM was a clear example of the likely future direction.

Finally, the signing at the end of 2020 of the China-Europe Comprehensive Investment Agreement (CAI) should also help increase China’s interest in European assets by providing a legal safeguard against any change in attitude towards Chinese acquisitions on the part of EU countries or EU-level regulators. In addition, to keep the door open to China, CAI also opens one more sector to China: renewable energy. Already, China Three Gorges has agreed to acquire a portfolio of Spanish solar plants, following on from their acquisition of 23% of the Portuguese utility EDP, completed in 2019.

All in all, 2020 was clearly not a good year for M&A globally, including for Chinese companies’ acquisitions overseas, but the trend changed for the better towards year-end. In fact, the relative better performance of the Chinese economy in the second half of 2020 and the very favourable global financial conditions have already helped China’s outbound M&A. Chinese M&A is very likely to increase in 2021, perhaps not to the record levels seen in 2016-17 but to levels above 2019-20. The EU, and EU companies’ assets whether in Europe or elsewhere, remain important targets, as has been the case for the last few years, including in 2020 notwithstanding the pandemic. As many EU companies are still in difficult financial situations, the focus of Chinese investment on the EU will continue, especially if the China-EU CAI is finally ratified. Whether Europeans should celebrate depends on which companies Chinese investors acquire and the ultimate use they are put to. If the trend continues, most Chinese acquisitions will target the EU’s core competitive advantage: the industrial sector.

Recommended citation:

García Herrero, A. and J. Xu (2021) ‘China’s M&A activity rebounds with a clear focus on Europe’, Bruegel Blog, 04 May