The impact of COVID-19 on artificial intelligence in banking

COVID-19 has not dampened the appetite of European banks for machine learning and data science, but may in the short term have limited their artificia

Before COVID-19, banks were keen adopters of artificial intelligence (AI), including machine learning and other advanced data-science techniques. After the technology sector, the financial services sector was the biggest spender on AI services in 2018. Thanks to such massive investment, AI now powers a wide range of tasks. Machine-learning systems trade, detect fraud, engage with customers and help banks comply with regulatory requirements.

On the face of it, the pandemic should reinforce banks’ adoption of AI. Accelerated digitalisation generates new data processing needs, while ultra-low interest rates and weakened revenues call for cost savings. But the crisis weakens the business case for AI in at least two respects. Machine-learning models trained on historical data are less useful when the present looks nothing like the past – 2019 data is little help in predicting whether Spanish hotels will survive 2021. Weak profitability may also drain banks’ R&D budgets and executive patience to invest in fundamental transformation. Rather than speeding up AI adoption, could the pandemic therefore impede the banking sector’s use of, and spend on, AI?

COVID-19 and the banking business case for AI

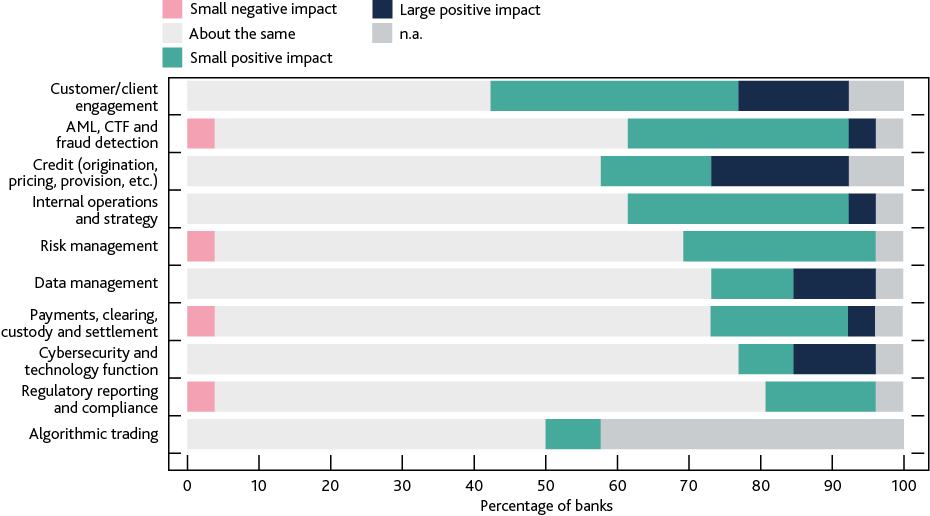

Early evidence suggests that banks’ interest in adopting machine learning and data science has continued during the COVID-19 crisis, and may have increased. Half of banks polled in a summer 2020 Bank of England survey said the COVID-19 crisis has made machine learning and data science more important for the future[1]. Over a third reported an increase in the number of their planned use-cases, with the business areas directly affected by the pandemic, such as customer engagement, expected to grow the most. One explanation for this is that machine learning and data science are part of a wider digitalisation of banking services, which has accelerated as a result of COVID-19. The first wave of the pandemic triggered a 10 to 20 percent rise in online and mobile banking across Europe. The trend towards increasingly digital banking services appears to have continued throughout 2020.

[1] The survey was sent to 26 banks in August 2020 that collectively account for roughly 90% of UK banking sector assets. Survey respondents included UK headquartered banks and European, North American and Japanese banks operating in the UK.

Figure 1: Impact of COVID-19 on banks’ plan to invest in machine learning and data science by use case

Source: Bank of England.

But a significant proportion of the banks surveyed by the Bank of England are not spending more on AI. Even though half of banks consider AI more important for their future operations, less than a quarter plan to increase funding and resourcing for planned applications. Moreover, 12% of banks plan to reduce funding for future applications. Some corroborating evidence for this can be found in hiring data, which shows that banks hired less AI talent in 2020 compared to previous years (Figure 2). So why the discrepancy?

The COVID-19 crisis partly explains banks’ budgetary reticence. The net income of European banks has fallen substantially during the crisis (although most of the decrease is down to provisions, which could be written back if loan losses do not materialise on the scale anticipated). Benoit Cœuré, who heads the Bank for International Settlement’s Innovation Hub, has warned of a possible technological divide between underperforming European banks and their more profitable American counterparts.

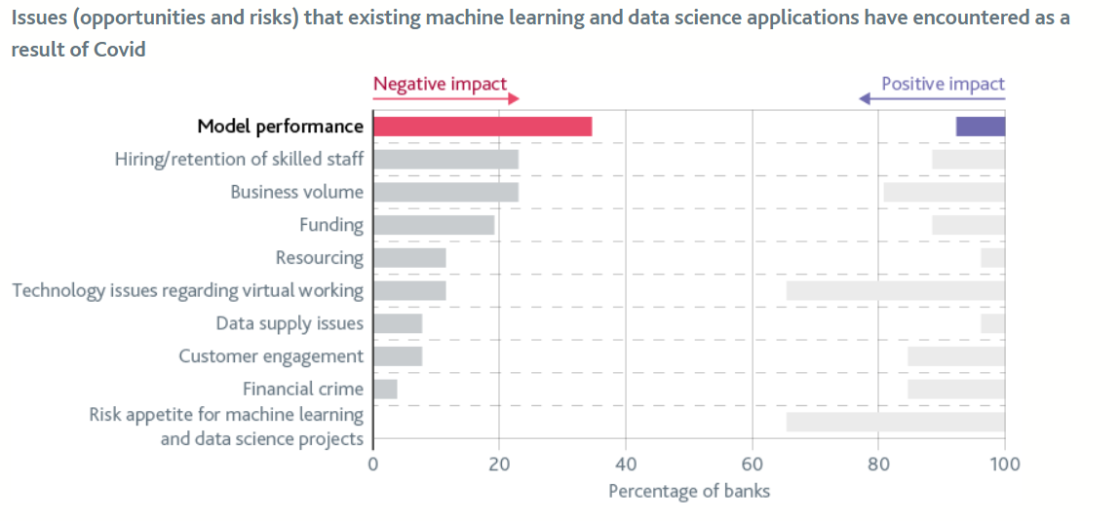

In addition to tighter budgets, the crisis has affected the performance of banks’ models (both machine learning and non-machine learning) and this may explain their reluctance to invest in new projects. Machine learning is only as good as the past data used to train it. Given the sudden, severe and unpredictable nature of recent epidemiological events, the performance of banks’ machine-learning models has suffered. Over a third of banks surveyed by the Bank of England reported their models had been negatively impacted by COVID-19 (Figure 3).

Figure 3: Opportunities and risks encountered by banking machine-learning and data-science applications as a result of COVID-19

Source: Bank of England.

What next? The outlook for banks’ use of AI in a post-COVID world

The impact of COVID-19 will likely be felt for years. Nevertheless, despite the pandemic, general interest in AI has been resilient. Worldwide Google searches on the topic of AI remained largely unchanged in 2020 and spiked in the first months of 2021. Similarly, academic output on AI stayed on course (in terms of academic publications, with either ‘machine learning’ or ‘artificial intelligence’ as key words, in the EBSCO and Scopus databases).

Interest in and application of AI in Europe’s banking sector has also been resilient. In the immediate post-pandemic world, many banks may seek to improve their profitability through cost-containment strategies. For AI, this could mean a reallocation of resources away from development of new trading models towards replacement of existing manual processes with automated routines, such as mortgage assessments. JP Morgan in 2016 reduced the time to review commercial loan contracts from 360,000 man-hours to a few machine-seconds. More such use cases will likely be explored by banks.

Banks may also seek to retrain machine-learning models to better perform under conditions of sustained instability, for example through an increased reliance on fast economic indicators and advanced simulation techniques that use reinforcement learning.

Some long-term pre-COVID-19 trends will likely persist. The digitalisation of society (accelerated under lockdown) and banking will continue to generate more data for banks to use. And as a new generation of workers with data-science skills joins the workforce, AI capabilities may become more affordable.

Regulatory clarity could also further boost AI adoption. Central banks and regulators, keen adopters of AI themselves, are engaging in dialogue with firms to support safe adoption and understand how existing policy frameworks affect and encompass AI. The French and German prudential regulators have already published discussion papers that outline some of the considerations for supervising banks’ use of AI. The European Commission is set to propose a regulatory framework for trustworthy AI this year, which will address uncertainties around liability and provide safeguards against algorithmic bias.

COVID-19 may have tempered banks’ spending appetite for expensive AI projects temporarily, but the pressure to cut costs and automate is stronger than ever. The use of AI could help banks boost revenues, reduce costs and uncover new and previously unrealised opportunities. Meanwhile, use of online and mobile banking is expected to continue at higher levels once the pandemic subsides, with between 15% and 45% of consumers expecting to cut back on branch visits following the end of the crisis. Despite their current budgetary constraints, it seems likely that banks across Europe will continue to build their AI capacity.

David Bholat is senior manager in Advanced Analytics, the Bank of England’s centre of excellence in data science, and was a Bruegel visiting scholar in 2019. Mohammed Gharbawi and Oliver Thew are senior Fintech specialists at the Bank of England’s Fintech Hub.

Recommended citation:

Anderson, J., D. Bholat, M. Gharbawi and O. Thew (2021) ‘The impact of COVID-19 on artificial intelligence in banking’, Bruegel Blog, 15 April