Ukraine: trade reorientation from Russia to the EU

Over the past five years conflict has led to a deterioration of Russo-Ukrainian economic relations while ties with the EU have been deepened. This shi

This blog post is based on the Policy Contribution "Six years after Ukraine’s Euromaidan: reforms and challenges ahead". Read it here.

During the past six years, Ukraine has been a victim of heightened Russian aggression – militarily, politically and economically. In fact, in 2013, economic pressure was used to try to persuade Ukrainian President Viktor Yanukovych not to sign the Association Agreement (AA) with the EU. Though temporarily successful, this pressure triggered the Euromaidan protests in November 2013, which eventually led to collapse of the Yanukovych regime in February 2014 and subsequent Russian military intervention.

In the following months, Russia continued to exert pressure to stop the Association Agreement, or at least its trade component, the Deep and Comprehensive Free Trade Area (DCFTA), which Russia (wrongly) judged detrimental to its interests, arguing that zero-duty imports from the EU into Ukraine could easily ‘leak’ into Russia. Despite the European Commission’s efforts to avoid a trade conflict through a one-year postponement and trilateral negotiations, the DCFTA eventually entered into force on 1 January 2016. Russia responded by unilaterally revoking its own bilateral free trade agreement with Ukraine, which had been in place since the dissolution of the USSR at the end of 1991.

The military conflict and subsequent Russian trade sanctions dealt a heavy blow to the Ukrainian economy. Russia had long been Ukraine’s main trading partner and both economies were deeply interlinked from Soviet times. On the other hand, the DCFTA with the EU opened up new trade and investment opportunities. Ukraine had to reorient its trade relations from Russia to the EU and other partners in a relatively short period, similar to the experience of several countries of central and eastern Europe in the early 1990s.

This blog post, based on our more comprehensive study (here), details the deep shifts in Ukrainian trade that have occurred in the past five years. It shows that Russia’s fears of a reorientation of Ukraine trade towards the West have become reality.

A change in trade partners

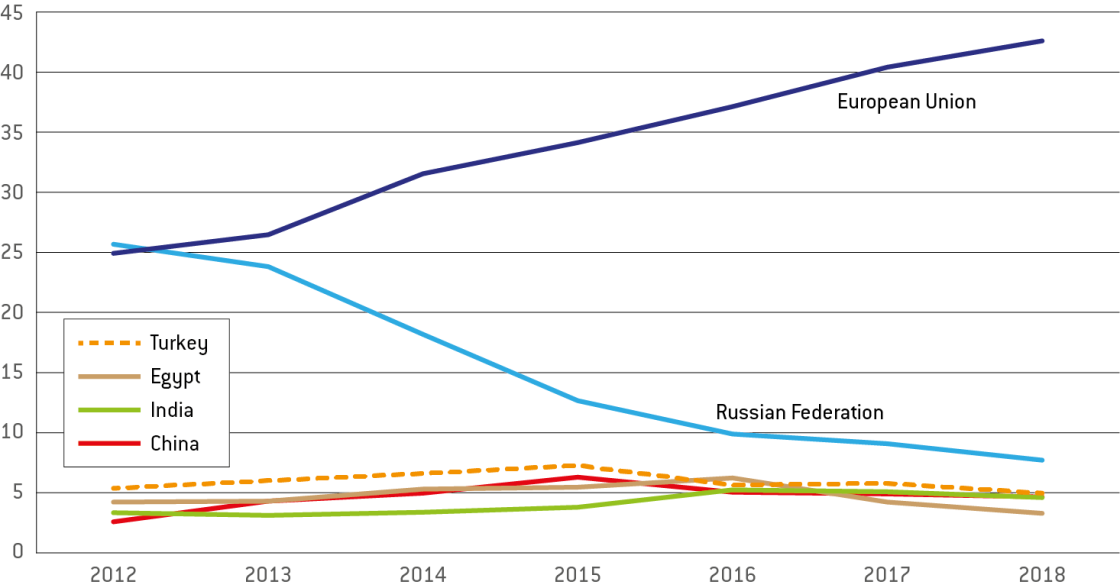

Since the start of the confrontation with Russia, the EU has drastically increased its share of Ukrainian exports, becoming by far its main trading partner.

In 2012, Russia was the destination for 25.7% of Ukrainian exports, compared to the EU’s 24.9%. Six years later, Russia’s share of Ukrainian exports had fallen to only 7.7%, while the EU’s share shot up to 42.6%. Perhaps most interestingly, the combined share of these two destinations remained constant throughout the period, accounting for slightly more than half Ukraine’s exports. The share of Ukraine’s four other largest export partners – China, Egypt, India and Turkey – grew from 15.5% in 2012 to a peak of 23% in 2015, then back to 17.5% in 2018.

Figure 1: Ukraine, exports of goods by destination, % of total goods exports, 2012-2018

Source: World Bank World Integrated Trade Solution (WITS).

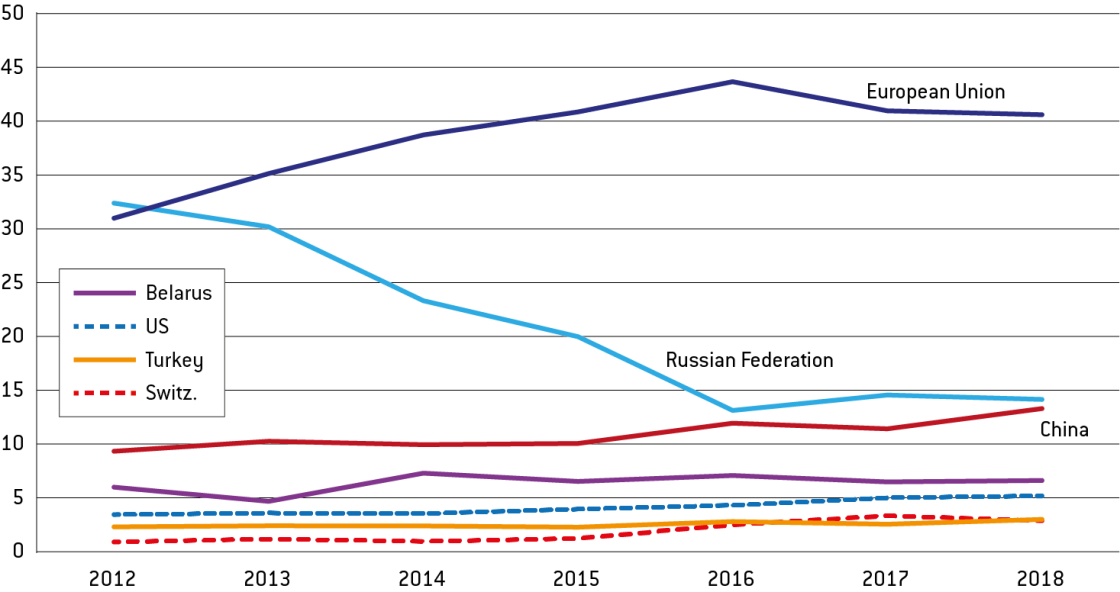

Imports have followed a similar pattern. Russia was the source of a slightly greater share of Ukraine’s imports than the EU in 2012 (32.4% vs 31%). However, Russia’s share by 2018 fell to under 15%, while the EU’s increased to 41%. A large part of this change originated in the reorientation of natural gas imports: deliveries from Russia were replaced by reverse deliveries from Slovakia.

However, while in 2012 almost 65% of Ukraine’s imports came from either the EU or Russia, this had fallen to 55% by 2018. During that time, the share from the next five largest source countries grew from 22% to 31% of the total. This was mainly to the benefit of countries in the broader Eurasian neighbourhood (Belarus and Turkey), as well as China, the United States and Switzerland (who, while still a small trading partner, saw its share of Ukraine’s imports triple in the seven years up to 2018). Meanwhile, China has become almost as important a source of imports as Russia.

Figure 2: Ukraine, imports of goods by origin,% of total goods imports, 2012-2018

Source: World Bank World Integrated Trade Solution (WITS).

Trade in goods

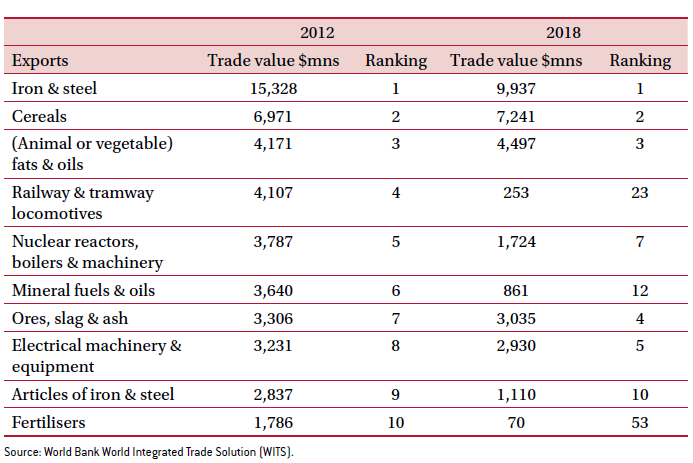

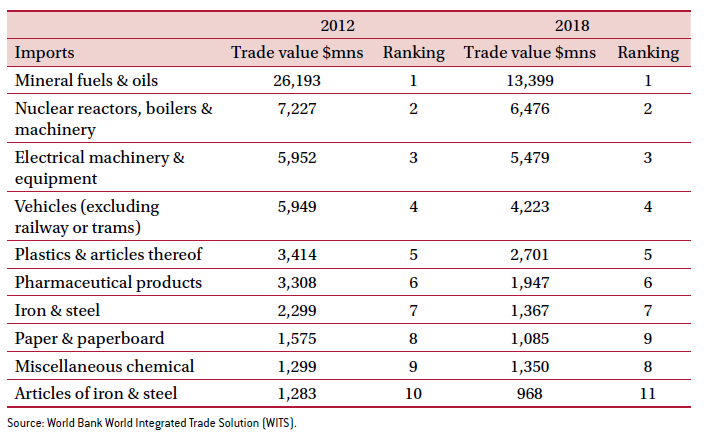

This pronounced shift in Ukraine’s trade partners does not seem to have also resulted in a sectoral shift. To examine this, we broke down trade in goods according to the World Bank’s World Integrated Trade Solution (WITS) database H2 classification, which divides products up into 99 categories.

The top three categories of exports from Ukraine remained the same (and in the same order) from 2012 to 2018. These were iron and steel; cereals and animal; and vegetable fats and oils. Together they make up 46% of total exports (from 39% in 2012). However, there has been a substantial shift from metals to agri-products. Other categories have seen more fluctuation. Locomotives (railway or tramway) used to be Ukraine’s fourth main export but have now dropped all the way to twenty-third place. Meanwhile, electrical machinery has become an increasingly important category.

Table 1: Ukraine: top 10 categories of goods exports (2012, 2018)

Table 2: Ukraine, top 10 categories of goods imports (2012, 2018)

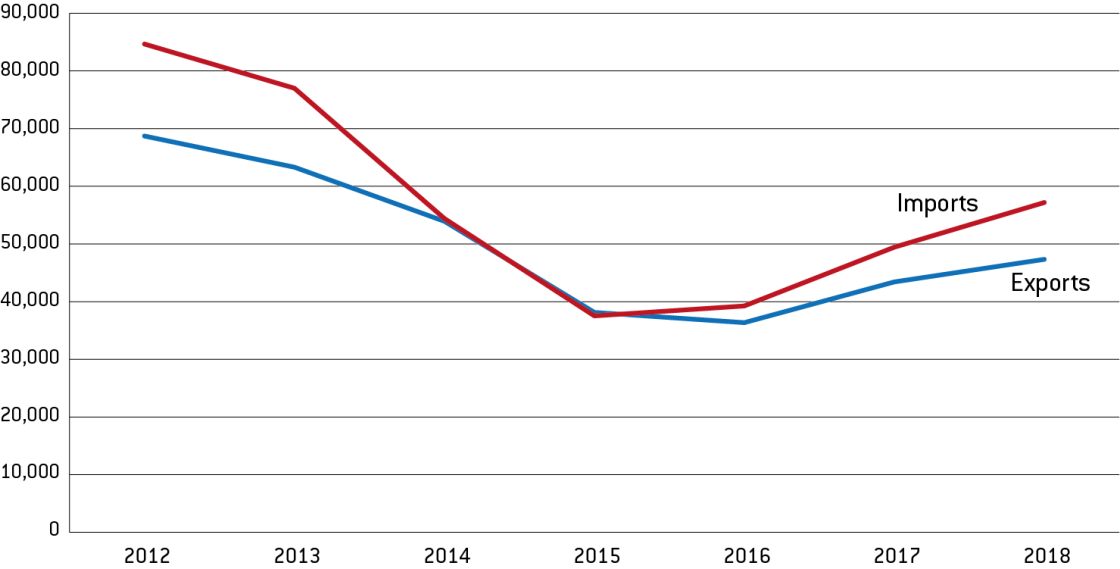

Trade dynamics reflect the military and trade conflict with Russia as well as changes in GDP: Ukraine went through a deep recession in 2014-2015, followed by a moderate recovery. Imports more than halved between 2012 and 2015 while exports almost halved between 2012 and 2016. Both partially recovered between 2016 and 2018.

Figure 3: Ukraine, imports and exports of goods, US$ millions, 2012-2018

Source: World Bank World Integrated Trade Solution (WITS).

Trade in services

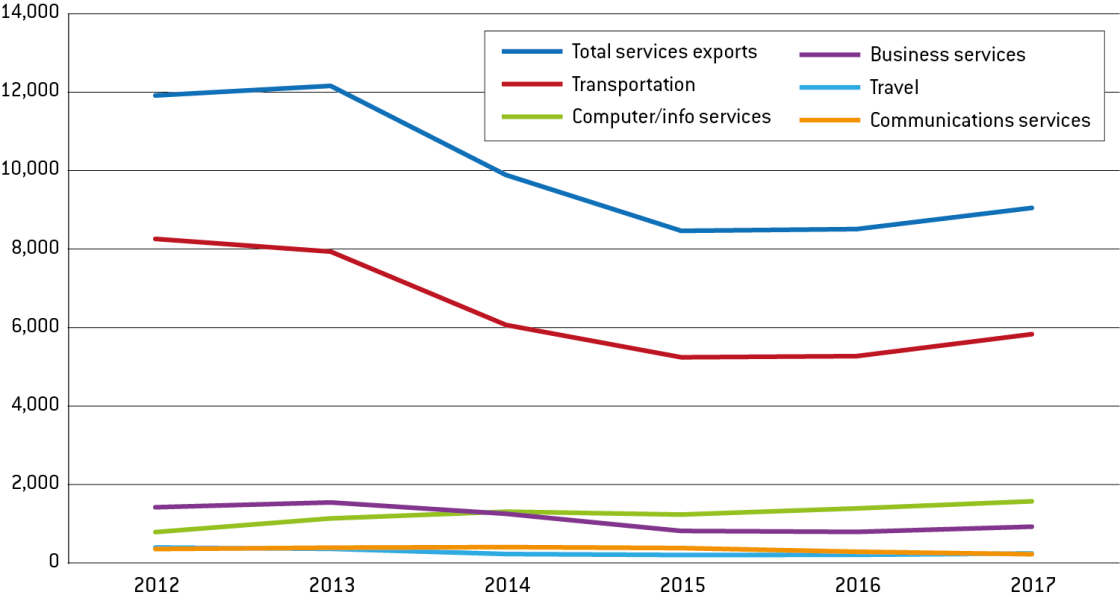

An overall decline in services exports over the time period is also evident, despite the slight recent recovery.

Transport clearly dominates Ukraine’s services exports and appears to explain the majority of the decrease. In contrast, computer and information services exports more than doubled over the time period in dollar terms, and their share of total exports almost tripled, making them Ukraine’s second largest services export.

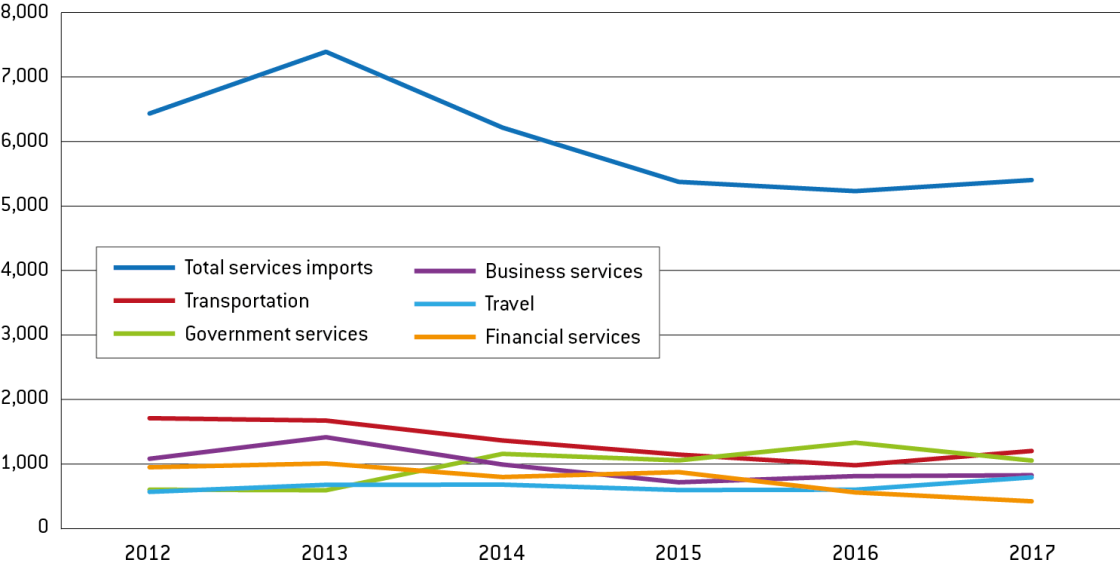

For services imports, the situation is more balanced: while transportation remains the most prominent sector, this fluctuated throughout the entire time period. Government services briefly took over in 2016, and today the dominance of transportation is far less pronounced. Government services imports have seen a 75% increase during the time period. In contrast, imports of financial services appear to have more than halved.

Figure 4: Ukraine, services exports, top categories, US$ million, 2012-2017

Source: UN COMTRADE.

Figure 5: Ukraine, services imports, top categories, US$ million, 2012-2017

Source: UN COMTRADE.

Natural gas import and gas sector reform

The over-consumption of natural gas imported from Russia was traditionally an ‘Achilles heel’ of the Ukrainian economy. It was underpinned by deeply subsidised domestic gas prices, the soft budget constraints of many industrial and communal gas consumers, and the lack of reform in the gas transportation and distribution sector. It led to continuous fiscal and balance-of-payment tension and to Ukrainian vulnerability in its economic and political relations with Russia.

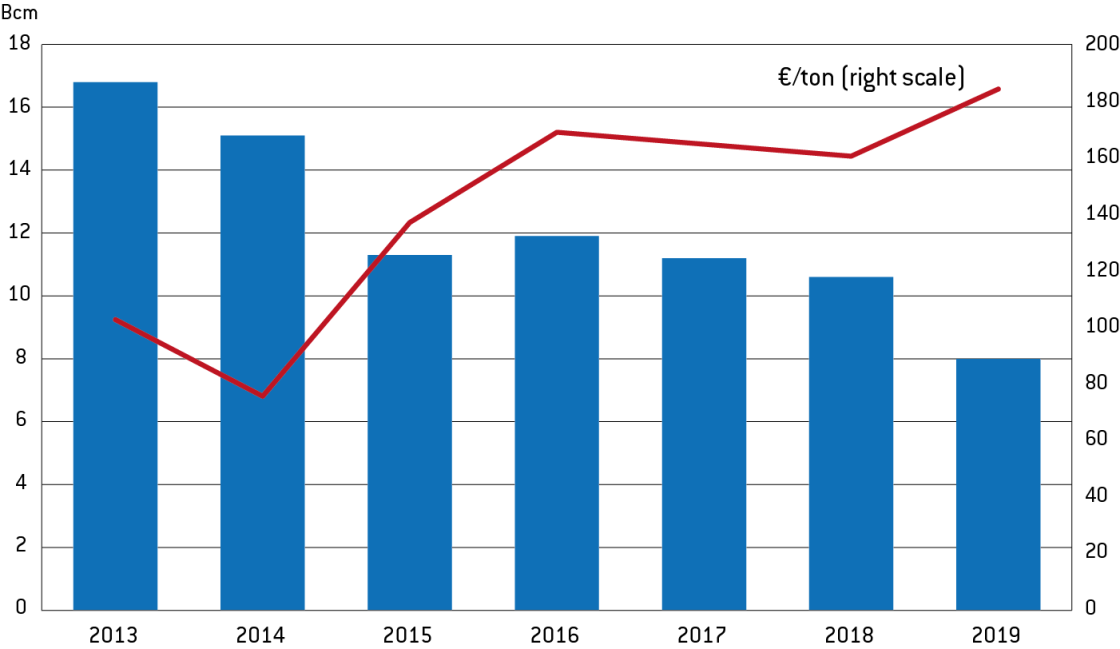

Ukraine has reformed its natural gas sector since Euromaidan. In 2014, the state-owned gas production, wholesale and transmission company Naftogas incurred a deficit equivalent to 5.5% of GDP. Thanks to increasing gas prices for consumers, managerial reforms, decreasing gas import prices and several successful court cases against Gazprom, in 2019 Naftogas contributed up to 1% of GDP to the state budget.

Regulated gas prices doubled in euro terms between 2014 and 2019, reducing inefficient gas usage and Naftogas’ losses from below-price sales. This previously unthinkable move went through relatively calmly as it was a condition for IMF assistance and was accompanied by a new housing and utilities subsidies system for poorer households, introduced in 2014. Overall, total gas demand dropped from 42 billion cubic metres in 2014 to below 30 bcm in 2019.

Figure 6: Household gas demand and natural gas prices in Ukraine, 2013-2019

Source: Bruegel based on NJSC Naftogas and National Energy Regulatory Commission.

From 2014, Ukraine began to import gas from the EU at prices below those that had been negotiated with Russia in the winter of 2008/2009 to Ukraine’s disadvantage. This bold move, which was enabled by some EU companies and governments, defused the threat of a cut in the supply of Russian gas during the escalating conflict in Eastern Ukraine and Crimea.

Another success was unbundling of the gas transit system from other Naftogas activities during the winter 2019-2020, which paved the way for a new gas transit contract with Russia. This ensures that substantial volumes (40 bcm per year) of Russian gas can transit via Ukraine until at least 2024, with a minimum total revenue of €7.2 billion[1]), and the payment of $2.9 billion owed by Gazprom to Naftogas.

Uncertain prospects

After three years of partial economic and trade recovery, Ukraine has been hit by the new economic crisis stemming from the COVID-19 pandemic. At the time of writing, it is impossible to predict the length and depth of the crisis, while many other factors of uncertainty remain: the speed of economic and institutional reforms, which could help economic recovery and increasing international competitiveness of the Ukrainian economy; and the prospects of conflict resolution with Russia. The future of economic relations between Ukraine and the EU is also uncertain. For example, completion of the Nord Stream II pipeline project will weaken Ukraine’s position in the gas transit market between Russia and the EU, and the introduction of a carbon adjustment tax by the EU would negatively affect Ukrainian metal and chemical exports to Europe.

[1] The contract contains a ship-or-pay clause which implies that Gazprom will also have to pay for unused volumes it booked.

Recommended citation

Dabrowski M., M. Dominguéz-Jiménez and G. Zachmann (2020) 'Ukraine: trade reorientation from Russia to the EU', Bruegel Blog, 13 July, available at https://bruegel.org/2020/07/ukraine-trade-reorientation-from-russia-to-…