China's targeted corporate shopping spree to continue, especially in Europe

Expect small, below the radar deals to continue to flourish and, by the same token, Europe to lose part of its edge in industrial technology and other

China’s enthusiasm for overseas acquisitions waned in 2019. The series of negative economic shocks, from the US-China trade war to the tightened regulation of shadow banking, made financing of certain economic activities much tougher, including outward foreign direct investment. The worsening of the domestic and international environments took a toll on China’s business sentiment, cooling corporates’ interest and ability to expand overseas, especially through purchases of foreign companies. As if this were not enough, in early 2020 China took another unprecedented hit from the coronavirus outbreak. Heightened US-China tensions suggest that the post-pandemic environment could become harsher for Chinese investors who are considering buying companies overseas.

Does this mean that China is retreating from mergers and acquisitions (M&A) overseas? It may look like it when observing headline M&A figures, but the devil is in the details.

After all, the economic incentives behind China’s outbound foreign direct investment still exist. Chinese corporates that suffer from structurally lower domestic growth and return on assets are pushed to seek new business opportunities abroad. The need for industrial upgrades remains obvious in some sectors such as the semiconductor industry. Furthermore, liquidity conditions have turned much laxer in 2020 thanks to the monetary stimulus in response to the pandemic. Finally, the very low valuation of companies overseas is another important pull factor.

In fact, tighter screening of foreign buyers, especially Chinese, has not deterred Chinese companies from their interest in the M&A market. A deeper look into the micro-level transactions suggests that the decline in 2019, typically measured in terms of total deal value, is mainly explained by the reduction of large-scale transactions, while smaller deals have remained in place. In other words, the number of outbound M&A transactions conducted by Chinese corporates has remained rather stable. This seems to indicate that the response of Chinese corporates to the tougher screening for their acquisitions has been to pursue smaller deals. In other words: keep acquiring foreign companies, but do it discreetly, below the radar.

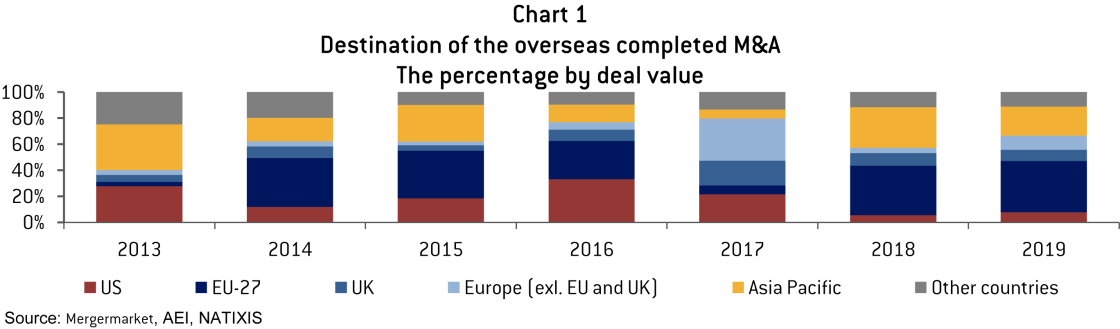

China’s target choices have also changed in response to the new global environment. Over the past few years, M&A transactions into the United States have waned, while Europe clearly gained importance, followed by Asia Pacific. To note though: while Asia Pacific received more deals than the EU, their total value was significantly smaller. Therefore, against the backdrop of declining average deal size, the EU remained the most important target for bigger acquisitions. For example, the Netherlands was China’s biggest target in 2019 because of Wingtech’s acquisition of the semiconductor company Nexperia. Russia also moved up as the second largest target for China in 2019 because of the acquisition of 20% of the Arctic LNG project in the first half of 2019.

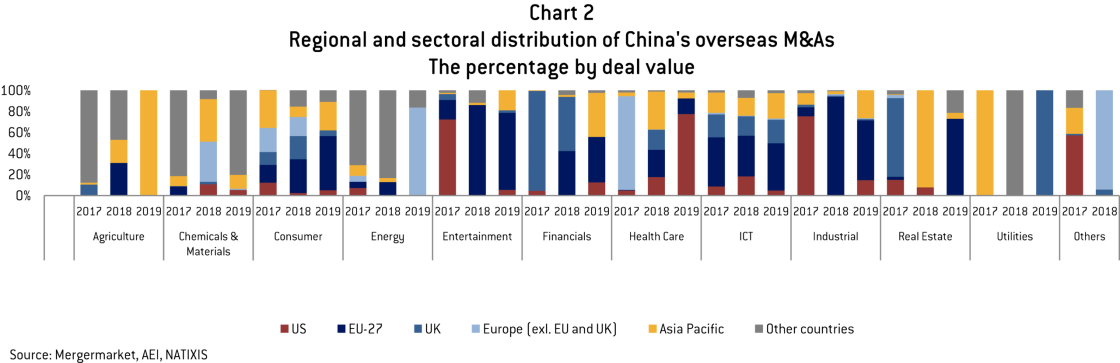

In terms of sectors, consumer, information and communication technology, and industrial sectors account for nearly 70% of the total value of China’s overseas M&A. China clearly considers the industrial field to be strategic, as confirmed by its prominent role in the China Manufacturing 2025 policy guidelines. As the EU remains an important manufacturing hub for global production chains and a high-technology supplier, EU companies are likely to be targeted for potential purchase by Chinese corporates, all the more so as the EU’s investment-screening mechanisms are clearly laxer than those of the US and advanced Asian countries such as Korea and Japan. Last but not least, while privately-owned companies have increased their participation in overseas M&A transactions, this is not the case in the EU. State-owned enterprises continue to be the main Chinese buyers of European companies.

All in all, notwithstanding the recent series of shocks and the tensions following the COVID-19 outbreak, we should not forget Chinese corporates’ enthusiasm for foreign expansion in the longer term. The business incentive still plays a key role, especially now that the liquidity environment and the valuation of the targets are likely to become more accommodative. Expect small – below the radar – deals to continue to flourish and, by the same token, also expect Europe to lose part of its edge in industrial technology and other strategic sectors.

Recommended citation

García-Herrero, A., J. Xu (2020) 'Chinese targeted corporate shopping spree to continue, especially in Europe', Bruegel Blog, 16 July, available at https://bruegel.org/2020/07/chinese-targeted-corporate-shopping-spree-t…