Why are some stock markets in Asia less affected by coronavirus?

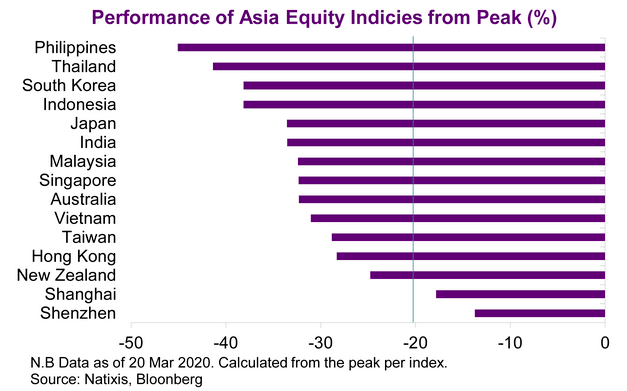

While Asian markets are in a sea of red, mainland China, New Zealand, Hong Kong and Taiwan are all defying the gravity.

Asian equities are in a sea of red. Thrashed by one fear after another, most markets have either entered the bear market or are getting close to the line. A widely spreading coronavirus pandemic, an unsolved oil dilemma and lower interest rates are intensifying fears not only for a recession but for a depression. Still, differences exist, with mainland China, New Zealand, Hong Kong and Taiwan all defying the gravity.

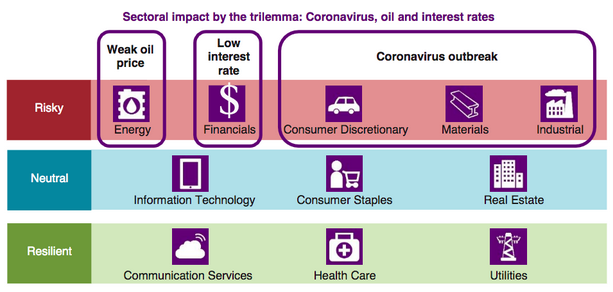

Under the current trilemma (coronavirus pandemic, weak oil and ultra low rates), the sectors facing the biggest headwinds are energy, financials, consumer discretionary, industrial and materials. Instead, consumer staple, real estate and information technology should be less affected, given the inelasticity on essential sales and the medium-term market outlook on 5G-related demand. Health care, utilities and communication services are more resilient.

Taiwan and New Zealand Less Impacted So Far

Among Asian markets, Taiwan and New Zealand are less negatively affected by the coronavirus directly due to sound and proactive policies and low exposure to oil in benchmark indices. The sectoral composition of the indices is also a factor. Although the recent turbulence has dragged performance, information technology has proven to be relatively stable in this round of market rout and constitutes 51% of market capitalization in Taiwan.

New Zealand’s index is dominated by resilient sectors, such as communication services, health care and utilities — and, to a lesser extent, consumer staples. The limited exposure to financials also imply that New Zealand is less sensitive to ultra-low rates.

The Rest of Asia Has Entered the Bear Market

Thailand is the worst off, given its exposure in oil and tourism. While Australia and Indonesia are also affected by energy, the impact is amplified through financials and materials. Singapore is impacted negatively with a large share in financials under a low-rate environment. Japan and Korea could have performed better, based on their sectoral composition and the nature of being oil importers, but the larger coronavirus transmission is threatening growth.

Although no market can hide from the global sell-off, Asian economies with higher infections tend to perform worse for reasons ranging from weaker consumption and services to disruption in manufacturing production. The uncertainties of being in a dark tunnel without a glimpse of the light have pushed markets with historically low volatility toward high fluctuations.

We classify various sectors into three types: risky, neutral and resilient. The trilemma in coronavirus, oil and interest rates is going to hurt some sectors more than others. Neutral sectors mean the condition is generally stable under large shocks, but it doesn’t mean they are without risks. Good sectors are relatively shielded from uncertainties.

High-Risk Sectors

Under the current trilemma, sectors facing the highest risks are energy, financials, consumer discretionary, industrial and material. Already hit by the coronavirus on lower demand, energy is further exposed to geopolitical dilemmas in oil prices with no clear solution in the short run. The headwind will be more challenging for financials due to lower interest rates and potentially worsening asset quality.

As for the coronavirus-related sectors, demand on consumer discretionary has shrunk not only in luxury goods and hospitality but also in the automobile industry, both in demand and supply. With tougher restrictions in passenger movement and lower demand in capital goods, industries are taking the brunt, ranging from aviation to machineries. As such, materials will suffer further with lower demand dragged by weaker global growth.

Source: Natixis.

The impact on basic goods is generally neutral, but the present globalization in larger cross-border trade and supply chain integration will mean consumer staples may not be the oasis it was in the past. Unless there is a contagion effect in the financial system, real estate should be relatively shielded, given the lower interest rate environment.

For the specific case of China, the high return has attracted capital, but risks remain on liquidity. As for information technology, the current uncertainties have brought short-term volatility but do not seem to alter the market perception on the medium-term outlook on 5G-related manufacturers and service providers, such as semiconductor, cloud services etc.

Amid the negative shocks, health care, utilities and communication services will be more resilient. Against the background of an escalating coronavirus outbreak, health care is a clear shelter from the turmoil. Although weaker production is posed to reduce demand on electricity, Asian utilities are supported by basic demand and good corporate health. Although disruption may still exist for communication services, the basic demand should remain solid.

Why Is There Variance Between Countries?

Equities in mainland China seem to be rather insulated from the world. Beyond the positive official news on the control of coronavirus spread, recent data has been disappointing, so it is hard to understand the reason for such resilience. While health care and information technology have supported Shenzhen, an explanation for Shanghai’s performance is unclear.

However, foreign investors have accelerated the sell-off, as illustrated by the Southbound Stock Connect, but the low share of foreign ownership means the shock is limited. Hong Kong has also benefited due to its stronger correlation with Chinese equities as a whole.

Challenges on containing coronavirus spread will persist in China when production resumes. The pushback of mobile shipment may also eventually revert the sentiment in information technology. Risks are clearly still on the downside, unless there is a breakthrough in coronavirus containment. Lower global rates may help on liquidity but cannot serve as a vaccine for coronavirus.

All in all, different sectoral compositions of Asian equity indices do offer some guidance as to the future evolution for investors, especially when the “risk on, risk off” behavior changes, in response to evolving uncertainties.