The cost of coronavirus in terms of interrupted global value chains

The coronavirus is slowly morphing itself into an important shock. While the extent and cost of this pandemic are unknown, we do know that global supp

The outbreak of the coronavirus in China threatens to affect the ability of European countries to produce. European production is very well integrated into global value chains, via which intermediate goods and services are traded (according to the OECD, this comprises about two thirds of world trade). Europe thus reaps the benefits of open and global trade, but also is vulnerable to developments that start outside its borders. We take a look at the extent of Europe’s exposure.

China’s exports have plunged because of the coronavirus. If China was to send no intermediate goods to Europe, what cost would that represent for each economy? We measured the direct costs if China stops sending those goods to Europe. However, trade links between Europe and China are not just direct and can also involve third countries: for example, car parts that come from China to Europe might first go through one or possibly more countries. Indirect costs would arise from the stopping of this trade.

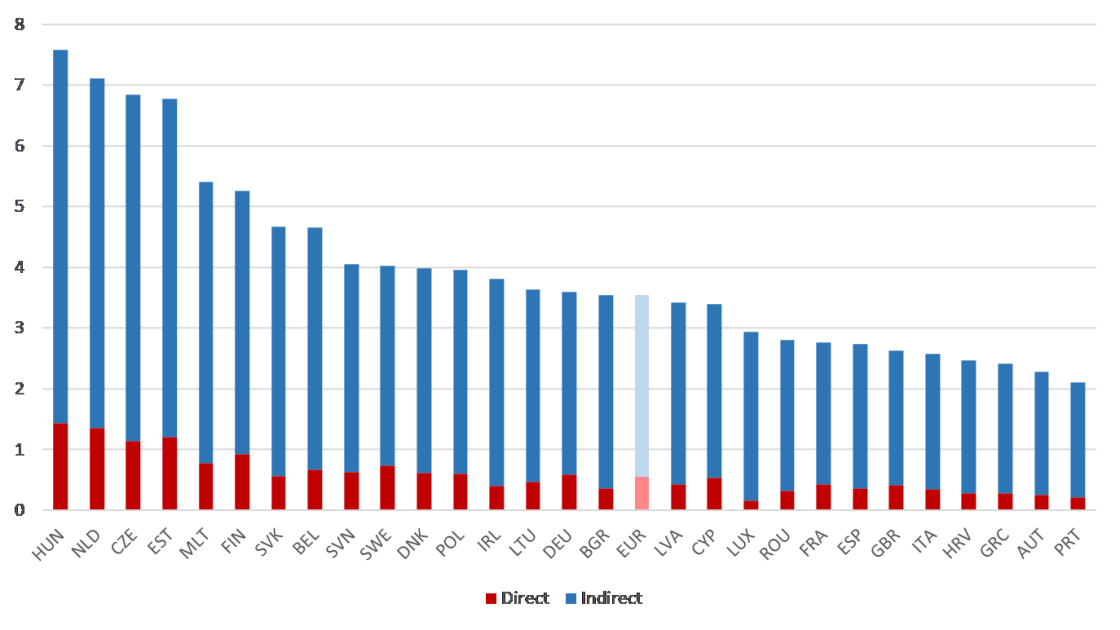

Figure 1 shows the total direct and indirect costs of interrupting global value chains between Europe and China. The indicator is of the percentage of the total revenues of the firms affected in each country. So, in Hungary for example, firms’ dependence on direct and indirect inputs from China represents around 7.5% of their total annual revenues.

This does not tell us anything about how essential the components of production are or how easily they can be sourced from elsewhere. Also, it does not necessarily reflect the true cost of such a disruption. To calculate the true cost, we would have to account for the impact of these firms inability to produce on other domestic firms.

Figure 1: Value of Chinese inputs into European production (% of gross value of output)

Notes: Bruegel based on data from 2014 World Input-Output Table from WIOD project. Gross value of production is defined as intermediate inputs + value added.

Smaller eastern and northern European countries would be most affected. The impact would be primarily indirect, reflecting the extent of their integration with German supply chains. The results for the Netherlands include the ‘Rotterdam effect’ of re-exports and therefore mask the Netherlands’ true domestic dependence. Around 3.5% of the gross output of those EU firms that are affected originates in China.

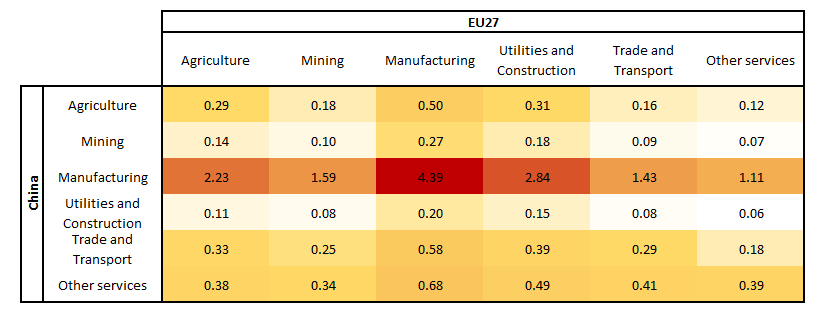

There would be major sectoral effects. Table 1 shows the share of intermediate goods in six sectors in the whole of the EU that originate from the same six sectors in China.

Table 1: Cross-sector Chinese inputs into the EU27 (% of gross value of output)

Notes: Bruegel based on data from 2014 World Input-Output Table from WIOD project. Gross value of the production is defined as intermediate inputs + value added.

The table shows there are major links even across different sectors. For example, 2.2% of EU agriculture gross output can be traced to Chinese manufacturing; 0.27% of EU manufacturing gross output originates from the Chinese mining sector. The EU27’s manufacturing sector has the highest dependence on all Chinese inputs and particularly manufacturing inputs (4.39%).

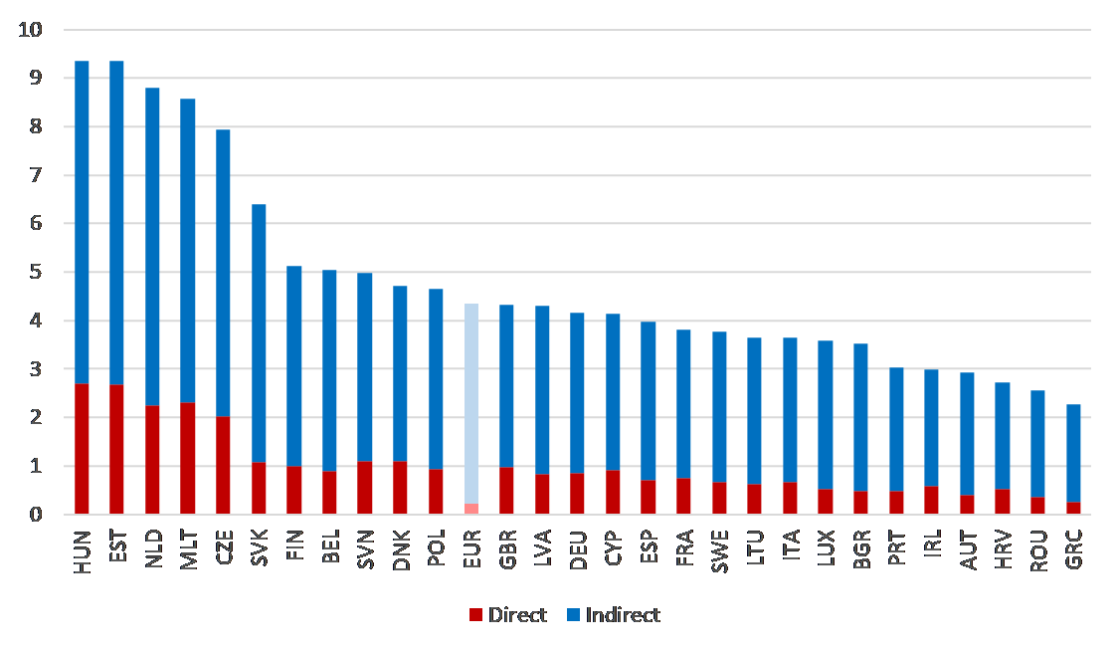

Figure 2 quantifies the dependence of European countries’ manufacturing sectors on Chinese manufacturing.

Figure 2: Chinese manufacturing inputs into European manufacturing (% of gross value of output)

Notes: Bruegel based on data from 2014 World Input-Output Table from WIOD project. Gross value of production is defined as intermediate inputs + value added.

In line with Table 1, the EU manufacturing sector is the most integrated into Chinese value chains, as the values are larger than for the whole economy (Figure 1). Of Hungary’s gross manufacturing output, more than 9% originates in Chinese manufacturing. Overall, the pattern is comparable to that for the entire economy, with small eastern and northern European countries most effected.

Τable 2 shows which sectors would be affected most per country. Computers and electronics manufacturing is the most exposed industry to China (for 20 out of the 27 EU countries). Textiles ranks second most-exposed industry in Europe, and the most exposed in Finland, Spain, France and Denmark.

Table 2: Most exposed industry to Chinese import by country

| Country | Sector | Chinese sector | Direct | Total |

| Hungary | Computers and electronics | Computers and electronics | 14.89 | 27.72 |

| Czechia | Computers and electronics | Computers and electronics | 14.71 | 26.98 |

| Estonia | Computers and electronics | Computers and electronics | 9.24 | 20.31 |

| Luxembourg | Computers and electronics | Computers and electronics | 9.10 | 16.41 |

| Netherlands | Computers and electronics | Computers and electronics | 8.24 | 15.76 |

| Poland | Computers and electronics | Computers and electronics | 7.77 | 15.60 |

| Slovakia | Computers and electronics | Computers and electronics | 5.76 | 14.11 |

| Cyprus | Air transport | Transport Equipment | 6.77 | 8.96 |

| Latvia | Computers and electronics | Computers and electronics | 3.83 | 8.33 |

| Malta | Repair of machinery | Transport Equipment | 5.71 | 7.95 |

| Finland | Textiles | Textiles | 3.60 | 7.57 |

| Ireland | Computers and electronics | Computers and electronics | 3.36 | 7.39 |

| United Kingdom | Computers and electronics | Computers and electronics | 3.58 | 7.45 |

| Spain | Textiles | Textiles | 3.22 | 6.78 |

| Lithuania | Computers and electronics | Computers and electronics | 2.91 | 6.11 |

| France | Textiles | Textiles | 2.73 | 5.70 |

| Denmark | Textiles | Textiles | 2.74 | 5.61 |

| Belgium | Computers and electronics | Computers and electronics | 2.43 | 5.33 |

| Slovenia | Computers and electronics | Computers and electronics | 1.83 | 4.99 |

| Germany | Computers and electronics | Computers and electronics | 2.17 | 4.64 |

| Italy | Computers and electronics | Computers and electronics | 2.02 | 4.52 |

| Bulgaria | Transport Equipment | Transport Equipment | 3.36 | 4.48 |

| Sweden | Computers and electronics | Computers and electronics | 1.68 | 4.32 |

| Portugal | Computers and electronics | Computers and electronics | 1.75 | 4.26 |

| Austria | Computers and electronics | Computers and electronics | 1.21 | 2.90 |

| Croatia | Computers and electronics | Computers and electronics | 1.25 | 2.87 |

| Romania | Computers and electronics | Computers and electronics | 1.15 | 2.85 |

| Greece | Computers and electronics | Computers and electronics | 0.83 | 1.99 |

Notes: Bruegel based on data from 2014 World Input-Output Table from WIOD project. Gross value of the production is defined as intermediate inputs + value added.

The car industry in Germany has much weaker links to China in terms of the value of inputs. However, although smaller in value, parts imported from China might be vital and disruption could therefore jeopardise production. Furthermore, the car industry relies on just-in-time production, with parts not stored but rather arriving on a continuous basis. If the supply stops, there would be no buffer stocks to fall back on. The methodology used here does not allow us to evaluate this degree of interdependence.