Do AI markets create competition policy concerns?

AI markets are young and their structure is yet to crystallise. Is European competition law ready for what happens next?

As the EU Executive Vice President for a Europe Fit for the Digital Age and Competition Commissioner, Margrethe Vestager holds both an industrial and a competition policy mandate. This dual mandate provides complementary, and potentially conflicting, instruments to support and restrain artificial intelligence (AI) in Europe.[1]

Should they come to accrue significant market power, tech firms may find themselves in a position to slow down the adoption of AI. And yet, Europe’s existing competition law gives Brussels the ability to protect AI-fueled growth and innovation from anticompetitive conduct.

What is machine learning?

Machine learning (ML), a subfield of AI, is a prediction technology that generates new information (‘predictions’) based on existing information (‘data’). ML is where the spectacular AI technological advances (and R&D spending)[2] are happening.[3] Think automated driving, image recognition, machine translation, and search.

ML algorithms live through two stages. During the training stage, ML algorithms use existing data (‘training data’) to learn new capabilities, e.g. to identify a bird in a picture. The cost-saving innovation is that ML can learn without relying on explicit instructions. Once trained, the learned capabilities of ML algorithms are used for inferences on data it hasn’t encountered before, e.g. recognising a bird in a new picture.

ML is economically significant because it dramatically reduces the price of a most ubiquitous task: prediction—in the same way in which the advent of computers was economically significant because it dramatically reduced the price of complex calculations (Agrawal et al., 2018).[4] The economic literature calls ML a “general-purpose technology”, i.e. a technological step-change, comparable with the advent of electricity (e.g. Brynjolfsson, et al., 2017).

The industrial organisation of ML goods and services[5]

ML products broadly fall under four categories: applications, hardware infrastructure, software infrastructure, and services.

ML applications are software products which critically rely on ML technology. Applications include, for instance, ML for the detection of money laundering in financial transaction data and ML for the detection of breast cancer in mammograms.

These applications may be offered more or less ‘off-the-shelf’, depending on the needs of the ML adopter. A 2018 McKinsey survey found that 18% of European businesses use ML applications at scale.[6] [7] On one end of the spectrum, off-the-shelf ML applications provide ready-to-use solutions, with most of the heavy-duty training work done by the application vendors. Off-the-shelf applications are well suited for non-core functions since the needs are similar across firms and industries, e.g. virtual assistant for customer support and language processing for HR functions.

At the other end of the spectrum, are applications developed in-house by the ML adopter. A 2018 McKinsey survey found that 40% of AI adopters build their AI capabilities in-house.[8] Applications closely linked to the adopter’s core business functions are most likely to be developed in-house, e.g. a bank developing its own credit-scoring ML application. An economist would say that that ML adopters are faced with the classic question of ‘make vs. buy’ (Varian, 2018)

To build in-house capacity, adopters require specific hardware and software infrastructure. ML software and hardware provide the capacity and functionality for the storing, analysing, organising and accessing of data. Recent years have seen the emergence of ML-specific hardware designed to meet ML’s increasing computation needs, e.g. specialised silicon chips designed to accelerate training and inference while reducing power consumption.[9]

Finally, ML service providers help clients implement ML solutions, such as devising data collection and model training strategies.

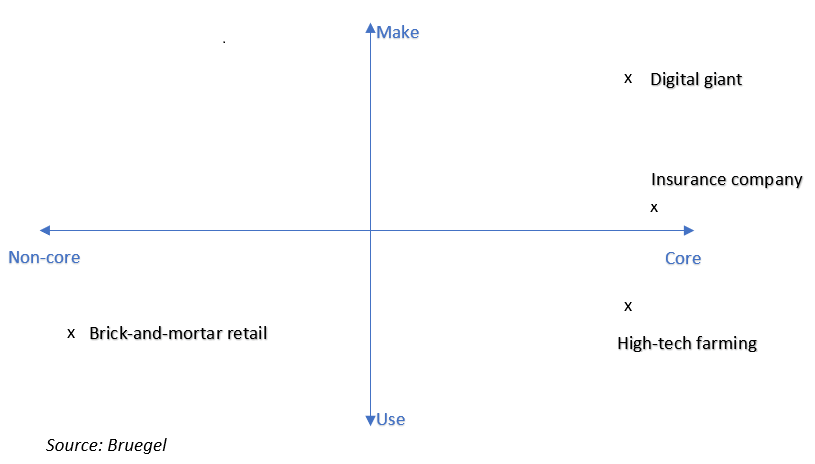

Figure 2 illustrates ML adoption along the two dimensions just discussed: make/buy and core/non-core. Digital giants tend to be in the upper-right quadrant. Google, whose core business is ML-powered, also ‘makes’ ML in all of its parts—everything from ML-specific chips to servers to ML applications. In the bottom-left quadrant are firms that buy off-the-shelf ML applications to, e.g., optimise internal HR operations.

Figure 1. Illustrative map of firms that use AI, along the make/buy and core/non-core dimensions

Current market dynamics

Cheaper prediction can benefit virtually all businesses. However, these benefits will only materialise where the supply of ML is readily available and competitive. Otherwise, ML adoption may generate economic rents for a few ML providers. Where do we stand today?

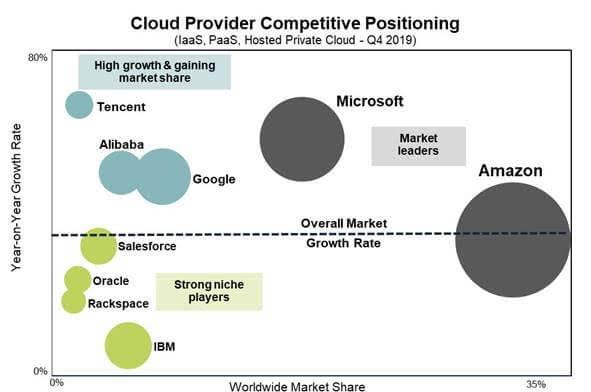

At present, about a quarter of the overall worldwide ML provision markets (i.e. hardware, software, and services combined) is in the hands of four large U.S. technology firms: IBM, Dell, HP, and Oracle.[10] Digital giants such as Microsoft, Amazon, and Google capture a smaller share of the overall pie. The market share of these last players, however, is likely to be very large in some submarkets, e.g. Google’s ML-specific chips, or Amazon’s cloud-based ML infrastructure services (see figure 1).

Market positions are far from crystallised: the market for ML provision is very fast-growing and a 2019 McKinsey survey shows a nearly 25% year-over-year increase in the use of AI (including ML) in standard business processes.[11] In the long-run, however, and as discussed in a next post, ML’s reliance on big data may affect market structure towards concentration.

Figure 2. Cloud provider competitive positioning (Q4 2019)

Source: Synergy Research Group

Many ML players are present in multiple vertically and horizontally related markets.

Today's leading ML players are present in multiple market segments that are both horizontally and vertically related to one another. If these players also enjoy market power in one or more relevant markets, then they may be able to exploit their market power in a way that hurts competition.

That is not to say that the combination of these features inevitably leads to harmful conduct. Market power has yet to be determined in the context of ML and anti-competitive conduct must be assessed on a case-by-case basis. But risks do exist and, given the importance of ML as a general-purpose technology, these risks deserve to be explored. The rest of this section discusses multi-market presence and vertical integration in greater detail.

First, some of today's leading ML players are present in multiple related markets. IBM’s ML revenues, for instance, are spread across software, hardware, and service markets.[12] Multi-market presence is not bad in itself. In fact, it is often beneficial for consumers, e.g. when it enables time-saving one-stop-shopping. If, however, a multi-market firm holds significant market power in one of the relevant markets, then it may be in a position to leverage that power to reinforce or extend its power to other markets. For example, a firm that holds significant market power in ML training may be in a position to offer its services under the condition that data storage services be bought along with it (i.e. a ‘tie-in’ sale).

Second, and relatedly, some of today's leading ML players are vertically integrated, i.e. they own critical upstream input for the production of ML goods and services, such as data or chips. Google, for instance, uses its own data to train its own algorithms running on its own chips deployed on its own cloud.[13] As in the case of multi-market presence, vertical integration often provides great consumer benefits, e.g. in the form of lower prices.[14] But it also raises competition concerns if it allows firm with significant market power in an upstream input market to restrict access to downstream rivals so as to reinforce or extend its power in the downstream market (i.e. ‘vertical restrain’). For example, a firm with exclusive access to specific training data (e.g. labelled x-rays of a tumour) necessary for the development of its own ML application (e.g. an image recognition ML for the detection of that tumour) may refuse to sell these images to a rival.

Significant market power combined with multi-market presence and/or vertical integration may generate economic rents for ML providers, to the detriment of ML adopters. It may also slow the pace of technological diffusion if potential adopters are restricted to unattractive offers. These are not welcomed outcomes for Ms Vestager’s industrial policy mandate: fast ML adoption is key to maintaining European competitiveness. But to tackle the behaviours just described, Ms Vestager can rely on her competition policy team: the behaviours neatly fall within the current competition law framework which prohibits abuse by dominant firms.

Some features of ML markets, however, are novel and will be more difficult for Ms Vestager to address with existing tools. These features stem from ML’s reliance on big data.

Recommended citation

Anderson, J. (2020), ‘Do AI markets create competition policy concerns?’, Bruegel Blog, 23 January, available at bruegel.org/2020/01/do-ai-markets-create-competition-policy-concerns/

Bibliography

Agrawal, Ajay, Joshua Gans, and Avi Goldfarb. 2018. Prediction machines: the simple economics of artificial intelligence: Harvard Business Press.

Brynjolfsson, Erik, Daniel Rock, and Chad Syverson. 2017. Artificial intelligence and the modern productivity paradox: A clash of expectations and statistics. National Bureau of Economic Research.

Varian, Hal. 2018. Artificial intelligence, economics, and industrial organization. National Bureau of Economic Research.

--

[1] See Bruegel’s “Questions to the Competition Commissioner-designate” (https://bruegel.org/2019/09/questions-to-the-competition-commissioner-designate)

[2] Machine learning represented almost 60 per cent of all AI investment from outside the industry in 2016. Source: McKinsey Global Institute, 2017. Artificial Intelligence The Next Digital Frontier? (https://www.mckinsey.com/~/media/McKinsey/Industries/Advanced%20Electronics/Our%20Insights/How%20artificial%20intelligence%20can%20deliver%20real%20value%20to%20companies/MGI-Artificial-Intelligence-Discussion-paper.ashx)

[3] ML is itself a broad field. Different types of machine learning algorithms can be distinguished based on the approach, the type of data (input and output), and the type of task or problem to be solved. This post does not explore the different types of ML, though different industry structures and competition policy issues will likely emerge in each of the different ML subfields. Varian 2018; Agrawal et al 2019; Cockburn et al 2018 focus on the ML subfield of Deep Learning.

[4] For some applications, we have yet to reach the bottom of the ML price drop: in a recent 18 months-period, the time required to train a large image classification system fell from three hours to 88 seconds. (18-months period leading up to July 2019. Training is done on cloud infrastructure. Source: Stanford’s AI Index 2019 https://hai.stanford.edu/sites/g/files/sbiybj10986/f/ai_index_2019_report.pdf)

[5] Note that the industrial organisation literature for AI is still in its infancy, and this section is very much informed by industry research (Google’s Hal Varian is leading efforts on the industrial organization front).

[6] Adoption of ‘AI tools’, a category which covers ML-enabled applications such as virtual assistants, computer vision, and voice recognition. % of 650 surveyed European firms using technology at scale. (https://www.mckinsey.com/~/media/mckinsey/featured%20insights/artificial%20intelligence/tackling%20europes%20gap%20in%20digital%20and%20ai/mgi-tackling-europes-gap-in-digital-and-ai-feb-2019-vf.ashx)

[7] Relatedly, a 2018 survey by the European Investment Bank (EIB) found that close to 30% of European firms in the service sector and over 27% in the manufacturing sector adopted big data and analytics solutions on which ML relies (EIB, 2018).

[8] Based on survey of 1,640 firms. “how organizations source capabilities and talent needed for AI work” https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Artificial%20Intelligence/AI%20adoption%20advances%20but%20foundational%20barriers%20remain/Notes-from-the-AI-frontier-AI-adoption-advances-but-foundational-barriers-remain.ashx

[9] https://medium.com/sciforce/ai-hardware-and-the-battle-for-more-computa…

[10] AI market share in terms of revenue, 2018 figures. Source: IDC, “Worldwide Artificial Intelligence Market Shares, 2018: Steady Growth — POCs Poised to Enter Full-Blown Production” (https://www.ibm.com/downloads/cas/MK85Y8V3)

[11] https://www.mckinsey.com/featured-insights/artificial-intelligence/global-ai-survey-ai-proves-its-worth-but-few-scale-impact

[12] Source: IDC, “Worldwide Artificial Intelligence Market Shares, 2018: Steady Growth — POCs Poised to Enter Full-Blown Production” (https://www.ibm.com/downloads/cas/MK85Y8V3)

[13] see https://ark-invest.com/research/googles-ai

[14] By avoiding double marginalisation.