Collective action in a fragmented world

International collective action is in search of a new paradigm. It cannot rely anymore on global binding rules supported by universal institutions. Ne

The issue

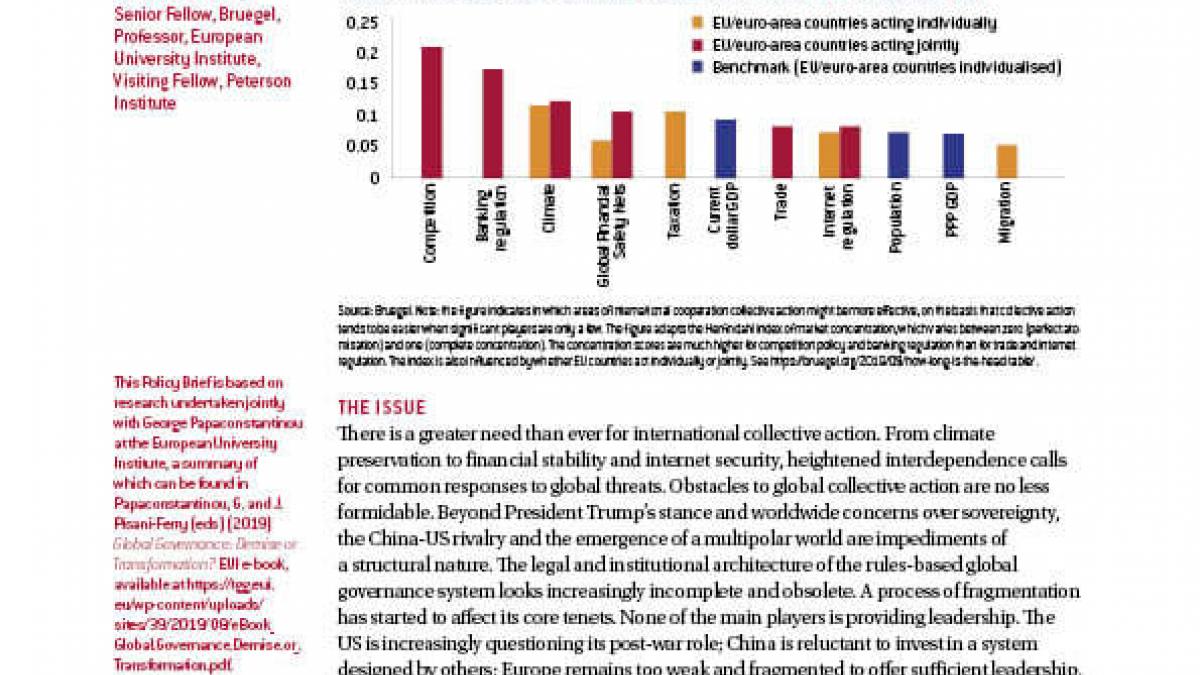

There is a greater need than ever for international collective action. From climate preservation to financial stability and internet security, heightened interdependence calls for common responses to global threats. Obstacles to global collective action are no less formidable. Beyond President Trump’s stance and worldwide concerns over sovereignty, the China-US rivalry and the emergence of a multipolar world are impediments of a structural nature. The legal and institutional architecture of the rules-based global governance system looks increasingly incomplete and obsolete. A process of fragmentation has started to affect its core tenets. None of the main players is providing leadership. The US is increasingly questioning its post-war role; China is reluctant to invest in a system designed by others; Europe remains too weak and fragmented to offer sufficient leadership.

Policy challenge

International collective action is in search of a new paradigm. It cannot rely anymore on global binding rules supported by universal institutions. New forms of cooperation have emerged in a number of fields. These are soft pledge-and-review mechanisms, cooperation between independent agencies, regional groupings, coalitions of the willing and open partnerships involving non-state participants and knowledge networks. To maximise the effectiveness of such arrangements, they should rely on a limited set of universal principles and be served by nimble and legitimate institutions. Existing international institutions should be regarded as globalisation’s social capital. There are problems that will not be solved without having recourse to strong participation and enforcement mechanisms such as sanctions or pecuniary incentives. Europe should equip itself to be an effective player in this new global game. This calls for internal governance reforms.