Takeaways from Xi Jinping’s visit to France and Italy and ideas for the EU-China summit

The author appraises China's strategy towards Europe ahead of next month's EU-China summit.

Only a few days before Chinese premier Li Keqiang’s official visit to Brussels for the EU-China summit on April 9th, President Xi Jinping has conducted his second trip to southern Europe in only five months. Such a keen interest in southern Europe is hard to understand, especially if one considers that high-level Chinese officials are busy negotiating with the US to reach a deal to halt the trade war.

Here are some takeaways on Xi’s visit:

First, it has become crystal clear that Europe (including the European Union) is increasingly important for China’s external policy. The EU-China summit, like its predecessors, will not target key strategic issues. The EU intends to demand from China the same treatment as the US in the ongoing negotiations. China, knowing the difficulties in negotiating with the EU as a whole, prefers to deal with EU member states separately, at least for the issues where national competences dominate.

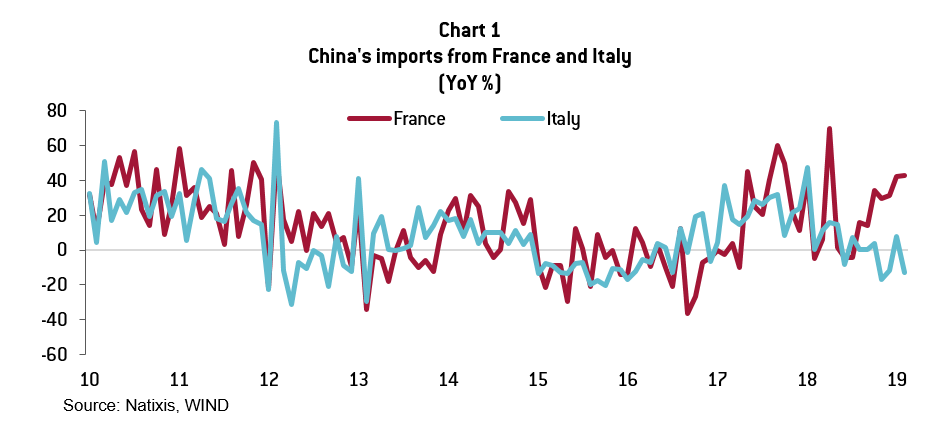

Second, China’s strategy towards EU member states is tailored to each country’s key needs. This is why it is so effective. In the case of Italy, Chinese funding for infrastructure projects is the best enticement to the Italian government to support its flagging economy. This was also the case for Portugal and Greece in the past, but the prize that China handed over to Italy is larger. As one of the EU’s founding members and one of the selected groups of the seven largest industrialised countries in the world (G7), Italy has received the largest prize. On the other hand, Chinese strategy to get France closer to China is very different as it focuses on increasing imports of French goods (Chart 1) (especially for the aircraft and aerospace industry) as well as access to the Chinese market for French financial institutions (banks and insurance in particular).

China should be conscious of the risk of perhaps inadvertently weakening Europe further

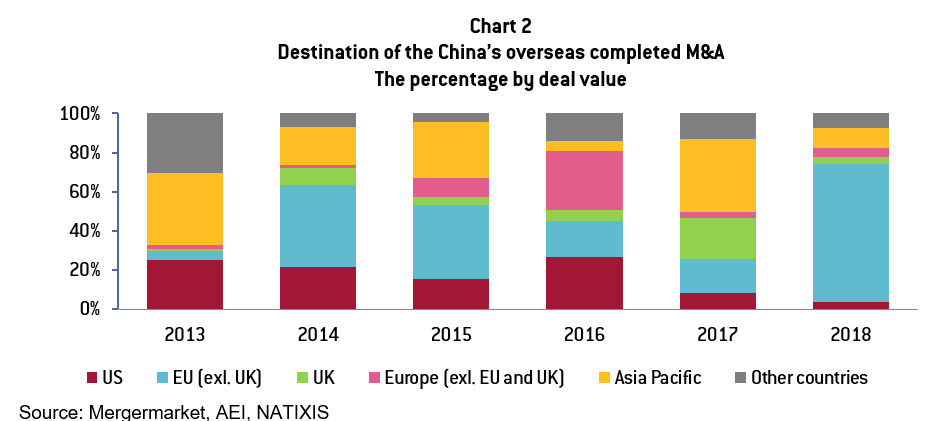

Third, China’s gifts to European countries are obviously not free lunches. China’s massive investment in Italy comes in exchange for the latter’s endorsement of China’s major soft-power machine, namely the Belt and Road Initiative. Against the backdrop of the China-US trade war, China is more interested than ever in expanding influence to the detriment of the US, which is what China is doing with Italy. For a country as important as France on the military/NATO front, China’s objective is driven more by economic factors. In fact, China’s key interest with France is rather to keep an open market for its acquisition of valuable companies (Chart 2). In other words, countries like France are more attractive for China to move up the technology ladder rather than to expand its soft-power umbrella.

All in all, China’s strategy towards the EU looks well-targeted, offering each country what it really needs while focusing less on EU institutions. However, China should be conscious of the potential risk of the strategy. It could, perhaps inadvertently, weaken Europe further. For the past 12 years, the EU has suffered from too many shocks. As China’s key export market and a major destination for acquiring assets, a united Europe is a plus for China. China’s ideal scenario would be a united Europe putting some distance from its Transatlantic Alliance with the US. This is not realistic, but it is always better to aim at a higher goal than to end up with a weakened and divided Europe.