The higher yield on Italian government securities is becoming a burden for the real economy

Francesco Papadia and Inês Gonçalves Raposo have recently written on Italian fiscal policy and the increase in the spread between Italian (BTP) and Ge

On September 10th 2018 we published a post with the title: ”The higher yield on Italian government securities could soon be a burden for the real economy”.

In that post we documented a very straightforward issue: the increase in the spread between Italian (BTP) and German (Bund) government securities, caused by the Italian government fiscal program, would, before too long, affect the private sector, making credit more expensive and scarcer, thus offsetting, in part or in full, the expansionary impulse from fiscal easing. This prediction was based on the experience during the most acute years of the crisis, in which the disorderly increase in the spread pulled up the cost of bank lending and reduced its availability.

Two developments have taken place since we wrote our post, one good and one bad.

The good development is that the Italian government, differently from our fears, seemed to understand the dangerous direction into which it had put its fiscal policy and decided to tweak it, reducing the planned deficit from 2.4 per cent to the incredibly (in the proper meaning of the word) precise figure of 2.04 per cent. The European Commission, with a somewhat generous interpretation, took this as a sufficient correction not to start an Excessive Deficit Procedure, even if it committed to “continue to monitor the situation, starting with the adoption and implementation of the agreed measures”.

This positive development is seen in figure 1: the spread is now, at 2.5 per cent, still higher than it has been in the last 5 years and nearly double what it was before the recent Italian elections, but it is some 54 basis points lower than the peak reached before the correction.

Figure 1. Spread between 10 year government bonds in Italy and Germany

Source: Bloomberg. Note: Monthly data.

The negative development is that credit conditions have started to deteriorate in Italy, as we had feared in our post. This is visible in figure 2, reporting the results of the ECB Bank lending survey.

Figure 2. ECB Bank lending survey: Net tightening of credit standards to enterprises in Italy and the Euro Area

Source: ECB Note: The chart depicts the net percentages (tightened conditions minus eased or reverse) of banks reporting tightening credit standards over the past three months for Italy and the Euro Area. Positive values represent a net tightening in credit conditions. Negative values represent a net easing in credit conditions.

We see in the figure that credit standards to enterprises are now tightening in Italy while they have mostly been easing since the end of 2014 This is in contrast with developments in the euro-area overall, as stated in the ECB Report, “Credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans to enterprises remained broadly unchanged in the fourth quarter of 2018.”

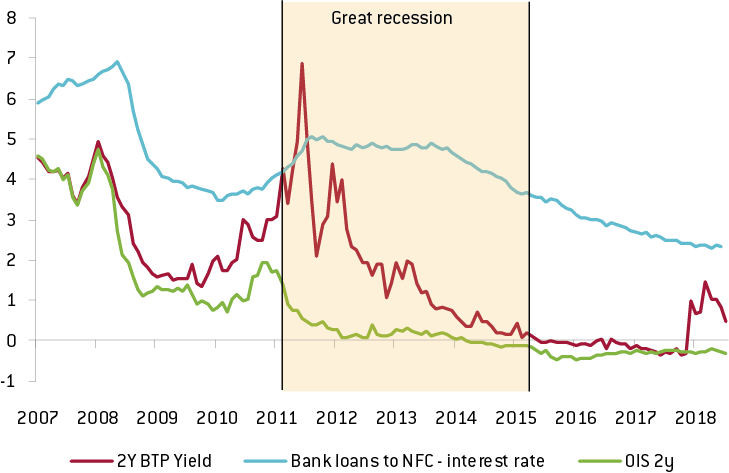

Given the lags with which the yield on government securities affects the cost of bank loans, as seen during the crisis, there is not yet an effect on the latter, as can be seen in figure 3 and, in any case, the impact should be lower, just because there has been some reduction of the spread. The fear remains that, while the ECB maintains its very accommodative policy, as shown by the still negative OIS rate, Italian firms would see credit conditions tightening over the next few months.

Figure 3. OIS rate, BTP yield and the cost of bank loans in Italy