What the 2018 EBA stress tests (don’t) tell you about Italy

The results of the latest European Banking Authority stress tests were eagerly awaited for their results on the four biggest Italian banks. At first s

November has brought with it the results of the European Banking Authority (EBA) 2018 EU-wide stress tests. This exercise, aimed at surveying the resilience of EU banks against adverse market developments, covers 70% of total banking-sector assets across 48 EU banks.

The results of the EBA stress tests were anticipated particularly for the results reported on the four biggest Italian banks: BPM, Intesa Sanpaolo, UniCredit and UBI. In this blog post, we consider how useful these numbers are and pick out specific limitations.

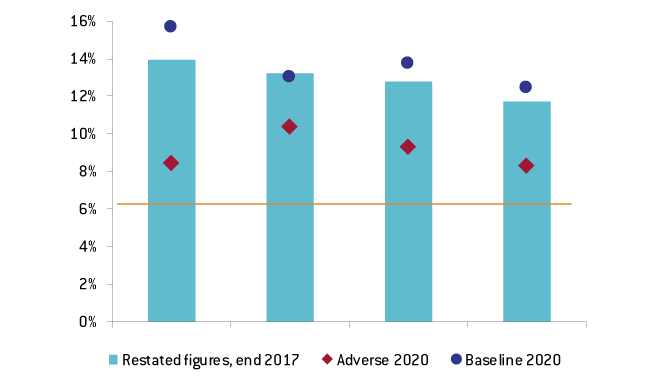

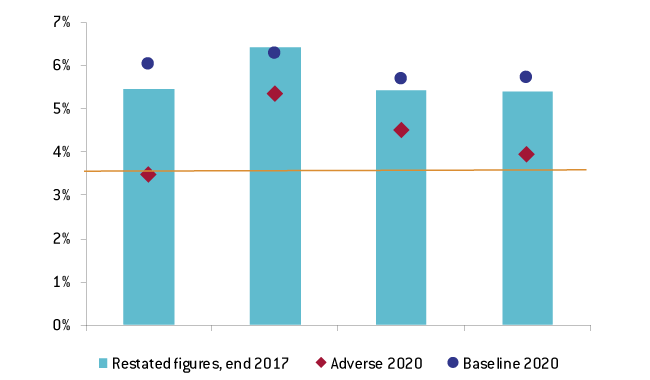

At first sight, Italian banks seem well prepared to withstand an adverse macro-financial shock. Two key variables are the Common Equity Tier-1 (CET-1) capital ratio, which reflects the capability of the banks’ capital to withstand shocks, and the leverage ratio, which is indicative of the bank’s ability to meet its financial obligations. After all, the four banks report transitional CET-1 capital ratios above the minimum requirement of 4.5%. And all banks report levels above the minimum leverage ratio of 3% outlined by the Basel-III regulatory framework.[1] For CET-1 ratios, the impact of the adverse scenario – measured as the difference between the baseline and adverse 2020 scenarios – ranges from 2.64 to 7.27 percentage points. Leverage ratios show differences between the baseline and adverse scenarios ranging from 0.94 to 2.58 percentage points (Figure 1).

Figure 1. CET-1 and Leverage Ratios results by bank

Panel A. CET-1 Ratio, transitional

Panel B. Leverage ratio, transitional

Source: Bruegel based on EBA

However, some qualifications are in order. The first is that this exercise is built on data from end-2017, so it is not fed with the latest information on banks’ balance sheets.

The second is that the uncertainty associated with the latest developments in Italian politics has been left aside from the design of the scenarios. The European Systemic Risk Board (ESRB) had identified in January four main material threats to the stability of the EU financial sector. While political uncertainty and increased volatility in financial markets was one of them, the board was focused mostly on Brexit-associated risks.

The adverse scenarios designed by the ESRB and the ECB are based on projected developments that are summarized in Table 1. Projections from the national central banks are used as baseline forecasts for EU countries. The projections cover three years, beginning with the first quarter of 2018, where shocks are assumed to materalise.

While it is only fair to point out that the adverse scenario presupposes a simultaneous contraction in all variables, which is still not the case, I and others see that the current developments put the BTP-Bund spread (i.e. the difference between the yields on Italian and German government bonds) already beyond the values forecast as the adverse scenario (310 basis points at the time of writing).

The implication is that part of this theoretical stress on the banks’ capital positions is already being experienced. And while the four evaluated banks account for 41.6% of the domestic market in loans, the effects of these developments on smaller, non-evaluated banks is not publicly known. This Monday’s developments surrounding mid-sized lender Banca Carige are not particularly encouraging.

One can ask whether these results really show any new information that the markets did not yet anticipate. Judging by the fall of share prices following their publication, it seems safe to say that investors were not too appeased by the results that came out.

So what other information can we use to derive a better understanding of the risks that the Italian political crisis poses for the euro-area banking system? Data on sovereign exposures is not made available in this exercise. Although the EBA reports that sovereign risk is reflected in credit and market risk, bank-level data will only be made public in December in the context of the 2018 EU-wide transparency exercise. We do know, however, that resident banks have increased their holdings of sovereign debt since 2017.

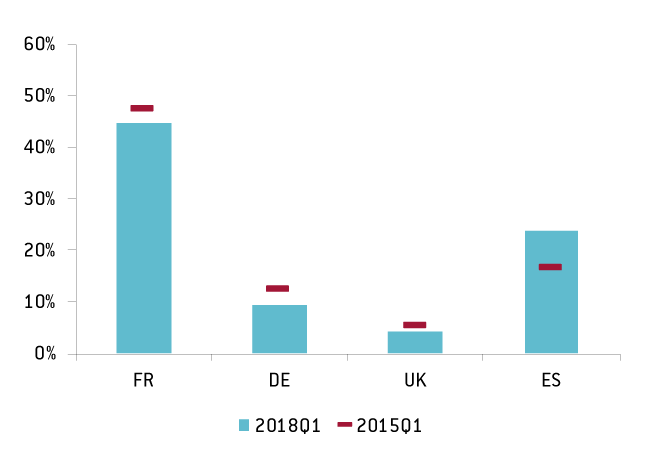

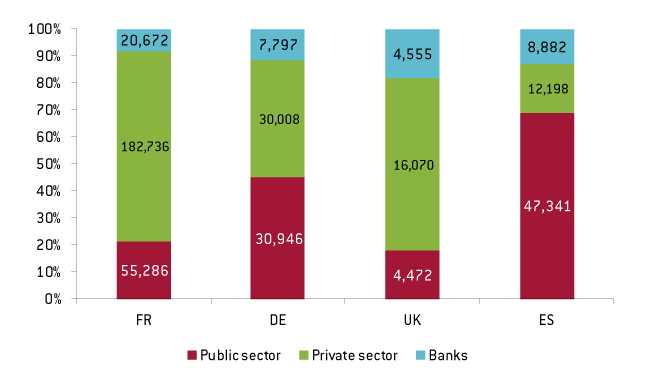

The exposure of non-resident banks to Italy as a whole is also an important indicator that has been overlooked so far. Figure 2 shows the most recent data for the first quarter of 2018 on the exposure of non-resident banks to Italy. The exposure of French banks to Italy amounts to almost half of the French GDP. In Spain, total claims on Italy amount to a third of Spanish GDP.

However, the composition of these claims differs significantly between countries. While Spain is mostly exposed to the public sector, most of the claims by French banks relate to the private sector (households and companies). While giving a more current version of the events, it is true that these numbers still do not capture the repositioning following the coalition formation in May.

Figure 2. Exposure of banks to Italy, selected countries

Panel 1. Total claims on Italy, % GDP

Panel 2. Composition of claims on Italy, 2018Q1 - % of total claims and EUR million

Source: Bruegel based on BIS Consolidated Banking Statistics

All in all, the EBA stress tests are useful to gather what could happen to banks’ balance sheets in the event of a downturn. Yet looking at indicators such as the exposure of resident banks to the Italian sovereign, or the exposure of non-resident banks to Italy, may give a better insight as to which risks are building up.

Footnotes

[1] Our analysis focuses on transitional ratios. Note that, using fully loaded ratios, BPM presents a leverage ratio of 2.71%, below the minimum Basel III requirement.