Inequality in China

After amply discussing income inequality in Europe and the US, economists are now looking at the magnitude, implications and possible remedies for thi

Sonali Jain-Chandra published a striking chart on income inequality in China on the IMF blog – which is based on a recently issued working paper. It shows that the Gini coefficient has risen by 15 points since 1990 to 50: that is a big change, even though some increase in inequality could have been expected as the level of development improved.

Differences in education are one important driver of the increase inequality. Rapid technological change and industrialisation have boosted demand, and therefore incomes, for highly skilled workers. Differences in incomes between urban and rural areas are another major factor: educational attainment is lower in rural areas, and China’s hukou system of household registration restricts migration to urban areas, where wages are higher.

While China has implemented policies to limit inequality – such as raising the minimum wage and the minimum threshold for income taxes on multiple occasions, abolishing agricultural taxes, and improving public services and social protection in the countryside – Jain-Chandra thinks that inequality is likely to rise further without additional policy changes, and argues that China could rely more on the personal income tax and less on regressive consumption taxes.

Ben Westmore at the OECD writes that income inequality as measured by the Gini coefficient has been on a declining trend since 2008, having climbed to a very high level – reflecting some regional income convergence as the central, western and north-eastern parts of the country have made progress catching up with the east, and a narrowing of the urban-rural income gap.

Across the income distribution, incomes of those in the middle have risen particularly strongly. Nevertheless, there are signs that many of the poorest are being left behind. The gap between the richest and poorest urban households in terms of disposable income has barely narrowed. In rural areas, it has even widened. The large and persistent income gap is partly the fault of China’s tax and transfer system. In particular, the redistributive influence of the personal income tax regime is stifled by a very generous personal income tax allowance and exemptions that favour high-income individuals. Rules around social security contributions are also regressive.

Speaking of taxes, Gabriel Wildau reports for the Financial Times that China is indeed planning an income-tax cut in order to boost consumption and reduce inequality. The new tax plan raises the threshold above which an individual is subject to income tax from $6,300 to $9,000 per year and expands the three lowest tax brackets – 3%, 10% and 20% – to cover millions of taxpayers who previously paid higher rates. The maximum threshold for the 20% bracket was nearly tripled from $16,000 to $45,000 per year. Almost all individual taxpayers will receive a tax cut, with those earning between $27,000 and $45,000 receiving the largest cut in percentage terms. China is also moving forward with plans to impose a property holding tax, but that process – which is more controversial – is expected to take longer.

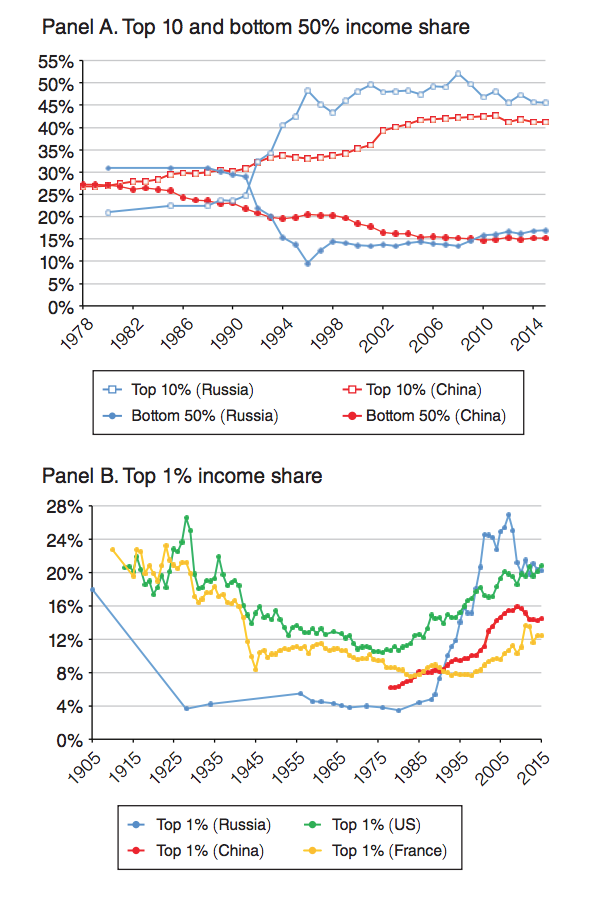

Filip Novokmet, Thomas Piketty, Li Yang and Gabriel Zucman compare recent findings on private and public wealth accumulation in China and Russia in their transition from communism to a more capitalist-oriented economic system, and discuss the impact of the different privatisation strategies followed in the two countries on income inequality.

In China, the transition has involved gradual but nevertheless wide-ranging reforms. The reforms were implemented progressively, from special economic zones in coastal cities toward inland provincial regions, and in sectoral waves. By contrast, Russia opted for a “big-bang” transition after the fall of the Soviet Union in 1990-1991, with a rapid transfer of public assets to the private sector and the hasty introduction of free-market economic principles.

Income inequality has increased markedly in both China and Russia since the beginning of their respective transitions but the rise of inequality was much more pronounced and immediate inRussia,and was more limited and gradual in China. Markedly divergent post-communist inequality patterns suggest that the rise in inequality is not inevitable and point to the importance of policies, institutions, and ideology in shaping inequality (see figure below).

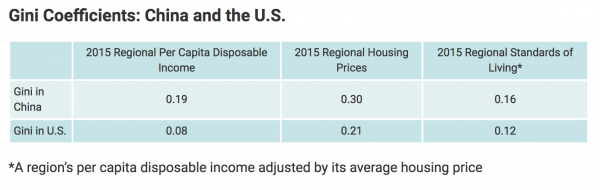

Brian Reynold and Yi Wen look at housing costs and regional income inequality in China and the US. Living standards within a country can vary greatly due to differences in regional housing costs: adjusting income by regional housing prices provides a better picture of income inequality. They create a measure of living standard, adjusting disposable income by housing prices for both China and the US. Regional inequality is substantially less severe in the US than in China when considering only disposable income, but when accounting for housing prices, the degree of inequality among China’s provinces improves. For US states, this measure of inequality worsens (see Table below).

Xiaohui Hou, Shuo Li and Qing Wang investigate the relationship between financial structure and income inequality in China and explore a channel for changes of financial structure in order to influence income inequality. Their results suggest that, relative to total bank credit, an increase in the raised capital from the stock market reduces income inequality, whereas a rise of turnover in the stock market augments income inequality. Financial structure affects income inequality by influencing the development of medium-sized enterprises. Their evidence supports the financial structure relevancy view and the three argue that to reduce income inequality, the Chinese government should help promote equity financing and decrease excessive speculation on the stock market.

ChinaPower at CSIS looks into whether women in China face greater inequality than women elsewhere – a question that is made especially interesting in light of the lingering effects of China’s One-Child Policy and the longstanding cultural “son bias”.

Rapid modernisation has enabled China to provide its citizens with improved living standards and increased economic opportunities. Yet this process has yielded uneven gains between men and women. Pronounced wage gaps and imbalanced political representation are just two of the many issues hindering gender equality in China. China’s economic growth has improved overall prosperity, but Chinese women have benefited less from these gains. Throughout the 1980s, female participation in the labour force was high, averaging around 80%. By 2017, however, female workforce participation had dropped to 68.8%. This decreasing trend runs contrary to other major developing countries, like Brazil and South Africa, which witnessed increased female participation over the same period.

In 1973 Albert O. Hirschman published ‘The Changing Tolerance for Income Inequality in the Course of Economic Development’. Init he argues that in the early stage of development, when income inequality among different classes, sectors, and regions tends to rise, society’s tolerance for this inequality will be substantial. The reason people can tolerate this inequality is that they hope and expect that this disparity will fall at one day or another. However, if this disparity does not narrow, there comes a point when people will no longer endure it. Hirschman uses the example of a two-lane tunnel to explain how people respond (the so-called “Tunnel Effect”). Wannaphong Durongkveroj revisits Hirschman’s tunnel effect in the context of China.