Italy’s capital flight: 2011, 2016, and early 2018

International investors have been repositioning vis-à-vis Italy, after the new government took office in early May. We compare this summer turmoil to

The most recent balance-of-payment data from the Bank of Italy show important outflows in the portfolio investments of foreigners in Italy, down by €33 billion in May and €42 billion in June (Table 1). The biggest outflows were recorded on government debt (€25 billion out in May and €33 billion in June), a sign that investors are concerned about the risk that could stem from the new government’s fiscal stance, to be unveiled in the upcoming budget process.

But the banking sector has been affected too. Bank debt has undergone outflows of €6.7 billion in May and €4 billion in June. Down also are foreign equity investments in Italian banks (€2.5 billion in two months) and in the rest of the Italian private sector (€2.9 billion in June). Direct investment – traditionally a more resilient flow – also dropped by €4.3 billion in June, possibly a sign that the scepticism of international investors is not limited to the short term (Table 1).

Other investment liabilities have instead increased in both months – i.e. inflows were recorded. In May, the increase is mostly explained by the central bank’s accounts, whereas June also saw a large inflow into the non-bank private sector, which is attributable to an increase in Italian banks’ recourse to centrally cleared repos.

Table 1 - Capital outflows: flows, BoP financial account, liabilities (EUR bn)

| EUR bn | May.18 | Jun.18 |

| Total Portfolio | -33.4 | -42.4 |

| of which: | ||

| Equity | 0.3 | -4.1 |

| Banks | -1.3 | -1.2 |

| Others | 1.6 | -2.9 |

| Debt | -33.7 | -38.3 |

| Banks | -6.7 | -4.0 |

| General Gov. | -24.8 | -33.0 |

| Others | -2.2 | -1.3 |

| Total Direct Investment | 2.1 | -4.3 |

| Total Other Investment | 46 | 42.8 |

| Of which: | ||

| Central Bank | 37.8 | 17.3 |

| Banks | 6.6 | -2.8 |

| General Gov. | 0 | 0 |

| Other | 2.3 | 26.3 |

| Rest (undistinguished) | -0.8 | 2 |

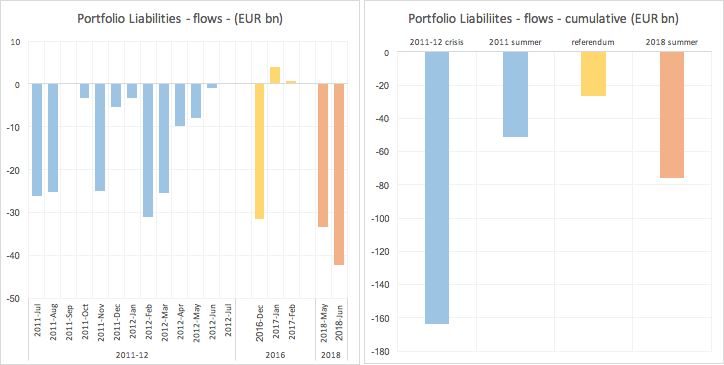

How does the current situation compare to previous episodes of stress that Italy has been through? Figure 1 shows the portfolio outflows during three episodes: the 2011-12 crisis, when Italy effectively underwent a sudden stop in international private capital flows; the period immediately following the 2016 referendum, which marked the resignation of Prime Minister Renzi; and the available month of summer 2018. The left-hand side of Figure 1 shows monthly outflows during the three episodes.

Three important findings emerge. First, the 2016 episode was really more of an instant scare: after a €31 billion portfolio outflow in December, the next two months saw positive (although small) inflows. Second, although isolated, the December 2016 outflows were larger than any monthly outflows observed between July 2011 (start of the Italian 2011 crisis) and July 2012 (Mario Draghi’s “whatever it takes” speech). Third, the outflows in May and June 2018 were both larger than the 2016 figure, and larger than any of the 2011-12 monthly outflows.

We see this reflected in the cumulative portfolio outflows (Figure 1, right-hand side). In just two months – May and June 2018 – outflows from Italian portfolio investments have exceeded the outflows recorded during the summer of 2011, and are already halfway to matching the cumulated total outflows recorded during the entire 2011-12 crisis.

It has to be noted that in 2011/12 the ECB's activated its SMP program, which is now terminated. Under the SMP, the Eurosystem bought Italian debt, and to the extent that part of the purchases were operated by foreign central banks, this also had a balance of payment impact. The flows presented here do not take out those purchases, because we do not have monthly data on those operations. Absent the foreign component of SMP operations, however, the 2011/12 flows represented in figure 1 would be larger.

Figure 1 - Portfolio outflows in three Italian crises

Source: BoP data, Central Bank of Italy

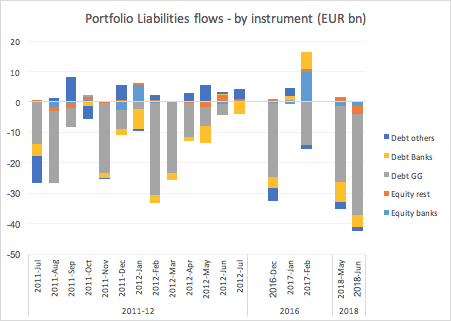

Most of the outflows – then as well as now – are accounted for by portfolio government debt, unloaded by foreigners. Bank debt is being unloaded too – now as in 2011-12. But while during the 2011-12 episode international investors at least kept investing in Italian portfolio debt issued by the non-bank private sector, this appears not to have been the case in summer 2018.

Figure 2 - Portfolio and Other Investment Liabilities flows, three crises compared

Source: BoP data, Central Bank of Italy

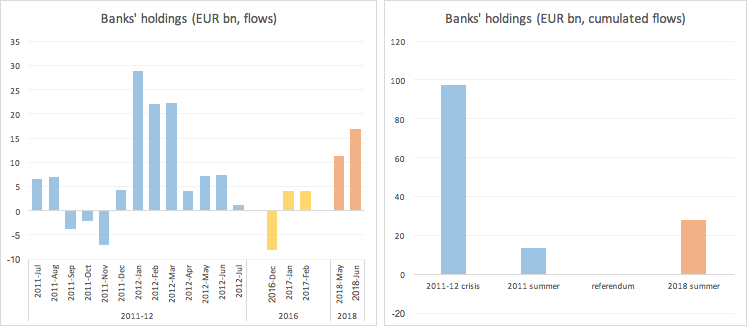

Similarly as they did in 2011-12, the domestic banks have increased their holdings of domestic government debt in response to the foreign outflows (Figure 3). In two months, Italian banks have increased their holdings of GGBs by €28 billion.

Figure 3 - Italian Banks’ holdings of Italian government debt (EUR bn)

Source: ECB

Overall, the facts presented here will look very familiar to observers of the Italian balance of payments during the euro-area crisis. Italy appears to be on the point of going through a new wave of capital flight, again concentrated on portfolio investment and especially government debt. What should ring an alarm bell, however, is the magnitude of this episode’s outflows compared to the previous 2011-12 episode.

This suggests that investors are getting less and less patient with political risk, and that there is no room for error on the side of the new government. The process to negotiate next year’s budget will be a first and very important test. But if this summer’s episode were to continue, with similarly sized flows, for a prolonged period of time, things could get very serious very quickly.