Trade war: How tensions have risen between China, the EU and the US

The multilateral trading system has been challenged by unilateralist measures and subsequent threats of retaliation. We collect the main events that h

Since the beginning of the year, the multilateral trading system has been challenged with a number of decisions and announcements on tariffs. The trade conflict between the United States and China may be escalating, while the European Union finds itself in a precarious position in responding to the US’ challenges.

So what has and what has not yet happened this year? We focus on the measures taken and announcements made by China, the EU and the US in terms of trade policy. Here is the timeline:

- January 11: US secretary of commerce reports results of an investigation into the effect of imports of steel mill articles on national security.

- January 19: US secretary of commerce reports results of an investigation into the effect of imports of aluminium on national security.

- January 22: President Trump approves recommendations to impose safeguard tariffs on imported large residential washing machines and solar cells and modules.

- February 28: President Trump’s policy agenda and annual report “for free, fair, and reciprocal trade” are released.

- March 6: the European Commission (EC) extends anti-dumping measures on Chinese steel products.

- March 7: the EC outlines EU plan to counter US trade restrictions on steel and aluminium.

- March 8: proclamation of US’ tariffs on imported steel (25%) and aluminium (10%), effective from March 23, without prejudice to (temporarily) exempted countries.

- March 16: the EC launches a public consultation on the US’ tariffs and possible EU retaliatory measures (EU list of products), considering the US tariffs as de facto safeguard measures.

- March 21: Commissioner Malmström met US Secretary of Commerce Ross, “with a view to identifying mutually acceptable outcomes as rapidly as possible”.

- March 22: following the Office of the U.S. Trade Representative (USTR) investigation on “China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation”, President Trump announces his decision to take actions on China.

- March 22: the Chinese Ministry of Commerce (MOFCOM) decides to launch anti-dumping measures for imports of photographic paper from the EU, US, and Japan, from March 23 and for 5 years.

- March 23: USTR launches a WTO challenge to address China’s technology licensing requirements.

- March 23: MOFCOM issues a list of discontinuation concessions against the US’ steel and aluminium tariffs, involving approximately US$3 bln worth of trade, and solicited public comments on tariffs to be imposed on certain products imported from the US.

- March 26: the EC launches a safeguard investigation on imports of steel products to prevent trade diversion into the EU, in response to the US’ steel and aluminium tariffs.

- March 27: MOFCOM launches an anti-dumping investigation against phenol products imported from the US, the EU, the Republic of Korea, Japan, and Thailand.

- April 3: USTR publishes a proposed list of products imported from China that could be subject to 25% tariffs. A public hearing will be held on May 15.

- April 5: MOFCOM publishes a list of US’ products potentially affected by 25% import tariffs of its own, in response to recent US’ announcements. On the same date, it files a request for consultation at the WTO, claiming that US’ steel and aluminium tariffs are actually safeguards.

- April 17: MOFCOM decides to launch provisional anti-dumping measures for grain sorghum originating in the US, starting from April 19.

- April 20: MOFCOM launches provisional anti-dumping measures against the imported halogenated butyl rubber originating in the US, the EU, and Singapore;

- April 24-27: President Macron (April 24) and President Merkel (April 27) meet President Trump, holding talks that included trade relations.

- April 27: USTR releases 2018 Special 301 report on intellectual property rights, identifying 36 countries on the Priority Watch List or Watch List (Greece and Romania are the only EU Member States included, in the Watch List; China is in the Priority Watch List).

- May 1: extension until 1 June of the EU’s exemption from US tariffs on steel and aluminium imports.

- May 3-4: US’ trade delegation meets Chinese officials on the US-China economic relationship, providing a “draft framework” in advance. A second round of trade talks is scheduled to start on May 15th.

- May 8: President Trump and President Xi discuss bilateral trade over phone call.

The result of those is the looming prospect of continuous trade restrictions and retaliation measures involving a variety of products. Apart from steel and aluminium, the US targeted over 1,300 imported Chinese products worth around $50 billion, possibly aiming at China’s high-tech and industrial sectors.

China announced discontinuation tariff concessions for 128 products and a longer list of its own (also worth approx. $50 billion), focusing more on lower-end products, while the EU has a two-part list of products imported from the US that it could target if the US moves forward with steel and aluminium tariffs (worth approx. $7.5 billion, of which $3.2 billion from Part A, and $4.3 billion from Part B), targeting very “American” goods from specific regions.

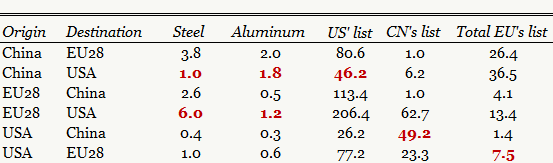

Here is a table on which trade flows are mainly affected. The affected numbers are in red.

Table 1: Trade value of main products possibly affected by announced/implemented tariff schemes (billion USD)

Source: USITC, Eurostat, Comtrade.

Note: Product categories selected up to the 8-digit code where possible, otherwise the 6-digit aggregate is used. Product lists retrieved from the Office of the U.S. Trade Representative (USTR), China's Ministry of Commerce (MOFCOM), and DG Trade. Data for 2017, except for US exports to China of products affected by China's proposed retaliation list (2016 data).

The four charts below depict the network of international trade flows between China, the EU, and the US for different categories of goods (steel and aluminium targeted by US tariffs, the US list of products, China’s long list of products, and the EU’s total list of products). The thickness of the bilateral linkages is proportional to trade value, and highlighted are those (potentially) affected by the announced/implemented tariff schemes.

Figure 1: Network of bilateral trade flows – China’s list

Figure 2: Network of bilateral trade flows – Steel and aluminium

Figure 3: Network of bilateral trade flows – US’ list

Figure 4: Network of bilateral trade flows – EU’s list

The charts show how much is being exported of each of the goods that would be affected by tariffs. Imagine for a moment that a good is perfectly substitutable.

For example, the goods exported from China to the US that would be affected by the US list amount to $46 billion. China exports $81 billion-worth of the same kind of goods to the EU. Chinese producers could compensate for a 10% reduction in Chinese exports to the US, due to the tariff, if they were able to increase their exports to the EU by only some 5%. In turn, the EU could compensate for the newly arriving supply from China by increasing its exports to the US by only 2%.

In the event of a full-fledged China-US trade war, trade diversion constitutes a risk to the EU, as the redirection of flows towards the EU may cause an impairment of the position of local industries. Furthermore, greater protectionism may also induce higher production costs and a slowdown of Global Value Chain participation (through the channel of intermediate goods), possibly affecting technology diffusion and productivity growth. However, such a crisis might also bring opportunities for EU industries if there is production and innovation capacity to cover the void left by tariff schemes. Thus, one of the key questions is to what extent the goods affected by bilateral tariffs are substitutable and can somehow be shifted around to other destinations.

In practice, the raising of bilateral tariffs will likely create substantial distortions for the global economy that would also affect the EU, bringing some opportunities but also creating costs for industries. However, a deal between the US and the EU could also have negative consequences for the EU as new trade could be created and the EU would potentially lose access, at least in relative terms. It is time for the EU to reflect on its options in global trade, and to reduce the vulnerability of its industries to the global challenge that Trump and China pose.