Why a good Brexit outcome matters (and it’s not just the economy, stupid!)

Uncertainty still reigns over the future shape of the EU-UK relationship, as Brexit negotiations rumble on. Though the two parties are parting ways,

At the current stage of Brexit negotiations, the two sides seem to have reached an impasse – a natural consequence of the strategic game the two parties are following. In fact, the process itself is beginning to look like a “prisoners’ dilemma”, where both parties have an incentive to be uncooperative, risking an outcome that would be unfavourable for all.

Like in a prisoners’ dilemma, there is a better outcome for both parties if they recognise their mutual interdependence, evaluate honestly the cost of the options in front of them and, more importantly, take a longer-run view that goes beyond economic partnerships.

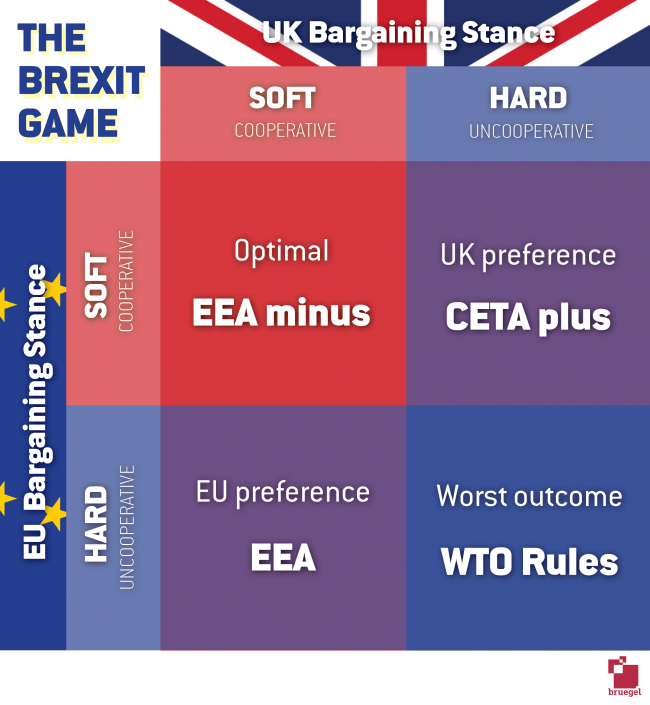

As argued in a previous article in December, there are two alternative starting points for Europe’s negotiations with the UK. Firstly, CETA-plus: starting from the template offered by the trade agreement the EU has with Canada, the Comprehensive Economic and Trade Agreement (CETA), but then aiming to add an extra clause to allow for a deal on financial services. Or, secondly, EEA-minus: starting from the template offered by the trade deal the EU has with Norway and others, the Agreement on the European Economic Area (EEA), but then moving backwards to constrain freedom of labour movement.

The UK government would prefer a deal based on what the EU currently has with Canada (CETA), with some additional agreement on services to protect its big financial sector – hence CETA-plus. This is seen as the least costly solution, economically speaking, while allowing the UK to “take back control” in terms of national polices and negotiating international trade agreements.

The EU would instead prefer an “EEA”-type of agreement as it would be very close to the current arrangement, at least in economic terms. This would therefore be the least disruptive solution to Brexit. But to achieve it, the EU needs to maintain a hard stance in the negotiations; the UK does not wish to pursue an option that would subject it to the same obligations as any EU member, but without any internal influence.

The two parties’ prospective choices of negotiating stance – described simply as cooperative-soft, or antagonistic-hard – generate four broad end-points to this process, shown in Figure 1.

If both parties maintain a hard approach, then the natural outcome is no trade deal and the two would have to resort to WTO rules when trading with each other. Both sides acknowledge that this is the outcome to avoid, as it is expected to cause big economic disruptions. Nevertheless, both sides use the possibility of “no-deal” as a strategic threat, as they both believe it is the “other” that has more to lose from this outcome. Only one – not both – can be right, but the inability to quantify exactly what either side stands to lose has encouraged a game of bluffs.

The British debate is driven by those that consider ‘no-deal’ a reassertion of national sovereignty and see the current account deficit of the UK against Europe as a sign that Europe has more to lose in a no-deal scenario. Foreign secretary Boris Johnson’s now infamous “prosecco” remark is just a colourful version of an argument which underpins the UK strategic position. This mercantilist idea of the gains from trade is very far from the real gains of being in the world’s largest free trade area.It also runs the risk of leading the UK into a strategic cul-de-sac, where the worst possible outcome is the only narrative that is politically acceptable.

The Europeans in turn, believe that the UK government and the British public will have to reconsider their decision to leave the EU once the full extent of the cost of no-deal becomes evident. As argued by Donald Tusk, paraphrasing Hanna Arndt: “A full understanding of all the consequences of the political process is the only way to reverse the irreversible flow of history." The problem with this position is that the full extent of the cost of Brexit will not be revealed before it is too late to reverse the process, locking both parties into the worst possible outcome.

As both parties need to adopt an uncooperative stance to achieve their preferred option, the no- agreement outcome remains a distinct possibility.

The perverse logic of an uncooperative stance

Both parties’ hard stance is a function of overestimating what they actually gain by achieving their respective “preferred” outcomes. This is because their preferences have not, in our view, given sufficient consideration to the long-term economic and political effects.

The British political class is by now trapped in a narrative which requires confrontation with the EU in order to find legitimacy for undertaking Brexit. And with this confrontation, losses incurred in the country after leaving the EU can then be attributed to continental intransigence. This appears as a self-serving approach with little consideration for what the country actually gains.

But the European leadership also finds itself in a similar trap of short-term thinking. The Brexit vote has shown that the EU is neither inevitable nor is it irreversible. In this line of thinking, the EU aims to protect the integrity of the European project, if not its very existence, by punishing those who press the narrative that was at the heart of Brexit.

With a CETA-plus arrangement the UK overestimates the economic gains that it will manage to derive from its ability to craft trade deals with third countries. A much smaller player, the UK is unlikely to achieve as good terms in deals with third countries by comparison to what it had enjoyed as an EU member so far. By failing to appreciate the EU as an important global player, the UK is willingly relinquishing a crucial advantage.

Similarly, though, the EU is overestimating the gains from a “victory” in the Brexit negotiations. An EEA-type of agreement may produce an equivalent to the status quo economic outcomes, but will leave the UK “defeated”. And a UK “defeat” will feed into, if not vindicate, the narrative that brought the country to Brexit in the first place. Such a “victory” risks alienating the UK even beyond what is implied by withdrawal from the EU, the ramifications of which are not necessarily easy to evaluate.

Moreover, an EU approach towards the UK that does not strive to achieve good relationships, or – worse – is punitive and vindictive, will send the wrong signal to all Member States in terms of how the EU values its alliances. Historical ties between the UK and continental European countries, individually and collectively, cannot be erased with EU withdrawal. Alliances between sovereign states transcend institutions and need to be nurtured. We have created the EU because we are allies; we are not allies because we have created the EU, even if that helps us strengthen our links. By wishing to stop the UK from cherry-picking, the EU may be encouraging others to do so by eroding trust in established alliances.

A case for a cooperative stance

What would an EU cooperative stance look like and why is it a better option? First, the EU must recognize that it is in its own interest to have a successful third-country relationship with the UK. By definition this relation is not going to be as good as currently, otherwise EU membership would be of no added value to Member States. The fear that a successful UK outside the EU will encourage other countries to follow suit is a vote of no confidence in what the EU has to offer. It is important, then, to appreciate that the UK needs to have a way of justifying leaving the club but without jeopardising a good and workable overall relationship with the EU. The EU may be losing a Member State but it should not lose an ally.

Equally, the UK should start to recognise that the four freedoms are not the main source of the malaise afflicting British society. Arguably the UK has benefited the most from them, by attracting the largest number of skilled workers from the continent and by being the financial and educational hub of Europe. Even if currently unable to see what a step backwards Brexit actually is, the UK needs at least to acknowledge the EU as its most important ally. A global power, even with just 27, the EU can always promote and protect its own interests as well as those of its close allies. In a world that is evolving into a system of three powers - the US, the EU and China - it is difficult to see how Britain can exert power that will work better to its advantage than what it enjoyed as a full member.

These arguments call for a much more cooperative approach from both sides. The EU needs to come to terms with the fact that the UK needs to gain politically from the autonomy that EU membership necessarily limits. The UK, for its part, needs to try to remain as a close ally to the EU, and not only in economic terms, in order to benefit from its association with a big world player. Regaining autonomy as a result of EU withdrawal necessarily implies reducing Britain’s ability to be an effective global player.