Accounting for true worth: the economics of IFRS9

The introduction in 2018 of forward-looking provisioning for credit losses in EU banks delivers on a key objective in the post-crisis regulatory agend

As one of the final items in the post-crisis regulatory agenda, IFRS9 will come into effect for financial institutions across the EU in 2018. The new accounting framework delivers on the ambition of G20 governments in 2009 to dampen pro-cyclical lending as banks put in place more substantial provisions against credit losses, and do so earlier in the credit cycle.

The regime to date has been one of ‘incurred credit losses’. Only once a bank had observed an actual credit event, such as a loan default, would it need to set aside reserves for the ultimate loss. Banks tended to smooth income through provisions, re-enforcing cyclical swings.

Provisions ahead of the financial crisis were clearly “too little too late”. Even as risks built up, capital requirements were largely unaffected. The Bank of Spain was one of very few supervisors to implement countercyclical general provisions, though these ultimately proved inadequate. Once the crisis set in, provisioning models forced a sharp adjustment.

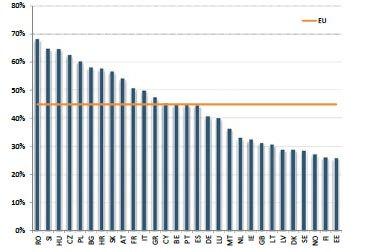

IFRS9 now represents a fundamental regime change, as banks will need to anticipate losses. Where a loan is already classed as defaulted, the losses expected over the entire remaining lifetime will need to be set aside. This should help converge provisioning levels which are still widely different across Europe, reflecting often protracted procedures in enforcement and foreclosure.

Provisioning coverage of NPLs in Europe

Source: EBA Risk Dashboard, Q2 2017.

But there is an important stock of loans in Europe’s banks that are questionable but not yet covered in the NPL data. These would be classed as under-performing, but have periodic payment delays of less than 3 months. There would be some probability of default, and a deeper analysis may even reveal an enterprise as not viable. Under the new regime losses over the coming year will need to be provisioned for all loans, and once there is a payment delay of more than a month, losses expected over the entire remaining lifetime of the loan need to be booked. This will force early recognition of credit losses, and likely give stronger incentives for financial restructuring of debt-distressed borrowers.

European banks seem on the whole ill-prepared for this change. Impact assessments that were based on survey responses, such as the EBA’s in July, find a sizable need for additional provisions which may need to increase by 20 to 30 per cent. Capital coverage could fall by about half a percentage point. Smaller banks especially in the high NPL countries are likely to be more severely affected. The calculation of capital requirements based on internal models, which the EU has vigorously defended, will give more flexibility but it is not normally employed by smaller institutions with a less complex asset structure.

Even though this change has been expected ever since the finalisation of the standards in 2014, the Commission nevertheless now fears a sudden impact on bank capital ratios. Part of its so-called banking reform package of late 2016 have just been agreed and put in place a lengthy transition period. This seems to have been informed by a report by the ESRB and additional analysis earlier this year. This demonstrated that the potential concentration of capital losses at the point when the economic outlook deteriorates may in fact amplify, rather than reduce, variability in capital and hence lending over the cycle. It will be some time before discipline in credit loss recognition will be reflected in capital requirements.

New ECB standards

The implementation of the IFRS should not be confused with the recent initiative by the ECB to further tighten its guidelines on banks’ management of non-performing loans. Under this proposal NPLs newly emerging from 2018 would need to be provisioned for the unsecured component within two years, and fully provisioned after seven years. This would be under the ECB’s powers as euro area supervisor, and the Council’s action plan on NPLs asked the Commission to implement a similar change within the capital regulation.

This change would clearly further raise provisioning needs beyond those already under way through the IFRS. It would only apply to new NPLs for which the inflow is already much reduced, and it would be limited to the largest euro area banks that are under direct ECB supervision. Several countries expressed concerns over the implications for loan pricing. The change would affect those loans that iterate between non-performing status, forbearance and restructuring, and it would likely ultimately also be reflected in the supervision of smaller banks.

The new accounting rule changes will bring loan loss provisions forward. Once this is fully reflected in capital requirements, the resulting dampening of the loan cycle is to be welcomed. Yet, an individual bank’s capital position will depend on the model used to estimate future credit losses and collateral recovery, and provisions will be sensitive to the macroeconomic scenario that was assumed. It will be hard to compare banks’ models but we should expect a downturn in the economic outlook to lead to a contraction in lending much sooner than used to be the case.

Both IFRS9 and the proposed changes in ECB guidelines would bring banks’ net book values of loans more into line with the valuation of investors who may acquire such assets. Romania in 2013-15 demonstrated how more forceful provisioning requirements can kickstart a process of asset separation and develop an NPL market. This is clearly the ambition in the Council’s action plan and may well be the result of the more intrusive supervision of high NPL banks by the ECB.