Phillips vs. Pass-through, or the changing ECB understanding of inflation

This blog post looks at how the approach of the ECB to inflation has changed over the years. It shows the ECB has moved, over the years, from a small

Two basic approaches to inflation

There are basically two schematic approaches to assess and forecast inflation developments: the “small country” and the “large country” approach. Pushing them to the extreme, we get, on one hand, to the “atomistic open economy” model and, on the other hand, to the “closed economy” model.

In the small country approach, basically all prices, and hence inflation, are determined in the global economy and the exchange rate of the small country, translating global prices into domestic ones and inflation, is the only differentiating factor between domestic and global variables. The “pass-through” from the exchange rate to domestic prices is high, tendentially unitary, and stable.

In the large country approach, instead, the basic determinants of inflation are to be found in the domestic labour market, according to some version of the Phillips curve: the tighter are the conditions in the labour market the higher are wages and inflation.

Of course, in reality the two approaches are complementary rather than rival. Still their relative weight is very different depending on the size and the openness of the country: if you want to interpret inflation developments in a tiny, very open economy like, say, Luxembourg pre-euro, the exchange rate will be the dominant variable; to understand inflationary phenomena in the United States, instead, you are likely to start with the labour market.

The interpretative approach of the ECB

An interesting development, somewhat akin to an experiment, took place in 1999, when the euro was adopted, increasing at the strike of a pen the size of the 11 participating economies, which were, from a monetary point of view, melted into a larger, less open economy.

This post aim at documenting whether, when and in what way the ECB has incorporated into its interpretative model of inflation the increased size and lower openness of the countries which adopted the euro, which, as is well known, grew from 11 in 1999 to 19 now. The authors of this post think that the change of approach by the ECB is justified, but this is not the point of this post, which merely aims at documenting it, without passing a judgment.

The question of a possible change of approach is particularly important in current circumstances for two reasons:

- The ECB is struggling with too low inflation and the way it interprets the inflationary phenomenon is critically important to understand what its policy will be,

- The exchange rate and the unemployment rate send opposing signals, with the former appreciating and the latter showing improving labour market conditions.

The latter statement is illustrated below. The nominal and real effective exchange rates of the euro are reported in Figure 1.

Figure 1. The nominal and real (CPI deflated) euro effective exchange rate, index number Q1-1999 = 100 (1999-2017).

Source: Statistical Data Warehouse doi: http://sdw.ecb.europa.eu/quickview.do?ERIES_KEY=120.EXR.Q.E7.EUR.EN00.A and http://sdw.ecb.europa.eu/quickview.do?SERIES_KEY=120.EXR.Q.E7.EUR.ERC0.A

Accessed on 20 Oct. 17. The real effective exchange rate is CPI deflated. The nominal and the real effective exchange rate of the euro are calculated against a group of 38 trading partners.

One can see that, notwithstanding the appreciation in the last two years, the real euro exchange rate is, historically, on the low rather than on the high side, given the low rate of inflation in the euro-area. The nominal exchange rate instead is historically quite high, but far from the peak in 2008-2009. Overall, the message is one of appreciation over the last two years, but not an extreme one.

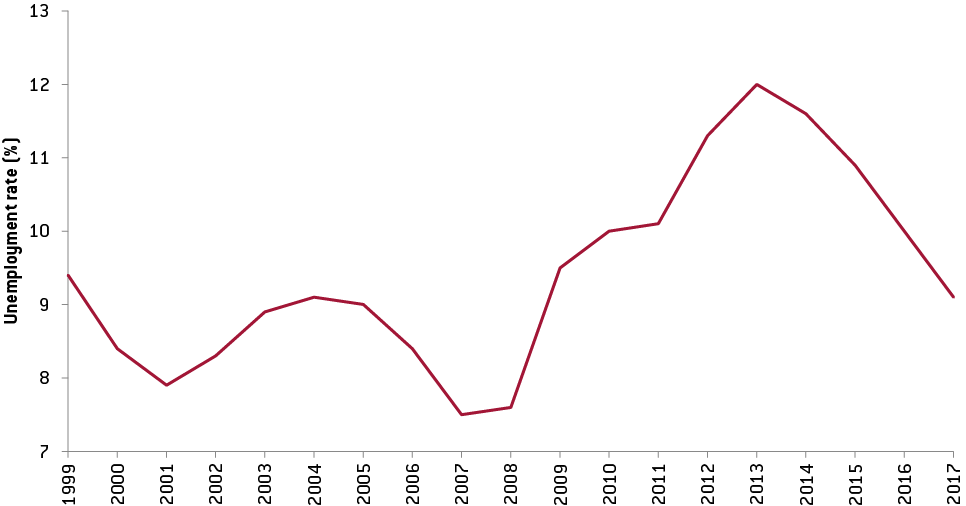

Figure 2. The total unemployment rate, as percentage of active population (1999-2017).

Source: Eurostat, doi http://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do (Accessed on 20 Oct. 17).

The unemployment rate has significantly come down since the peak in 2013, even if remains well above the through achieved just before the Great Recession. The reduction in unemployment in the last few years should exert an upward pressure on inflation, even if not much of it has been seen so far.

Overall, the balancing of the opposing effects on inflation of the recent moves of the exchange and the unemployment rate is uncertain. In addition it is unclear whether these changes will persist over time. It is thus critical to understand how the ECB considers these two variables in assessing inflationary prospects.

A semantic analysis of the speeches of the ECB President and Vice President

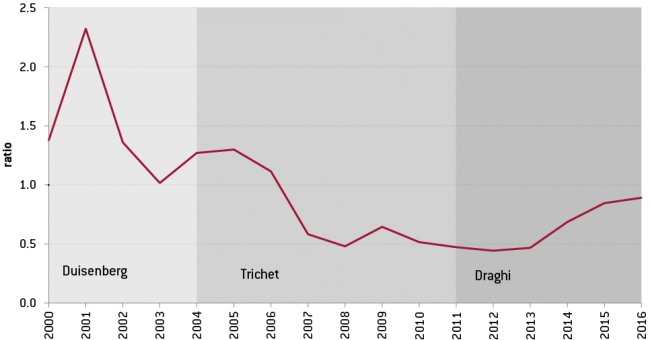

To get a handle on this issue we proceeded to a semantic analysis of the speeches of the President and the Vice President of the ECB. In particular we have counted, year after year, the frequency of the terms that are consistent with the “large” and the “small’ country approaches respectively[1]. Figure 3 shows the results.

Figure 3. Ratio of frequency of terms consistent with the small and the large country approach. ECB 1999-2016.

Source: Authors’ elaboration. Moving average (over 2 periods).

To give a clear sense of the relative frequency of the terms consistent with the two approaches, figure 3 gives the ratio of the two frequencies: when the ratio is higher than one more terms consistent with the small country approach are to be found in the speeches of the President and the vice President, when the ratio is lower than one, the opposite prevails.

One clearly sees that, up until 2006 the terms consistent with the small country approach were more frequently used than those consistent with the large country approach. Since 2007 the opposite result prevails. Still, while remaining lower than one, starting from 2013 the ratio started to increase, implying a more intensive use of small country terms approach. The main variables leading this upward movement are the “exchange rate” and “oil (food) price”. This likely reflects the falling price of oil observed in the last 4 years and the emphasis on the exchange rate as a channel of transmission of Quantitative Easing.

Based on the evidence in Figure 3, one should conclude that, about a decade after the adoption of the euro, the ECB moved from the paradigm of a small open economy towards that of a large economy. This change of perspective would have happened during Trichet’s tenure. Thus, since more than 10 years, the ECB clearly gives less weight than previously to the exchange rate and other variables consistent with the small country approach in assessing inflation prospects.[2]

Do changes in underlying variables influence the frequency with which small or large country terms are used?

One issue in drawing conclusions from the results reported in Figure 3 is that the frequency with which a term appears in the speeches of the President and the Vice President could depend on whether variables consistent with one or the other approach deviate from some historical norm. In simpler terms, are they going to mention the exchange rate or unemployment rate more often when they are further away from some historical norm?

To check on this, the frequency of terms relating to the two approaches was regressed on deviations from the mean of the most salient variable pertaining to the two approaches: the exchange rate for the small country and the unemployment rate for the large country approach respectively. In Appendix 2 a more precise specification is given of the regressions that were run.

A first regression shows that the deviation, either upwards or downwards, of the unemployment rate from the historical average does not seem to push the President and the Vice President of the ECB to mention large country terms more often. Thus, there does not seem to be the need to correct the frequency in their use reported in Figure 3. Instead, deviations of the exchange rate from the average, either in the appreciation or the depreciation direction, do lead the two ECB representatives to mention more often terms consistent with the small country approach. Unfortunately, the regression results are not precise enough to allow using the regression residuals as “frequency corrected for the deviation of the exchange rate from the mean”. However, the residuals clearly indicate a break in 2007, when they become consistently negative. This indicates that the actual frequency of small economy terms was lower than that estimated on the basis of the deviations of the exchange rate from its mean. This is consistent with a decreased importance of the small country approach in the inflationary assessment of the ECB.

Comparison with the Fed.

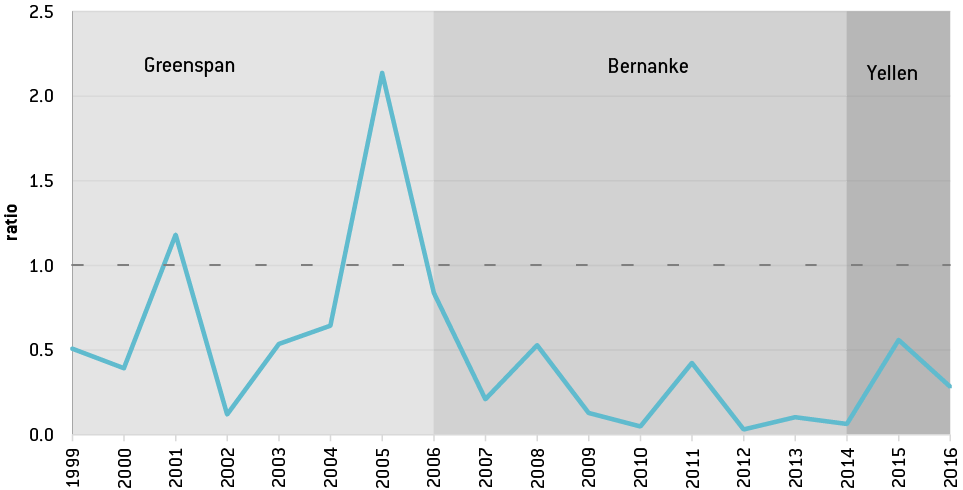

The same analysis conducted for the ECB was carried out for the Fed, with quite striking results, as shown in Figure 4.

Figure 4. Ratio of frequency of terms consistent with the small and the large country approach. Fed 1999-2016.

Source: Authors’ elaboration.

Unlike in the case of the ECB, the frequency of use of terms relating to the small country approach is generally a fraction of the frequency relating to the large country approach[3]. The exception is represented by the year 2005, particularly due to the high frequency of the term “oil (food) price”, and this can be related to the rising price of crude oil. The overall remark is that the interpretative model of the Fed is much more domestic oriented than that of the ECB. In addition, the approach of the Fed does not seem to have importantly changed in the last two decades or so. However, the large approach was prevalent especially in the years 2012 – 2014, when the ratio was close to zero, because of the scarce use of terms related to the small country approach.

Of course, the higher frequency of terms related to the large country approach also depends on the dual objective of the Fed that, unlike the ECB, has to pursue maximum employment in addition to price stability. Furthermore, the US economy is somewhat less open than that of the euro-area, as measured by the ratio of exports+imports to GDP, even if the two economies are of the same order of magnitude.

Still the fact remains that in interpreting inflation developments the approach of the Fed is much more domestically oriented than that of the ECB.

Conclusions

Overall the results indicate that, even if it still gives less weight to domestic variables than the Fed, the ECB has moved, over the years, from a small towards a large country approach. In practical terms, this means that the weight of the exchange rate and other small country variables in ECB deliberations is smaller than it was. In current conditions, the inference is that the ECB is likely to give more weight to the improving employment conditions than to the appreciating exchange rate in deciding its next monetary policy moves.

The table shows that there is no statistically significant relation between the movement of the unemployment rate over years and the use of large approach’s terms.

[1] The “large” country approaches terms are the following: domestic slack, Phillips curve, wages/unjt labour costs, unemployment, labour market conditions. The “small” country approaches terms are the following: import price/imported inflation, global slack, exchange rate, food/oil prices, pass though. The full description of the exercise is given in Appendix 1.

[2] Coeure gives a subtler interpretation of the link between the pass-through and domestic conditions: “These examples demonstrate that it is by and large the state of the economy that will determine the strength of the pass-through. Monetary policy, for its part, is likely to influence the pass-through predominantly through its impact on the economy itself.” The transmission of the ECB’s monetary policy in standard and non-standard times. Speech by Benoît Cœuré at the workshop “Monetary policy in non-standard times”, Frankfurt am Main, 11 September 2017.

[3] More detailed results are reported in Appendix 1.

[4] The link https://www.ecb.europa.eu/press/key/date/2017/html/index.en.html and https://www.ecb.europa.eu/press/pressconf/2017/html/index.en.html have been used to perform the analysis.

[5] Speeches used for this analysis are retrieved from the following link https://www.federalreserve.gov/newsevents/speeches.htm.