Falling Pound might not bring UK trade balance boost

The Pound Sterling depreciated by 14% against a basket of world currencies in the four months after the referendum vote to leave the EU. A number of p

The British Pound has lost ten percent of its value since the UK voted to leave the EU. The general wisdom is that this fall should make imports more expensive and exports cheaper, reducing the UK’s trade deficit. But there is still little evidence that such a trend is emerging. Indeed, could it be that we are witnessing a breakdown in the relationship between exchange rates and trade balances around the world?

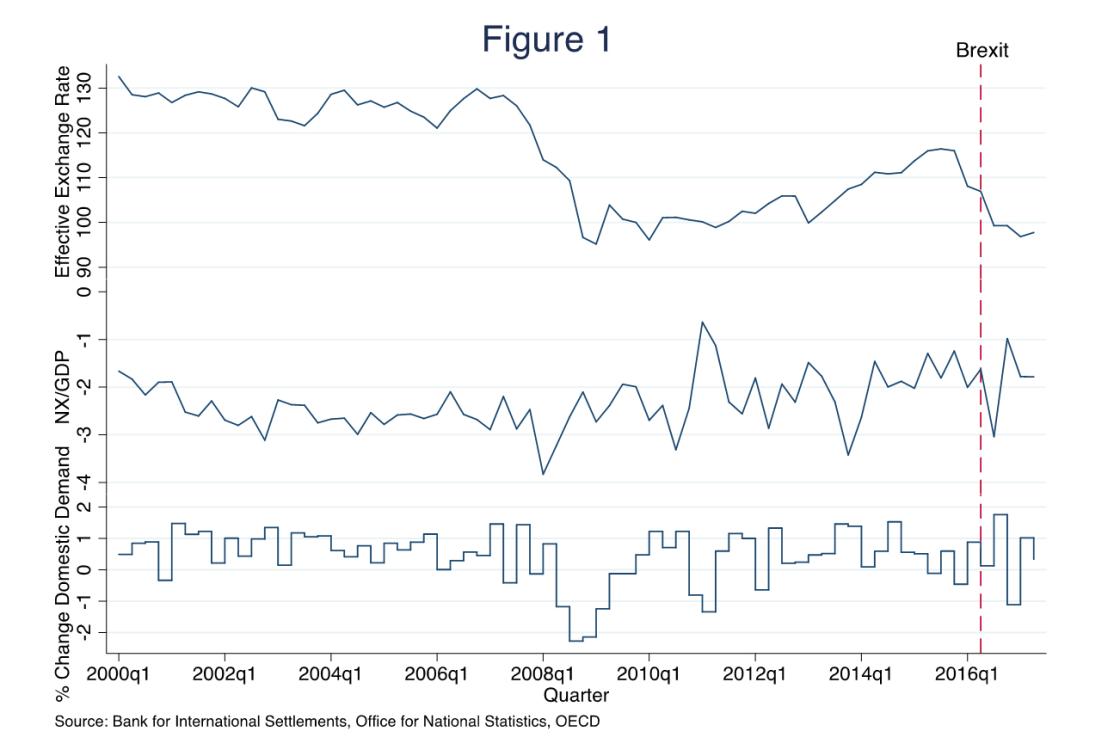

Figure 1 displays time series plots of the UK real effective exchange rate, trade balance as a fraction of GDP, and domestic demand. Two trends stand out. First, and perhaps most strikingly, the two large deprecations since 2000 have had no obvious effect on the trade balance. After the large real depreciation brought on by Brexit, the trade balance has yet to meaningfully change. After its slide to -3% in Q3 2016, it jumped to -1% in Q4 2016. But, it then fell again in Q1 and Q2 2017. Second, general movements in the trade balance may be more strongly driven by domestic demand conditions than by the real effective exchange rate. The large improvements in the trade balance in 2008 and 2011 coincided with pronounced negative growth in domestic demand. And from 2008 to 2015, during a period of weak demand growth, the trade balance seems to have been on a slightly positive trajectory despite an appreciating exchange rate.

How can we explain this apparently weak relationship between the exchange rate and trade balance? The literature suggests that low pass-through to imports and global value chain (GVC) participation may be the cause. The level of pass-through to imports describes how completely import prices respond to exchange rate fluctuations. This matters because depreciations are expected to improve the trade balance by provoking shifts in expenditure — away from suddenly-more-expensive imports in the home country and toward now-less-expensive exports from the home country in foreign markets. However, in a low pass-through environment imports may not become more expensive following a depreciation, disrupting the expenditure switching effect.

Recent findings suggest that over the past decades, pass-through to imports has been falling. For the US, Marazzi et al. find a “striking and robust” decline in pass-through to imports from around 0.5 in the 1980s to 0.2 over the past decade. For the OECD, Campa and Goldberg find that pass-through to imports has declined from 1975 to 2003. And Ollivaud, Rusticelli, and Schwellnus find that pass-through to the terms of trade was lower for 9 of 11 OECD countries analysed during 1993-2014 than during 1970-1992.

Decreasing pass-through to imports seems to have two causes: increasing prevalence of local currency pricing and more credible inflation-targeting monetary action. Local currency pricing occurs when exporters price their products in the currency of the market to which they are exporting. When exporters choose local currency pricing, they absorb exchange rate fluctuations in their bottom lines rather than pass them on to consumers. The effect is lower pass-through to imports. Gopinath, Itskhoki, and Rigobon show just how pronounced this effect is in the US. They find that after a price shock, pass-through to imports after one month is essentially 0 for goods priced in dollars and 1 for goods not priced in dollars. Even after two years, they find that pass-through for goods priced in dollars is only around 0.2.

Bussière, Chiaie and Peltonen find that emerging market economies may be more likely to engage in local currency pricing. They also observe that the composition of a country’s imports is related to its rate of pass-through. Together, these findings suggest that the increasing importance of emerging economies in global trade may be depressing pass-through to imports. Similarly, Marazzi et al. explain falling pass-through to imports for the US by citing increasing local currency pricing among the Asian newly industrialising economies and an increasing import presence of China, whose exporters, Goldberg and Tille find, invoice exports to the US “almost exclusively” in dollars.

The credibility and effectiveness of a central bank at keeping inflation under control may also affect pass-through to imports. When exporters have reason to expect that prices will increase predictably and moderately each year, they may be less likely to pass exchange rate fluctuations through to import prices. Taylor first conjectured that monetary policy that is successful at delivering low inflation decreases rates of pass-through by reducing the “expected persistence of cost and price changes.” And several researchers have since reinforced Taylor’s conclusion: Choudhri and Hakura, Devereux, Engel, and Storgaard, Gagnon and Ihrig, Campa and Goldberg, Caselli and Roitman, and Carrière-Swallow et al.

The UK experiences low exchange rate pass-through to imports. Faruqee estimates UK pass-through to imports at 0.28 after 1 month and 0.60 after 18 months. Bussière, Chiaie and Peltonen estimate pass-through in the long run at 0.466. Campa and Goldberg estimate pass-through to imports in the short and long run at 0.36 and 0.46. Mumtaz, Oomen, and Wang estimate pass-through to imports in the short and long run at 0.44 and 0.66 using aggregate data and at 0.38 and 0.49 using disaggregated data. They also find a significant decline in short run pass-through for the UK from over 0.9 in 1985 to around 0.25 in 2004.

The two previously discussed explanations for low pass-through seem relevant to the UK. Exporters to the UK engage in local currency pricing. Goldberg and Tille find that 33% of imports were invoiced in Pound Sterling in 2002. The Bank of England is also a credible monetary authority and the UK has experienced stable inflation over the past two decades. Since 1995, CPI monthly inflation has averaged 2.0% with a standard deviation of 1.06%. And during only two months of that period did inflation exceed 5%.

Increasing global value chain (GVC) participation may also be disrupting the link between the exchange rate and the trade balance. Firms that import inputs are GVC participants. In the case of a deprecation, their input costs rise. This effect hurts their competitiveness, counteracting the boost provided by a depreciated exchange rate. Amiti, Itskhoki, and Konings study Belgian exporters and observe that the more a firm imports inputs, the less its prices in foreign markets respond to the exchange rate.

UK firms are dependent on GVCs. In 2014, the import content of the UK’s gross exports, according to the OECD, was 21.9% — higher than the U.S. (15.3%) and Japan (18.2%), though lower than Germany (25.4%), Italy (25.4%), and France (26.3%). This suggests that many firms will face higher input costs following a depreciation. A Pound Sterling depreciation may thus take a toll on UK exporters, through lower margins or higher prices, and mitigate any boost to the trade balance.

The literature examining whether falling pass-through to imports and rising GVC participation have fractured the link between exchange rates and the trade balance is recent and has failed to yield consistent and conclusive findings. Ahmed, Appendino, and Ruta find that, over time, the elasticity of manufacturing volumes to the real effective exchange rate has decreased. They attribute 40% of this fall to a rise in GVC participation. They also find that increasing GVC participation is associated with a smaller effect of depreciation on export volumes.

Leigh et al. find essentially the opposite. By estimating trade elasticities for 60 economies, they conclude that a 10% real depreciation boosts net exports by, on average, 1.5% of GDP. They also find no evidence of a weakening relationship between the trade balance and the exchange rate over time. The authors note that when the tests performed in Ahmed are repeated by deflating export volumes not with the CPI, as in that study, but with export prices, “there is little evidence of decline in export elasticities.” The approach employed in Leigh, however, is also not free from critique. Mumtaz, Oomen, and Wang find that using aggregate data to estimate pass-through, as Leigh does, can result in significant overestimation from aggregation bias.

These observations are useful for dialogue, but they are incomplete. In the absence of robust empirical analyses, it remains unclear whether the exchange rate has genuinely become disconnected from the trade balance in the UK, what may explain this, and whether this represents a broad trend in advanced economies. And, until a greater literature on this topic emerges and begins to clarify the opposing conclusions of Ahmed and Leigh, these questions will remain unanswered. What is clear, however, is that the drop in Pound Sterling has so made the UK a poorer country without any visible improvement in the trade balance.