Reinforcing the EU energy industry transformation: stronger policies needed

The European energy system is being transformed by three major forces, decarbonisation, digitalisation and decentralisation. Decarbonisation is changi

Towards a 3D European energy system: decarbonised, digital and decentralised

The European energy system is going through a profound transformation as two trends reshape it: decarbonisation and digitalisation. Based on strong public policies, decarbonisation is changing the European energy mix, while innovation in digital technologies is enabling disruptive change in the way energy systems are operated.

Digitalisation can be an important catalyst for decarbonisation. Digital technologies, such as smart meters, give consumers more control over their energy use and offer benefits from additional services. Energy suppliers, meanwhile, can optimise their operations and develop new offers. System operators can benefit from increased availability of real-time data to manage their grids more efficiently and to integrate an increasing amount of variable renewables into the system.

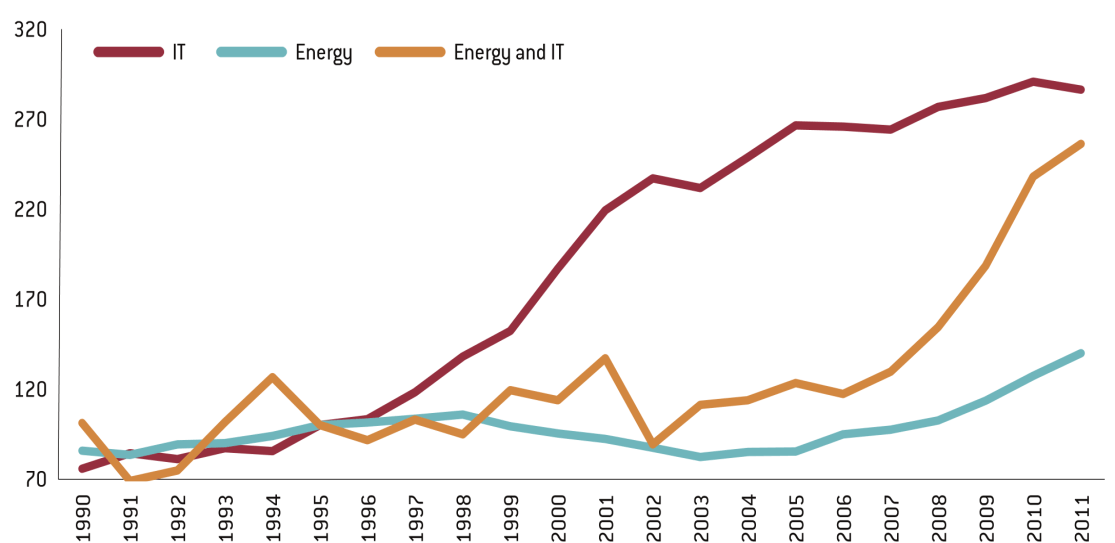

The extent to which energy is already going digital is illustrated by the share of patents in which energy and IT appear on the same patent application. This share has boomed since 2006, outpacing traditional patents in IT and energy taken individually (Figure 1).

Figure 1: Share of IT and energy tech in total patents, EU28, index=1995

Source: Bruegel based on PATSTAT.

Increasing digitalisation also enables the European energy system to become more decentralised, with greater interaction between services (electricity, heat, transport, data) that used to be largely separate.

In this context, the European energy industry must quickly rethink its strategies in order to adapt to, and make the best of, the new reality.

The future of oil and gas companies

Oil and gas companies are the biggest part of the European energy industry. Their total market capitalisation exceeds that of utilities by about 50 percent, and their traditional business models mean they are most at risk from decarbonisation.

To fully unleash the transformation of these companies, even stronger policy signals are needed, such as a meaningful carbon pricing. Otherwise, oil and gas companies might decide to continue in a business-as-usual mode, at best just refocusing their activities on gas.

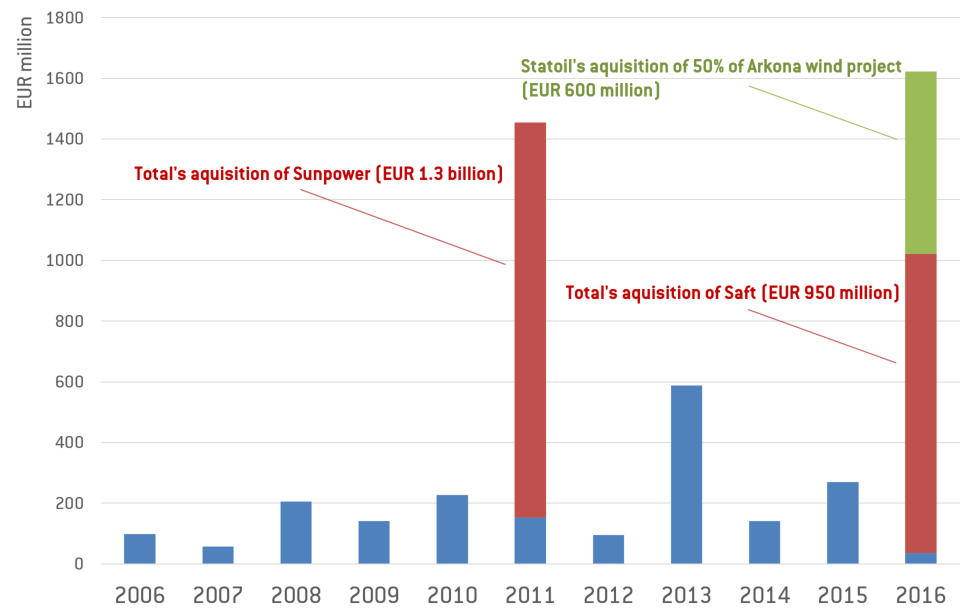

Over the last few years, leading European oil and gas companies have often pledged to commit to new energy solutions. However, these companies have yet to translate declarations into action, as only sporadic sizeable investments have been made so far (Figure 2). Stronger policies could push European oil and gas companies into the new energy solutions territory in a more assertive way.

Figure 2: European oil and gas companies’ investments in new energy solutions

Source: Bruegel based on Bloomberg.

The future of electricity utilities

Since 2008, electricity utilities have experienced a deep crisis because of the rapid emergence of new market and policy conditions that have put pressure on their traditional business models. The rise of renewable energy and weak electricity demand have led to significant overcapacity and significant losses of traditional energy businesses. In the future, strong decarbonisation policies, improved energy efficiency favoured by technological development, the rise of distributed generation and new developments in demand response and storage capacities will put even more pressure on conventional generation assets.

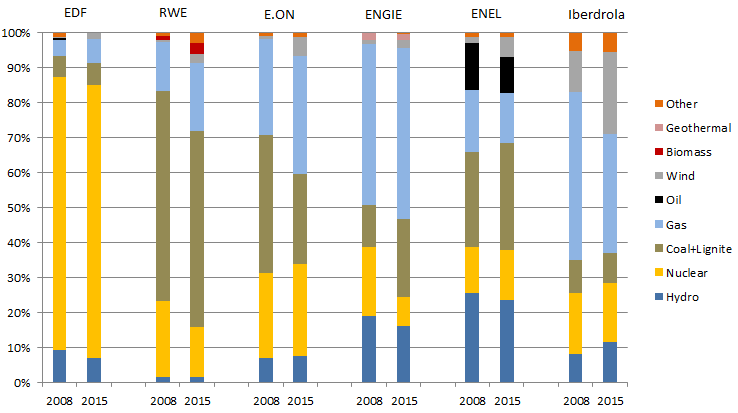

In such a complex situation, utilities must decide whether to defend their existing business models or to become drivers of the energy transition. Electricity utilities might bet on convincing policymakers that their coal and gas units are indispensable (Figure 3) to keep the lights on and thereby secure new policy-driven cash flows for their plants. Corresponding capacity mechanisms have already been implemented in several EU countries.

Figure 3: Leading European utilities’ generation portfolios: still a lot of coal and gas

Source: Bruegel based on Bloomberg.

Alternatively, electricity utilities might bet on deep decarbonisation and build up significant renewable generation capacity, invest in networks and divest from fossil fuels. For this to become a general trend, clearer policy signals are needed. Returns from the network business and renewables are indeed largely policy driven. Regulators explicitly decide on the rate of return for electricity networks and policymakers decide on the remuneration schemes for renewables. A change in regulations can cost regulated businesses billions of euros. Therefore, understanding and managing the political environment is probably more important for the success of renewables and network electricity companies than good internal management or efficient supply chains.

Setting the right policies: the need for a high-level platform to discuss the future of energy

Considering the complexity of the energy transition, we consider that partial fixes to the current EU energy regulatory system are not sufficient to provide the appropriate long-term regulatory stability to the energy industry.

Instead, Europe urgently needs a high-powered platform – representing all major stakeholders – to discuss a broader vision for the design of its future energy sector. This should go beyond the existing working-level discussion forums.

The European Council should ask the European Commission to prepare a green paper on the organisation of the European energy sector in the twenty-first century. It should form a consistent basis for upcoming legislation in different policy areas.

The ongoing structural transformation of the European energy system requires a parallel structural transformation of the policy framework. This should become a priority of the EU Energy Union initiative, because with the current level of uncertainty, investors are unlikely to deliver the annual €379 billion of investment required between 2020 and 2030 to turn the EU 2030 energy and climate targets into reality.