Africa and Chinese rebalancing

What’s at stake: China and Africa have developed close economic ties over the past 20 years. The need to rebalance the China-Africa relationship was a

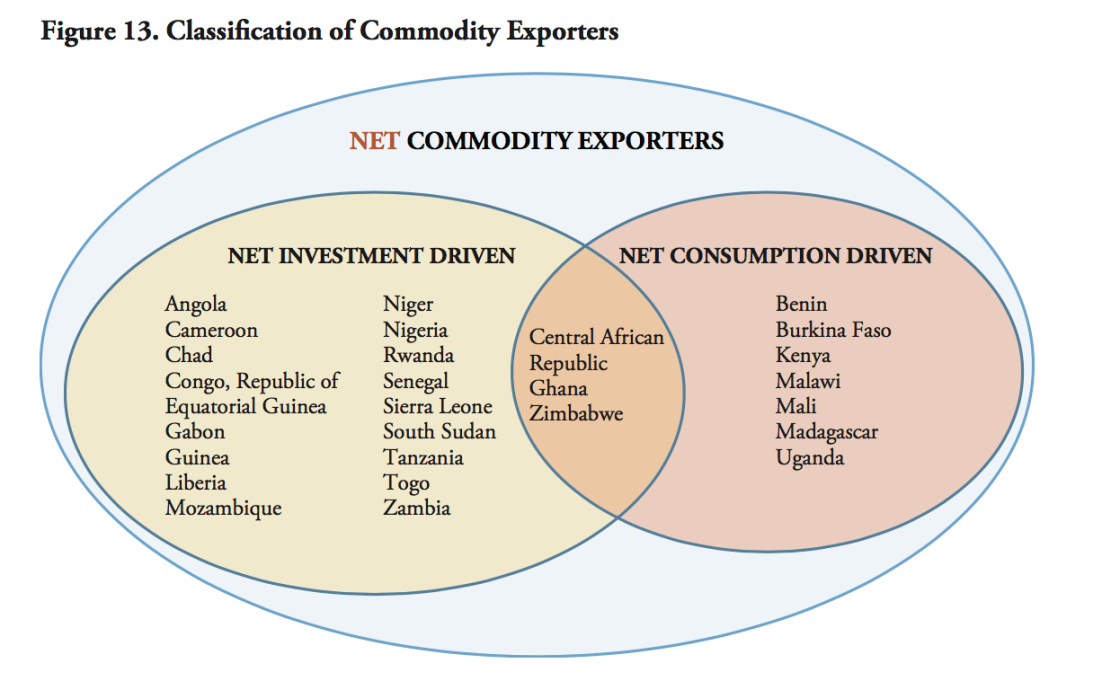

Chen and Nord in a recent IMF paper document that Africa’s commodities exports have fallen as a result of the decline in Chinese demand and the precipitous fall in world commodity prices, putting pressure on the scale and external accounts of many African countries. Beyond commodity prices, the rebalancing of China’s growth model from investment-led to consumption-led growth is expected to affect the country differently, depending on the type of commodity they export (Figure below). Chen and Nord hypothesise that a Chinese slowdown in investment is likely to have an adverse effect on investment-driven commodities exporters in sub-Saharan Africa, both because of decreases in the world price and directly through lower import demand in China. On the other hand, the boom in consumption-driven commodities is likely to have a positive impact on exporters of those commodities in sub-Saharan Africa, through a surge in world prices of those commodities and increased import demand by China.

Source: Chen and Nord

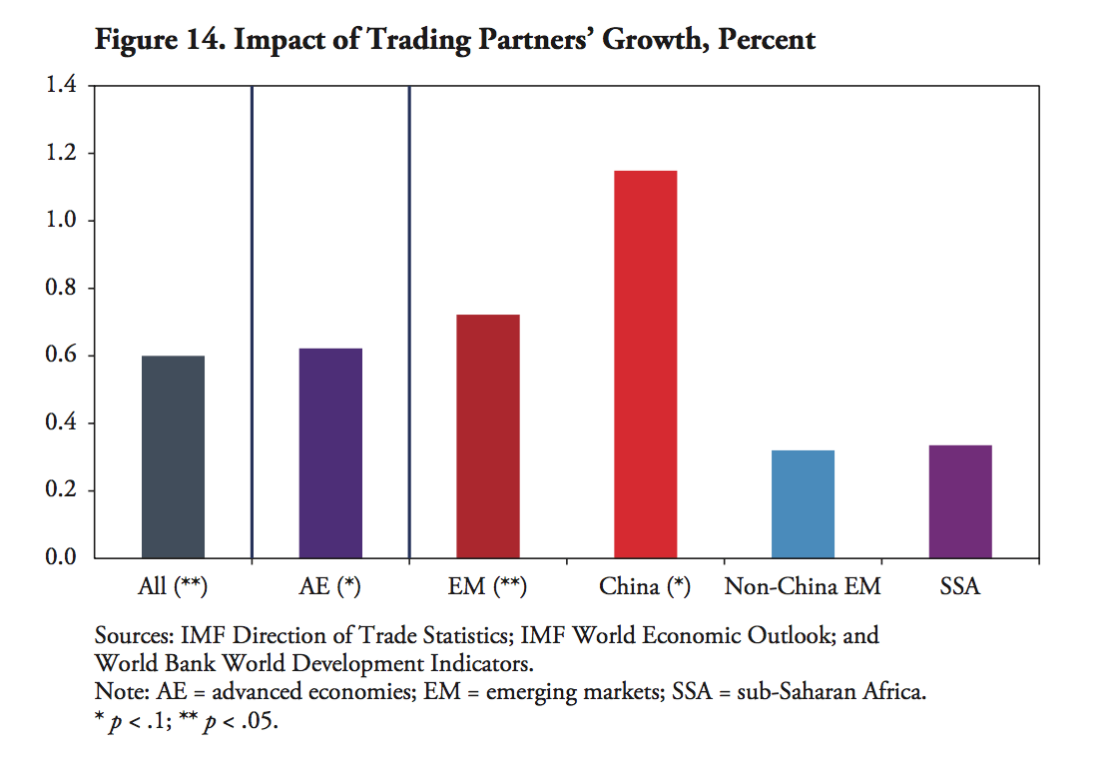

Chen and Nord’s empirical results suggest that trading partners, especially China, matter for Africa’s growth. A 1% increase in trading partners’ growth will raise sub-Saharan Africa’s growth by 0.6%, but a 1% increase in China’s growth increases sub-Saharan Africa’s growth by more than 1% (Figure below). Second, China’s impact on investment-driven net commodities exporters is especially large. For them, a 1% increase in China’s growth is associated with about a 2% increase in their own growth. Thus, if China’s growth were to slow down because of falling investment, the investment-driven commodities exporters would likely experience negative impacts on their growth, while consumption-driven exporters would not face the same adverse effects.

Source: Chen and Nord

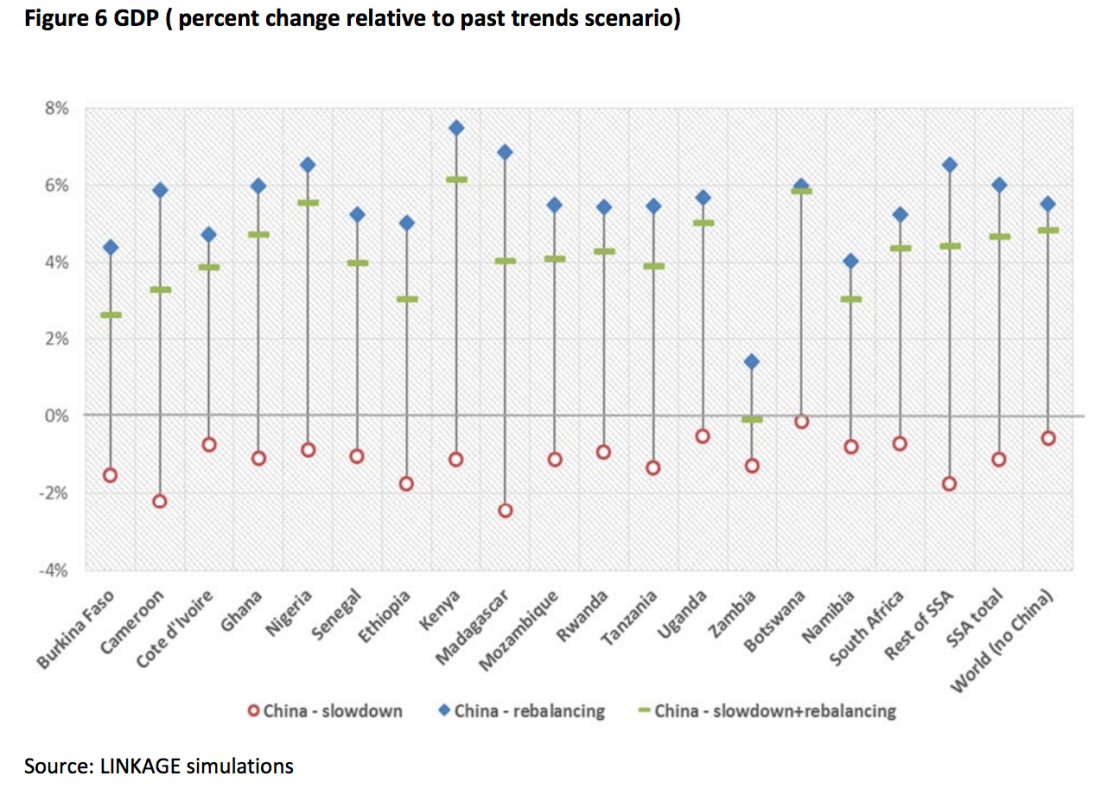

Similar results were also offered by Lakatos et al. at the World Bank. They explored the economic impacts of two related tracks of China’s expected transformation - economic slowdown and rebalancing away from investment toward consumption - and estimated the spillovers for the rest of the world, with a special focus on Sub-Saharan African countries. They find that an average annual slowdown of gross domestic product in China of 1% over 2016-30 is expected to result in a decline of gross domestic product in Sub-Saharan Africa by 1.1% and globally by 0.6% relative to the past trends scenario by 2030 (Figure below).

Source: Lakatos et al.

However, Lakatos et al. argue that if China’s transformation also entails substantial rebalancing, the negative income effects of the economic slowdown could be offset by the positive changes brought along by rebalancing through higher overall imports by China and positive terms of trade effects for its trading partners. If global supply responds positively to the shifts in relative prices and the new sources of consumer demand from China, a substantial rebalancing in China could have an overall favorable impact and economic growth could turn positive and higher on average, by 6% in Sub-Saharan Africa and 5.5% globally, as compared with the past trends scenario. Finally, they argue that rebalancing would reduces the prevalence of poverty in Sub-Saharan Africa compared with the isolated negative effects of China’s slowdown, which slightly increase the incidence of poverty.

Helmut Reisen wrote on the OECD blog that three unfolding dynamics are worth considering. First, trade dynamics are changing. China’s trade engagement with Africa has has crowded out other trade partners in relative terms, except for India. African countries best placed to export consumer goods to China, including agricultural products, will now benefit most from China’s lower but more balanced growth. Second, Africa’s ability to mobilise domestic resources is being undermined. The recycling of large surpluses in the current account of oil exporters (including African) will not be paralleled by corresponding surpluses of oil importers and trade tax revenues also may be affected by China’s rebalancing. Many countries in Africa rely on trade taxes (tariffs) to sustain government revenues, so collapsing commodity exports worsen fiscal positions. Third, financial flows to Africa may be harmed. The fast accumulation of global economic imbalances over the 2000s brought about a significant shift in the world’s wealth in favour of emerging countries running surpluses. Since mid-2014, both foreign exchange reserves and sovereign wealth fund assets in emerging economies have dropped as a result of lower commodity prices and lower gross capital inflows. As a result of shrinking surpluses in their current account and dwindling reserves, the size of export-buyer credits, resource-backed credit lines and hybrid financing mechanisms extended to Africa by China and other emerging market economies risk being cut back. Despite those headwinds, Africa’s external capital flows have remained fairly stable overall, thanks to official bad-weather finance.