The US 100% renewables dispute

What’s at stake: Two years ago, a debate started on whether it would be feasible for the US to achieve 100% renewable energy power. The arguments on b

In 2015, Mark Jacobson and his colleagues at Stanford argued that it would be technically feasible for the United States to be entirely powered by clean energy sources, between 2050 and 2055. One factor currently inhibiting the large-scale conversion to 100% wind, water, and solar (WWS) power for all purposes (electricity, transportation, heating/cooling, and industry) is fear of grid instability and high cost due to the variability and uncertainty of wind and solar. Jackobson et al. conducted numerical simulations of time- and space-dependent weather and coupled them with simulations of time-dependent power demand, storage, and demand response, to provide low-cost solutions to the grid reliability problem with 100% penetration of WWS across all energy sectors. They argue that solutions can be obtained without higher-cost stationary battery storage by prioritizing storage of heat in soil and water; cold in water and ice; and electricity in phase-change materials, pumped hydro, hydropower, and hydrogen.

Last year, Bistline and Blanford offered a skeptical response. They argued that the conclusions of the study by Jacobson et al. were based on strong assumptions and methodological oversights, and that they omit the essential notion of trade-offs by making use of a “grid integration model” in which investment and energy system transformations are not subject to economic considerations. Bistline and Blanford argue that the resulting renewable dominated capacity mix is inconsistent with the wide range of optimal deep decarbonization pathways projected in model intercomparison exercises in which the contribution of renewable energy is traded off in economic terms against other low-carbon options. Moreover, Bistline and Blanford believes that the Jacobson study underestimates many of the technical challenges associated with the world it envisions, and fails to establish an appropriate economic context. Every low-carbon energy technology presents unique technical, economic, and legal challenges. Evaluating these trade-offs within a consistent decision framework is essential.

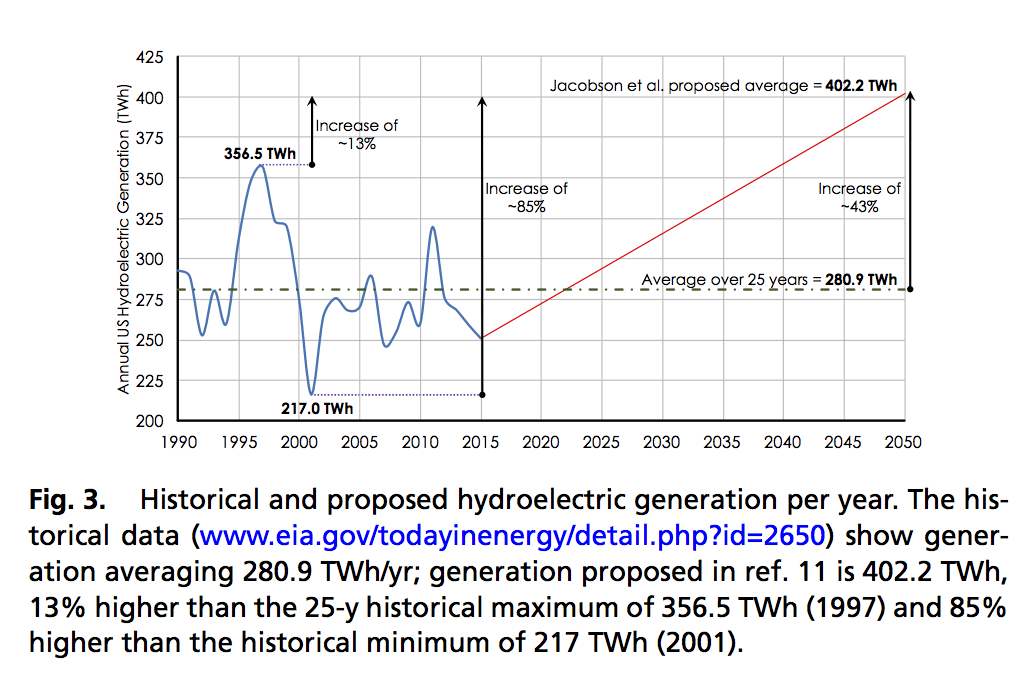

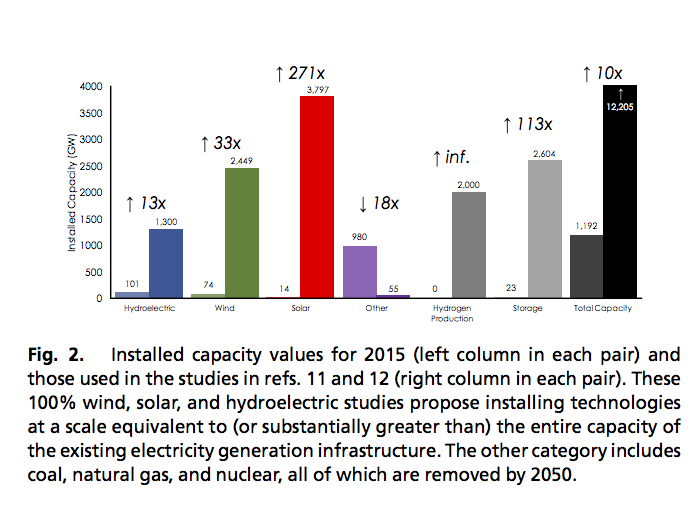

More recently, Christopher Clack and 20 other co-authors casted further skepticism on the Jacobson paper. A number of analyses, meta-analyses, and assessments, have concluded that 80% decarbonization of the US electric grid could be achieved at reasonable cost and that deployment of a diverse portfolio of clean energy technologies makes a transition to a low-carbon-emission energy system both more feasible and less costly than other pathways. This contrasts with the findings of Jacobson et al.’s paper, which according to Clack et al. is plagued by significant shortcomings, such as invalid modeling tools and contained modeling errors. Additionally, they argue it is made implausible by inadequately supported assumptions. In particular, Clack et al. argue that both hydroelectric power and flexible load have been modeled in erroneous ways in the jacobson paper and that these errors alone invalidate the study and its results (see figures below). Policy makers - they conclude - should treat with caution any visions of a rapid, reliable, and low-cost transition to entire energy systems that rely almost exclusively on wind, solar, and hydroelectric power.

Jacobson et al. defended their study, offering five reasons why the claims offered by its critics should be considered inaccurate. First, regarding the decision to exclude nuclear power from the study, they argue that grid stability studies finding low-cost up-to-100% clean, renewable solutions without nuclear or CCS are the majority. Second, they point out that the Intergovernmental Panel on Climate Change contradicts Clack et al.’s claim that including nuclear or CCS reduces costs. Third, the official studies cited by Clark et al. in their counter-argument have never performed or reviewed a cost analysis of grid stability under deep decarbonization. Fourth, Clack et al.’s include nuclear, CCS, and biofuels without accounting for their true costs or risks. Fifth, Jacobson et al. dispute the claim that they place “constraints” on technology options.

Vox has a broader overview of the issues involved in the 100% dispute. As Brad Plumer at the New York Times points out, the 100% dispute has the merit of having shifted the focus of the renewable debate onto much higher targets than were thought feasible in the past. Policymakers may have a tendency to treat the 100% target as “gospel”, but the important question is whether - in light of the disagreement on this issue - we want to keep other tech and R&D options open for the time being (such as CCS/nuclear) or whether we think it's a good idea to phase out the existing nuclear fleet instead of relying on it for some decarbonization. If 100% renewables isn't ultimately doable and we close off other options today, we may find ourselves in a dead-end a few decades from now.