Raising the inflation target: a question of robustness

In an unexpected move, the Federal Reserve Chair Janet Yellen has recently brought up the issue of raising the inflation target. This blog argues that

The discussion on raising the inflation target to 4% has just gotten a new impetus after the Fed Chair, Janet Yellen, urged in a recent press conference to rethink the issue. Ms Yellen, asked for more research to be done to understand what this would achieve.

Since there is some evidence that euro-area monetary policy eventually follows US monetary policy, we perhaps need to have this discussion in the euro area as well.

In my view, there are three questions that we need to ask in order to understand what a higher inflation target would offer and also what the risks would be.

Does aiming for higher inflation avoid periods of disinflation more effectively? In my view, it does. This is the main argument put forward by Olivier Blanchard and co-authors, and reiterated by Janet Yellen. Having an inflation target at a slightly higher level would provide greater space for the interest rate to move before landing on the zero-lower bound, where it ceases to function. If the costs of falling prices are very high, then we must avoid the problem by overshooting in the other direction.

Is the objective of price stability better served by setting a higher target? Price stability is identified by an inflation rate below but close to 2%. By exploring the merits of increasing the target to 4%, I do not argue that the definition of price stability has changed; I just explore whether a higher target would avoid periods of very low inflation more effectively. What follows naturally in the argument, in my view, is that the inflation objective of 2% cannot be achieved in the policy horizon but has to be considered as an average over a longer period.

But there are important issues to consider here that relate to the possibility of implementing such a target. The success of revealing an inflation target is that it helps anchor expectations and thus build credibility. But, importantly, that target should also be consistent with price stability. Can we really talk about credibly committing to an inflation rate other than what is consistent with price stability? Doesn’t that risk de-anchoring expectations, eliminating the benefits of inflation targeting, and effectively jeopardising the central bank’s ability to control inflation?

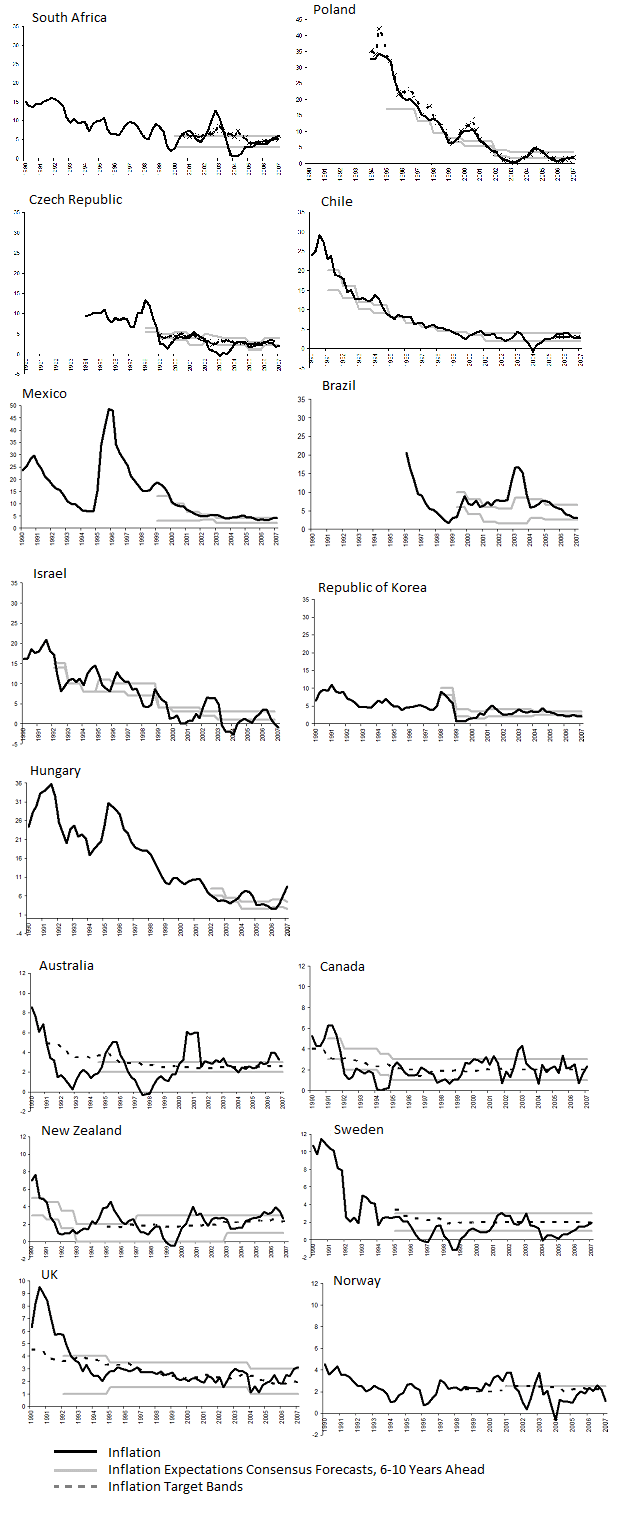

The variety of national experiences in the way they have adopted an inflation targeting regime is quite illustrative in this respect (figure 1). Some countries that have had to bring inflation down from very high levels (Poland, Chile, Israel, Mexico and to lesser extent Canada and New Zealand) adopted inflation targeting in a step-wise manner. This meant changing the target (and the width of the tolerance band around it) in small consecutive steps. This was a way of making small but very concrete progress by demonstrating that they can indeed control inflation. Each time inflation fell, respective Central Banks reduced the target further, building up credibility along the way. I explain here in detail the mechanism of how this happens. Other countries (Australia, Sweden, UK and Norway) instead preferred to reduce inflation to the level consistent with price stability, before adopting (a)n (low) inflation targeting regime

Figure 1: Inflation, long-term expectations where available and tolerance bands

Sources: Consensus forecasts and Central Bank sites

In my view, both approaches can work. It is a matter of communicating effectively what the new objective would aim to achieve. If this objective in the euro area is communicated as an effort to avoid very distortionary outcomes, then markets can learn to adapt to the new framework. Communication could then take the following form: while the objective of monetary policy is still to achieve 2% inflation, it will be assessed as an average over longer periods of time, not over the 2-year horizon as is currently. Aiming for 4% in the 2-year horizon, the argument goes, would help achieve 2% in the longer run.

So, if putting up with a higher inflation rate in “normal times” is sufficient to ensure avoiding the zero-lower bound, then, yes, the objective of price stability is better served. The target simply becomes an instrument for managing uncertainty in the medium term. And it is a more robust method as it avoids very distortionary outcomes more effectively. The remaining question then is how to decide by how much to increase the target. Is 4% sufficient, and in what sense can we talk about sufficiency? One answer provided in this respect is by moving away from “optimal” outcomes to a “good enough” outcome. Defining “good enough” is then very important. Concretely, policy makers would have to define the highest level of inflation that they would be prepared to tolerate as an objective in good times.

Can we manage the transition? There are important reasons why this might be difficult, the most obvious one being how to get to 4%. With the zero-lower bound difficult to escape from and core prices persistently low, what types of policies could realistically bring the system to this higher level of inflation, when even 2% is proving so difficult to attain? What size would QE have to take and could this harm banks and the financial system?

This difficulty becomes even more pertinent if one believes that the euro area economy is slowly moving into “secular stagnation”. If the new normal does involve lower levels of growth and interest rates, then a higher inflation rate may be difficult to justify. My view on the latter point is that so long as levels of debt (private and fiscal) remain as high as they are in the euro area, we should not attempt to answer this question. We shouldn’t therefore draw conclusions before the financial system becomes capable of generating credit that is convincing for sustainable growth.

Lastly, it is legitimate to ask whether the ECB, coming out of a very difficult 10-year period and still relying on unconventional instruments to perform its tasks, has sufficient standing to afford to change the “terms of the contract” it has signed with its “principal”.

Conclusions

While changing the inflation target involves risks and can run into important transitional difficulties, we must give sufficient consideration to the fact that we need to rethink how to best pursue price stability. The most important aspect that I believe we should introduce is a framework for thinking about uncertainty and how to manage it. It is the only way of creating robust systems. I welcome the suggestion of increasing the target as a way of avoiding the very distortionary effects of deflation, irrespective of how likely we are to witness disinflation in the future. It remains to be seen by exactly how much we should increase the target and I would welcome discussions on the issue.