We need a European Monetary Fund, but how should it work?

Many voices are calling for the ESM to be developed into a fully-fledged European Monetary Fund. But what changes would this entail, and how could the

Sovereign debt crises and banking crises were not supposed to happen in the euro area. Or more precisely, the Maastricht Treaty, which founded the European Monetary Union (EMU), contained no common provision for dealing with a sovereign or banking crisis. The euro area was therefore totally unprepared when hit first by a banking crisis, then by a sovereign debt crisis and finally by a sovereign-bank “doom loop”.

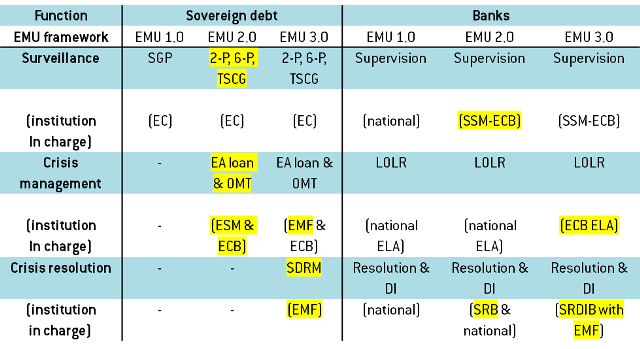

Under the Maastricht philosophy, or EMU 1.0, each member country was supposed to take care of its sovereign debt or banking problems on its own. The only common instrument that existed, the Stability and Growth Pact (SGP), was for the surveillance (and correction) of public deficits by the European Commission. There was no common instrument in case a sovereign faced a liquidity or solvency crunch. For banks, there was not even a common instrument for the surveillance of risk, and there was no common instrument in case of a liquidity or solvency crisis. Everything was left in the hands of individual member countries. This Maastricht architecture is described in the two columns entitled EMU 1.0 in Table 1.

The situation changed radically after the euro area was hit by a series of banking and sovereign crises. National and European authorities were forced to realise that a sovereign or banking crisis, leave alone a sovereign-cum-banking crisis, has implications for the entire area – even if it occurs in only one euro-area country. As a result, they gradually took steps to create new common tools for the surveillance of sovereigns and banks, for the management of sovereign debt and banking crises, and for the resolution of banking crises. Four major steps were taken:

- The first step was the reinforcement of the surveillance of public deficits and debts by the European Commission, with the Two-Pack (2-P) and Six-Pack (6-P) measures, and the Fiscal Compact of the intergovernmental Treaty on Stability, Coordination and Governance (TSCG). Membership is open to all EU countries.

- The second step was the creation of the European Stability Mechanism (ESM), an intergovernmental instrument to provide financial assistance to euro-area countries facing temporary financial problems. Membership of the ESM is restricted to countries belonging to the TSCG. Its current members are all the euro-area countries. The ESM offers three main facilities: lending to governments subject to a macro-economic adjustment programme (ex-post conditionality); precautionary financial assistance consisting of credit-lines available to countries meeting certain conditions (ex-ante conditionality); and lending for bank recapitalisation.

- The third step was the decision to create a European banking union (BU) to strengthen financial stability in the euro area. The banking union architecture will consist of three separate mechanisms: the Single Supervisory Mechanism (SSM), the Single Resolution Mechanism (SRM) and the European Deposit Insurance Scheme (EDIS). So far, only the first two mechanisms have been created. Membership of the banking union is open to all EU countries, but its current members are only those belonging to the euro area. After the creation of the Single Resolution Board (SRB) and its Single Resolution Fund (SRF), the ESM decided to extend its bank recapitalisation instrument, initially only available to governments, to banks under strict conditions (see below).

- The fourth step was the decision by the European Central Bank (ECB) to create the Outright Monetary Transactions (OMT) facility. The OMT programme allows the ECB to purchase government bonds in the secondary market subject to ex-post or ex-ante conditionality in the form of an ESM macro-economic adjustment programme or a precautionary credit-line.

The current architecture, resulting from these four successive steps taken during the crisis, is described in the two columns entitled EMU 2.0 in Table 1.

Although vastly superior to the previous situation (EMU 1.0), the current state of affairs (EMU 2.0) still suffers from three main weaknesses:

- The first weakness concerns the treatment of sovereign debt. The new system reduces the risk of sovereign debt crises, partly thanks to the improved surveillance framework, and greatly thanks to the ESM’s lending capability (€500 billion) and the ECB’s OMT facility, which is potentially unlimited. Thanks to the ESM and the OMT, the new system is well equipped to deal with liquidity crises. However, it still lacks an instrument to deal orderly with insolvency crises.

- The second weakness concerns the incompleteness of the banking union. The SSM is completely up and running, and functioning well (see here). The SRB is also up and running, but the SRF is still in transition. In addition, use of the ESM’s direct recapitalisation instrument is subject to such strict conditions that it falls short of a credible ex-ante fiscal backstop to the SRF. Finally, there is still no agreement among governments to set up a European deposit insurance mechanism.

- The third weakness concerns the governance of the ESM. Unlike the International Monetary Fund (IMF), where decisions to provide financial assistance to a member country are taken by a majority vote, similar decisions by the ESM are taken by unanimity and require prior approval by some national parliaments. The unanimity rule also applies for lending under the direct recapitalisation instrument . The result is that in practice ESM resources are only granted as a final resort. Earlier intervention, before a country loses market access and provided it meets certain conditions, could mitigate or even prevent full-blown crises, thereby saving money and jobs. The same logic applies to the direct recapitalisation instrument for banks.

The way to correct these problems is to turn the ESM into a European Monetary Fund (EMF). This EMF would be fully capable of acting as the fiscal counterpart of the ECB to guarantee the financial stability of the euro area in the event of a sovereign or banking crisis, or a threat thereof.

This reform would respond to important questions about governance. It is important to integrate the governance of sovereign and bank crises within the ECB on the one hand and within the EMF, as the fiscal agent of euro area governments, on the other. The reason is that ultimately the standing of a banking system depends on the strength of the fiscal authority behind it and its ability to provide a fiscal backstop. A banking crisis can turn into sovereign crisis when the sovereign cannot credibly backstop its banking system. In the euro area, the ECB can or should be able to prevent or to manage a sovereign or a banking crisis as long as it is a matter of providing liquidity on a temporary basis, but beyond that it should be the responsibility of the EMF to protect the stability of governments and banks.

In practice, what should the EMF do? Basically, it should take over the existing responsibilities from the ESM, but expand them and adopt a different governance model.

The first expansion of the EMF compared to the ESM concerns the governance of sovereign debt crises. Some, like Minister Schäuble, have argued that the EMF should take over from the European Commission the responsibility for the surveillance of fiscal rules. In their view, the European Commission is too political and not sufficiently independent from the countries it is meant to watch over to enforce the rules with sufficient rigour. However, it is doubtful that the EMF will be less political and more independent from its member countries than the European Commission. The ESM is certainly not. In fact, it is unlikely that any official European body – the EC, the ESM or the EMF – could have the power (bestowed upon it by the member states) to strictly enforce the EU fiscal rules and completely avoid debt sustainability problems.

A more promising approach would be to give teeth to the no-bail-out clause of the European treaty by setting up a European Sovereign Debt Restructuring Mechanism (ESDRM) to ensure orderly resolution in the euro area (see here for an early proposal). The creation of this mechanism would strengthen market discipline and help prevent future sovereign debt crises.

The ESDRM would carry both a judicial and a financial function. The former would involve a procedure to initiate and conduct negotiations between an insolvent sovereign debtor and its creditors resulting in an agreement on how to reduce the present value of the debtor’s future obligations so as to re-establish the sustainability of its public finances. This task should be left to a special court, whose role is to make the settlement between the debtor and creditors binding on all parties. The court would work in close partnership with the EMF, whose role should be to assess when a sovereign debtor has become insolvent, by how much its debt should be reduced, and what its future primary surplus should be to restore its debt sustainability. The EMF would also have the task of providing financial assistance to the debtor country to help it undertake the necessary economic adjustment towards fiscal sustainability. Such assistance should only be provided after an agreement between the debtor and the creditors re-establishing solvency has been reached.

We do not propose that all financial assistance by the EMF be conditional upon debt restructuring. Rather we envisage that, like the ESM, the EMF continues to lend money to solvent sovereigns who face temporary difficulties. Only in exceptional situations, when the EMF would have judged a sovereign to be insolvent and when the insolvency procedure by the judicial arm of the ESDRM would have led to an agreement between the sovereign debtor and its creditors, should lending by the EMF be conditional upon debt restructuring.

The creation of the ESDRM and the possibility of sovereign debt restructuring should be accompanied by important changes in the regulatory treatment of sovereign exposures by banks. As argued elsewhere (here), this could take the form of risk weights or large exposure limits for sovereign bonds held by banks. Such changes would further strengthen market discipline and limit the risk of future sovereign debt crises.

The second area where the new EMF should have an expanded remit compared to the current ESM is the governance of banking crises. Here the guiding principle should be “he who pays the piper calls the tune”. Now that the ECB supervises significant banks and calls the tune, it should also be responsible for Emergency Liquidity Assistance (ELA) to banks experiencing liquidity problems, a function currently carried by national central banks (see here).

The same guiding principle should apply to crisis resolution. The SRB is already in charge of resolution in the euro area, and manages the SRF, which is still in a transition phase. A European Deposit Insurance Scheme should also be created and should be managed by the same institution that manages resolution, as in the United States (US) with the Federal Deposit and Insurance Corporation (FDIC). The integrated Single Resolution and Deposit Insurance Board (SRDIB) could apply the least cost principle, which requires the resolution authority to choose the resolution method in which the total amount of expenditures and (contingent) liabilities incurred has the lowest cost to the resolution and deposit insurance fund. The combination of functions would allow for swift decision-making.

The role of the EMF would be to serve as fiscal backstop to the euro-area banking system. This would mean two things. First, the procedure for the implementation of the Direct Recapitalisation Instrument should be simplified (see below) so it can actually be deployed. Second, the EMF should be able to provide a credit line to the Single Resolution and Deposit Insurance Fund (SRDIF) managed by the SRDIB, just like the US Treasury can provide, and has provided, to the FDIC.

It is important to note that the risk of moral hazard associated with the EMF acting as a fiscal backstop to the banking system would be much reduced if, as we proposed above, the regulatory treatment of sovereign exposures by banks was tightened in conjunction with the creation of the ESDRM.

The proposed architecture is described in the two columns entitled EMU 3.0 in Table 1.

The new roles assigned to the EMF would require a new form of governance compared to the ESM. The most important change would be to abolish the unanimity rule that hampers ESM decisions. All financial support decisions by the EMF, whether to governments, banks or the SRDIB, should be taken by a supermajority. Beyond that, there is the question as to whether the EMF should be intergovernmental like the ESM and the IMF, or a European institution like the European Investment Bank (EIB) or the ECB. Note, however, that the question of unanimity vs. supermajority voting is separate from the question of intergovernmental vs. European institutions. Unanimity is absent in the intergovernmental IMF as well as in the EU-treaty based ECB and EIB.

Establishing the EMF as an EU institution would give it greater European legitimacy. In the ESM, all the important decisions are taken by the Board of Governors, which is made up of the finance ministers of the Eurogroup. In the EMF, the Board of Governors could comprise not only the Eurogroup ministers but also a euro-area “finance minister” and a few other representatives of the euro area, which would together constitute a “Eurosystem of Fiscal Policy” (EFP). The EFP would replace the Eurogroup as the body responsible for all the fiscal decisions in the euro area. The euro-area “finance minister” and the other euro-area representatives would be appointed by the European Council subject to approval by the European Parliament to which they would be accountable.

The transformation of the European Stability Mechanism into a European Monetary Fund should not be viewed as a stand-alone initiative. On the contrary, it should be considered as part of a wider institutional reform of the fiscal dimension of the euro area, which should be aimed not only at better managing sovereign and debt crises, but also at improving economic conditions in less severe situations.

The election of Emmanuel Macron as president of France has sparked a new debate about the possible need for a euro-area treasury and finance minister as well as a euro-area budget and parliament. At this stage, we can only echo the view of our colleague Guntram Wolff who has recently argued that “[d]eveloping the fiscal dimension of the euro area will have profound implications for the legal order, for economic resources and for moral hazard. It will raise major questions about legitimacy, the role of the European Parliament, the role of national parliaments and the link between national fiscal resources, federal fiscal resources and the European Central Bank. The euro area will need a sincere debate about the pros and cons of all options.”

Table 1 - EMU governance: from Maastricht (EMU 1.0) to the EMF (EMU 3.0)