President Trump’s budget: the 3% growth quandary

What’s at stake: the Trump administration released its full budget proposal. Economists have been arguing about the feasibility of the underlying grow

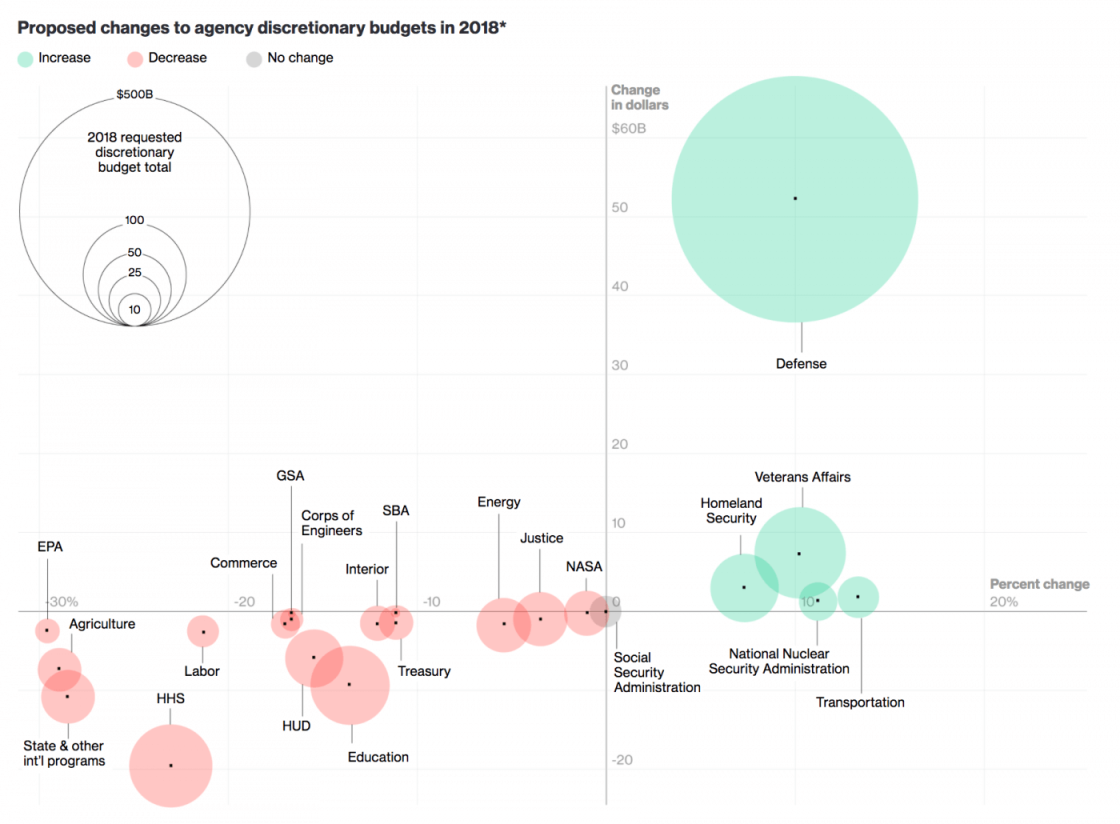

Bloomberg has a very telling graphical representation of what this budget would imply for the federal government (figure 1 below). CNN has updated numbers on what would be cut and by how much. While the overall proposed spending is about on par with last year, at $4.1 trillion for 2018, the budget envisions severe cuts to domestic programs focused on science and research, the arts and, most notably, social welfare programs. At the same time, defense spending would be increased by about 10% and more than half of the increase in border security funds would be directed toward the construction of a the border wall.

Source: Bloomberg based on OMB

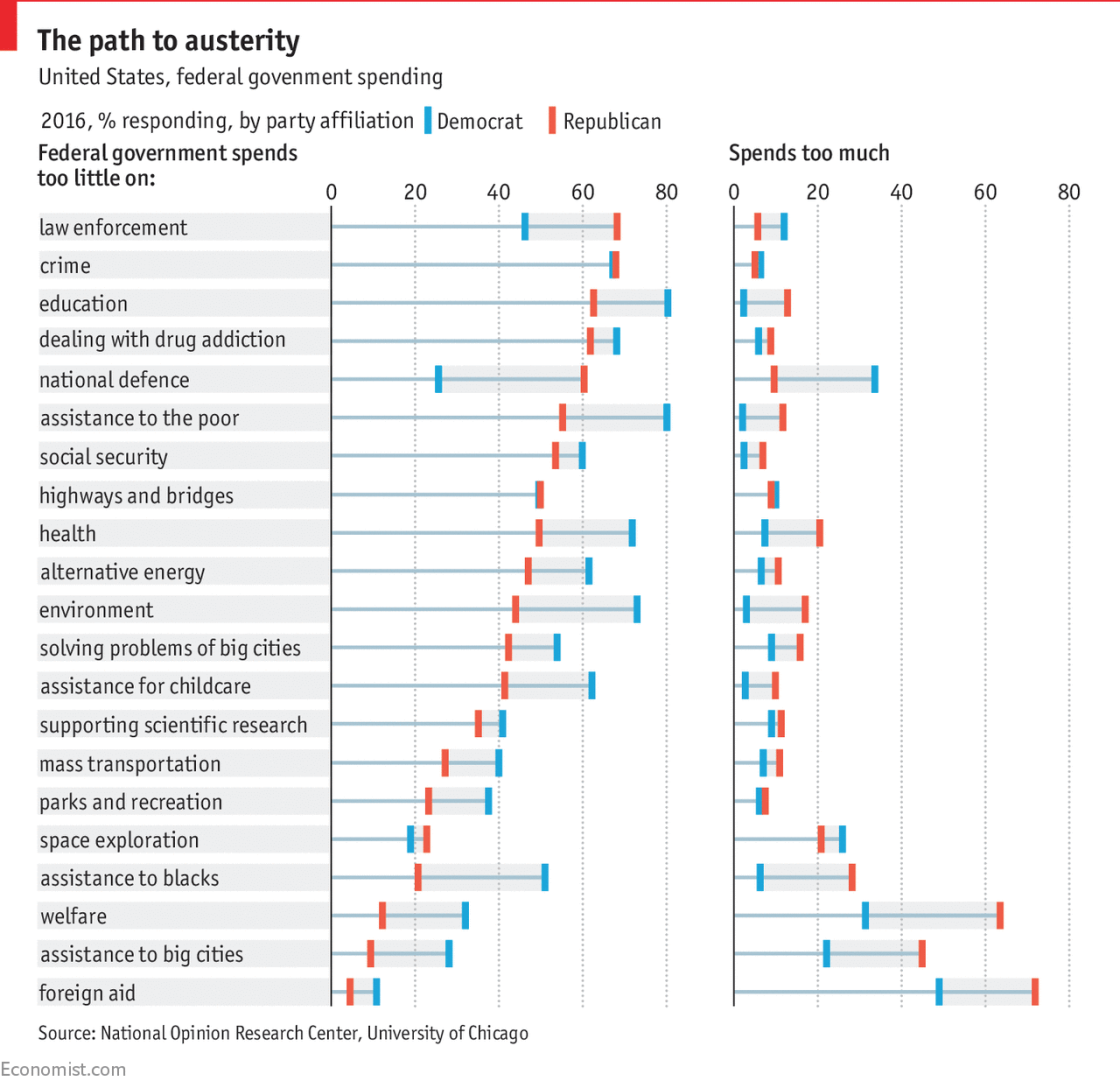

The Economist notes that one way Donald Trump distinguished himself in the Republican primaries was by promising to maintain spending on the federal government’s “entitlement” programmes in healthcare and pensions. This budget thus marks Trump’s shift away from the promises of his campaign and towards conventional Republican orthodoxy on policy matters. However, bipartisan spending cuts are hard to achieve, largely because there is very little that both Democrats and Republicans are both willing to give up (see figure 2 below).

Source: The Economist

Underlying the arithmetics of the budget, there is a projection of 3% long-run economic growth. However, this long-run forecast differ significantly from the prevailing consensus. Economists have expressed differing views on the feasibility of this target.

Larry Summers argues that the budget is “simply ludicrous” and that “there appears to be a logical error of the kind that would justify failing a student in an introductory economics course”. The budget forecasts that US growth will rise to 3.0 percent because of the Administration’s policies - largely its tax cuts and perhaps also its regulatory policies. Then the Administration asserts that it will propose revenue neutral tax cuts with the revenue neutrality coming in part because the tax cuts stimulate growth. This is an elementary double count. You can’t use the growth benefits of tax cuts once to justify an optimistic baseline and then again to claim that the tax cuts do not cost revenue.

Tyler Cowen argues that the budget provides an occasion to consider some basic macroeconomics of budgeting: namely whether “g,” the growth rate of the economy, is likely to exceed “r,” in this case, the government’s borrowing rate. Currently the US is in this situation, as real economic growth seem to be running in the range of 2%, while the 1-year nominal Treasury yield is slightly above 1%. If those conditions were to persist, Trump’s budget could increase the deficit with impunity, even if the budget contains unrealistic “supply side” projections. In this context, the tax cuts would be grabbing a free lunch (borrow at 1 percent and invest at 2 percent or more). However, this also means that if the Trump budget can work at all, the spending cuts are probably not needed. In this regard, the Trump budget reflects a deep incoherence, and it inconsistently mixes various optimistic and pessimistic scenarios. If the spending cuts are required for fiscal stability, then we probably shouldn’t be doing the tax cuts.

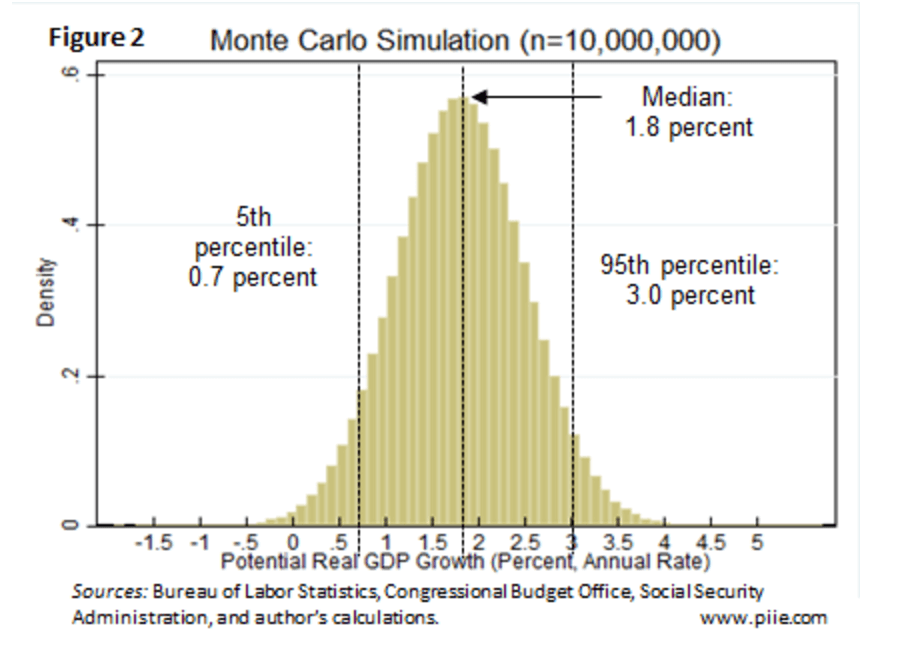

Jason Furman at the Peterson Institute for International Economics has run 10 million Monte Carlo simulation to assess the likelihood of the US experiencing 3% growth over the next decade (Figure 3 below), and is definitely more pessimistic on the likelihood that the administration can overcome the structural obstacles to long-term growth. Furman’s simulations suggest that 3% is above the median growth rate and the the odds of the growth rate being at or above 3% are only 4%, requiring the economy to repeat some of the fastest productivity growth it has seen over the past seven decades. While the policies proposed by the Trump administration could have a small effect on the future growth rate, the long-term impact of unfavourable demographics, the exhausted effect of women’s entry in the workforce, and the weak productivity growth appears to be a daunting obstacle to the achievement of the target.

Source: PIIE

Edward Laezer argues that the average annual U.S. growth rate in the 30 years preceding the 2007 recession was 3.1%. In recent years productivity growth however has slowed, and the workforce has been ageing. Laezer argues that reaching the 3% is unlikely, but possible with some luck on the technology front and with an investment-friendly tax policy. The Trump administration’s plans include changes in K-12 education that may enhance human capital, but that would be a slow process, unlikely to boost dramatically the 10-year growth rate. Technology responds more quickly to investment and research, which would give the administration an opening, since it can change investment incentives by overhauling the tax structure. As for the demographics, the proportion of employed working-age Americans has fallen during this recession and recovery to 59.9% from 63.4%. Laezer argues that at least some of this is driven by government policies that subsidize leisure over work, including the Affordable Care Act.

So would cutting welfare increase the number of people who work? Greg Ip in the WSJquotes research by Robert Moffit (Johns Hopkins University) who finds that about half of household heads on food stamps and three quarters of those on Medicaid already work. At most, 13 million recipients of Medicaid and 6.5 million recipients of food stamps don’t work (and the two groups overlap). When welfare was cut off in the 1990s for single mothers able to work, the share of those not working dropped by up to a third. That kind of effect on 13 million Medicaid recipients or 6.5 million food-stamp participants would generate only a modest, and one-off, boost to a labor force of 160 million. The effect on gross domestic product would be even more muted because these workers have extremely low skills and thus low-productivity. Nor would repealing the Affordable Care Act do the trick The CBO estimates its health-insurance subsidies, which become less generous as wages rise, discourage work and would eventually reduce employment by 2 million, but little of that has materialised yet.

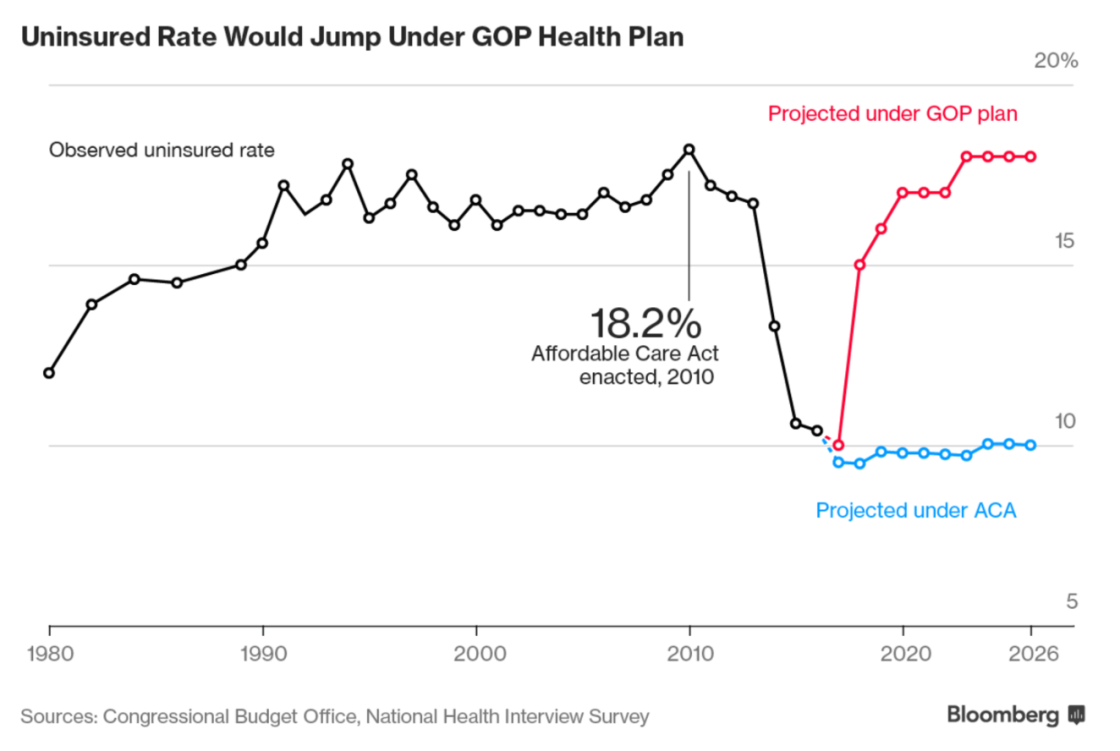

Yet, the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) have published an impact assessment of the Trump administration’s American Health Care Act (AHCA), which shows that enacting the current version of the Act would reduce the cumulative federal deficit over the 2017-2026 period by $119 billion. Over the 2017-2026 period, enacting the AHCA would reduce direct spending by $1,111 billion and reduce revenues by $992 billion, for a net reduction of $119 billion in the deficit over that period. The CBO and JCT estimate that, in 2018, 14 million more people would be uninsured under the new healthcare regulation than under current law. The increase in the number of uninsured people relative to the number projected under current law would reach 19 million in 2020 and 23 million in 2026. In 2026, an estimated 51 million people under age 65 would be uninsured, compared with 28 million who would lack insurance that year under current law (Figure 4 below).

Source: Bloomberg based on CBO data

Keith Hennesey argues that President Trump has a $2 trillion hole in his fiscal policy proposals, which creates a conflict between two of his fiscal policy goals: tax reform and balancing the budget. Even assuming that the 3% growth target is reasonable, the balanced budget claim depends on $496 billion effect of economic feedback in year 2027, which is a really big number for a single year. Team Trump also assumes economic growth means the federal government will need to borrow $2 trillion less over the next ten years. That equals 6.6% of GDP in 2027, an enormous amount. Still, the balanced budget promise and the positive budget effect of the 3% growth assumption, would work together.

The problem is fitting debt-neutral tax reform into this puzzle as well. If the tax proposal, which has been left out of the budget proposal, is debt neutral, then the administration needs to have the same amount of new revenues to fully offset the revenue lost to the government from the proposed gross tax cut. In theory, this offsetting revenue can result either from proposed tax increases or from the higher revenue that results from economic growth, or from a combination of the two. But either the $2 trillion of added cash inflows resulting from faster economic growth can pay for more government spending and reduce the need for government to borrow, or that $2 trillion can replace the cash lost to the government from cutting taxes and reduce the size of painful tax increases you need to propose. Arithmetic forces you to choose one goal or the other.