Tariffs and the American poor

What’s at stake: much has been said and debated — during the US election and beyond — about the distributional impact of free trade on the disadvanta

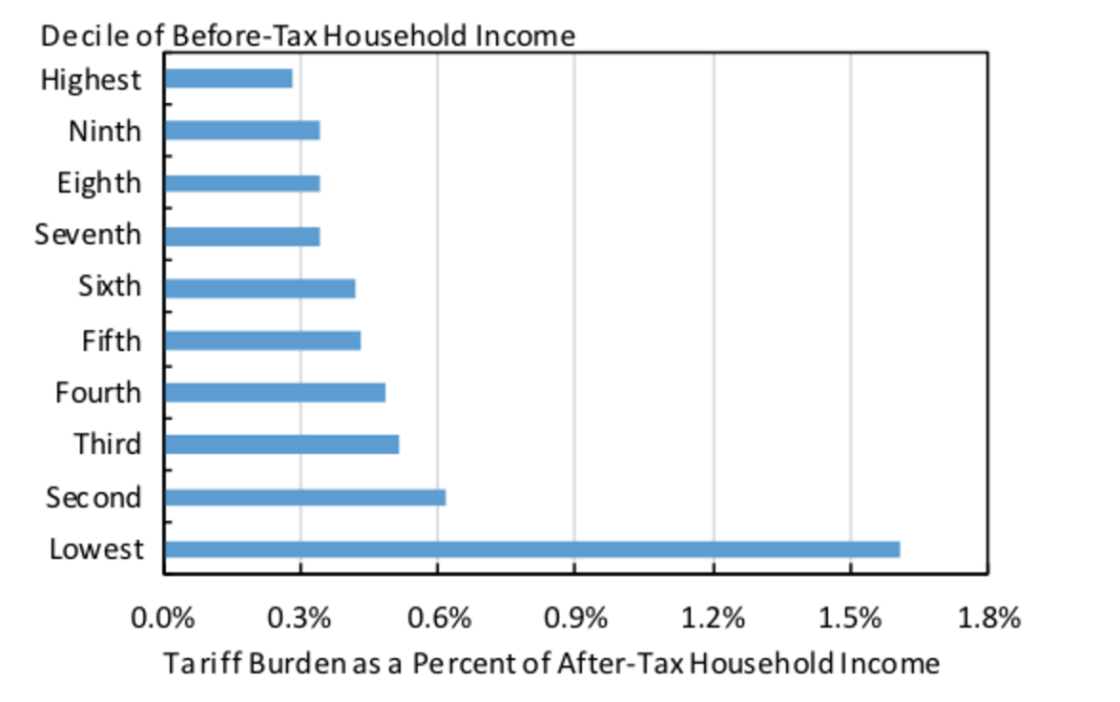

Currently, the US collects more than $33 billion a year – or roughly 0.2% of GDP – in tariffs, which are taxes on US imports. Furman, Ross and Shambaugh match import duties to standard consumer expenditure data and argue that tariffs likely impose a heavier burden on lower-income households, as these households generally spend more on traded goods as a share of expenditure/income and because of the higher level of tariffs placed on some key consumer goods.

For the US, they calculate — assuming that protection via tariffs does not induce domestic producers of similar goods to raise their prices at all — that the poorest 10% to 20% of households in the income distribution pay about $95 a year due to tariffs, middle-income households pay roughly $190, and the richest 10% about $500. In the figure below, we also show a range of higher tariff burdens that reflect some impact on prices of domestic goods (see Appendix note 6 for details).

Tyler Moran at PIIE agrees that tariff would hit the poor hardest, and broadly operate as a regressive tax. He finds that the biggest contributor to the regressive impact of the US tariff schedule on lower income households is tobacco, but food and clothing tariffs also have a greater impact on poor households.

Fajgelbaum and Khandelwal also argue in a recent paper that individuals who consume different baskets of goods are differentially affected by relative price changes caused by international trade, and develop a methodology to measure the unequal gains from trade across consumers within countries. They also find that trade typically favors the poor, who concentrate spending in more traded sectors.

These findings are consistent with the cases of other countries. Beyza Ural Marchand finds similar results when estimating the distribution of welfare gains due to the trade reforms in India, by simultaneously considering the effect on prices of tradable goods and wages. The findings show that households at all per capita expenditure levels had experienced gains as a result of the trade liberalization, while the average effect was generally pro-poor and varied significantly across the per capita expenditure spectrum.

Jara and Ganoza examine the welfare effects on Peruvian households from the reduction of the effective tariff on yellow corn between 2000 and 2011. The study calculates the welfare effect of the tariff change on consumers of yellow corn’s main derivative product, chicken meat, which accounts for an important share in the household food expenditure basket. They show that, on average, the reduction in chicken meat retail prices induced by the tariff reduction for yellow corn generates a welfare gain of 0.24 per cent for households studies, and the poor households experience the highest welfare gain.

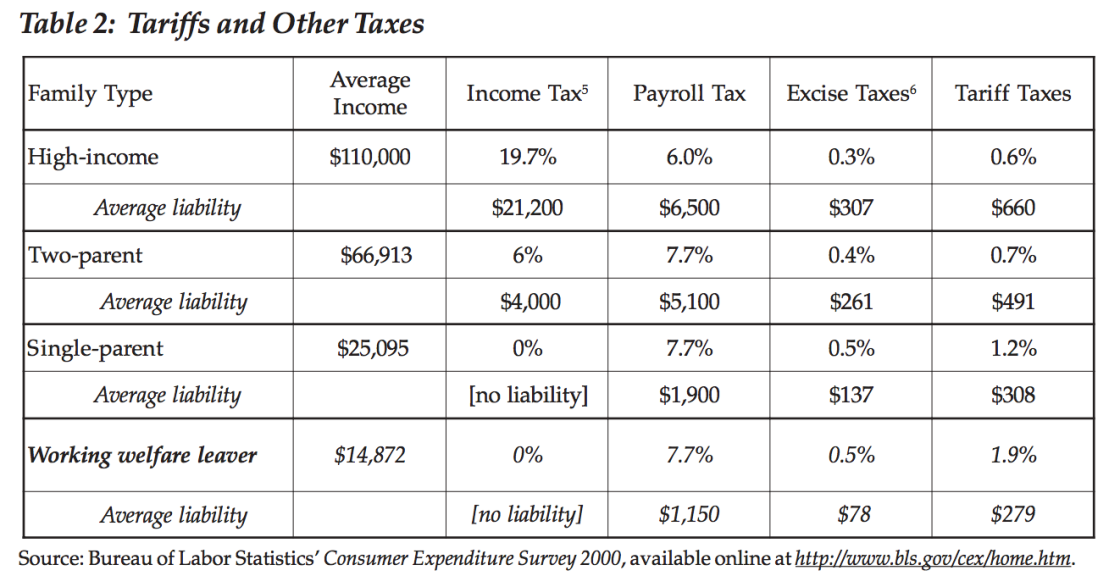

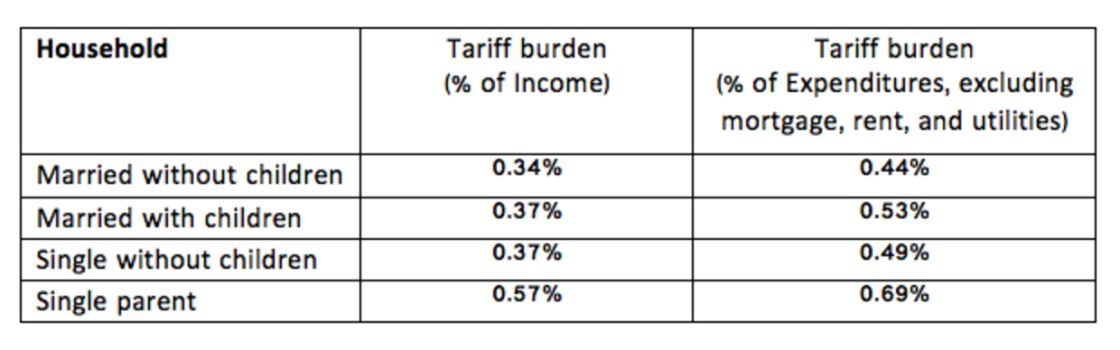

Another important aspect is variation of tariff impact across different demographic groups. Furman, Ross and Shambaugh argue that the tariff burden is highest for families with children, but particularly single parents. In addition, the average effective tariff on many categories of women’s apparel exceeds that for men’s apparel by a substantial margin, so the tariff burden among single parents may be even higher for single mothers than for single fathers.

An older study by Edward Gresser also finds that single mothers are especially hit from the distributional consequences of tariffs. He also compares the impact of tariffs to that of other taxes. Overall, he argues that income taxes are fairly progressive; payroll taxes and excise taxes are more regressive, but the creation of the Earned Income Tax Credit gives poor families a way to offset at least part of the payroll tax. The effective tariff tax rate, in contrast to all other taxes, escalates rapidly for poorer families and has no offsetting credit comparable to the EITC.